Can Turkey bring down hyperinflation?

Turkey’s economy has undergone a remarkable policy shift since last year’s presidential election. President Erdogan has appointed a competent Treasury and Finance minister who is taking measures to bring down the deficit. The government is also getting rid of costly regulations, meant to stop the slide of the lira. Most importantly, the central bank abandoned its unconventional monetary policy and finally raised its policy rate more than fivefold to bring down inflation. That said, inflation remains far above the central bank’s target and has been broadening. A continued restrictive monetary policy stance will be needed to bring inflation back in line.

Introduction

Last month, Turkey’s central bank decided to keep interest rates steady again at 50%. The bank vowed to maintain tight monetary conditions until a significant and sustained decline in the underlying trend of monthly inflation is observed. Turkey has experienced a remarkable policy turnaround since President Erdogan’s narrow reelection in May 2023, shifting both budgetary and monetary policy in meaningful ways. The question remains whether the current interest rate level will be sufficient to bring Turkey’s inflation back to target in the near term.

Turkey tightens its budgetary policy

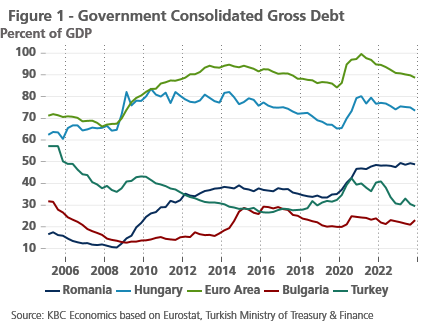

Following the election, President Erdogan appointed Mehmet Simsek, a respected economist to head the Treasury and Finance Ministry. Under his watch, Turkey’s government is taking steps to bring down the government deficit. The finance minister has since announced multiple measures to bring the deficit back under control. In January, the tax on petrol was tripled, the standard VAT rate raised from 18% to 20%, and the lower VAT rate for essential items raised by 2 percentage points. In May, the government also announced cuts to public spending such as cuts to public hiring and slowing investment in major infrastructure projects. This will bring down the deficit significantly. Though the IMF still expects a deficit 5.4% in 2024, it expects the budget to be close to 3% by 2026. Government debt is far lower than most of Turkey’s peers (see figure 1). The central government also abolished a regulation forcing banks to encourage deposits in lira and unwound the costly KKM-scheme, which protected lira-denominated deposits against lira devaluations with government funds. This limits the government’s exposure to further currency devaluations.

A major central bank U-turn

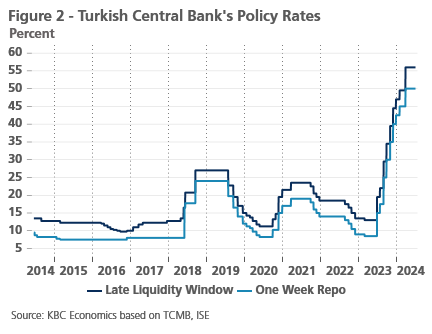

The return to orthodoxy at the central bank has been even more remarkable. Prior to the election, Turkey’s central bank, the TCMB, kept rates artificially low at 8.5%, despite inflation being in the high double digits. The appointment of Hafize Gaye Erkan, a former Goldman Sachs Banker, as Governor of the TCMB, marked a complete turnaround. She started replenishing the bank’s FX reserves, which had been depleted as a result of the continued (unsuccessful) FX intervention operations. More importantly, she raised the one-week repo rate from 8.5% in June 2023 to 45% in February 2024 (see figure 2). Though she resigned on 2 February 2024, her successor, Fatih Karahan, a former economist at the Federal Reserve Bank of New York, continued raising policy rates. The one-week repo rate reached 50% in March. The TCMB vows to maintain its policy rates at this level until inflation is under control.

Inflation still accelerating

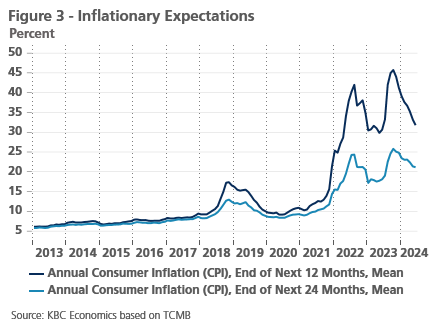

The question remains whether these shifts in policy will be sufficient to bring inflation back to the 5% target. Inflation accelerated in May, rising from 69.8% in April to 75.5% in May. Core inflation stayed broadly flat at 75%. On a monthly basis, core inflation increased by 3.76% (45% annualized) and is showing no signs of deceleration. Inflation is also becoming broad-based and is shifting to stickier components. Service price inflation reached 95.9% in May. Even more concerning is the rapid acceleration in housing inflation from 55.5% to 93.2%, which might keep this component elevated in the months to come. Looking further ahead, inflation expectations have been trending downwards but remain well above the 5% central bank target (see figure 3). Money supply growth, another leading indicator of inflation, has been trending downward, but remains at an elevated 47.6%.

Conclusion

Turkey has gone through a remarkable policy shift since last year’s presidential election. The shift in monetary policy has been especially remarkable and has brought down inflation expectations. That said, inflation is a stubborn beast and is tough to tame. Turkish inflation is increasingly broad-based and sticky. The TCMB will thus have to maintain its hawkish stance for a while if it wants to beat hyperinflation.