Will the monetary cure get worse than the disease ?

Globally, major central banks are continuing or returning to their extremely accommodative policies after a temporary normalisation. Nevertheless, inflation remains persistently low and in many cases well below target. In that sense, current monetary policy is not very effective. Moreover, the side-effects of the ‘cheap money’ policy of the past decade are gradually outweighing the benefits. Important side-effects are the distortions of financial markets with artificially low (or even negative) interest rates, insufficient credit and liquidity risk premia and the increasing valuations of risky financial assets. In spite of these side-effects, however, there was probably no alternative to the monetary policy pursued in the past decade. In this sense, central banks are still trying to cope with the legacy of the Great Financial Crisis.

Short-lived policy normalisation

As the first of the major central banks, the US Federal Reserve took steps towards the normalisation of its extremely accommodative policy that was put in place to deal with the financial crisis a decade ago. It gradually increased its policy rate and even began to reduce the bond portfolio it had built up as part of its quantitative easing programmes. However, in the course of 2019, this policy normalisation came to an end. The Fed lowered its policy interest rate again and stopped the reduction of its balance sheet earlier than expected. If we take into account the new liquidity injections into the US money market following the recent spike of the reporate, the Fed has even restarted its quantitative easing.

The ECB did not even get the opportunity to make an attempt at normalisation. On the contrary, in September it lowered its negative policy rate to a new low and resumed its quantitative easing, which it had phased out at the end of 2018. In the meantime, the Bank of Japan continues to pursue its extremely unconventional policy. This policy also explicitly focuses also on long-term interest rates, and even includes the purchase of equity funds.

Cure with side effects

Can the ECB’s policy stance be made even more accommodative if necessary? ECB chief economist Lane clearly thinks so. However, the ECB’s increasingly explicit call for fiscal policy support suggests that the ECB is also aware of the limits of what monetary policy alone can achieve. Indeed, despite extremely accommodative monetary policy, underlying inflation in the eurozone remains stubbornly low, fluctuating around 1%. That is half of the ECB’s medium-term inflation target.

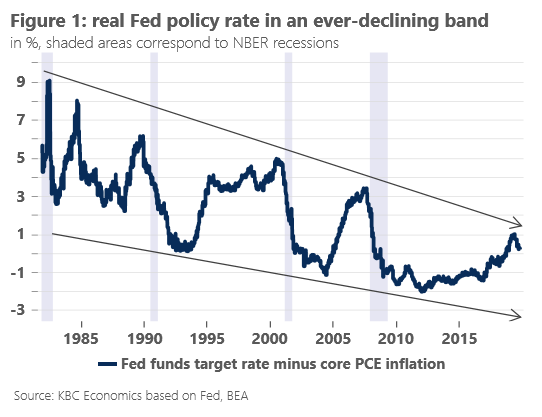

The effectiveness of monetary policy in meeting its inflation target and stabilising the business cycle is diminishing. More and more stimulus is needed to achieve the same objective (or even less). For example, as Figure 1 shows, the Fed’s real policy rate has been in a downward channel for a few decades already. To some extent, this is related to structurally slowing economic growth. However, is is striking that in each downward economic cycle, real policy interest rates need to be cut deeper than in the previous cycle. At the same time, in an upward phase of the business cycle, the real policy rate does not rise to the same level as in the previous cycle.

In addition, monetary stimuli are having more and more negative side effects. The ECB itself pointed to financial risks in its latest Financial Stability Review, including distorted asset prices on financial markets (i.e. financial bubbles), and increasing appetite by institutional investors for credit and liquidity risks.

This time is not different

Excessive price increases of financial assets lead to corrections sooner or later. The negative German bond yield (both nominal and real) is a remarkable example of such a price exaggeration. Investors holding these bonds until maturity fully expect not to be repaid their initial investment, not even in nominal terms. Put differently, borrowers are even paid to accumulate debt.

More specifically, expectations of a negative real interest rate make little sense from an economic point of view. Positive inflation expectations in the euro area and negative interest rates are indeed inconsistent with each other. Either inflation expectations in the euro area will need to fall to 0% or lower, leading us into an inflation and interest rate environment similar to the Japanese one. As the Japanese experience shows, this is not necessarily bad news for real economic growth. Or, alternatively, we are facing a bond market bubble which will burst at some point, pushing bond yields higher in line with inflation expectations. A combination of both is of course possible as well.

The sustainability of the valuations of many financial assets is heavily dependent on interest rates remaining very low. A stronger than expected rise in these interest rates would therefore probably lead to an abrupt downward price correction. According to the ECB’s valuation models, the fall in benchmark yields accounted for no less than half the rise of euro area equity prices since mid-2012. By stating this, the ECB does implicitly acknowledge a link between its highly accommodative interest rate policy and the valuation of financial assets.

The ‘search for yield’ in times of negative benchmark rates has led to a steady decline in both the average credit quality and the average liquidity of debt securities. According to the ECB, around 45% of traded and rated corporate bonds in the euro area now have a BBB-rating. The combination of poorer credit quality, lower liquidity and higher asset valuations is a potentially explosive cocktail that calls for vigilance.

The side-effects of monetary policy do not necessarily mean that the monetary policy pursued in the past decade has been wrong. After all, what would have been the alternative for the ECB when it was facing the financial crisis and the European debt crisis that followed? However, even a decade after the financial crisis, monetary policy still has to take into account considerations of debt sustainability and financial market expectations. Therefore, a meaningful policy normalisation is not on the agenda for some time to come. Meanwhile, the side effects are piling up.

De nevenwerkingen van het monetair beleid betekenen niet per definitie dat het gevoerde beleid verkeerd is. Wat zou immers het alternatief geweest zijn voor de ECB in de context van de financiële crisis en de Europese schuldencrisis die erop volgde? Het is wel zo dat het monetair beleid ook een decennium na de financiële crisis nog altijd rekening moet houden met de houdbaarheid van de schuld en met de gevoeligheden van de marktverwachtingen. Een verregaande beleidsnormalisatie is bijgevolg nog een hele tijd niet aan de orde. Maar de nevenwerkingen stapelen zich intussen wel op.