Supply chain disruptions: not out of the woods yet

A post-pandemic recovery is well underway. However, it is facing increasing headwinds from supply chain disruptions. Against the background of strong demand conditions, supply is slow to catch up due to several reasons, including production cutbacks, input shortages and surging shipping rates. Such large supply-demand imbalances are not only holding back the recovery across the advanced economies but also fuelling near-term inflationary pressures. We maintain the view that most of the supply-side bottlenecks are transitory – as well as related upward price pressures – though probably longer-lasting than initially envisaged due to the negative spillovers from the spread of the Delta variant in Asia. Overall, we believe that supply-side frictions may dent, but not fundamentally derail the recovery, assuming that most supply-demand imbalances will gradually narrow in the coming quarters.

Although the global economy is recovering strongly from the pandemic, it is facing increasing headwinds. In addition to the rapid spread of the Delta variant, there are signs that widespread supply chain disruptions are holding back the recovery across the advanced economies. Against the background of strong demand conditions – especially a pandemic-driven surge in demand for some consumer goods – many manufactures are unable to increase output fast enough, creating large supply-demand imbalances in many areas of the economy, most notably in the goods sector.

Strained supply chains

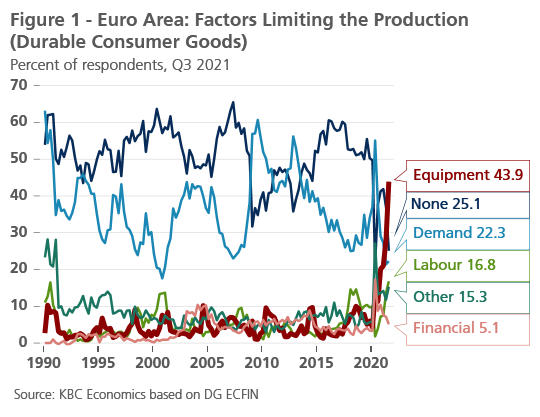

Global supply is slow to catch up due to several reasons. To begin with, some manufacturers scaled back production in expectation of lower demand when the Covid-19 crisis hit in early 2020, and others had to cut back output amid tight sanitary restrictions. At the same time, the global manufacturing sector has been affected by input shortages, including essential raw materials (timber, rubber, plastics or steel) and most prominently semiconductors (figure 1). The disruption within the supply chain of semiconductors has adversely affected production across many industry segments with auto manufacturers facing particular distress. Finally, shipping costs have surged, and delivery times have lengthened dramatically owing to a range of factors, including a shortage of shipping containers, the Suez blockage and closures of ports where Covid-19 outbreaks occurred.

All this appears to be holding back industrial output in major economies as reflected in the second-quarter GDP data, thus acting as a speed-bump on the post-pandemic recovery. The most recent high frequency data show that industrial activity remains constrained by supply-side bottlenecks on both sides of the Atlantic. Furthermore, supply-chain disruptions are also having a material impact on consumer prices; input cost inflation has accelerated sharply (after the initial pandemic-induced plunge) as companies now pay more for raw materials and components, as well as transport services, fuelling near-term inflationary pressures.

Transitory nature of supply-side pressures

We have long argued that most of these supply chain disruptions are transitory. Some should ease relatively quickly as production is ramped up to meet demand, which is already seen in commodities such as lumber with prices now back to pre-pandemic levels. Admittedly, such a degree of self-correction (i.e. higher prices encouraging higher output) may take longer in other sectors. In the semiconductor industry, supply is relatively slow to adjust, and capacity utilisation is already relatively high. On a positive note, the semiconductor shortage is expected to have peaked in Q2 2021 based on comments from industry leaders, though it will likely take several quarters for the supply tightness to fully normalise.

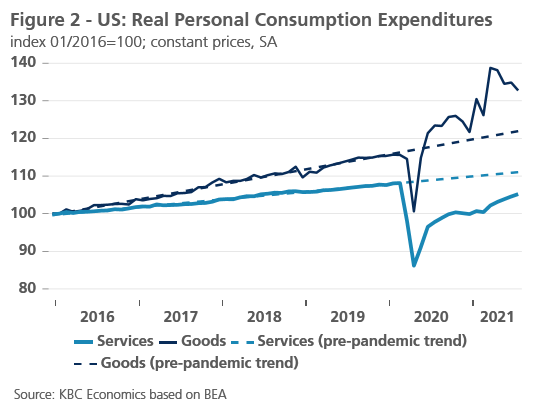

Besides, as economies continue to reopen, spending is gradually shifting away from consumer goods and towards services, helping improve the supply-demand mismatch (figure 2). Along with easing supply chain frictions, this should alleviate some price pressures, namely in core goods inflation. In the US, the recent surge in consumer prices has been driven mainly by a handful of categories such as used cars and trucks which appears to reflect a temporary increase in prices due to pandemic dislocations. Encouragingly, there are signals that prices in some of these categories may have/are about to peak; for example, the US used car market is already cooling down (as indicated by the Manheim Used Vehicle Value Index).

Delta variant is creating new uncertainties

Despite signs that supply chain disruptions have peaked in several sectors, we expect that supply constraints will likely last longer than initially envisaged. This is, in particular, due to the rapid spread of the Delta variant in Asia, where lockdown measures have been reintroduced or tightened in recent months. Against the background of the low vaccination coverage, and with some Asian countries pursuing zero-Covid policies, new outbreaks have led to temporary factory and port closures. That said, each setback in the reopening raises the risk of negative spillovers to other regions of the world economy, potentially leading to longer – if not more intensified – supply chain disruptions.

Overall, both the spread of the Delta variant and supply chain disruptions remain key downside risks to our economic outlook, highlighting how critical the path of the pandemic is to the functioning of supply chains. At the same time, we maintain the view that supply-side frictions may dent, but not fundamentally derail the recovery, assuming that supply-demand imbalances will gradually narrow in the coming quarters. Similarly, while price pressure will likely stay firm in the remainder of the year (and with the near-term price risks tilted to the upside), we view related upward inflationary pressures as transitory, underpinned by the fact that the recent surge in inflation has not (so far) dislodged inflation expectations.