Economic Perspectives December 2021

Read the full publication below or click here to open the PDF.

- The economic outlook has become more uncertain and is subject to substantial downside risks heading into 2022. The pandemic still plays a prominent role in shaping the macroeconomic landscape, with the emergence of the Omicron variant serving as a reminder of this. Omicron represents a severe downside risk, which will ultimately depend on its transmissibility, ability to evade immunity, and overall health impact (e.g., on hospitalisations and mortality). In addition, multiple pandemic-related supply shocks are feeding into elevated inflationary pressures and are weighing on the near-term economic outlook. At the same time, our baseline scenario assumes that these headwinds will delay rather than derail the recovery, and we still expect strong annual growth rates in the euro area and the US from a historical standpoint.

- After a strong performance in the second and third quarter, the euro area recovery appears to be losing pace amid increasingly strong headwinds. While activity indicators paint a somewhat mixed picture, the latest spike in new Covid-19 infections has prompted renewed mobility restrictions, likely dampening activity well into Q1 2022. Against this backdrop, we have lowered our near-term growth forecasts, leading to marginally lower annual real GDP growth of 4.9% this year. In 2022, economic growth in the euro area was pared down more significantly from 4.2% to 3.5%.

- The US economy appears to be regaining momentum, following a soft patch seen in the third quarter. The fourth-quarter activity data have been mostly upbeat, boding particularly well for private consumption and exports. Meanwhile, the November employment report came in below expectations, but a broad array of indicators suggest that the US labour market is already on the tight side. The broad-based strength in activity data has led us to improve the US growth outlook for Q4, resulting in a moderately higher annual GDP growth for 2021 of 5.6%. The overall growth figure for 2022 is also slightly more positive at 3.7%.

- Oil prices have plummeted to USD 70 a barrel, triggered by the fears that the new Omicron variant could dampen oil demand. In our view, the oil market is currently pricing the tail risk that existing vaccines are not effective against the new variant. Oil prices are therefore likely to remain under pressure until more information on the virulence of Omicron variant is available.

- Inflation continues to surge to multi-decades high across advanced economies. We maintain a forecast for a gradual disinflationary path in the euro area and the US in the course of 2022, assuming a stabilisation in energy prices, some alleviation in global supply bottlenecks, and a normalisation in consumption patterns. While we acknowledge the upside risk to inflation stemming from second-round effects, there is so far limited evidence, especially in the euro area, that temporary high inflation has set off a wage-price spiral through higher inflation expectations, which would be necessary to produce more entrenched inflationary pressures.

- The Fed is gravitating towards a more hawkish stance on monetary policy, signalled by the recent comments of several FOMC members, including Chair Powell. We now expect the Fed to double the tapering pace to USD 30 billion per month from January onwards, implying a first rate hike already by the end of Q2 2022, followed by two additional 25 bps rate hikes in the latter part of the year. Meanwhile, the ECB is taking a significantly more cautious approach. That said, increased uncertainty due to the emergence of the Omicron variant makes a delay on clarity on the post-PEPP world to early 2022 more likely. Overall, we maintain the view that the ECB will not raise its policy rate in 2022.

The global economy is set to face another challenging winter as we head into 2022. Although underlying growth momentum varies significantly among different regions, the economic outlook has become more uncertain and is subject to substantial downside risks, in particular with respect to the evolution of the pandemic. Almost two years into Covid-19, this highlights the fact that the pandemic still plays a prominent role in shaping the macroeconomic landscape. At the same time, the global economy continues to face a number of additional headwinds such as persistent supply chain disruptions and surging commodity prices, both feeding into elevated inflationary pressures in most economies.

Another pandemic wave, another virus strain

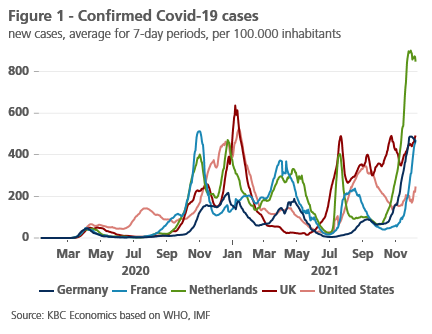

To begin with, the near-term outlook has become cloudier due to the fourth Covid-19 wave in Europe, which poses risks for the entire Northern Hemisphere this winter (figure 1). Despite relatively high vaccination rates, the recent spike in new Covid-19 infections has led to renewed strain on healthcare systems, prompting additional mobility restrictions in many European countries. In Austria and Slovakia, nationwide lockdowns were implemented as a response to a rapid surge in ICU occupancy.

In our view, additional targeted/regional restrictions are likely to be imposed going forward, with a significant risk that more lockdowns could be implemented. That said, even in the absence of stricter lockdowns, voluntary social distancing is likely to have some negative economic consequences, dampening activity in large parts of Europe well into Q1 2022.

Moreover, the emergence of the new and possibly more transmissible Omicron variant could exacerbate these pressures. So far, it has triggered a wave of risk aversion across global financial markets, but it is still unclear whether Omicron increases the risk of hospitalisation/death, and most importantly whether it reduces the efficacy of existing vaccines. All this will shape its economic impact and is set to present a significant source of uncertainty until there is more clarity on Omicron’s characteristics.

We therefore think it is too early to assess its economic impact in our baseline scenario. In any case, despite recent progress in the medical response to Covid-19 (e.g., booster shots, vaccinations for children and antiviral drugs), the emergence of Omicron serves as a reminder that the exit from the pandemic will likely be bumpier and possibly longer than initially envisaged.

Supply-side shocks boost inflation

In addition to adverse Covid-19 developments, multiple pandemic-related supply shocks are weighing on the near-term economic outlook. Global supply chain disruptions have intensified further, limiting manufacturing output worldwide. While we still expect to see a gradual easing of supply bottlenecks through 2022, the risk remains tilted towards longer-lasting pressures, especially should Omicron lead to another setback in the reopening of major exporting nations.

An additional supply constraint on growth is arising from elevated energy prices. In particular, soaring natural gas and electricity prices are eroding households’ purchasing power (in spite of governments’ emergency measures) and are further depressing output in the industrial sector. Against the backdrop of tight natural gas supplies in Europe, we see a colder-than-usual winter as another notable downside risk to our outlook.

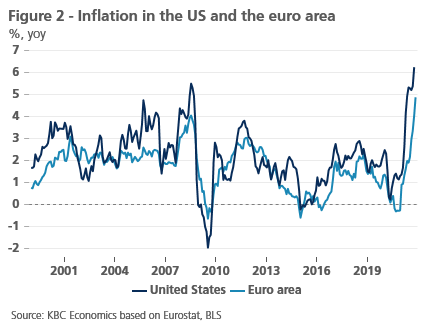

These supply shocks have pushed inflation to multi-decades high across advanced economies, prompting the discussion about global stagflation (figure 2). We maintain the view that supply shocks as well as other pandemic-related dislocations (e.g., changes in the composition of spending patterns in favour of goods) are unlikely to create lasting price pressures. At the same time, that is not to say that inflation will not remain elevated in the coming months (especially in the US) with risks being tilted to the upside.

Importantly, there is currently limited evidence, particularly in the euro area, of strong second-round effects, i.e., we do not yet see that temporary high inflation has set off a wage-price spiral through higher inflation expectations, which would be necessary to produce more entrenched inflationary pressures. In addition, financial markets are not pricing a shift towards structurally higher inflation and seem not to have lost faith in central banks’ ability to attain official inflation targets. Assuming a stabilisation in energy prices, some alleviation of global supply bottlenecks, and a normalisation in consumption patterns, we therefore maintain a forecast for a gradual disinflationary path in the euro area and the US in the course of 2022.

Overall, our baseline economic outlook has become somewhat cloudier and is dominated by downside risks. The near-term headwinds are particularly strong in the euro area (reflected in real GDP growth downgrades), while the US economy appears to be better positioned for sustained activity over the upcoming winter. At the same time, our outlook assumes that headwinds will delay rather than fundamentally derail the recovery. And while real GDP growth is set to moderate across major economies next year, we still look for strong growth rates in both the euro area and the US from a historical standpoint. In China, real GDP growth is set to ease sharply in 2022 against the background of important downside risks stemming from the real estate sector and the policy push towards deleveraging.

Euro area: winter is coming

After a strong performance in the second and third quarter, largely driven by an incremental reopening, the euro area recovery appears to be losing pace amid increasingly strong headwinds. Although retail sales posted a marginally positive 0.2% month-on-month pick-up in October, rising infections and renewed mobility restriction, together with high inflation, are likely to be a drag on the consumption recovery, darkening the economic outlook in the euro area for the months ahead.

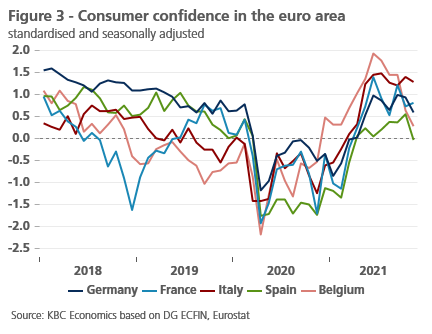

Turning to sentiment indicators, fourth-quarter readings paint a mixed picture. On the one hand, the latest deterioration in consumer confidence reinforces the view of challenges to spending growth in the coming months (figure 3). In November, euro area consumer confidence dropped markedly (though from historically elevated levels), reflecting concerns about rising Covid-19 cases and heightened inflationary pressures.

On the other hand, the euro area composite PMI surprised to the upside and rose to 55.4 in November, rebounding after three consecutive declines. The gains were broad-based across countries and sectors as both services (55.9) and manufacturing (58.4) moved higher and remained well anchored in expansionary territory. However, we take these signals with a grain of salt as the November PMI data did not fully capture the latest surge in infections and new mobility restrictions.

Against the backdrop of mounting headwinds, we have lowered our forecasts for quarterly growth in Q4 2021 and Q1 2022. The moderation in sequential growth dynamics from unusually strong rates seen in the last two quarters had been anticipated, but the recent developments, especially the deteriorating pandemic situation, suggest that growth dynamics are likely to slow more than previously expected.

Taken together, the downward revisions to the near-term growth outlook have brought us to marginally lower annual real GDP growth in the euro area of 4.9% (down from 5.0%) this year. In 2022, economic growth was pared down more significantly from 4.2% to 3.5% (in large part due to the lower overhang effect). That said, growth is set to remain strong by historical standards, supported by pent-up consumer demand (fuelled by still elevated household savings rates), fiscal support from a ramp-up in NGEU disbursements (boding well for public and private investment), and very accommodative monetary policy.

US: re-accelerating momentum in activity

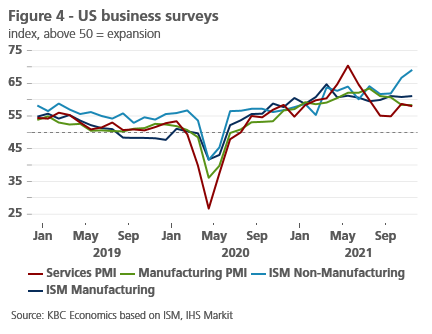

In contrast to the euro area, the US economy appears to be regaining momentum, following a soft patch seen in the third quarter. The fourth-quarter activity data have been mostly upbeat with solid October prints for personal consumption expenditure (+0.7% mom) and retail sales (+1.7% mom), suggesting consumption is off to a much better start this quarter compared to last. As with the retail sales report, October industrial production exceeded market expectations, picking up by 1.6% mom, in part driven by the unwinding of hurricane-related disruptions in previous months.

Incoming soft data reinforce the picture of solid recovery dynamics in the US economy. Across the board, business surveys remained well established in expansionary territory in November, with a particularly buoyant reading for the non-manufacturing ISM index (figure 4). The headline activity index for the manufacturing ISM also recorded a healthy outcome, led by strengthening in production, orders, and employment. The improvement in new export orders (from 53.4 to 54.6) bodes particularly well for exports, which may provide an additional boost to growth in the fourth quarter despite persistent supply constraints affecting the manufacturing sector.

At the same time, the November employment report disappointed with a 210,000 increase in non-farm payrolls, though this followed strong (and upwardly revised) gains recorded in October. Furthermore, the relatively soft headline figure comes with a drop in the unemployment rate from 4.6% to 4.2% (figure 5) and a modest pick-up in the labour force participation rate to 61.8%. Despite total employment still 3.9 million jobs down relative to the pre-pandemic level, a broad array of indicators (e.g., a multi-decade high quit rate) suggest that slack is rapidly diminishing and the US labour market is already on the tight side (also see KBC Economic Opinion of 18 November).

The broad-based strength in activity data has led us to improve the US growth outlook for the fourth quarter, which together with a marginal upward revision of Q3 data, increases annual GDP growth for 2021 to 5.6% from 5.5% previously. Meanwhile, we have marginally decreased the expected growth rate for Q1 2022 based on more of the catch-up growth from a relatively weak Q3 happening already in Q4. However, given overhang effects, the overall growth figure for 2022 is still slightly more positive at 3.7% from 3.6% previously.

There are, nonetheless, important downside risks to this relatively upbeat outlook. Above all, risks related to pandemic developments continue to dominate, especially given relatively low vaccination rates (58% of the US population is fully vaccinated) combined with the November and December holidays in the US that translate into large, often indoor, gatherings.

China: easing supply constraints

Although risks to the economic outlook in China have mounted in recent months, economic activity for the fourth quarter appears to be off to a strong start. October industrial production and retail sales both accelerated to 0.4% mom and 0.3% mom, respectively, corresponding to year-over-year growth rates of 3.5% and 4.9%, respectively. The data, particularly on the industrial side, together with an improvement in the November NBS manufacturing sentiment indicator back above 50 (at 50.1, signalling expansion), suggest that the supply-side constraints stemming from China’s power shortages in September have started to ease. The data also suggest that though growth is expected to continue slowing in the fourth quarter, from 4.9% year-over-year in Q3, the slowdown could be somewhat contained, leaving annual growth of 8.2% in 2021 in reach.

However, there are still important downside risks to this outlook and the outlook for 2022, particularly stemming from the real estate sector and the policy push towards deleveraging. Various indicators suggest that turnover in the real estate market and associated construction investment is decelerating, presenting an important drag on growth. Policymakers in China, therefore, continue to face a trade-off between cracking down on risk in over-leveraged sectors and supporting growth. There are some nascent signals that the tide may be turning toward a moderate easing bias, however, given slight language adjustments in the PBoC’s most recent monetary policy report (i.e., the removal of references regarding not engaging in large-scale stimulus) and a further 50 bps cut to the Reserve Ratio Requirement to 10% (following an earlier 50 bps cut in July).

Oil: down sharply on Omicron fears

After reaching a three-year high of USD 86 a barrel in October, Brent crude has plummeted below USD 70 a barrel. Although oil prices started easing already in mid-November due to the US-led coordinated release of the Strategic Petroleum Reserves, the slump was largely triggered by fears that the new Omicron variant could dampen oil demand. Despite the adverse price developments, the OPEC+ alliance has agreed to continue ramping up production by 400,000 barrels per day in January, defying market expectations for a pause in the tapering of production cuts. On the flip side, the alliance’s December meeting is (unusually) technically still in session, indicating that OPEC+ stands ready to revisit its decision and “make immediate adjustments” should the downside risk to demand from Omicron start to materialise.

In our view, the oil market is currently pricing the tail risk that existing vaccines are not effective against the new variant. As a result, oil prices are likely to remain under pressure until more information on the virulence of Omicron variant is available, which can take several weeks. In the meanwhile, we maintain our constructive outlook for oil prices next year. Backed by still favourable fundamentals, we forecast Brent crude to average USD 80 a barrel in 2022.

Inflation: elevated but not lasting

A strong recovery in oil prices, together with the inflation impulse from reopening and supply bottlenecks have been the key driving forces behind surging prices this year. Admittedly, inflation has reached higher levels and remained elevated for longer than we had expected, prompting us to frequently upgrade our inflation outlook. In the course of 2022, we nonetheless expect inflation rates to moderate as we pencil in a stabilisation in energy prices, implying more favourable base effects coming into play. Furthermore, goods inflation is expected to decelerate amid a gradual easing in global supply chain disruptions, and a normalisation in the composition of spending (i.e., a rotation towards services).

In October, US headline CPI inflation accelerated to 6.2% year-on-year, led by increases in housing costs, food prices, and transportation costs (figure 6). The latter is driven to a large degree by higher fuel prices, but the price increase of new and used cars also accelerated again after decelerating between July and September. We see a similar story for housing price inflation, with the accelerating cost of fuels and utilities playing a role but increasing rent prices also contributing strongly.

The result is that core CPI inflation also increased to 4.6% year-over-year in October after having decelerated in July and August and stabilising in September. Year-over-year inflation will likely remain strong through the end of 2021, implying annual inflation at 4.6%. However, we continue to expect a deceleration of price growth through 2022, though potentially at a slower pace than previously envisioned. Given this and overhang effects, we have moderately revised up our 2022 annual inflation forecast from 2.7% to 3.0%.

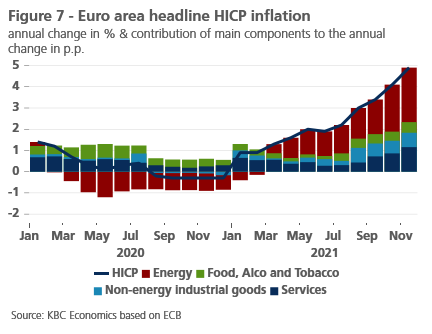

In the euro area, headline HICP inflation rose to 4.9% year-on-year in November, the highest level since the creation of EMU (figure 7). Energy remained a major driver of inflation acceleration, but price momentum has turned increasingly broad-based with a sizable jump in services inflation and a somewhat more modest rise in non-energy industrial goods inflation, leading to a rise in core inflation to 2.6% year-on-year. Euro area inflation is expected to start falling notably in the coming months, helped by favourable base effects and the unwinding of technical factors, including tax and methodological changes.

Following November’s HICP data releases, we have mechanically updated our headline inflation forecast for 2021 to 2.6% (from 2.5% previously). Our forecast for euro area inflation in 2022 was also revised higher from 2.0% to 2.3%.

Central banks: time to take the turn

After the November policy meeting where the tapering of asset purchases was announced, the Fed appears to be gravitating towards a more hawkish stance on monetary policy. Fed Chair Powell, who is set to be re-appointed by President Biden to another four-year term, has made a notable remark that “transitory” is no longer the right description of the inflation story, implying that the balance of risks clearly shifted in his view. Importantly, Powell translated his new inflation view and associated risks into backing a faster taper process, echoing the hawkish views of some of his FOMC colleagues.

Against these strong hawkish signals, we now expect the Fed to accelerate the tapering pace from USD 15 billion to USD 30 billion per month from January onwards so that the tapering is completed by the end of the first quarter, or latest at the beginning of the second quarter of 2022 (instead of originally scheduled mid-2022). In our view, a much faster tapering implies an earlier lift-off than previously envisaged. We therefore now assume a first rate hike by the end of Q2 2022 (with an upside risk of lift-off as early as March), followed by two additional 25 bps rate hikes in the latter part of the year.

In Europe, the ECB is taking a significantly more cautious approach. The latest comments by ECB officials continued to emphasise the transitory nature of inflation stemming from supply-side shocks. At the upcoming December policy meeting, the ECB was expected to provide additional forward guidance about the likely end of its Pandemic Emergency Purchase Programme (PEPP) in March 2022. However, a sharp rise in new Covid-19 cases in Europe, and especially increased uncertainty due to the emergence of Omicron variant suggest a delay on clarity on the post-PEPP world to early 2022.

Overall, we side with the view of not expecting too much from additional bond purchases under the Asset Purchase Programme (currently EUR 20 billion a month) beyond the shelf date of the PEPP. Net asset purchases are expected to grind to zero towards the end of 2022, clearing space to tackle inflation via the traditional interest-rate mechanism afterwards. Along these lines, and consistent with the central bank’s own forward guidance, we do not expect the ECB to raise its policy rate in 2022.

All historical quotes/prices, statistics and charts are up to date, up to and including 6 December 2021, unless otherwise stated. The positions and forecasts provided are those of 6 December 2021.