Vanguard fights in European-American Trade War

International institutions are squeezing each other out to lower their growth prospects for the global economy. The trade war between the United States and China is presented as a major cause of the growth slowdown. The possible escalation of this conflict to Europe is a matter of great concern. In particular, the American threat to impose higher import tariffs on European cars and car components weighs on sentiment and prospects for European industry. A direct trade confrontation between the European Union and the United States is temporarily blocked by hopes of a breakthrough in the ongoing trade negotiations. At the same time, however, both trading partners are bombarding each other with more and more economic weapons. These vanguard fights increase the chances of an effective escalation of the trade war to Europe.

No hard confrontation

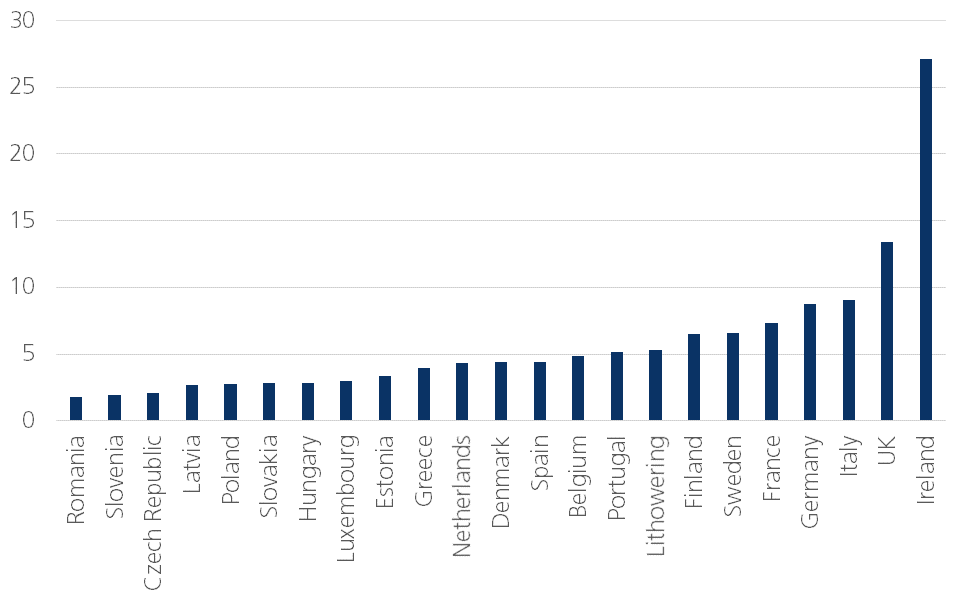

Strictly speaking, there is currently no trade war between the United States (US) and the European Union (EU). The European Commission calculated that only 2% of all trade contacts between the US and the EU currently give rise to some form of discussion. At most, we can talk about a real trade conflict in the steel and aluminium sectors. Indeed, the US increased tariffs on steel (25%) and aluminium (10%) in 2018. The motivation for this decision was the impact of the rapidly growing steel and aluminium imports on US national security, a debatable argument. The EU’s counter-reaction to this protectionist move was relatively mild. Europe only increased some tariff rates on some symbolic products such as Harley-Davidsons, Bourbon whiskey and Levi’s jeans. Meanwhile, we note that the introduction of the higher tariffs had only a limited impact on international steel exports to the United States (see figure 1). European companies, in particular, are holding their own in this conflict, thanks in part to their many years of experience with the rise of protectionism and, above all, because of the higher quality of European products.

Figure 1 - Recent evolution in US steel and iron imports

Thanks to the mild European reaction, this sector-specific conflict did not escalate into a total trade war. Europe can be accused of being somewhat naive, but the cautious European attitude brought - for the time being at least - stability in transatlantic trade relations. European exporters are also protected by an informal agreement between Jean-Claude Juncker and Donald Trump not to fight each other for now, but to look for common interests at the negotiation table.

Keep on talking

Negotiations between the US and the EU have been ongoing for several months now. They are not formal trade negotiations that should lead to a new bilateral agreement, as was previously the case with the Transatlantic Trade and Investment Partnership (TTIP). This far-reaching ambition is dead and buried for the time being. The abolition of most of the existing tariffs on industrial goods is, however, still on the table. This ambition is not unrealistic, as tariff protection in both directions is currently already very limited (around 3% on average). A recent study by the European Commission showed that the complete elimination of all import tariffs would increase EU exports to the US by 8% and, conversely, US exports to the EU by 9%. The welfare effects due to increased efficiency and price reductions would be significant, due to the size of total US-EU trade. More fundamentally, further liberalisation of EU-US trade requires an agreement on non-tariff barriers. Harmonisation or mutual recognition of regulations in particular would generate the greatest economic impact, but this remains the most difficult exercise. The attitude towards China also remains a bone of contention, given Europe’s relatively milder attitude towards the Chinese dragon. Finally, we note a willingness on the part of both the EU and the US to reform and modernise the World Trade Organisation. The airwaves are relatively silent about all these matters. The big question is whether, after the silence, there will be a breakthrough that reduces transatlantic trade tensions, or whether this is rather silence before the storm.

From Google Tax to Car War

If we look at other aspects of EU-US economic ties, the ‘silence before the storm’ option seems the most likely. In anticipation of greater clarity about the evolution of direct trade relations, we are seeing a number of policy initiatives in Europe that may have major implications for trade relations, to put it mildly. The fine imposed on Google by the European Commission hits the American economy right at its economic heart, the fast-growing technology sector. Earlier, the French government introduced a ‘Google Tax’ to oblige multinationals to pay a minimum tax regardless of their international fiscal constructions. These are very dangerous manoeuvres that can provoke fierce reactions from the White House. This is particularly true now that the US administration has a US Department of Commerce investigation report on the possible harmful impact of European vehicle imports on US national security. This report remains secret for the time being, so the American President himself can interpret the results of the investigation and use them at will in any reaction to Europe.

Europe is also playing with fire in other areas. The introduction of higher environmental standards is high on the European agenda. The recent tightening of CO2 emission standards for cars in particular received a great deal of attention. More generally, the EU and its Member States are tightening up many environmental standards in the justified fight against climate change. Despite the good intentions of these measures, they have a side effect: they increase technical barriers to trade for non-European companies, which are also obliged to adapt to European standards. Especially for American producers, who are generally less focused on environmentally friendly technologies, this means a considerable adjustment cost, which creates a competitive disadvantage. Some will interpret this as unfair competition measures which, once again, cannot exclude retaliation.

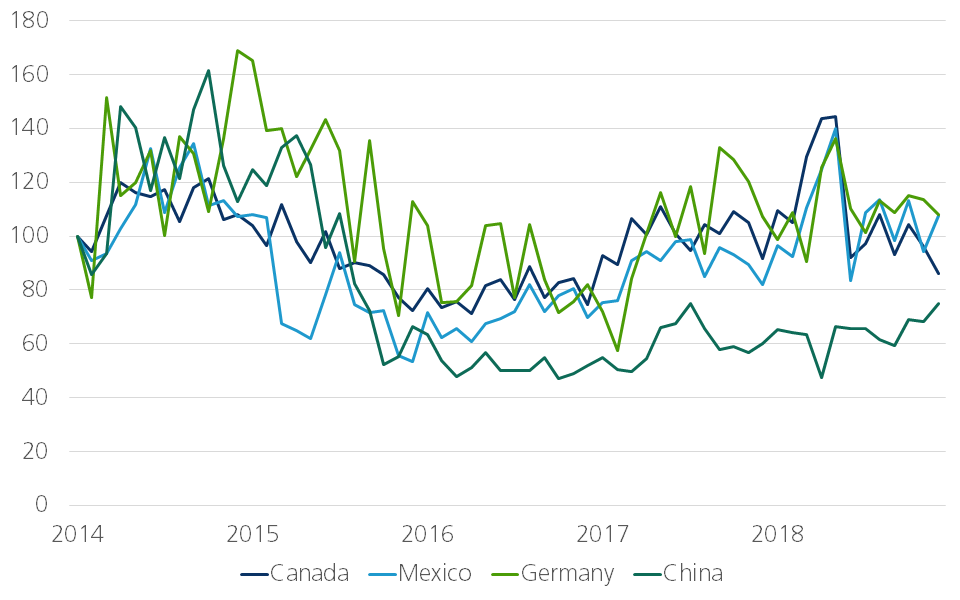

Conversely, Europe may, of course, also be annoyed by several recent US policies. Just think of the high fines imposed on a number of European financial institutions in the wake of the financial crisis. The American sanctions for European companies doing business with countries like Iran also seem unfair, at least in European eyes. But the big difference is that the outbreak of a fully-fledged transatlantic trade war will hurt Europe more than the US. The open European economy depends on good market access to the main world markets. The US market is particularly important for many EU Member States, although its relative direct importance varies considerably (see Figure 2). The current vanguard battles therefore threaten to provoke a direct trade conflict. It is important that the EU and the US continue an intensive dialogue with each other, not only on trade, but on their economic relations in the broadest sense.

Figure 2 - Exports of goods to US as % of total exports in 2017