Explaining the American real estate puzzle

American house prices have been surprisingly resilient to the pressures of severe monetary tightening. They have also increased much faster than rents. The main explanation is the fact that many homeowners have low-rate, fixed mortgages. They would lose their favorable mortgage rate if they sold their house. This has caused a steep drop in existing home sales, which hasn’t been compensated by an increase in new home sales. Over time, house prices are likely to become more affordable again. Supply of existing homes is likely to increase gradually as mortgage contracts expire. Meanwhile, high house prices and relaxed zoning laws could increase supply of new homes over time.

Introduction

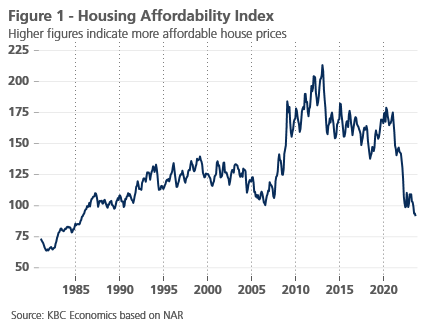

American house prices continue to surprise to the upside. In the latest data release, house prices increased by 1% month-on-month, according to the Case-Shiller index. House prices are now 43% higher than before the pandemic. The resilience of the housing market is all the more surprising given the relentless monetary tightening cycle started by the Fed in early 2022. This has driven up mortgage rates from around 3% to more than 7% in less than two years. As housing markets didn’t correct and mortgage rates have skyrocketed, buying a house has become extremely expensive. The Housing Affordability Index has dived to its lowest point since 1985 (see figure 1).

The resilience in house prices is also surprising, if we look at the evolution in rental markets. Market rental prices have been essentially flat the last 5 months. They increased by only 3.0% year-on-year in October. Looking at the US CPI, shelter price inflation increased by only 19.5% since 2020, notwithstanding the big rise in mortgage rates and house prices. What explains this divergence?

Fixed-rate loans drive down US home sales

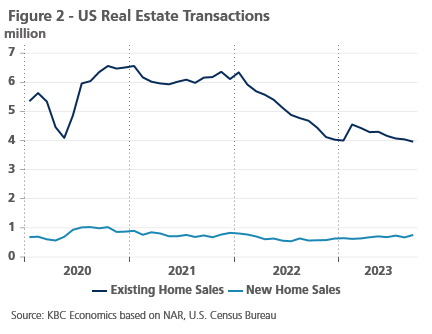

The answer to this puzzle lies in the American mortgage system. Around 85% of mortgage holders have fixed-rate loans (mostly 30-year loans) and many of these loans originated or were refinanced during the pandemic. Hence, around two-thirds of mortgage loans still have an interest rate below 4%, while average rates on new mortgages now surpass 7%. As many homeowners would lose their favorable rate if they sold their house, fewer owners are willing to sell. Hence, existing home sales declined dramatically (see figure 2). New home sales could not compensate for this decreased supply, which explains why there is still upward pressure on house prices.

Will rents and house prices converge?

In the longer term, the discrepancy between unaffordable house prices and relatively lower rent inflation is unlikely to last. Over time, low mortgage rate contracts will end, and more homeowners will then be enticed to sell their houses at the current highly attractive prices. High house prices will also drive up supply of new homes eventually. This can explain why, despite sky-high interest rates, higher building costs and labor shortages, housing permits bottomed out this year and are now back around pre-Covid levels. They remain much lower than the post-Covid peak, however.

Increased housing unaffordability is also putting pressure on politicians to relax tough zoning laws. California’s notoriously strict zoning laws have been loosened by a recent state law and are likely to be loosened further. Its governor, Gavin Newsom, promised to build 3.5m homes in his election campaign. Similarly, his New-York counterpart, Kathy Hochul, proposed an “upzoning” scheme to increase a greater density of housing in certain areas.

Unfortunately, the benefits of these changes will take time to materialize. Though housing is likely to become more affordable in the future, this is a slow-moving process. Americans will likely be stuck with unaffordable house prices for the coming months, if not years.