Sustainability governance

Effective sustainability governance for ESG integration

We have a robust sustainability governance in place to integrate our sustainability strategy across the group and core activities. Top-level responsibility covers all ESG themes. Group-level decisions are implemented by local teams in core countries, with top management ensuring proper execution.

The KBC Board of Directors sets and oversees the sustainability strategy, covering ESG themes like climate, gender diversity, human rights, and ethical behavior. Twice a year, they evaluate progress using the KBC Sustainability Dashboard. Important changes to policies and reporting are discussed when required.

The KBC Board of Directors and the Risk and Compliance Committee closely monitor ESG-related risks, including climate, environmental, cyber, compliance, and conduct risks. These are defined as top risks by the Executive Committee. For more details, refer to the KBC Group Risk Report.

The Audit Committee ensures the Executive Committee establishes effective internal controls and monitors KBC's sustainability reporting process.

The Executive Committee manages KBC's sustainability strategy, including ESG-related strategies and policies. It also monitors the implementation of this strategy across the Group.

Key executives and top management level responsibility

The Internal Sustainability Board (ISB) is KBC's main forum for ESG-related discussions. Chaired by the Group CEO and vice-chaired by the Group CFO, it includes executive and top-management representatives from all business units, core countries, and group services. The ISB collaborates closely with the Group Corporate Sustainability division and the Senior General Manager Group Sustainability, who is also a member.

The Sustainable Finance Steering Committee, chaired by the Group CFO, oversees the progress and technical implementation of the Sustainable Finance Programme. This programme focuses on KBC's climate action and environmental themes like biodiversity, water, and circularity. Various departments collaborate at the group level. A core team of specialists from Finance, Credit Risk, and Risk functions, along with sustainability experts, handles day-to-day implementation and works closely with all relevant departments throughout the Group.

The Data and Metrics Steering Committee, chaired by the Group CFO and supported by the Senior General Manager of Finance, manages climate-related data collection and reporting challenges.

The CSRD (Corporate Sustainability Reporting Directive) Steering Committee, established in 2023, oversees the conceptualisation and implementation of KBC's CSRD Programme. This programme aims to integrate the KBC Sustainability Statement into the new European reporting legislation, CSRD. The committee focuses solely on reporting topics, while strategic decisions remain with existing decision-making bodies and committees.

The Senior General Manager Group Corporate Sustainability leads the Group Corporate Sustainability Division, reporting directly to the Group CEO and regularly meeting with the Chairman of the Board of Directors. The division oversees ESG-related issues, develops sustainability strategies and policies, and implements them across the Group.

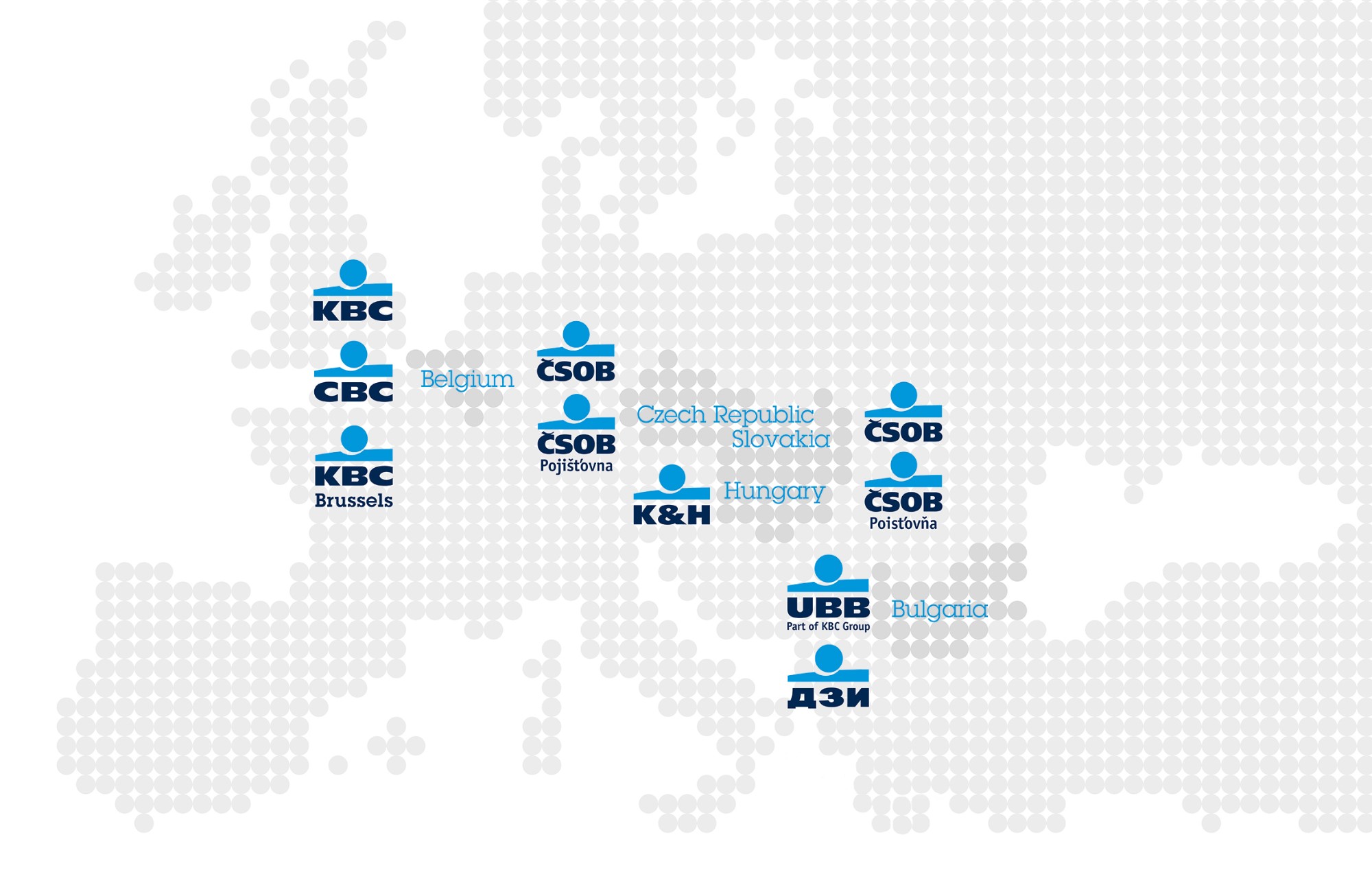

Local accountability in our core countries

The organisation of the local sustainability teams varies from country to country. However, they are generally organised as country sustainability departments and committees. Local top management steers these committees. They provide support for the local integration of the sustainability strategy as well as the organisation and communication of local sustainability initiatives.

External boards

Another external board, the RI Advisory Board, acts as an independent body overseeing the screening of the responsible character of the Responsible Investing funds offered by KBC Asset Management.