US banking crisis

Abstract

The recent wobbles of US regional banks have caused important economic damage. Lending standards have tightened significantly and taxpayers are likely to have taken an important hit. The crisis will thus likely contribute to the slowdown of the US economy in the coming quarters. Nonetheless, even if other US regional banks were to face difficulties, a 2008 repeat is unlikely. The financial sector is now in better shape, authorities are more proactive and the economic origin of the crisis is very different.

Introduction

In early August, Moody’s, a major credit rating agency, downgraded the ratings of ten regional US banks. The downgrades shook financial markets and were a stark reminder of the remaining vulnerabilities in the US banking sector, especially among lesser regulated regional banks. Comparisons with the 2008 global financial crisis, which plunged the US in a prolonged recession, did resurface. However, though the recent banking woes are certainly damaging the US economy, their eventual structural impact is likely to be milder (even if new flare-ups of the banking crisis were to arise and more US regional banks were to face sudden liquidity issues).

Financial sector is more solid

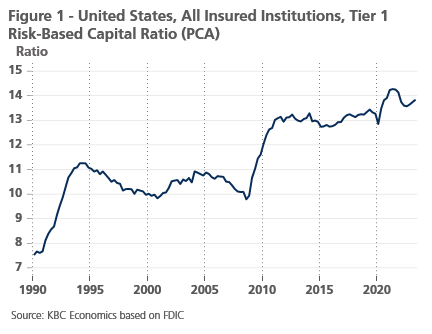

A first important difference with 2008, relates to financial regulation. Following the financial crisis, the US Congress passed the “Dodd-Frank Wall Street Reform and Consumer Protection Act”. The law included provisions to prevent predatory lending, limit speculative trading and subjected banks with (over) 50 billion USD in assets to more strenuous capital and liquidity requirements and regular stress-tests. Unfortunately, the 2018 “Economic Growth, Regulatory Relief, and Consumer Protection Act” increased the asset threshold to 250 billion USD. Nonetheless, the current US financial system is far more resilient today than in 2008. Though other medium-sized US banks could still face sudden outflows going forward, overall, banks now have far greater buffers to withstand new financial shocks (see figure 1).

Faster government reaction

A second important difference was the reaction of central authorities. On 15 September 2008, the government allowed Lehman Brothers to collapse in a disorderly manner, causing a panic reaction across the financial sector. Later, in the midst of serious financial panic, on 29 September 2008, the US House rejected the Emergency Economic Stabilization Act, which authorized the Treasury to spend as much as 700 billion USD in taxpayer funds to buy mortgage-backed securities and other distressed assets. Luckily, it passed a slightly adjusted version four days later, which calmed financial markets. Nonetheless, the slow government response caused considerable economic damage, as consumer and producer confidence nosedived.

The reaction of the government was much forceful this time around. When Silicon Valley Bank collapsed, the FIDC decided to insure all deposits at the bank (including previously uninsured ones), effectively extending its deposit guarantee to larger deposit holders. It also introduced the Bank Term Lending Program (BTLP), allowing banks to borrow money up to 1 year, using bonds at par value as collateral (despite significant lower market valuations triggered by stronger-than-expected increases in interest rates). Furthermore, the Federal Home Loan Banks, a grouping of suppliers of lendable funds to financial institutions, provided 144 billion USD of liquidity to troubled regional banks at the onset of the crisis. These measures effectively stemmed the crisis for now.

No economic misallocation

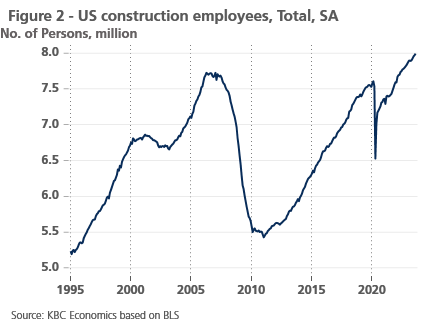

A final difference is the nature of the crisis. In 2008, the underlying cause of the crisis was the proliferation of subprime mortgages. This allowed people to buy or build houses they could not afford. As a result, the construction industry boomed prior to the crisis, but went bust afterwards. Millions of construction workers became unemployed and had a hard time finding new jobs that matched their skills (see figure 2).

In contrast to 2008, this year’s US banking troubles are mostly the result of maturity mismatches and concentrations of uninsured deposit pools within US regional banks. Their assets such as loans and bonds typically have long maturities, while their liabilities such as uninsured deposits have shorter maturities. Banks such as Silicon Valley Bank insufficiently hedged this mismatch, materially exposing these regional banks to run risks. That said, though the maturity mismatch is painful for a bank’s P&L, it does not cause a misallocation of jobs within the wider economy and its economic impact is thus more limited.

Conclusion

It’s important to say that the recent US regional banking crisis will have a notable impact on the economy. It has contributed to further tightening of lending standards and cost taxpayers an estimated 31.5 billion USD. That said, even if other regional banks would face further trouble, a 2008 scenario looks implausible. Contrary to 2008, the regulatory environment has improved, authorities are quicker to intervene and the crisis has not caused any economic misallocation. A deep financial crisis is hence unlikely.