Steel and aluminium are just the forerunners of a complex trade conflict

Despite intensive bilateral negotiations, from 1 June 2018 higher tariffs will be applied on American imports of European steel and aluminium. The American government is implementing the previously announced measures to protect American steel and aluminium producers against strong international competition, officially in the interests of national security. A complaint to the World Trade Organisation, as well as a counter-reaction by the EU, will follow soon. This is effectively the start of an escalating international trade conflict. The economic damage of this first step remains limited, but the likelihood of the conflict spreading to the European automotive sector is significant. Moreover, the differing export interests among EU member states threaten to exacerbate the escalation and make negotiations more difficult.

From rhetoric to fact

In recent weeks, opinions had been divided on the assertive American trade policy. Some analysts considered the measures announced unilaterally by the US to be merely a threat and a bargaining technique. Restricting trade with important Western trading partners and allies in the steel and aluminium sectors seemed an irrational decision. Imposing massive trade restrictions on China also seemed a bridge too far. With the current effective introduction of higher import tariffs on steel and aluminium, it is becoming clear that it is not just a question of rhetoric, but of hard facts. The meticulously defined list of products affected (based on codes in the Harmonised System, an important trade classification system) also indicates that this is not an impulsive policy action, but a carefully designed strategy.

High impact escalation

The direct economic impact of these measures remains relatively low. After all, the importance of the steel and aluminium industry within the entire European and American economy is relatively limited. However, these facts do trigger a chain reaction that will have a major impact on the European economy. Firstly, producers from emerging economies - in particular China, but also Russia and South America - will have to look for new markets because access to the American market will be more difficult. No doubt they will try to export more to the EU, which will increase import competition on the European market. European producers have little scope to win the competition on the basis of prices, but are fortunately protected by the higher quality and innovation of their products.

Secondly, the EU will take countermeasures. The EU has already announced that it will tax some EUR 3 billion in US products, which is about half the value of Europe’s total exports of steel and aluminium to the US. This is actually a mild response, but the EU intends to signal its independence from US policy choices. The provisional list includes a number of symbolic products that are likely to affect US voters’ sentiment in certain US states. Thirdly, EU countermeasures will increase the likelihood that the US Government will again take measures against European exporters. The communication by the US President clearly shows dissatisfaction with the relatively strong import of German cars. As US import tariffs would always be applied to the entire EU, they risk hitting one of Europe’s most important export sectors. This protectionist spiral can, of course, continue.

Divided Europe

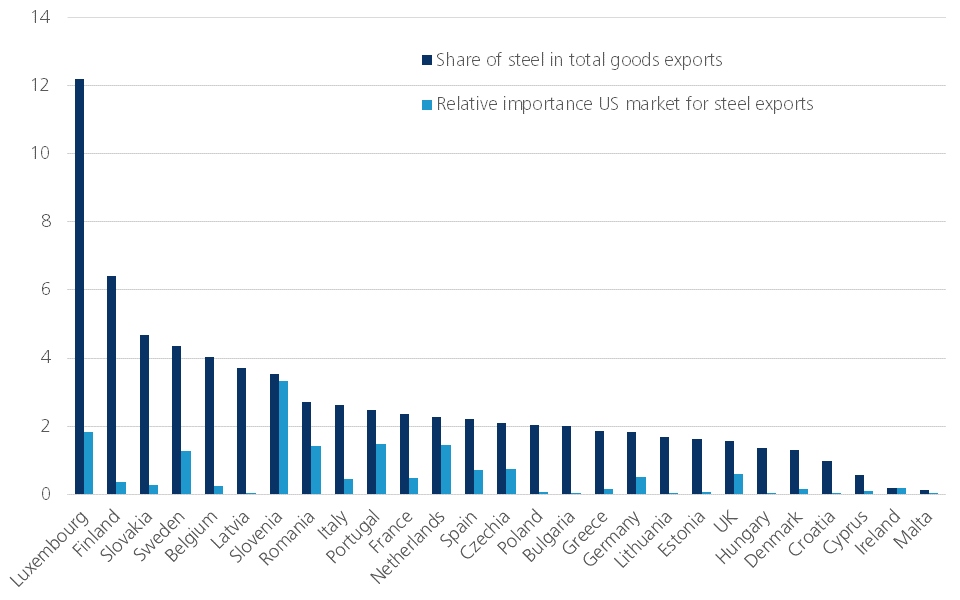

One of the reasons why the negotiations failed was because of the diverging interests of the EU Member States. The American proposals to introduce voluntary export restrictions on European steel and aluminium were reasonable and would have avoided an escalation of the conflict. However, it quickly became clear that the EU Member States are not all on the same wavelength. The relative importance of the steel and aluminium industries in European countries varies widely. Figure 1 shows, for example, that the share of steel exports in the total exports of the EU countries varies between 12% for Luxembourg and almost 0% for a number of countries. In the same figure, we also show the relative importance of the US market for European steel exports (measured as the share of steel exports to the US over total goods exports to the US relative to the share of steel exports to the world over total goods exports to the world, for each EU member state). This shows that the importance of the US market also varies significantly between European exporters. For example, the US market is extremely important for Slovenian exporters, but it is less important for some of the main European steel exporting nations, such as Belgium, Finland and Slovakia. These differences make it difficult to reconcile demands among all EU Member States.

Figure 1 - Diversity of European export interests in the steel sector (in %, 2017)

Furthermore, the importance of the US market for other important sectors, in particular the automotive sector, also differs considerably. Once again, therefore, it seems difficult to put forward a single strong European vision in the trade negotiations. This European division is in danger of ultimately causing further damage to Europe. In the absence of a unified European vision and strategy, it is particularly difficult to make strategic trade agreements. While the EU subscribes to the general interest of international trade openness, in practice national interests still play a decisive role in bilateral trade negotiations. Moreover, it is often vested interests that lead to restraint, while unconditional openness will create more opportunities in the long run, particularly for new sectors and exporters.

The fact that, in the meantime, the EU is continuing to negotiate new bilateral trade agreements is a hopeful sign. The relatively cautious counter-reaction to the recent US tariff increases will hopefully lead to little provocation. In any case, international trade will remain an important issue in the coming months.