Bulgaria - Economic update

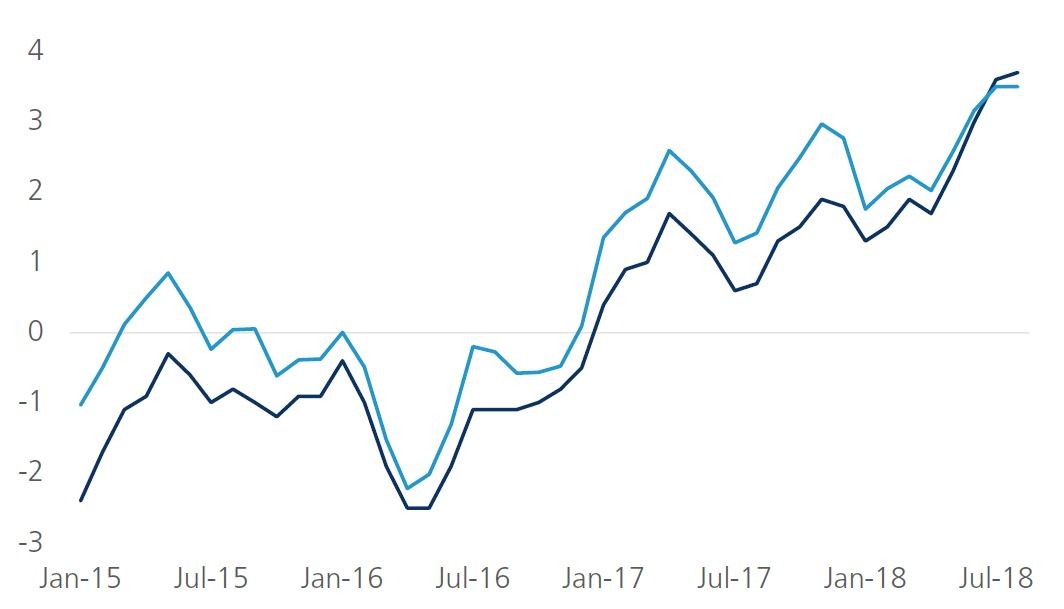

Oil price inflation has been accelerating for several months now, pushing the Bulgarian headline inflation figures upwards. According to Eurostat data in August 2018, the HICP of average annual inflation was 3.7% (figure). We expect inflation to rise further by the end of 2018. The primary source is oil, which is traded on international markets at prices significantly above last year’s. Meanwhile, NSI reported a rise in house prices in Bulgaria for Q2 of 2018 by 2.8% qoq and by 7.5% yoy. Internal migration to major cities is the main reason for the dynamics of real estate prices. The unemployment rate remains at a record low - 5.2% in August according to Eurostat’s latest seasonally adjusted data. This is the lowest level of unemployment since the end of 2008.

The Bulgarian National Bank (BNB) introduced a new countercyclical buffer for banks from October 1, 2019. After one year, Bulgarian banks will have to set aside additional capital to cover the growing cyclical risk. The countercyclical buffer, which since its introduction so far has been 0%, will be set at 0.5% as of October 1, 2019.Trends in the economic environment and credit activity give reason to believe that the country is in the upward phase of the economic and financial cycle. Against the background of increased economic activity, the claims of the banking system in the non-government sector are growing at a rate above those in recent years, especially in household loans. The current favourable economic conditions provide an opportunity to strengthen the capital position of credit institutions further, thereby increasing their resilience against losses in the future materialization of cyclical systemic risks resulting from possible adverse developments in the economic environment. For Bulgarian banks, the introduction of the buffer will mean that the CET1 requirement will increase by another 0.5% for all their risk exposures in the country, while for those with other countries the analogous buffers introduced by the respective local oversight. This extra buffer is superimposed on those already introduced by the BNB.

Figure - Bulgarian inflation developments mainly driven by oil price moves (headline inflation, % change yoy)