Trade protectionism again the main actor after years as a hidden extra

As a kind of extra on the global economic stage, concealed trade protectionism has been tolerated over the past decade. Mainly in the form of non-tariff measures, it was able to grow over the years. The rise of the topic in 2018 as a result of President Trump's 'America First' policy seemed very sudden. However, it was actually only an outburst of an underlying trend that has been dormant for years. A rapid turnaround to freer world trade is therefore unlikely. Trade protectionism hence remains an impediment to the world economy in the coming years.

US-China trade war striking scene

In recent years, words such as ‘protectionism’ and ‘trade war’ have dominated newspapers and journals. President Trump’s ‘America First’ policy and the escalating trade dispute between the US and China were the main reasons. Hence, trade protectionism again became very visible for the public. The focus was often on the multiple import tariff increases by both parties. So far, the US has increased its tariffs on imports from China for a total value of roughly USD 250 billion. On the other hand, China also raised tariffs on imports from the US by USD 110 billion. The temporary ceasefire between the two superpowers represents a brief pause in the conflict. However, it seems unlikely that the negotiations will lead to a comprehensive agreement. New tariff rounds in the near future are therefore not excluded (also see KBC Economic Perspectives January 2019).

The Sino-American trade war goes beyond tariff increases alone though. An exclusive focus on this would result in an underestimation of the total impact of the trade conflict. After all, governments have a much broader arsenal of policy options that (may) have a negative impact on the exports of one or more trading partners. They can also impose non-tariff barriers to trade such as (export) subsidies, import quotas, anti-dumping measures, security standards, etc. These have become increasingly important in recent years. In addition, other policy measures, e.g. environmental measures, may have a negative impact on trade as well. Hence, only focusing on targeted bilateral tariff increases will overlook important manifestations of trade tensions. The Global Trade Alert (GTA) is an independent organisation that monitors such government interventions with an impact on trade flows. The GTA calculated that the total value of Chinese exports to the US faced with new trade distortions in 2018 equalled USD 369 billion. Significantly more than the USD 250 billion of imports from China on which higher tariffs apply.

An important nuance is that the value of Chinese exports to the US that last year faced trade barriers only for the first time was much lower (‘only’ USD 82 billion) according to the GTA. In 2017, 30% of Chinese exports to the US were free of any barriers to trade, compared to only 13% at the end of 2018. This shows that trade tensions between the US and China are certainly not exclusively attributable to the current US administration led by President Trump. Under President Obama, measures were also taken to protect the US economy against competition from China.

...but many more players on stage...

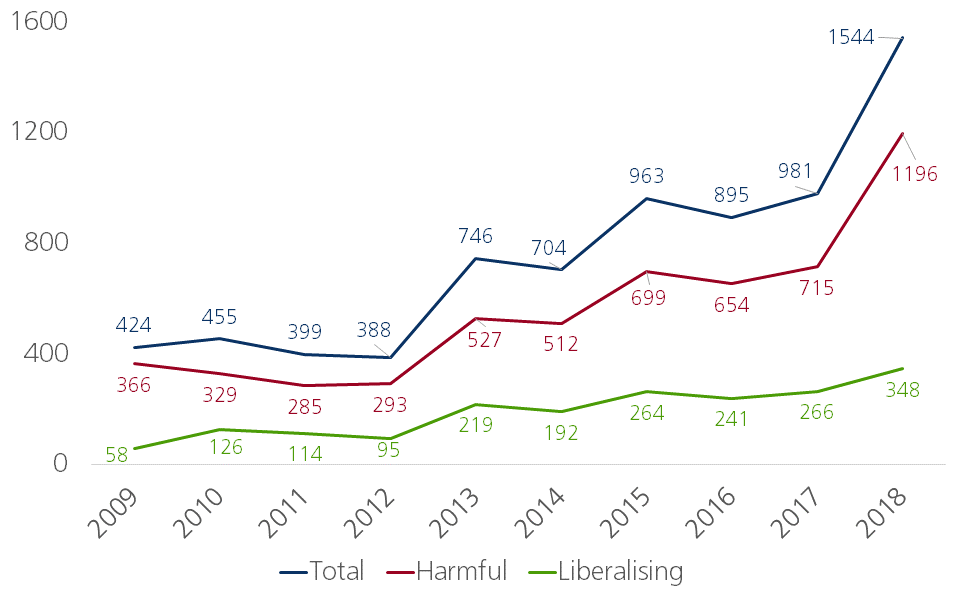

Although most visible in the media, China and the US are not the only countries guilty of trade protectionism. In 2018, the GTA registered 1196 measures introduced by the G20 - the world’s 20 largest economies - that hamper world trade. By comparison, only 348 trade liberalising measures were counted during the same period. There are major differences between the G20 though. The US, Germany and India were the top three countries to introduce the most trade barriers in 2018. The countries which implemented the least trade restrictive measures were Saudi Arabia, South Korea and Russia. China was in the middle with 42 measures that make international trade more difficult. Despite the many accusations of unfair commercial practices by American President Trump against China, the US appears to suffer from the same flaw.

... and many rehearsal years

In 2018, trade protectionism came more to the fore, but trade-restricting measures were also popular before that. Since the financial crisis in 2009, the balance between trade restricting and trade liberalising measures has always been in favour of the former (Figure 1). Since 2012 the difference has even been increasing, with 2018 as the absolute peak. Consequently, since the G20 economies made their commitment to combat protectionism, they have never really managed to fully resist the temptation to protect their domestic companies from foreign competition. In a sense, concealed trade protectionism was tolerated, so that it only increased over the years.

Figure 1 – Trade protectionism on a rising trend in recent years (number of implemented trade measures by the G20 economies)

Trade protectionism was thus once again one of the main players on the world economic stage in 2018. That was anything but sudden or unexpected. Although President Trump’s approach put the issue more in the spotlight, hidden trade protectionism was given the opportunity to grow in its role for years. Moreover, the final scene of the piece is not yet in sight. The negotiations between China and the US are unlikely to result in a comprehensive trade agreement. The 90-day deadline is far too short to reach a consensus on matters on which both parties have large differing opinions (e.g. protection of intellectual property) (also see KBC Economic Perspectives January 2019). Moreover, American import tariffs on (among others European) cars and car parts still remain a possibility. The deletion of the explicit commitment in the G20 final declaration to combat protectionism also does not bode well. Finally, in a macroeconomic context that is becoming increasingly difficult with an expected growth slowdown for most of the G20 economies in the coming years, there are few incentives to reverse the trend of increasing trade protectionism.

Unlike a real play intended to entertain the audience, the evolutions mentioned above are by no means amusing. Indeed, the growing success of trade protectionism remains a major impediment to global economic growth due to its dampening effect on trade and confidence indicators. Moreover, an escalation of trade disputes remains one of the main downside risks to our economic scenario.