Economic Perspectives June 2019

Read the full publication below or click here to open the PDF

- The global deterioration of corporate sentiment has continued, in particular with the US joining the global trend according to the latest business sentiment surveys. Escalating trade tensions together with growing concerns about a severe global growth deceleration have been the main causes of the rising pessimism in recent months. Persistently weak sentiment among firms, mainly concentrated in the manufacturing sector, supports our view that the surprisingly strong GDP growth results in Q1 of this year were most likely only temporary.

- In the context of increasing risks, a moderating growth outlook and a subdued inflation outlook, central banks are responding accordingly. The European Central Bank (ECB) extended its forward guidance saying euro area interest rates are likely to remain unchanged for even longer than had previously been envisaged. With inflation expected to remain well below the ECB’s medium-term inflation target and a moderating growth outlook with more downward risks, we now project that the ECB will keep its policy rates unchanged this and next year.

- The Fed will likely react to the economic momentum deterioration as well. We expect the Fed to lower its policy rate to 1.875% by the end of 2019. The reasoning behind this would be to accommodate the further growth deceleration and an expected inflation path that is at best in line or even slightly below the Fed’s symmetrical inflation target around 2%. In the absence of an unexpectedly severe downturn, we don’t expect the cutting cycle to extend into 2020 as the Fed traditionally prefers not to alter its policy during US presidential campaigns.

- In the past few weeks we have seen some financial markets’ fears of a notably poorer economic outlook. This was reflected in another striking drop in long-term bond yields and a decline in inflation expectations. Regarding the German 10-year government bond yield, we expect it to remain broadly at current levels (-20 bps) for the remainder of this year. This is the result of the removal of expectations of any short-term rate increases by the ECB. Moreover, abundant excess liquidity will continue to exert downward pressure on the term premium of long-term German yields. US bond yields could even fall further in the near term as the market expectations that the Fed might cut rates fast and frequently may build.

Growth deceleration in Q2 likely

The global deterioration of corporate sentiment has continued, with most recent PMIs showing softer conditions have spread to the US economy. Escalating trade tensions together with growing concerns about a severe global growth deceleration have been the main causes of the rising pessimism in recent months. Persistently weak sentiment among firms, mainly concentrated in the manufacturing sector, supports our view that the surprisingly strong GDP growth results in Q1 of this year were most likely only temporary. In particular the advanced economies such as the US, the euro area and the UK, posted unexpectedly good GDP growth results in Q1. This was at odds with the decline in leading indicators such as corporate sentiment in that period and during the months before. Hence, although there still seems to be some disconnect between ‘hard’ activity data and ‘soft’ sentiment indicators, a growth slowdown rather than a further acceleration is the most likely scenario for Q2.

In particular for the US economy, we project growth to decelerate significantly compared to the 3.1% qoq annualised growth figure of Q1. Q2 will likely bring a drop below potential GDP growth - currently estimated around 2.0% on an annual basis - and the remainder of the year only a partial recovery. We expect this to result in an annual average growth of 2.5% for 2019 as a whole. In 2020, growth will likely decelerate somewhat again, leaving annual growth at 1.7%. This expected slowdown reflects the late-cyclical state of the US economy, fading effects of the earlier fiscal stimulus and the distorting impact of the trade war (also see Box 1).

Box 1 - Increased risk of further trade tension escalations

Recent events have showed that the risk of a further escalation of global trade tensions has increased. A protracted trade dispute with regular flashpoints between the US and China now seems most likely. US President Trump’s threat to impose additional import tariffs on the remainder of Chinese products that haven’t been targeted yet (worth roughly USD 300 billion), is likely to materialise. Moreover, the condemnation of Huawei by Trump symbolises the escalation of the US-China trade war into a technology war between the two superpowers (also see KBC Economic Opinion of 24 May 2019). The conflict will linger on in the coming years and negatively impacts the growth outlook for the US, China and the rest of the global economy.

President Trump is also hardening his stance towards other trade partners such as India (with the removal of previous US trade concessions) and Turkey (with the introduction of new trade defence initiatives). Moreover, the threat of import tariffs on goods coming from Mexico, which didn’t materialise due to the bilateral deal to curb cross-border migration, signals an increased risk of other US trading partners being targeted. The threat of using trade-related sanctions to get concessions on non-trade related issues, such as migration, illustrates Trump’s strategy of using trade (policies) as a kind of weapon against counterparties. Though still not part of our scenario, the risk of US import tariffs on (European) cars has hence increased.

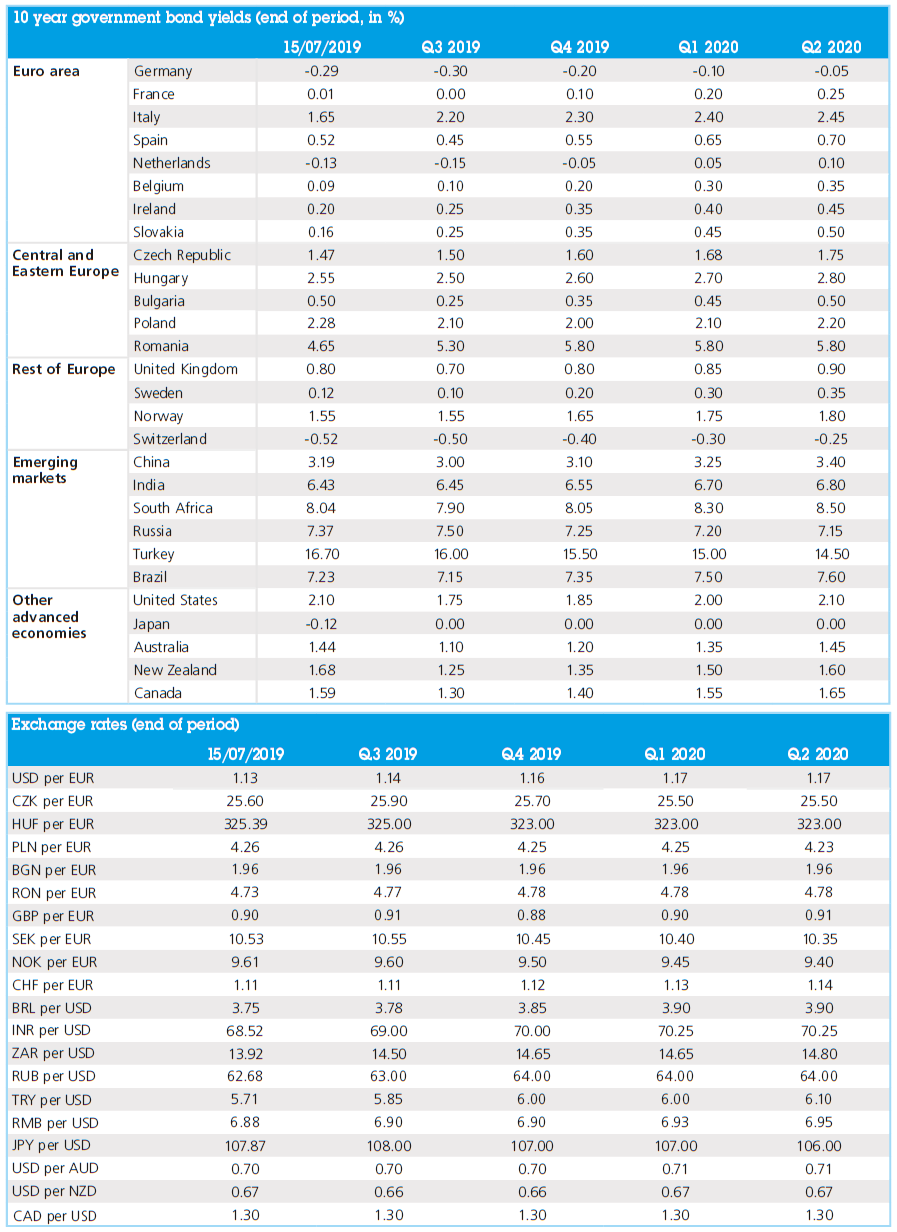

The euro area’s growth recovery in Q1 (to +0.4% qoq) was also only temporary, with a weaker Q2 outturn likely. For Q3 and Q4, growth dynamics could improve somewhat, but the moderately downward trend of annual growth will likely persist going forward. Indicators for manufacturing sector activity, such as industrial production, show little improvement from the recent lows (figure 1). Prospects for a (further) rebound in the euro area are hence limited. Furthermore, German industries that are most exposed to the global demand slowdown are performing poorly, although German exports are keeping up well so far. This seems to be translating into falling optimism of German consumers. Based on these results, we downwardly revised our euro area growth forecast for this year from 1.2% to 1.0%. 2020 will likely see some minor recovery of GDP growth to 1.3% (up from 1.2% last month), but no marked rebound is expected in the current risky global environment.

Figure 1 – Euro area industrial production starting Q2 on a weak note (industrial production index, % change year-on-year)

Low policy rates…

In the context of increasing risks, a moderating growth outlook and a subdued inflation outlook, central banks are responding accordingly. The European Central Bank (ECB) extended its forward guidance saying euro area interest rates are likely to remain unchanged for even longer than had previously been envisaged (at least until mid-2020 from the previously indicated end of 2019). At least as important was the increased signalling that the ECB was prepared to ease its policy again if needed. However, it should be emphasised that the increased risks acknowledged by the ECB have not translated into a notably darker economic reality. Compared to the ECB’s previous economic projections made three months ago, new projections envisage fractionally stronger economic growth and inflation in 2019 and only marginally weaker trajectories for 2020 and 2021. Circumstances in which the ECB sees the current outlook as still moderately positive but significantly threatened might suggest that the ECB will remain cautious but seek to impress upon markets that it had ample ammunition and is willing and able to act if necessary (also see Box 2).

Box 2 – Fiscal policy action needed?

Mr Draghi’s central message was that the ECB was aware of increased downside risks, that this meant any future rate increases would be further delayed and that should such risks increase further and translate into a notably poorer outlook, the ECB was both willing and able to act to ease policy further. However, some other comments made by Mr Draghi might also suggest that the ECB’s scope to act might be limited in some important respects.

One important constraint on further cuts to the deposit rate and possibly even on the extended maintenance of the deposit rate at current levels is the ongoing concern that prolonged negative interest rates might weaken the profitability of the banking sector and thereby diminish its lending capacity that is central to transmitting ECB policy to the broader economy (also see KBC Economic Opinion of 30 April 2019).

While Mr Draghi argued that thus far ‘in the aggregate’, the ECB wasn’t seeing any adverse effects on lending, a significant insertion in the ECB’s opening press statement noted ‘we will continue to monitor carefully the bank-based transmission channel of monetary policy and the case for mitigating measures.’ This wording might suggest the deposit rate is close, possibly very close, to the effective lower bound at present and the ability to sustain it at current levels cannot be taken for granted.

Arguably of major significance in the ECB pronouncements was Mr Draghi’s acknowledgement that ECB policy alone was unlikely to be able to fully offset a serious downturn in economic conditions. Mr Draghi noted “Certainly, fiscal policy will have to come into consideration…and play a fundamental role...”. This hints at a possibly fundamental change in ECB thinking. If the ECB were to countenance a more expansionary policy (even though Draghi only referred to it in circumstances of ‘adverse contingencies’), it would represent a major regime shift with potentially significant implications for the interest rate outlook in the medium term. It would also accord with some academic thinking for a more nuanced view of the role of fiscal policy such as that proposed in Olivier Blanchard’s address to the American Economic Association at the start of the year (also see KBC Economic Opinion of 7 May 2019).

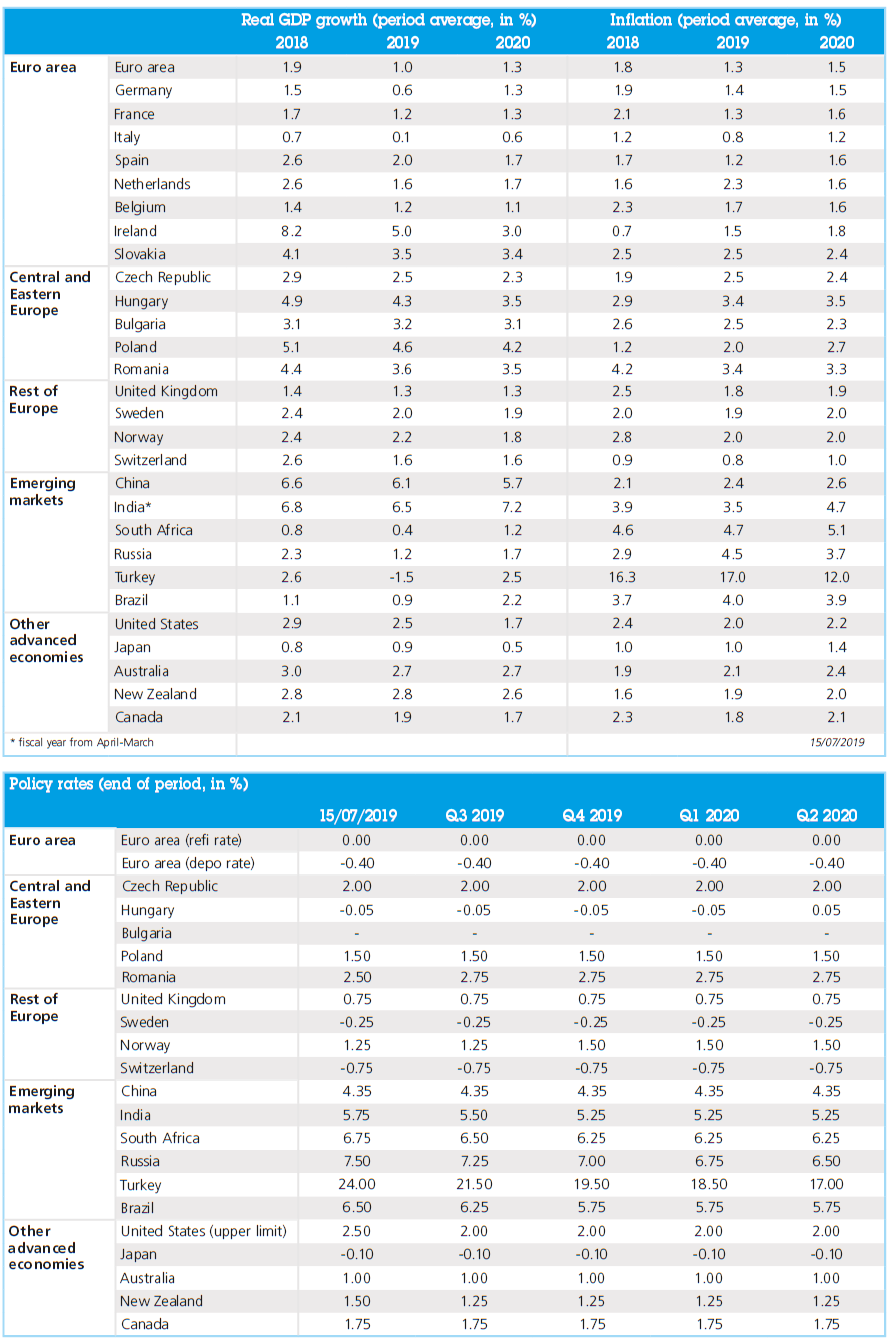

With inflation expected to remain well below the ECB’s medium-term inflation target and a moderating growth outlook with more downward risks, we now project that the ECB will keep its policy rates unchanged this and next year (figure 2). If risks materialise more severely than expected, the ECB might even consider easing its policy stance further (through one or more of the measures it has previously adopted such as lower policy rates or resuming its APP). Any later first rate hike will likely be more of a technical correction focussed on a desire to move away from its negative deposit policy rate rather than the start of a cyclical tightening.

Figure 2 – Euro area inflation again lower in May and expected to remain well below the ECB’s inflation target (harmonised index of consumer prices, % change year-on-year)

The Fed is also likely to react to the global momentum deterioration. We expect the US central bank to lower its policy rate to 1.875% by the end of 2019 and end the cutting cycle at that level. The reasoning behind this would be to accommodate the further growth deceleration and the expected inflation path that is at best in line or even slightly below the Fed’s symmetrical inflation target around 2%. This policy easing path is less aggressive than financial markets are currently pricing in (about 4 rate cuts of 25 bps each). However, in the absence of a notable sharper deterioration in US economic or financial conditions, it seems unlikely that the Fed will continue its easing during the upcoming US presidential election campaign next year, as this could be interpreted as political interference.

… and low long-term interest rates

In the past few weeks we have seen financial markets’ fears of a notably poorer economic outlook. This was reflected in another striking drop in long-term bond yields and a decline in inflation expectations. Regarding the German 10-year government bond yield, we expect it to remain broadly at current levels (-20 bps) for the remainder of this year. This is the result of no expectations of any short-term rate increases by the ECB. Moreover, abundant excess liquidity will continue to exert downward pressure on the term premium of long-term German yields. As German and US bond yields typically follow similar trends, we think the expected Fed’s monetary easing affects global long-term rates. In 2020, we expect a very moderate increase towards 0.15%. This will mainly be the consequence of the correlation with rising US yields and, to a lesser extent, of the anticipation of the ‘technical’ rate increase by the ECB later on.

The absence of any upward policy rate moves by the ECB and the abundant excess liquidity will continue to cause a ‘search for yield’ and hence will keep sovereign risk premia low. This will cause intra-EMU spreads to remain low for longer at or even slightly below the current levels. However, for country-specific reasons, there are exceptions to this general rule. Most notably, we expect Italian spreads to remain at high levels due to the possible new conflict between the Italian government and the European Commission on the Italian budget.

The US 10-year government bond yield is expected to decline further to 1.75% by the end of 2019, as a result of the (expected) Fed rate cuts. However, once financial markets realise that the number of Fed rate cuts will be less than they currently project, we expect long-term yields to bottom out and rise again to 2.4% by the end of 2020. The expected Fed rate cuts mean that there is less interest rate support for the USD in the short term. Moreover, valuation and political considerations continue to support the expectation of a weakening USD. Hence, our expected path for USD per EUR is less positive for the USD than previously expected (1.17 USD per EUR at the end of both 2019 and 2020).

All historical quotes/prices, statistics and charts are up-to-date, up to and including 7 June 2019, unless stated otherwise. The views and forecasts provided are those of 7 June 2019