In depth review: Belgium (seulement en anglais)

Credit Research: Belgium

2019 OLO funding need drops to €28bn; 2 new syndicated deals (10y & 20y(+) ?)

OLO volatility extremely low; fresh general elections a wildcard?

ECB remains active in OLO market via reinvestments; estimated at €5.85bn

Growth momentum slowing; tight labour market a hampering factor

Public debt: ageing costs need to be adressed to avoid rising debt ratio

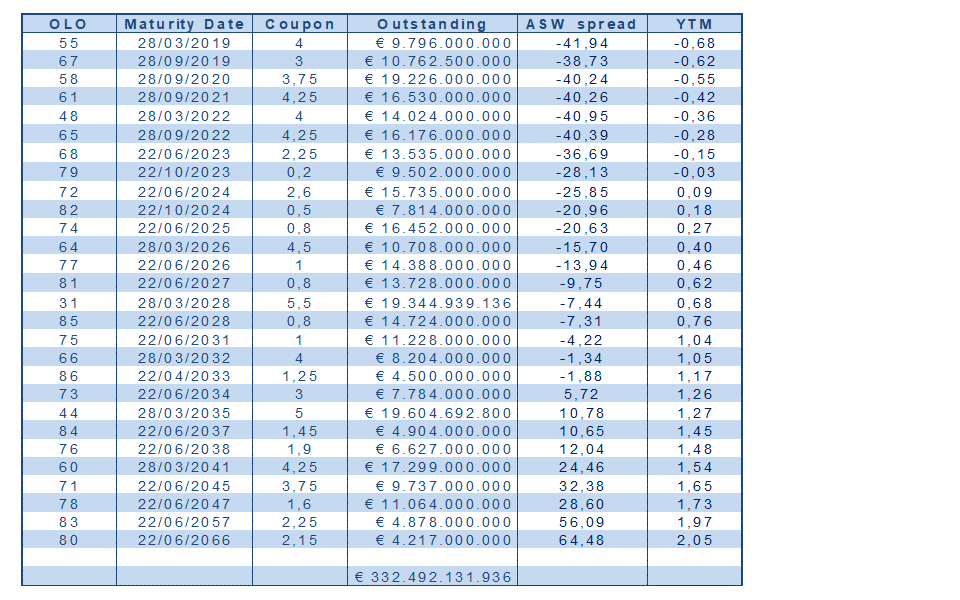

Funding update

The Kingdom of Belgium released its borrowing requirements & funding plan for 2019. The Treasury expects its gross borrowing requirements to amount to €30.11bn (vs €33.59bn in 2018). This consists of €23.35bn OLO redemptions, €1.16bn planned pre-funding for 2020, a €5.43bn budget deficit and €0.25bn other financing requirements. The debt agency adds that it doesn’t assume any proceeds of asset sales or privatisation when calculating the deficit. They are quite probable though, so the borrowing requirement could be lower than currently forecast. Maturing OLO’s are OLO 55 (4% Mar2019) and OLO 67 (3% Sep2019)

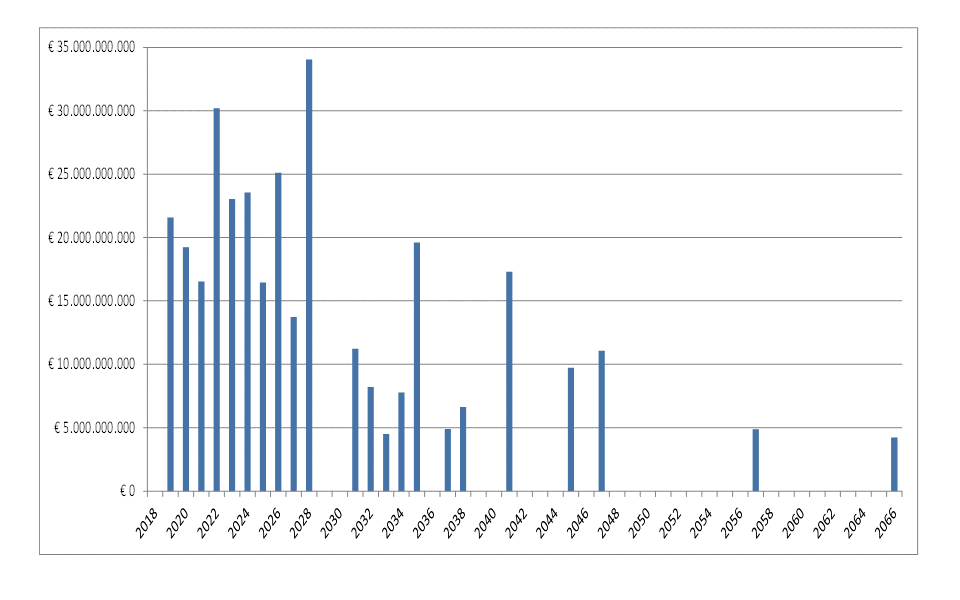

To fund the borrowing requirement, the Belgian Debt Agency plans amongst others to issue €28bn of OLOs, which is €5.94bn less than this year. It expects to launch two new OLO fixed-rate benchmarks. The main other funding source is the EMTN programme (€2bn). Apart from the new OLO syndications, the number of regular auctions remains at 7 and the Treasury may use the possibility of syndicated taps on longer term OLO benchmarks (including last year’s green OLO). The focus remains on extending the average life of the debt portfolio. At the end of November, the indicator reached 9.59 years. In 2019, it is required to be higher than 9 years, the same target as in 2018.

In this respect, we expect more long term benchmarks in 2019. Traditionally, the Belgian debt agency launches a 10-yr benchmark in January (Jun2029). There is no debt outstanding in 2029 or 2030, allowing the Treasury to fill these gaps in the curve next year and the year after. For the other new benchmark, the debt agency specifically mentions the syndication of a benchmark with a minimum maturity of 15 years. As the debt agency issued a 15-yr (green) OLO last year, we expect them to prefer a 20-yr deal or longer next year. On top, the debt agency already has €7.78bn outstanding in 2034, compared to no bonds maturing in 2039 (20y), 2044 (25y) or 2049 (30y). Investor demand and the yield environment will eventually decide on the preferred tenor. This year, the Kingdom issued 2 new bonds, following 4 benchmarks in 2016 and 2017: 10-yr OLO 85 (€5bn 0.80% Jun2028) and inaugural 15-yr green OLO 86 (€4.5bn 1.25% Apr2033).

The Belgian debt agency continues to have favorable supply dynamics in 2020 and 2021 with OLO redemptions amounting to approximately €20bn and €17bn respectively. Supply is thus expected to remain rather low.

Belgian redemption profile: favorable in 2019-2021

PSPP: reinvestments take over

Under its Public Sector Purchase Programme, the ECB bought €72.9bn OLOs up until the end of November. The Kingdom of Belgium has currently around €340bn OLOs outstanding. The weighted average maturity of the ECB portfolio is 9.32 years. The ECB ends its net asset purchases by the end of the year, but remains active in the EMU government bond market via its reinvestment policy. All maturing bonds from the ECB’s APP portfolio will be reinvested in full. There’s no specific end date to this policy and we don’t expect any announcement about it in 2019. We estimate that the ECB will buy around €5.85bn of OLOs this way during 2019, which is 21% of OLO supply. This compares with 45% in 2015, 68% in 2016/2017 and 34% last year, but still is a significant amount.

ECB remains OLO buyer even after ending net asset purchases

Volatility on OLO market extremely low

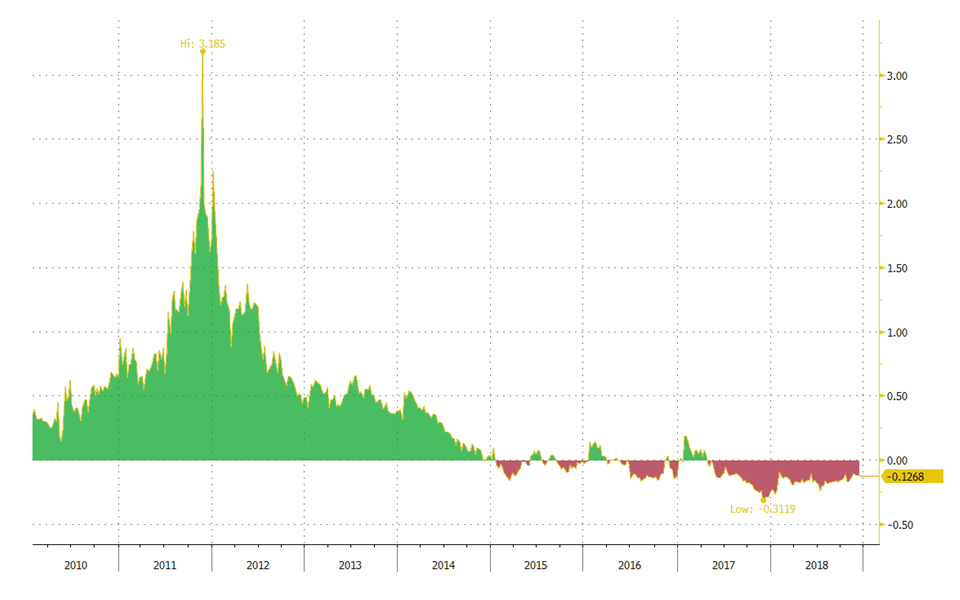

Belgian bonds traded extremely stable over the past months. Stress stemming from the Italian political scene didn’t influence (semi-)core debt. Investors shrugged off the Belgian political crisis (related to migration pact) as well, even if it threatens to advance next year’s May general election. The spread between OLOs and French OAT’s decreased lately, but that’s mainly due to a French underperformance. French President Macron’s reaction to stem street protest (hit the spending pedal) isn’t well received. A deteriorating fiscal situation might cause rating agencies to look into French ratings next year.

In 2019, we expect Belgian OLOs continue trading at relatively stable levels compared to swap with the ECB’s policy normalization only taking off very slowly. General elections are a wildcard as they risk putting the country in a new political deadlock. However, the eventual new government isn’t expected to allow a substantial erosion of fiscal policy, nor propose measures which run against existing E(M)U-treaties (like Italy did). Unlike the 2011 episode, monetary policy remains extremely accommodative, making the probability of a similar spread widening rather low.

Spread between Belgian 10y yield and EU 10y swap rate: new general election can cause new political deadlock, but this time without the negative side-effects from 2011

Credit rating stable

Rating agencies didn’t alter the Belgian rating or outlook during the course of 2018. The last rating action occurred at the very end of 2017 when Fitch downgraded Belgium’s credit rating from AA to AA- (stable outlook) as the government struggled to reach its goal of returning to a balanced budget. Persistent fiscal slippage delayed the start of substantial debt reduction to 2019, according to Fitch. That’s two years later than Fitch projected in November 2014, when it put Belgium’s rating at negative outlook. Fitch now maintains a similar rating as Moody’s (Aa3 stable outlook), while S&P’s rating is one notch higher at AA (stable outlook). We don’t expect any rating action this year neither.

Weaker growth momentum

Belgium’s economy grew at a more moderate pace compared to the euro area over recent years. Since 2013, cumulative real GDP growth has been 8.7% in Belgium, compared to 10.9% in the euro area. Amongst neighbouring countries, both Germany (+11.3%) and the Netherlands (+12.1%) performed much better, while France performed slightly worse (+8.0%). From a longer-term perspective, Belgium’s growth performance was not that bad, however. Cumulative real GDP growth over the full business cycle, starting at the beginning of 2008, is almost 10% in Belgium, compared to only 7% in the euro area. Germany has done better (+13%), while France underperformed (+8%) and the Netherlands performed on par with Belgium at roughly 10% cumulative growth as well.

Belgium’s more recent underperformance vis-à-vis the euro area continued through the first half of 2018. Third quarter GDP growth positively surprised though. Belgian real GDP rose by 0.3% Q/Q, as against growth of 0.2% in the EMU. It was the first time since Q2 2016 that Belgian growth outpaced euro area growth. The Q3 figure was similar to the growth figures posted in the previous two quarters. Looking at GDP components, the most remarkable fact in the Q3 figures was the fall in household consumption.

Belgian real GDP growth in Q3 beats EMU figure (Q/Q, in %)

Although Belgium’s Q3 growth outperformed growth in the euro area, it remains rather low. Most likely, real GDP growth in Belgium for 2018 as a whole will only be 1.5%. This is a clear slowdown compared to the 1.7% growth recorded in 2017 and below the figure expected for the euro area (i.e. 1.9% in 2018). Leading indicators are signalling that Belgium’s economic growth is abating, in parallel with the euro area in general. While consumer and producer sentiment indicators in Belgium are still at reasonable levels, they are now well below the record highs observed in late 2017. Since spring, Belgian consumers have been hesitant, alternating between a loss and recovery of optimism. The NBB business barometer, on the other hand, is clearly on a downward path.

Looking at sub-indicators of the NBB barometer, the assessment of export orders in Belgium’s manufacturing industry deteriorated in particular, fully in line with the sharp drop seen in the German Ifo-indicator. In 2018, economic activity in Belgium was still, to a large extent, supported by net exports. We believe that this will no longer be the case in 2019, as export dynamics gradually slow down. Against this background, real GDP growth in our scenario will slow further from 1.5% in 2018 to 1.4% in 2019. This figure is a bit lower than the 1.5% growth expected by the European Commission in its autumn forecasts. The expected pace of expansion in 2019 is still roughly in line with potential, however, which is estimated by the European Commission at 1.4%.

Export orders in the manufacturing industry (sub-component NBB barometer)

Tight labour market hampers growth

In recent years, the Belgian labour market has outperformed to such an extent that companies are finding it increasingly difficult to fill their vacancies. According to harmonised Eurostat figures, the Belgian unemployment rate averaged 6.3% in the first nine months of 2018. This is two percentage points lower than the euro area figure and the lowest rate since the early 90s. The fall in unemployment in recent years was mainly due to the high employment intensity of economic growth. In 2014-2017 each percentage point of real GDP growth generated 0.64 percent growth in employment on average, which is higher than in previous recovery periods. In this way, 250 000 net jobs have been created in Belgium since 2013.

The elevated tighthess of the labour market is reflected in a record number of job vacancies. In the second quarter of 2018, 3.5 out of 100 jobs in Belgium remained unfilled. This vacancy rate (measured as the number of job vacancies relative to the total number of jobs available) is the second highest in the European Union. The tightness of the labour market is also apparent from a survey of manufacturing companies conducted by the National Bank of Belgium: at present, almost one in eight companies suffers from a shortage of skilled labour.

On the one hand, the large number of job vacancies is an indicator of the favourable economic climate. On the other, the situation is also increasingly structural, due to demographic factors and the poor matching between job openings and jobseekers. As labour market tightness becomes more acute and structural, it is limiting opportunities for companies to develop new activities. This reverses the causal relationship between growth and tightness, with tightness hampering GDP growth. An indication that Belgium has reached this turning point is the growing gap between GDP growth and the shortage of skilled labour reported by companies. The problem is more acute in Belgium than elsewhere in the euro area and will likely contribute to keeping Belgian economic growth below that of the euro area in the coming years.

Labour market tightness and GDP growth in Belgium

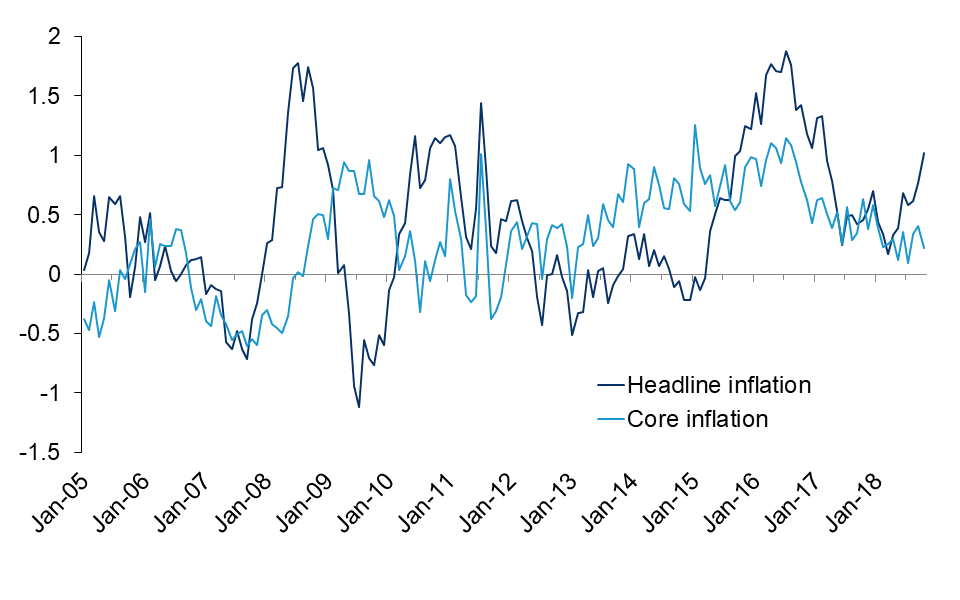

Inflation gap with EMU creeping up again

Belgian headline inflation, as measured by the harmonised index of consumer prices (HICP), was running at 3.2% in October. Inflation based on the national CPI stood at 2.8% that month. The large discrepancy between the HICP and the CPI inflation is mainly due to the larger weight of fuels and energy sources in the HICP and to the fact that a moving average is used for domestic heating oil in the CPI. The product group with the biggest upward effect in inflation in recent months was ‘housing, water and energy’. Despite the notable increase in the headline rate, Belgian core inflation (excluding energy and unprocessed food prices) has remained rather muted and unchanged at 1.6% since July.

In recent months, the headline inflation gap with the euro area has widened substantially again. The higher inflation in Belgium remains a point of attention, as it results in second-round effects in the economy through the system of automatic wage indexation. Preventing the inflation gap from becoming structural in nature, is a major challenge for safeguarding the country’s competitiveness. We expect average inflation in Belgium to decline, from 2.1% in 2018 to 1.8% in 2019. This should narrow the inflation gap with the euro area from 0.7 and 0.3 percentage point in 2017 and 2018 to 0.1 percentage point in 2019.

Inflation differential Belgium vs EMU (in % points)

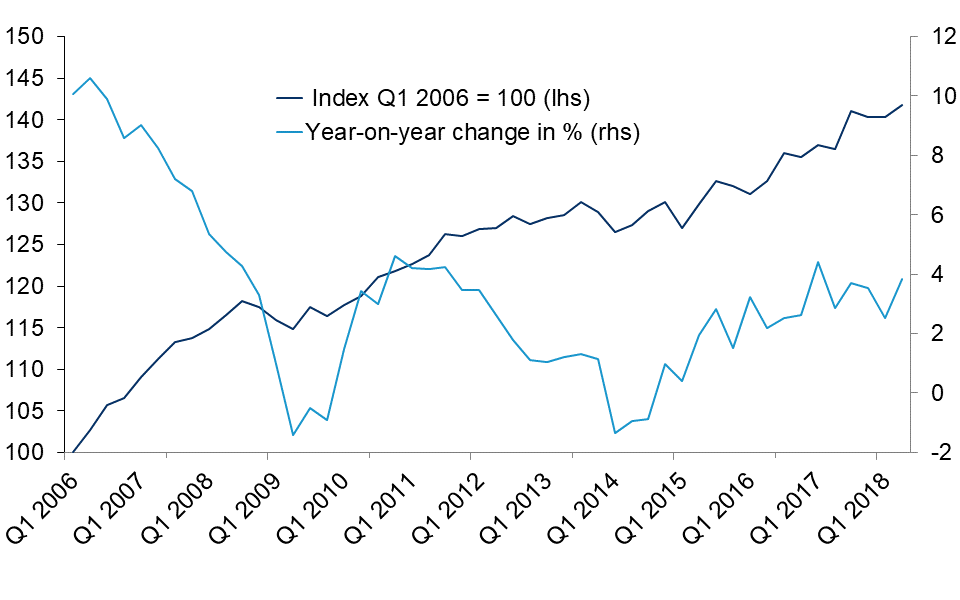

According to Eurostat’s harmonised house price index, prices for existing and new dwellings in Belgium rose by 3.9% in Q2 2018 (Y/Y). This is an acceleration compared to the Q2 price increase (+2.5%) and even to the 3.6% price increase recorded for the full year 2017. Further developments on the Belgian housing market must be monitored closely, as the price acceleration seen in recent years is adding to the risk of an overvaluation of the market. The fundamentals of Belgium’s housing market, generally, remain positive, but they don’t underpin price increases of above 3%. Given weaker GDP growth and higher interest rates ahead, we expect house price inflation in Belgium to slow down in the coming years, to between 2‐3% per year.

House prices (Eurostat harmonized figures)

Public debt simulation

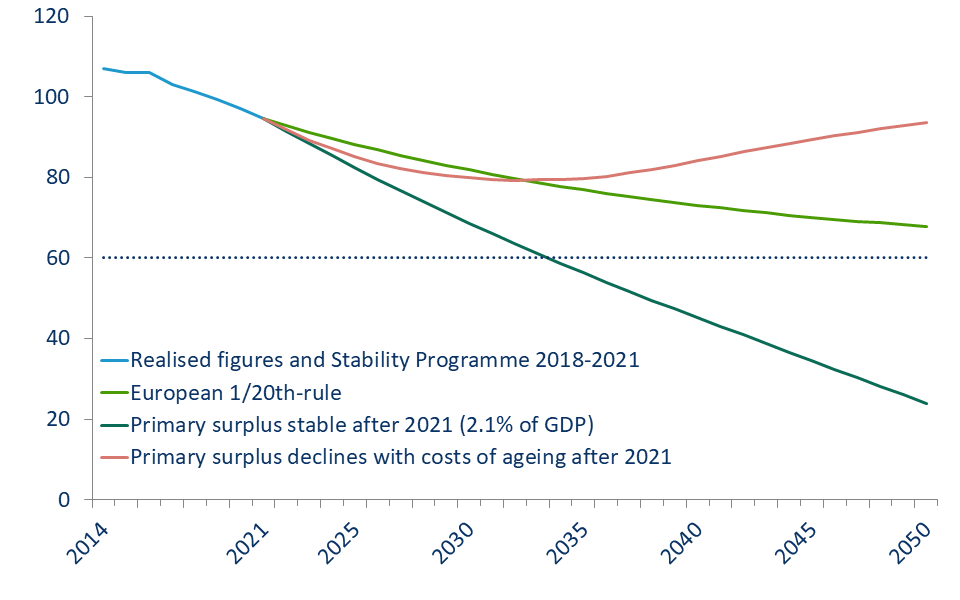

Belgium faces the major challenge of further reducing its debt ratio at a sufficiently rapid pace in the coming years. To reduce the debt in the long term and to be able to withstand negative scenarios concerning economic growth and interest rate developments, the primary surplus should ideally amount to at least 2% of GDP. In its latest Stability Programme, submitted to the European Commission in spring 2018, the Belgian government committed itself to increase the primary surplus to 2.1% of GDP in 2020 and 2021, from 1.6% in 2017. This commitment also implies achieving the medium-term objective (MTO) of a structural budget balance in 2020.

As soon as the MTO is achieved, further debt reduction must take place in accordance with the European 1/20th debt rule. This rule states that the debt ratio must decrease annually by at least 1/20th of the amount of debt above the 60% debt-to-GDP limit. If, from 2020 onwards, the government were to succeed in maintaining the primary surplus at 2.1% of GDP, the actual debt reduction would far exceed the reduction imposed by the 1/20th rule. The debt ratio would then fall below 60% of GDP between 2030 and 2035. In this simulation, we assume that nominal GDP growth from 2021 onwards will be 3.3% per annum (1.3% real growth and 2% inflation) and that the implicit interest rate on the debt will tend towards 2.5% in 2030, then 3.2% by 2040 and remain at that level thereafter. However, maintaining the primary surplus will be a difficult task given the expected costs of ageing. According to the Study Committee on Ageing, these annual costs will, on a no-policy change basis, increase by 3.6% of GDP to a peak around 2040 (by 2030 the increase will amount to 2.4% of GDP). If, after 2020, we allow the costs of ageing to affect the primary balance, the debt ratio will rise again from 2034 onwards. Consequently, after 2033, the 1/20th rule will no longer be met.

Scenarios for Belgian public debt after realization of Stability Programme (% of GDP)

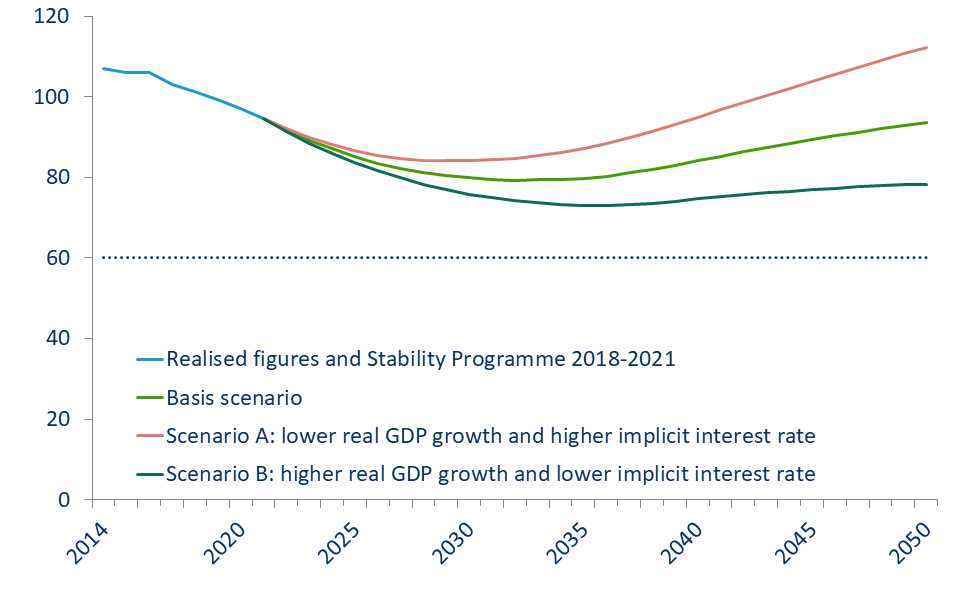

The graph below illustrates the sensitivity of the simulation to changes in the assumption regarding real GDP growth and the implicit interest rate on public debt. We again assume that, after 2021, the primary surplus decreases with the expected costs of ageing. In scenario A, we assume lower annual real GDP growth (1.0% instead of 1.3%) and a higher implicit interest rate, reaching 3.0% in 2030 and 3.7% from 2040 onwards (instead of 2.5% and 3.2% respectively). In scenario B, we assume higher annual real GDP growth (1.6%) and a lower implicit interest rate, reaching 2.0% in 2030 and 2.7% from 2040 onwards.

Scenarios for the Belgian public debt with the costs of ageing impacting the primary surplus (% of GDP)

It is clear that in a worst-case scenario of low growth, high interest rates and having to take account of the costs of ageing, the debt ratio would rise sharply again. In scenario A, the implicit interest rate will exceed nominal GDP growth from 2030 onwards, causing the interest snowball to start rolling again. Scenario B shows that the ageing costs are more digestible with higher growth and lower interest rates.

Overall financial situation still healthy

The latest budgetary figures cast doubt on the government's willingness to rapidly achieve a sufficiently high primary surplus. In the budget plan for 2019, the government sets the target for the overall budget balance at a lower level (a deficit of 1.0% of GDP) than had been put forward earlier this year in the Stability Programme (a deficit of 0.7%). According to the EC's latest estimate, the deficit will amount to 1.1% of GDP in 2019. For 2018, too, the deficit (estimated by the EC at 1.0% of GDP) will be slightly higher than previously forecast. Given the somewhat lower interest costs, the figure for the overall balance in 2019 corresponds to a primary surplus of 1.2% of GDP. This is a substantial decrease compared to the 2017 figure (1.6% of GDP) and lower than the Stability Programme target.

Net financial asset position (2017, in % of GDP)

Although the Belgian public debt ratio is still too high today, we should not overstate the economic risks associated with it. The high public debt is offset by the favourable overall financial situation of the Belgian economy, thanks to a relatively healthy private sector. As a result, the economy as a whole (households, businesses and government combined) is in a very positive net financial asset position. In 2017, it amounted to 48.3% of GDP, compared with a net debt position of 6.4% of GDP for the entire euro area. This is the highest figure in the euro area after Malta and the Netherlands). Belgium owes this favourable overall position to the high net assets of households (244% of GDP, compared to 150% in the euro area), which more than offset the net debts of the public and private sectors. In the non-consolidated figures, the debt burden of Belgian companies is artificially inflated by the existence of a large number of intra-group loans, due in part to the system of notional interest deduction.

Table 1: Outstanding Belgian government bonds (December 14)