High tide on the Belgian real estate market not without risk

The 60th edition of Batibouw - the largest Belgian building fair - will start on 21 February. In Belgium, both building permits and sales of existing property skyrocketed in 2018, partly driven by the real estate appetite of investors. The strong interest in real estate translates into continually rising house prices. Against the background of strong household debt accumulation and already some (limited) overvaluation, the risks of overheating of the Belgian real estate market are increasing.

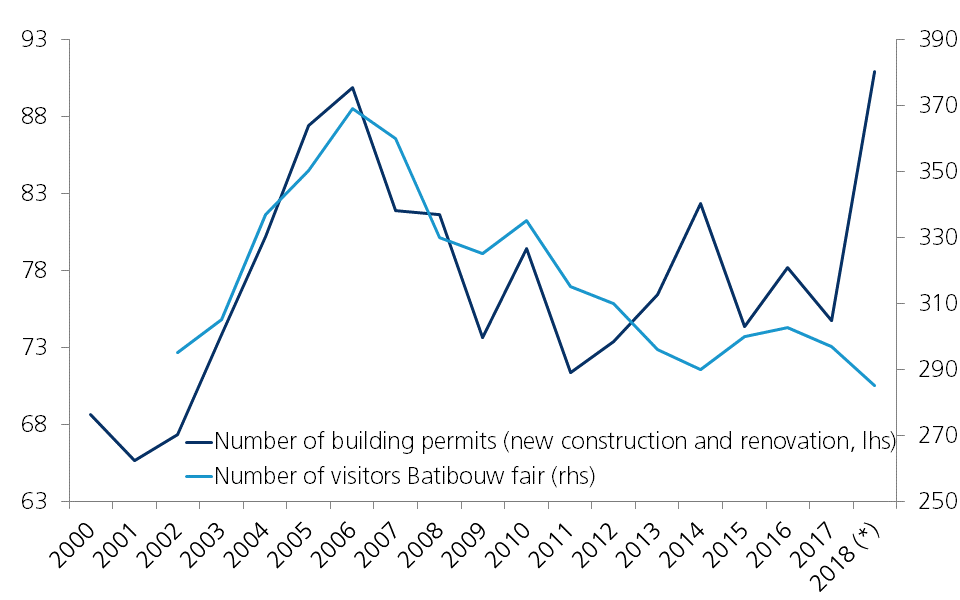

In the past, a (less) successful Batibouw edition - measured in terms of attendance - was often the precursor for a (less) good year for the building permits (Figure 1). Before the financial crisis, the number of visitors to the building fair and the number of building permits rose sharply. Both went downhill during the crisis. 2018 was an atypical year. The permits were booming and yet the fair received remarkably fewer visitors. According to the organisers, the number of visitors in 2018 suffered from adverse winter weather and a public transportation strike. That 2018 was nevertheless a good year for construction, is evidenced by other figures besides the building permits. Housing investments, for example, contributed positively to GDP growth, and confidence in the construction sector remained buoyant throughout the year. The latter is remarkable, as business confidence in the entire Belgian economy deteriorated.

Figure 1 - Number of visitors Batibouw and building permits (in thousand)

(*) Estimated permits based on growth first 10 months compared to same period a year earlier

Source: KBC Economics based on Batibouw and Belstat

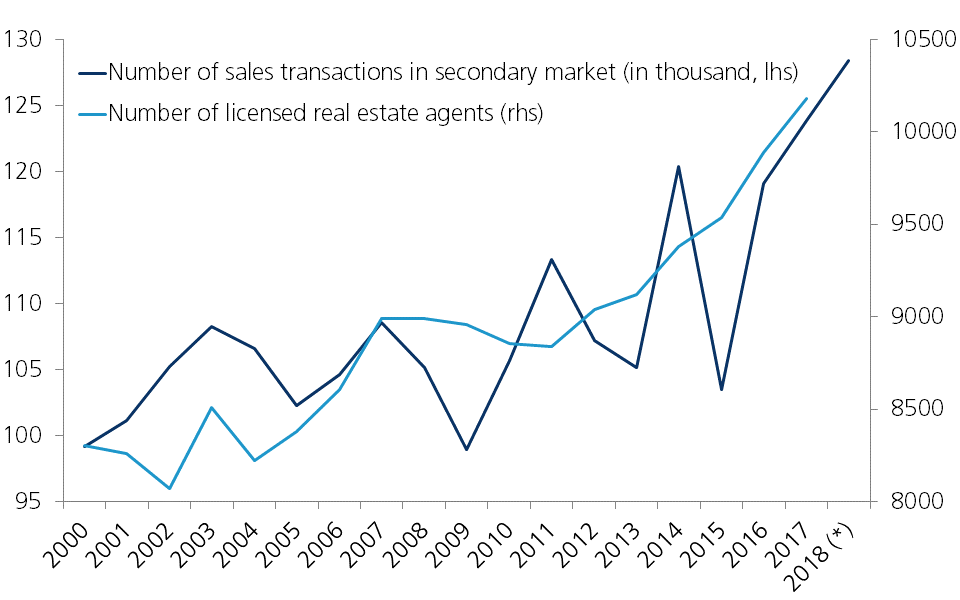

More generally, the broader property market in Belgium is doing very well. The sale of existing homes (the secondary market) is also celebrating high times, with a new peak in 2018. The high level of interest in real estate has led to a sharp increase in the number of licensed real estate agents in recent years (Figure 2).

Figure 2 - Number of real estate agents and sales transactions in the secondary market

(*) Estimated sales transactions based on growth first 9 months compared to same period a year earlier

Source: KBC Economics based op Institute of Professional Real Estate Agents (BIV) and Belstat

In 2017, the ten thousand mark was exceeded. The sum of the number of permits in the primary market (new construction and renovations) and the number of sales transactions in the secondary market is an indicator of the total activity on the Belgian real estate market. It has experienced strong fluctuations in recent years, mainly as a result of the financial crisis and changes in property taxation and new building regulations. But over a longer horizon, this sum has been structurally increasing. In 2018, it was estimated at 225,000, compared to 168,000 in 2000.

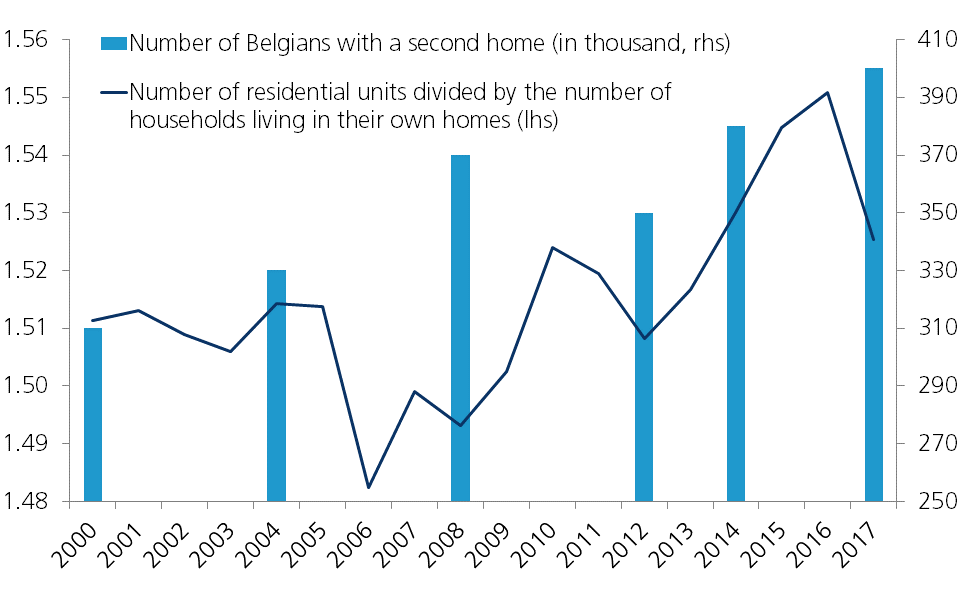

The strong interest in real estate comes to a large extent from investors. The main reason is the continuing low interest rate environment, which makes real estate investment relatively attractive. If we divide the number of residential units in Belgium by the number of households living in their own homes, we obtain a rough measure of the extent to which property owners invest in residential real estate. We make the simplifying assumption that the owner-occupiers are also the buyers of the other properties (for rent or as a second home) and that tenants therefore do not own any property. Figure 3 illustrates the increased investor interest looked at this way. Recently there was a decline, but this is because there are again more households with a first home. Figures from the West Flemish Economic Study Bureau (WES) on the number of Belgians with a second home also indicate a great interest in real estate (Figure 3).

Figure 3 - Measures of investors’ interest in residential property in Belgium

Source: KBC Economics based on WES, Belstat, Federal Planning Bureau and Eurostat

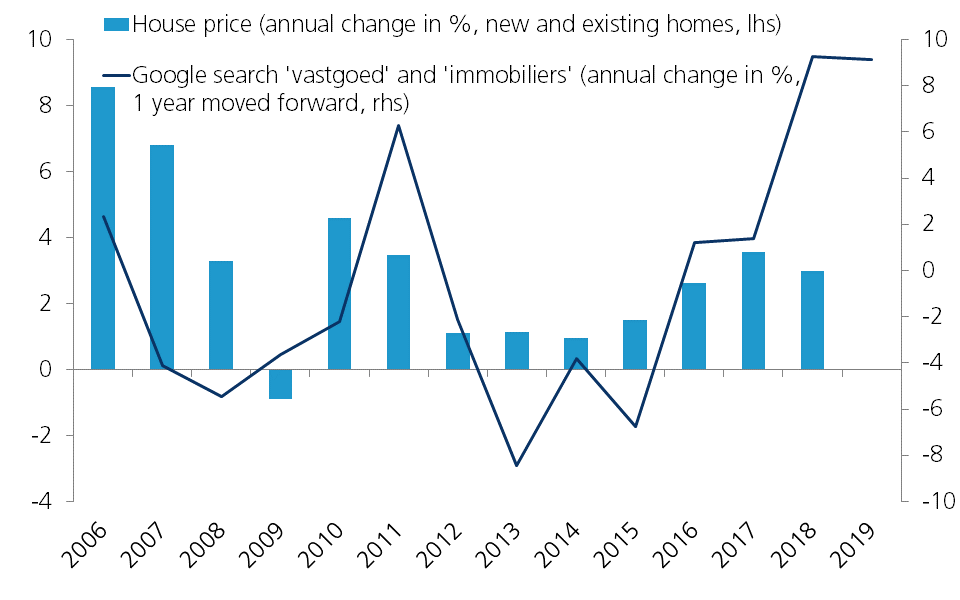

Logically, the real estate appetite of Belgians is reflected in the prices of Belgian real estate. Figure 4 shows that the number of times that the search terms ‘vastgoed’ and ‘immobiliers’ (i.e. the Dutch and French words for ‘real estate’) were typed into Google in Belgium is connected with the change in house prices a year later. In recent years, an increasing number of Google searches have been accompanied by again stronger price increases. Based on this relationship, the rise in house prices in 2019 may well be much stronger than generally expected.

Figure 4 - Link between house price dynamics and Google search for the terms ‘vastgoed’ and ‘immobiliers’

Source: KBC Economics based on Eurostat and Google Trends

Avoid overheating

The exuberance and associated price dynamics are not without risk. According to the National Bank of Belgium, the recent price evolution caused Belgian real estate to be overvalued by around 6% in 2018. This is not much in itself, but a further annual price increase of more than 3 to 4% would increase the overvaluation of the market and could eventually lead to a housing bubble. This is all the more problematic given the continued rapid growth in credit and household debt. Belgium is one of the European countries where outstanding mortgage debt has increased the most in recent years. Since 2014, household debt has been above the euro area average.

On the positive side, the monthly repayment burden of households has not increased further in recent years, thanks to income growth and low interest rates. The number of defaults also remains very low. But in the event of a financial or economic shock, such as a sharp rise in interest rates or in unemployment, the situation may change. Therefore, prudence with regard to lending and tempering investment enthusiasm must prevent the Belgian real estate market from overheating.