Data-dependent central banks and macro-sensitive bond markets

- Masters of the short rate, masters of the market?

- The (pre-pandemic) weight of monetary policy meetings

- Expectations or risk premiums ?

- Financial markets since the pandemic again more macro-sensitive

- Conclusion

Read the publication below or click here to open PDF

Abstract

Central bank communication has become an indispensable tool of monetary policy. It ensures the necessary transmission of monetary policy through the yield curve and provides additional information on the economy to financial markets. Policy meetings are the focal point of this communication strategy par excellence, making them (information) benchmarks in the news cycle of financial markets. During the crisis periods, when policy rates were stuck at their effective lower bound, communication (of non-conventional policies) proved to be of great value. However, in the current environment of positive interest rates and high macroeconomic uncertainty, the direct influence of communication during policy meetings is declining. Because of rule-guided policies, central banks are becoming more data-dependent. Financial markets are increasingly guided by specific macroeconomic shocks themselves in forming expectations, rather than by central bank communications during policy meetings. As a result, long-term interest rates are becoming more macro-sensitive and volatile. This increased volatility in turn complicates monetary policy transmission and makes long-term interest rates less predictable.

Masters of the short rate, masters of the market?

Central banks play a crucial role in the financial system. They ensure liquidity and, via policy rates, ’set’ short-term market interest rates. However, central banks have less direct control over long-term market interest rates. After all, these are determined by supply and demand in financial markets based on amongst others risk appetite, inflation expectations and the assumed (natural) real interest rate.

But central banks do have an interest in ensuring that those long-term interest rates are set stable and, above all, ’right’. After all, it is these longer-term interest rates (and not the policy rate itself) that have the greatest impact on lending and thus indirectly on the economy and inflation. Hence, central banks closely monitor the smooth transmission of policy rates through the yield curve. Effective and transparent communication (guidance) is indispensable in this respect and has quickly become a critically important monetary policy instrument. Indeed, effective monetary policy is not so much a matter of strict control over the policy rate, but rather of shaping market expectations regarding interest rates and key macroeconomic variables. Communication can provide financial markets with additional information on the current state of the economy and/or risks. In addition, the central bank provides further information (hints) about future economic trends and monetary policy. Based on such forward guidance, financial markets adjust their expectations and risk assessments if necessary. Forward guidance also became even more important following the financial crisis, when the policy interest rate was stuck at the effective lower bound and thus lost much of its informational value.1

Regular verbal and non-verbal communication, typically during or surrounding central bank policy meetings, is the (nowadays) preferred tool to guide market expectations about future monetary policy and the economy. Most major central banks hold extensive press conferences after each policy meeting that provide an excellent platform to guide markets in their interest rate expectations, if necessary. Some central banks, such as the Fed, regularly publish both short-term and longer-term economic and interest rate forecasts, such as, for example, using the impactful 'dot plots'. Those publications provide not only (sometimes fuzzy) information on possible paths for policy rates, but also various important economic and interest rate-setting trends. Central bank policy meetings (and the accompanying communications) have therefore become important benchmarks in the financial markets news cycle and act as coordination points where specific central bank information is (partially) made public and market expectations (and thus long-term interest rates) are adjusted (aligned).

The (pre-pandemic) weight of monetary policy meetings

Central banks do indeed succeed. Central bank meetings weigh particularly heavily in determining the trends of long-term interest rates. Central banks have ‘guided’ financial markets in adapting interest rates and interest rate expectations. One striking observation (Hillenbrand, 2022)2 convincingly illustrates this point: the trend decline in long-term (swap) interest rates in the U.S. is to very large extent due to interest rate movements that took place in a narrow (3-day) window surrounding FOMC policy meetings.

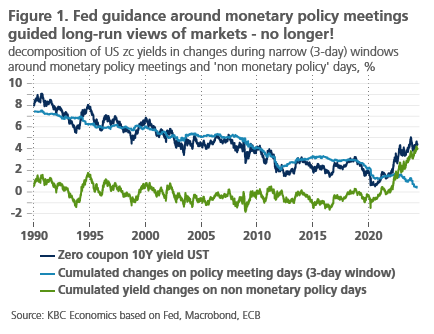

Figure 1 updates this analysis to the second quarter of 2024. The 10-year (zero coupon) US government yield is broken down into interest rate movements in a narrow time interval around the FOMC policy meetings3 (light blue line) and those outside this time window (green curve). This analysis convincingly illustrates the weight of FOMC policy meetings: interest rate movements during the policy window appear to weigh heavily and persistently (structurally) on the trend of long-term interest rates. Interest rate movements outside this time window seem rather cyclical, with no major impact on the interest rate trend itself. The trend decline in the 10-year US interest rate from around 8% in 1990 to around 2% at the end of 2019 (down 600 bp) is explained, for 530 bp, by interest rate movements just before, during, or after policy meetings. While trading days outside those policy windows contributed relatively little (70 bp) to the trend decline in long-term interest rates. At least, until the pandemic. Non-policy days, while weighing less in the trending interest rate movements, do play their part in the substantial cyclical interest rate movements (up to 200 bp deviation from the trend before the pandemic).

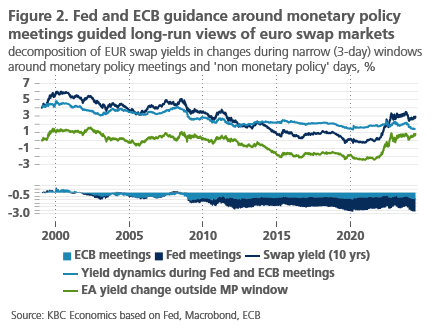

A similar finding is found for the ECB. Figure 2 shows the same decomposition for the euro swap rate. Of the 590 bp interest rate decline between 2000 and the end of 2019, 340 bp are explained by interest rate movements during a narrow time window during policy meetings (of both the ECB and the Fed). The disproportionate importance of policy meetings in determining the interest rate trend is also evident here: more than half of the total interest rate decline (nearly 60%) is realized on less than 15% of trading days, namely those within the time window around policy meetings.4 However, specific to this analysis is that Fed meetings, rather than those of the ECB, became directional for euro swap rates, especially since the financial crisis (cfr. Figure 2). The latter finding underscores again the Fed's dominant position in financial markets worldwide. Policy signals from the Fed in the context of FOMC policy meetings do appear to have a pronounced and long-lasting effect on money markets in the euro area.

Expectations or risk premiums ?

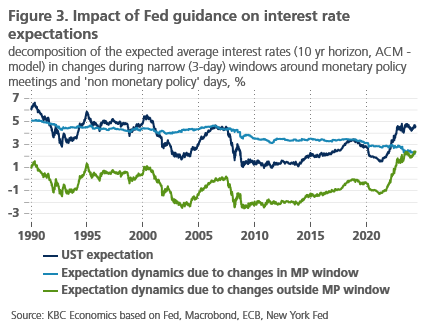

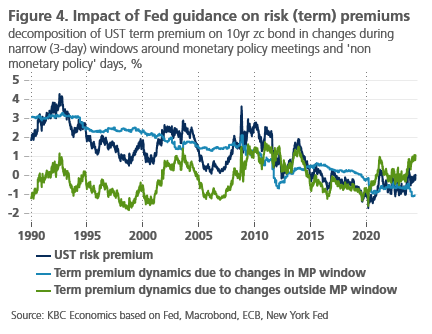

Central bank communications additionally act structurally on both market expectations about future policy rates and risk premia. Figures 3 and 4 show the structural impact of monetary policy (and communication) on market expectations and risk premia.5 Market expectations adjust structurally (trend-wise) in the time window around the Fed’s policy meetings (see Figure 3), while non-policy days explain more the cyclical movements in market expectations, especially in the period before the pandemic.

That the Fed structurally (trend-wise) steers markets’ interest rate expectations is not really surprising. After all, the Fed uses the adjustments (and surprises) in policy rates (and communications, e.g. the ‘dot-plots’) to guide medium-term interest rate expectations. Our analysis suggests that those policy decisions (and communications) sent average interest rate expectations more than 200 bp lower over the 1990-2019 period. Both forward guidance and the effective decline in policy interest rates contributed significantly to this trend-wise decline in interest rate expectations.

Less obvious is the observation that the Fed also "brought" risk premia structurally down, over that period (1990-2019). Risk premiums on the 10-year US yield fell, cumulatively across policy meetings, by about 300 bp, much of it (but not exclusively) following the 2008 financial crisis. Those declines were partly the result of the announcement and effect of the QE policy that the Fed pursued during that period. Recent analysis indicates a downward QE announcement effect on the 10-year yield (mainly via the risk premium) of around 10 basis points per (relevant) policy meeting. Our analysis thus confirms the crucial role of central bank communications in driving not only interest rate expectations, but also the associated risk premia.

Financial markets since the pandemic again more macro-sensitive

Since the pandemic, however, central banks appear to be loosening somewhat their grip on long-term interest rates. The pandemic, energy crisis and geopolitical tensions have increased macroeconomic uncertainty and induced central banks to adopt a more wait-and-see and especially data-dependent monetary policy. In such an environment, forward guidance becomes noticeably less forceful and effective.6

Now that the effective lower bound no longer locks in the policy rate, and thus that the policy rate has again become an active policy instrument, monetary policy becomes again more data-dependent. That data-dependence of monetary policy translates into greater uncertainty (even among central banks) around the appropriate interest rate path and endpoint of monetary policy. Central banks with credible reaction functions are also more ‘forced’ to align their policies with, and adjust to, the latest macroeconomic data. To the extent that those shocks dominate the macroeconomic environment, policy meetings themselves become much less informative and thus less decisive in guiding long-term interest rates. Financial markets in such circumstances are guided more by the macroeconomic shocks themselves (and any interpretation by central banks in the event of that shock but outside the policy window). Market expectations thus gradually become more shock-sensitive, causing an increased interest rate impact of those shocks themselves while central bank signals lose importance. Thus, in an environment of elevated macroeconomic uncertainty and shock sensitivity, data-dependent central banks lose influence in guiding long-term interest rates.

That loss of influence of central banks (during policy meetings) is also evident from our analysis (cfr. Figure 1 and Figure 2): much of the post-pandemic rise in interest rates ended up happening outside the time windows of policy meetings (most likely at the moment of important macroeconomic news regarding growth, labor markets and inflation). That is a clear indication that economic shocks (typically on non-meeting days) have gained importance. Whether that loss of direct central bank influence will ultimately be temporary or permanent remains to be seen and depends on how long central banks remain extremely data dependent. Data-dependent central banks are more likely to become the playthings of macroeconomic shocks than to set the stage for long-term financial markets.

With high macroeconomic uncertainty, data-dependent central banks are at the mercy of macroeconomic shocks rather than setting the stage and guiding financial markets. Central banks are, figuratively speaking, "forced" to follow their reaction function and thus respond (with a delay) to those macroeconomic shocks during policy meetings. The policy meetings themselves thus become less interest rate-setting, but rather macro-following. Consequently, financial markets - especially long-term interest rates - become more volatile and sensitive to macroeconomic shocks, complicating the transmission of policy rates through the yield curve. Poor transmission of monetary policy also potentially makes that policy less controllable.

1 During the period when policy rates fell to their effective lower bound, a divergence was observed between the actual policy rate and its shadow rate. The latter is an estimate of the level of policy interest rates consistent with current economic conditions. During the crisis period, that interest rate fell well below the effective lower bound. Thus, the actual policy rate (at that lower bound) turned out to be no longer informative about the current economic conditions.

2 Hillenbrand, S (2022), The Fed and the Secular Decline of Interest Rates, Working Paper (Harvard Business School), January 2022

3 We use a time window window window from one day before to one after the meeting.

4 Note that in this analysis we consider three-day time windows around both the ECB policy meetings and these of the Fed.

5 Market expectations about short-term interest rates and risk premiums are not directly observable. A breakdown of bond interest into average interest rate expectations (over the term of the bond) and the corresponding risk premium is based on the New York Fed's so-called ACM mode.

6 For example, a study by Campbell et al (2019), Journal of Monetary Economics, 108, finds that forward guidance again worked much less efficiently after the effective lower bound on interest rates was no longer binding. In a normal interest rate environment, the direct impact of guidance appears to be less pronounced, potentially making monetary policy less efficient and long term interest rates more volatile.