Cooling Belgian housing market will soften, but outlook remains subdued

- Summary

- Recent price development

- Housing market activity

- Housing market valuation

- Price outlook 2023-2026

- Continuing areas of concern

Read the publication below or click here to open the PDF

Summary

Figures on activity and prices in the Belgian housing market show that the market has been cooling for some time without, however, correcting heavily. Certainly in comparison with many other European countries, the Belgian market is holding up reasonably well. That said, even in Belgium, the house price correction in real terms (i.e., adjusted for general inflation) has already been considerable. Moreover, both hard data and sentiment indicators indicate that the construction sector in particular is feeling the cooling trend more and more strongly. We assume in our scenario that the current market weakness may still imply minor further nominal price declines in the second half of 2023. But as long-term interest rates relax somewhat again in 2024, affordability should improve and home prices may also rise again, albeit at a much more moderate pace than was the case until recently. Meanwhile, the cooling has meant that the overvaluation of the housing market has fallen back below 10% and thus should no longer be seen as a prime risk for a potentially severe price correction. Still, we see continuing areas of concern. These include the problematic affordability of real estate for certain households as well as likely more severe price corrections for energy-hungry homes.

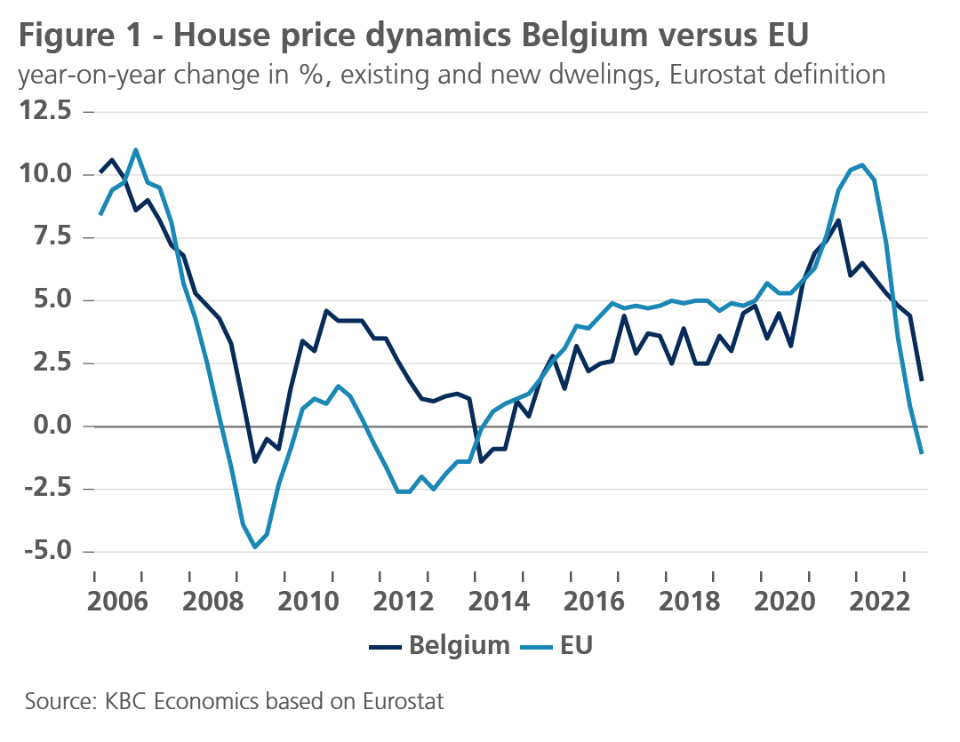

In recent quarters, housing market dynamics in most European countries cooled considerably. In the European Union (EU) as a whole, the year-on-year price change for (existing and new) houses weakened from still 10.4% in the first quarter of 2022 to 0.8% and -1.1% in the first and second quarters of 2023, respectively (Figure 1). Viewed against the previous quarter, there were price declines in quite a few member states. The wave of price corrections began in Q3 2022 in 6 countries. In Q4 2022, Q1 2023 and Q2 2023, there were 16, 12 and 11 countries, respectively, recording price declines. Meanwhile, relative to the peak reached earlier, the house price decline already occurring is greatest in Germany (-9.9%), followed by Luxembourg (-8.3%), Denmark (-7.6%), Sweden (-6.8%) and Finland (-5.6%). On the other hand, there are EU countries (especially Bulgaria, Croatia, Portugal, Greece and Estonia) where price increases have remained quite strong..

Belgium occupies an intermediate position among EU countries. The course of Belgian house prices has been rather mixed in recent quarters. In Q4 2022, Belgium was among the 16 EU countries where prices started to fall or continued to fall compared to the previous quarter. But the correction then was limited to 0.4%. In Q1 2023, however, Belgian prices rose again by 1.0%. With a 1.2% price drop in Q2 2023, Belgium was among the group of 11 EU countries with a price correction. Compared to the same quarter a year earlier, house prices in Belgium were still 1.8% higher in Q2 2023. That too is a solid cooling of the year-on-year price increase, which had peaked at 8.2% in Q3 2021. Compared to the EU as a whole, the cooling in Belgium started slightly earlier but, on the other hand, was milder (Figure 1).

The figures shown are the change in the so-called "harmonised house price index" published by Eurostat on a quarterly basis. For Belgium, it is calculated by the statistical office Statbel, which provides Eurostat with the index. In addition to international comparability, that index also has the advantage of correcting for price changes resulting from changes in the characteristics of the property sold. As a result, it gives a good picture of the true underlying price dynamics in the housing market. The index is also available broken down by existing and new homes. In Belgium, the index for existing homes peaked in Q3 2022 and has since declined by 1.4%. For new construction homes, the peak did not come until Q1 2023, but the index did fall relatively solidly by 2.7% in Q2 2023.

House price figures from other sources also indicate that the Belgian housing market is cooling without, however, correcting heavily. For example, the Federation of Notaries' real estate barometer shows that prices are practically stabilising. Meanwhile, that barometer is already available for Q3 2023. In the first nine months of 2023, a house in Belgium cost only 0.9% more than in the same period in 2022. The price of apartments still rose by 2.9% during the same period. The latter can probably be explained by the fact that a relatively large proportion of apartments sold are new constructions and their price is very sensitive to higher construction costs. Note that, unlike the harmonised Statbel index, the notary barometer does not correct for price changes due to changes in the characteristics of the property sold.

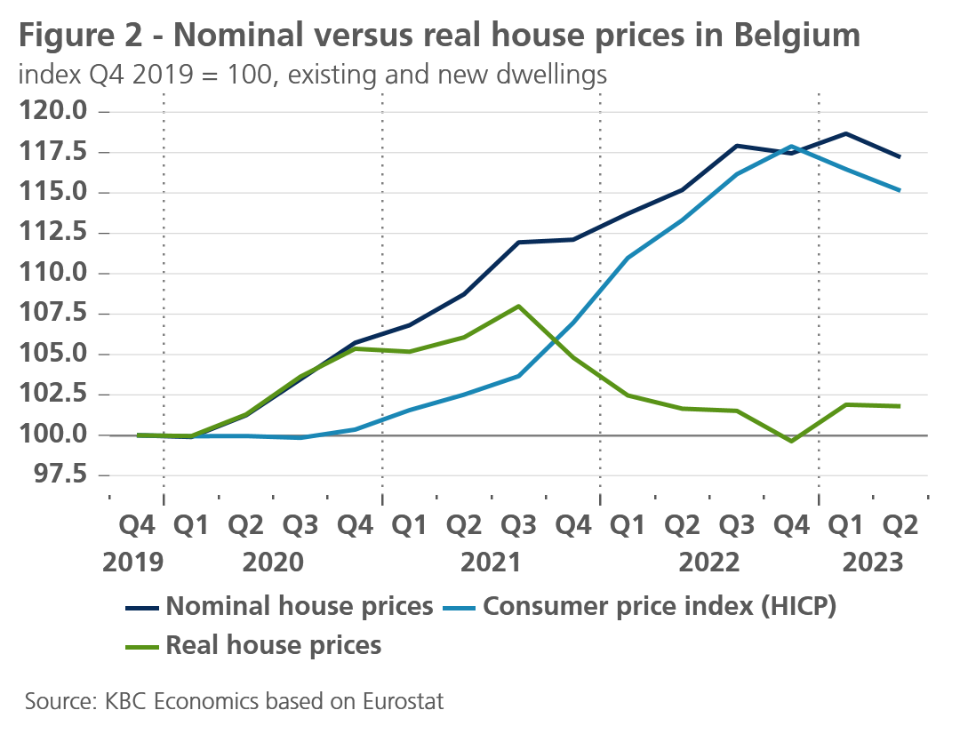

The fact that the Belgian market is still holding up reasonably well, especially when compared to many other European countries, does not detract from the fact that even in Belgium the price correction "in real terms" is already quite substantial. This means that in recent quarters the change in the price of housing has lagged significantly behind the general increase in the price of goods and services, as reflected in the general consumer price index. If we relate the harmonised house price index to the harmonised consumer price index (HICP), this relative development resulted in a cumulative real decline in Belgian house prices of 5.7% in the period Q3 2021-Q2 2023 (Figure 2). By comparison, across the EU as a whole, there was a real house price decline of 9.2% in Q4 2021-Q2 2023.

2. Activity on the housing market

The ongoing cooling of the housing market is rooted in less favourable macroeconomic fundamentals. First and foremost, there is the substantial rise in interest rates. Between Q2 2021 and Q2 2023, the average mortgage rate (weighted by the relative share of fixed versus variable rate loans) in Belgium rose by 2.2 percentage points. In addition, the decline in households' real disposable income also played a role, against the backdrop of skyrocketing inflation. Depending on the consumer price index taken into account (national CPI or harmonised HICP), the fall in real income in Belgium in 2022 remained limited to 1.5 to 3%, which is less than in many other European countries, thanks to automatic wage indexation and relatively stronger job creation in Belgium, and probably helps to explain why the Belgian housing market held up relatively better than in the EU as a whole.

The cooling-off was also reflected in a sharply reduced number of transactions (Figure 3). According to Statbel figures, the number of sales of existing homes in Belgium in the first half of 2023 was 21.2% lower than in the same period a year earlier. For houses (-23.4%), the decline was greater than for apartments (-16.4%). However, this rather sharp decline must be qualified somewhat, as sales activity at the start of 2022 was inflated by the shift in sales due to the reduction of registration fees in Flanders. The number of building permits (new construction and renovation) was also down 11.8% in the first half of 2023 compared to a year earlier. The reduced construction activity was also reflected in the volume of effective construction investments by Belgian households, as reflected in the National Accounts. Those fell by 5.4% since the peak in Q1 2022.

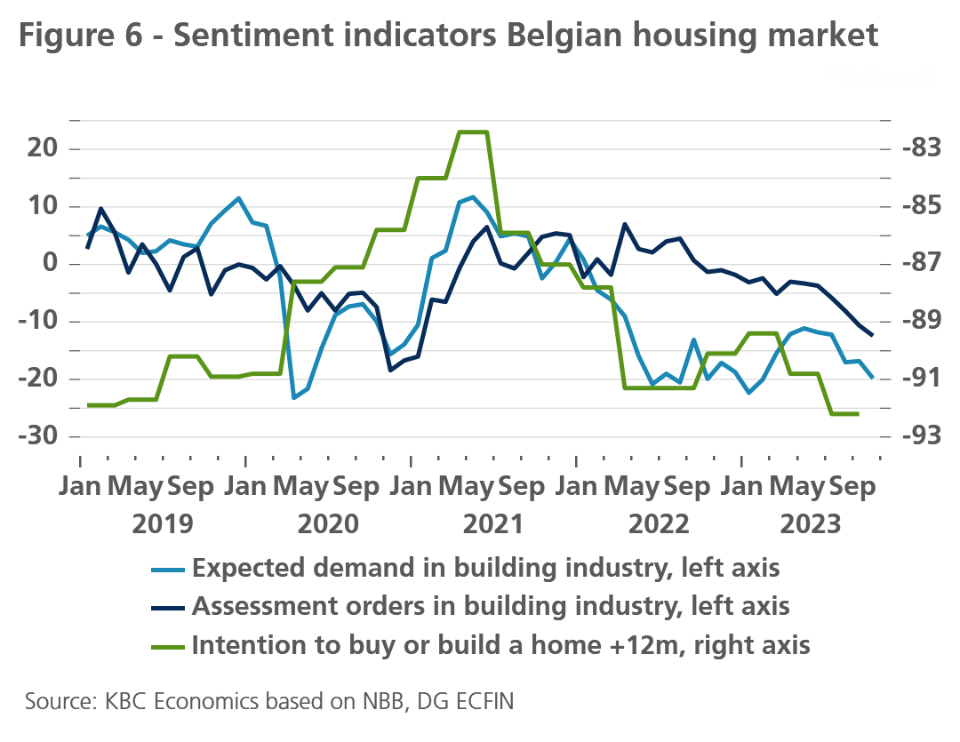

In recent months, the cooling-off was also evident in construction sentiment indicators. Confidence in the construction sector, measured by the NBB Business Cycle Barometer, has long held up well compared to that in the manufacturing sector, but has fallen sharply recently. September in particular saw a pronounced dip in the confidence indicator. The building barometer published by the Bouwunie, which gauges confidence among Flemish construction SMEs every quarter, also took a heavy hit in Q3 2023. Companies indicated in the confidence indicators that they have less work and are seeing a decline in current orders. Finally, a similar picture emerges from the European Commission's survey of construction companies. In September 2023, some 10% of firms surveyed were struggling with insufficient demand, coming from just over 5% in spring 2022.

An interesting question is to what extent the sharp weakening of house price dynamics in recent quarters has tempered the overvaluation present in the Belgian housing market. The answer depends not only on recent price developments but also on the evolution of its main determinants (the so-called market fundamentals). An over- or, as the case may be, undervaluation occurs when the evolution of house prices is no longer in line with what these fundamentals indicate. Often, demand factors, such as household income, mortgage rates and demographics, are considered primarily for the latter. However, measuring over- or undervaluation is a tricky task. The fact that different figures circulate is because there are different measures that are not all equally comprehensive.

For example, the price-to-income ratio is a simple measure that relates housing price developments to that of households' disposable income. The reasoning is that this income is needed to build up a piece of equity for a mortgage loan but more so to provide sufficient repayment capacity. The current value of the ratio is compared to its long-term average which is assumed to correspond to an equilibrium level. When the ratio rises too sharply above its long-term average, it is an indication that households' ability to finance a home is at risk. Thus quantified, the housing market was still widely overvalued in the second quarter of 2023 (43%), but less so than in early 2022 (60%). In addition to weaker price dynamics, the decline in the measure has to do with the fact that nominal household incomes have risen sharply along with high general inflation via the automatic indexation of wages and social benefits.

Besides income, the affordability of real estate depends on the development of mortgage interest rates. This determines the repayment burden and thus the borrowing capacity of buyers. If we correct the price-to-income ratio to take interest into account, we obtain the interest-adjusted affordability. This compares the annual annuity a mortgagee has to pay (both capital repayment and interest) with disposable household income. The more the annuity and income diverge, the more difficult it becomes to finance a home. As with the price-to-income ratio, this expanded measure is expressed as percentage deviation from its long-term average. Because the trend of sharp declines in interest rates has supported affordability, the overvaluation so quantified is much lower than quantified based on the price-to-income ratio, at 24% in the second quarter of 2023.

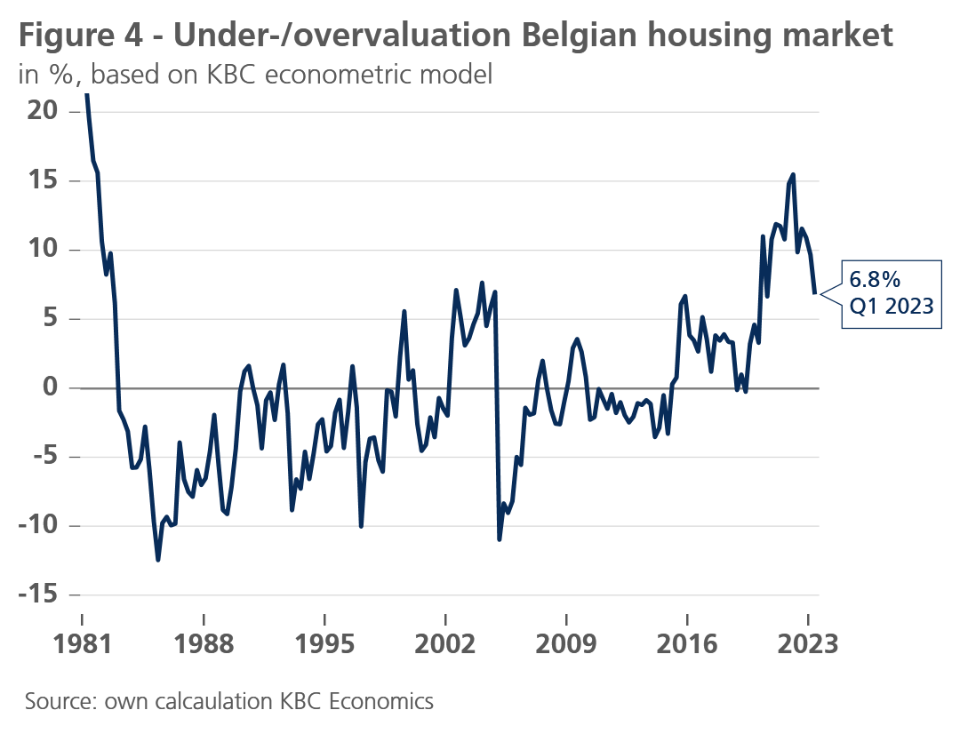

Housing market valuation is also often approached from a broader econometric model. One thereby seeks a long-term mathematical equilibrium relationship between housing prices and fundamentals. In addition to household income and mortgage interest rates, these typically include demographics (number of households) and changes in the structural characteristics of the housing market (such as property taxes). The extent to which the effective price trend deviates from the equilibrium value calculated by the model (i.e., the error term in the regression equation) can then be viewed as a measure of overvaluation. According to KBC Economics' model, the overvaluation thus quantified was 6.8% in Q2 2023, coming from 16% in Q1 2022 (Figure 4). The NBB has a similar model, which estimated overvaluation at 10% for Q4 2022 (latest available figure). The ECB's model, which is more rudimentary, points to a limited overvaluation of 2% for Q1 2023.

The decline in the overvaluation to 6.8% was mainly caused by the cooling of house price dynamics. The figure implies that the Belgian housing market is no longer so overvalued that there would be potential from that angle for a possibly severe price correction someday. In this sense, the ongoing cooling of the market is a "desirable" scenario. However, the evolution of fundamentals themselves (income, interest rates, demographics, taxation, etc.) may well exert further downward pressure on housing prices (nominal and real). In our economic scenario, we see Belgian 10-year bond yields rising somewhat from their current level (around 3.5% in mid-October) to 3.75% by the end of 2023. As European inflation normalises, we assume that ECB policy rates are now at the peak of the tightening cycle. We expect a first, limited policy rate cut in the last quarter of 2024 and see the yield on 10-year German Bunds falling from 2.95% at the end of 2023 to 2.75% at the end of 2024. In its wake, Belgian bond yields will also fall somewhat to 3.55% by the end of 2024. To the extent that mortgage rates also follow that path, there will still be (have been) downward pressure from the interest rate angle on house prices in Q3 and Q4 2023, but perhaps no longer (or at least less as far as the interest rate level also plays a role) in 2024.

Household incomes continue to be underpinned by persistently favourable labour market conditions, supporting real estate affordability. The dynamics of job creation, although falling sharply during 2022, due to the Ukraine war and energy crisis, picked up again in the first two quarters of 2023. The Belgian unemployment rate remained fairly stable during 2023 and is likely to remain low below 6%. Indeed, the Belgian labour market remains quite tight. The Belgian job vacancy rate (i.e., the number of open vacancies as a % of the total labour supply) did decrease since its peak in Q2 2022, but at 4.6% in Q2 2023 it is still the second highest in the EU and significantly higher than the EU average (2.7%).

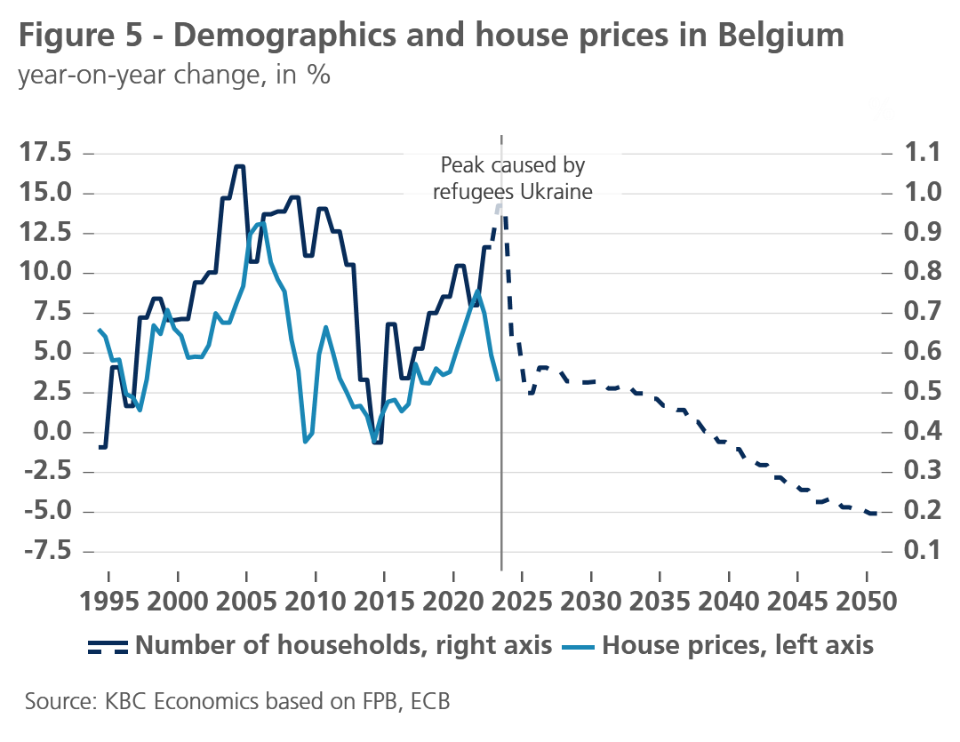

Specifically, KBC Economics assumes that Belgian house prices (according to the harmonised Eurostat definition) will have fallen some more in Q3 2023 and may also correct slightly in the final quarter. Because the price corrections (compared to the previous quarter) will have been limited during 2023 and there were still decent price increases during 2022 (with the exception of the fourth quarter), we expect the change in average prices in the whole of 2023 compared to average prices in the whole of 2022 to still be slightly positive at 1%. Thereafter, we see that average price change picking up to 1.5% in 2024, 2.5% in 2025 and 3.0% in 2026. So in the medium term, price increases will probably no longer be as sharp as in the past. This is partly because interest rates will not fall back to previous ultra-low levels, but also because price pressures from demographics will diminish. Indeed, the Federal Planning Bureau sees the further increase in the number of households in Belgium gradually softening in the coming years (Figure 5).

5. Continuing areas of concern

The recent and expected price path implies an overall "soft" landing for the Belgian housing market. That said, the scenario outlined implies a further real house price decline. As general inflation is likely to continue to exceed house price growth in 2023 and 2024, prices in real terms cumulatively over the years 2022-2024 are expected to have fallen by around 10%. Also, businesses in the broad real estate sector will undoubtedly continue to struggle for some time. Construction in particular is going through a difficult period. For many interested buyers, it has become impossible to purchase a new home. This is reflected in the outlook contained in various sentiment indicators (Figure 6). The assessment of current orders and expected future demand in construction, as contained in the NBB barometer, indicate that the weaker activity is likely to continue for some time. The European Commission's confidence indicator that gauges Belgians' intention to buy or build a home also continued to move downwardly in Q3 2023.

Furthermore, the duality that has been present in the Belgian housing market for some time also remains a major concern. The combination of more expensive credit and high house price levels, following the sharp increases of the past decades, means that, on the one hand, it has become more difficult or even impossible for more households to still acquire their own affordable home, making them more often dependent on the rental market. On the other hand, there is another group of households (still large enough for the time being) that is able and willing to buy property because they have the means to do so. Among the younger age groups, these are mostly families with financial support from (grand)parents. While the relaxation of interest rates in 2024 may improve affordability somewhat, it will be insufficient to substantially reduce the indicated duality.

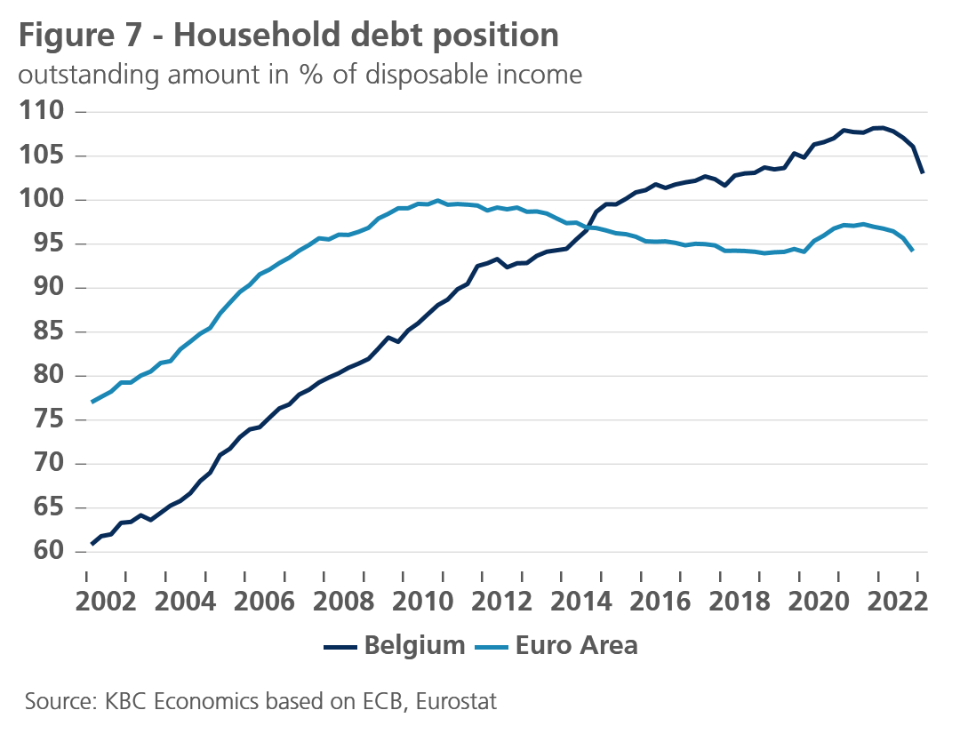

In addition to the measurement of overvaluation, risks in the housing market are usually also estimated based on the evolution of household debt. Belgium is one of the European countries where mortgage debt increased the most in the past decade. Related to their disposable income, the total debt of Belgian households, predominantly composed of mortgage loans, has been above the euro area average since 2015. After a continuing increase over the past few years, the rising trend in the debt ratio does appear to be reversing in recent quarters. In the first quarter of 2023, the debt ratio reached a rounded 103%, coming from a peak of over 108% in early 2022 (Figure 7). The reversal is explained by the combination of much weaker mortgage lending (caused by higher interest rates) and solid growth in nominal incomes (following high inflation).

Finally, the further evolution of activity and prices on the Belgian housing market will also depend on other uncertain factors, for which forecasting remains very difficult. One of these is real estate taxation. Should the government, in the context of a tax reform or the much-needed consolidation of public finances, drastically change housing taxation (e.g., taxing rents actually received and/or capital gains on real estate), the housing market could be affected. Also, in the coming years, the energy efficiency of housing is likely to become a more important determinant of house prices. This will cause the price differential between energy-efficient and non-efficient homes to increase. In the process, energy-guzzling homes (especially large ones in less well-located locations) may even fall in price quite substantially in nominal terms. After all, the government has decided that buyers of such homes will be required to renovate them. These will already factor in a renovation budget when setting the price they are willing to offer, taking into account substantially more expensive materials to renovate.