The impact of Biden’s new tariffs

President Biden recently sharply raised tariffs on several Chinese imports including semi-conductors, solar-cells and electric vehicles. Though unfair trade practices were cited as the main trigger, the move should be seen in light of the current US presidential election. The tariffs could indeed raise his electoral support in three critical Midwestern battleground states. The tariffs are unlikely to cause critical short-term economic harm. On a longer-term, however, they are likely to stifle innovation and raise prices in growing industries and they will likely delay the green transition of the US economy. They are also likely to trigger a response from China and possibly the EU, causing a further fracture in the global world order.

Introduction

America fired another shot in the on-going trade war with China. On 14 May, President Biden raised tariffs on numerous Chinese imported products including semiconductors (from 25% to 50%), steel and aluminum products (from 0-7.5% to 25%), solar cells (from 25% to 50%), lithium-ion batteries (from 7.5% to 25%) and medical products. The most important increase, however, was on electric vehicles, where tariffs quadrupled from 25% to 100%.

The White House cites China’s unfair trade practices as a justification for these new measures. It is certainly true that the Chinese state has provided massive support to these critical industries through a combination of underpriced loans, equity injections, purchase subsidies, tax rebates and government contracts. Nonetheless, the proposed tariff hikes could be excessive, especially those on electric vehicles. Furthermore, through subsidies provided in the Chips and Science Act and the Inflation Reduction Act, President Biden already provided ample protection to the American companies in these sectors.

US presidential election is the underlying reason

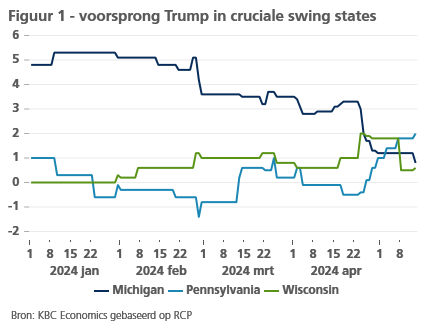

The tariffs increase should thus be seen in light of the upcoming US presidential election, where President Biden is facing a rematch against ex-President Trump. President Biden is trailing Trump in national polls. More importantly, as US Presidents are not elected by popular vote, but through the Electoral College, President Biden is trailing his opponent in the key Midwestern swing states of Wisconsin, Michigan and Pennsylvania (see figure 1).

These Midwestern states account for 44 of the total 538 Electoral College Votes. The election results in these states tipped the 2016 election in favour of Mr. Trump and, tipping in favour of Biden, contributed to Trump’s loss in 2020. They are likely to be critical again in the upcoming election. These states have solid manufacturing bases and many employees in these sectors will be pleased (feel supported) by the new tariffs, especially in Michigan, where automotive or mobility jobs represent 20% of its workforce.

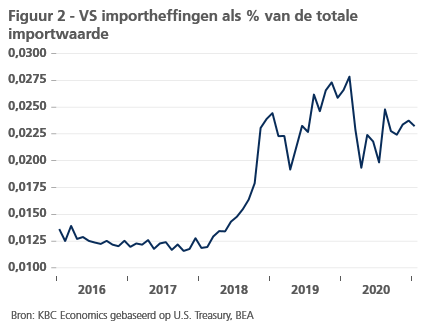

Unsurprisingly, President Trump attacked President Biden by saying the measures didn’t go far enough. President Trump initiated the trade war with China six years ago, causing custom duties on imports in the US to almost double as a result (see figure 2). He now vows to increase tariffs to 60% on all Chinese goods and promises a 10% tariff on all US imports.

Economic impact of the new measures

The new tariffs cover about 18 bln USD worth of annual imports from China. That is less than 0.1% of US GDP. It is also much smaller than the 350 bln USD worth of imports that Trump’s tariffs covered in 2019. Many economists thus see the impact of the new tariffs on GDP and inflation as relatively small.

That is certainly true in the short term. Yet in the longer term, the tariffs could have a dramatic effect. Many of the tariffs cover rapidly growing industries. The Energy Information Administration expects US solar power generation to grow 75% from 2023 to 2025. US Electric vehicle sales are expected to more than quadruple in the next ten years according to Global Market Insights. By protecting these expanding industries, President Biden is likely to lower their growth potential and stifle innovation in these sectors.

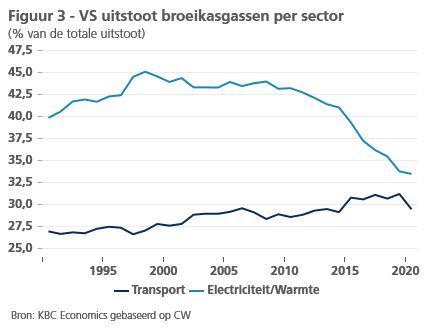

Furthermore, it could delay the climate transition. Electricity generation and transportation are major contributors to US emissions (see figure 3). Solar energy and electric vehicles are likely to be a play a major role in the decarbonization in these sectors. The new tariffs will risk slowing down the adoption of both.

How will China and the EU respond?

A major question remains whether and how China will retaliate against the new tariffs. China’s foreign ministry states that China “opposes unilateral tariff increases that violate World Trade Organization rules and will take all necessary measures to safeguard its legitimate rights and interests”. The move threatens China’s economy, where export of goods and services still account for around 20% of GDP. Furthermore, China has recently ramped up investment in what it calls the ‘new three industries’ (i.e. solar, EVs and lithium batteries). The new tariffs directly counter this strategy (see our research report of 7 May 2024).

Another question is whether the EU will follow the US’s lead. The European Commission recently launched investigations into Chinese state subsidies for solar products, electric vehicles, and wind turbines. These could result in new tariffs, though the EU tariffs are likely to remain lower than the US ones.

Conclusion

Though President Biden’s new tariffs are unlikely to cause major economic harm in the short term, they could lower the US growth potential in the longer term and delay the climate transition. Furthermore, the tariffs could cause an escalation in the on-going trade war and further the divide between the West and China.