Recessions: ambiguous, inevitable and overrated

Disappointing figures have dominated the economic news in recent months. Risk factors such as Brexit and the trade war continue to create uncertainty, and consumer and business confidence in the economy are weakening. That is why we see a resurgence of the heavily loaded R-word: recession. This brings up doomsday images of mass unemployment and bankruptcies for many people. There are, however, several reasons not to overreact to recession threats. First, there are different definitions for recessions, and the one that’s most often used also has the biggest range in intensity and impact. In addition, recessions don’t only bring trouble. They are also crucial for the sustainable growth of market economies. Finally, there are ways to soften the blow of a recession and compensate those who are affected on an individual level. Our advice: don’t panic when you hear the R-word.

What’s in a name

For a term that is used so often, there is a lot of uncertainty about what a recession is. The confusion is not surprising given the variety of definitions that exist for the term. The press often speaks of a recession when the real GDP of an economy falls for at least two consecutive quarters, i.e. when real GDP growth is negative for two consecutive quarters. This definition has the advantage of the clarity and speed with which a recession can be identified. Conceptually, this definition is not very useful. Indeed, it is sufficient for real GDP growth to temporarily stagnate (e.g. with a quarterly growth rate of -0.1%) in order to classify a period as a recession. Also, GDP figures are often revised, and this can happen months or years after the initial publication. This makes the ‘two quarters of negative growth’ recession definition very unstable. Moreover, the definition is conceptually arbitrary: suppose that an economy has a negative growth potential, for example as a result of a very sharp population decline. This does not in itself mean that the economic cycle of that economy is permanently in recession. Conversely, the economic cycle of an economy with relatively high potential growth, such as the Chinese one, can be in a downward phase of the economic cycle without quarterly growth ever turning negative. The popular definition would erroneously not label the cooling off as a Chinese recession.

The OECD defines recessionary periods in various ways, including on the basis of a recession indicator calculated on the basis of GDP. If this index rises above 67%, an economy is in recession. If the index falls below 33%, the recession is over.

The National Bureau of Economic Research (NBER), which officially determines whether there is a recession in the US, does not speak of a recession until there is a significant drop in economic activity, spread over the entire economy, lasting more than a few months and visible in industrial production, employment, real income and wholesale and retail trade. As the NBER takes into account a wide range of indicators and the duration of the slowdown, its definition is much more robust than the ‘two quarters of negative growth’ method. However, the major drawback of this approach is that, by construction, it is very late in signalling a recession. As a result, it loses much of its practical usefulness for business cycle analysts.

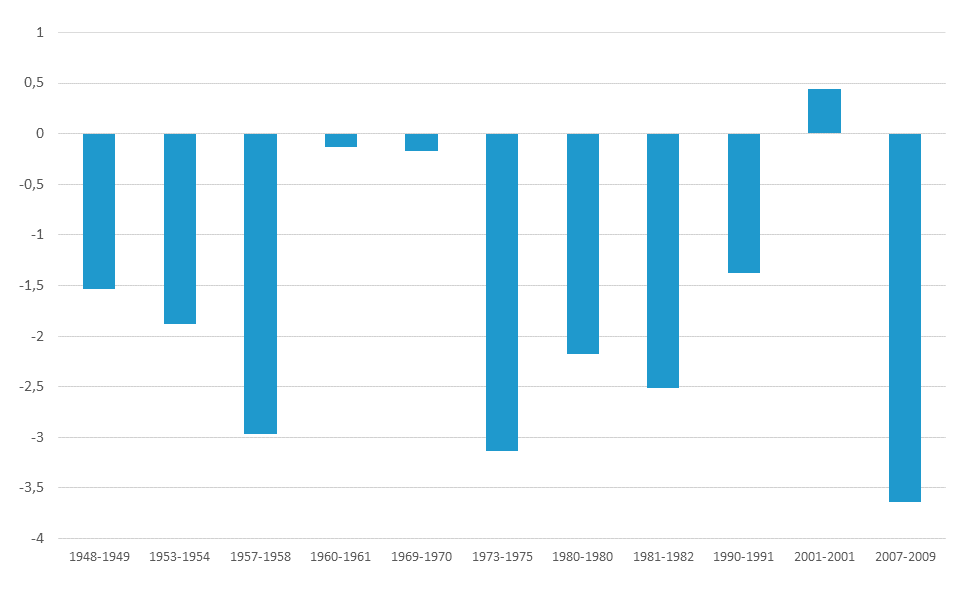

What all different definitions have in common is that there can be a lot of variation in the severity of recessions. A growth decline of 0.1% for two quarters is not the same as a deep crisis that lasts for several years (see figure 1). In addition to the confusion about which definition is used, there is often unnecessary panic about what the impact of a recession will be on the economy.

Figure 1 - Not every recession has the same impact on growth (change in GDP during NBER recessions in the US, in %)

Prune to bloom

Recessions are inherent to the functioning of a market economy. A market economy evolves in cycles, and recessions are just as inevitable as expansion phases. Within the framework of a market economy, recessions can be mitigated but not avoided.

Moreover, recessions are often wrongly seen as something purely negative. It is indeed true that no recession, regardless of its severity, is painless. After all, to varying degrees, they are accompanied by dismissals, insecurity, etc. Certainly on an individual level the consequences can be dramatic. For the economy as a whole, however, there are also positive aspects to a recession. There is a concept that applies to our market economy just as it does to our plants: pruning makes plants blossom more. A recession causes weaker, ill-equipped companies to go bankrupt and make way for more productive companies. Because of the healing effect of this creative destruction, recessions make the allocation of means of production more efficient. Efforts to avoid creative destruction at all costs in the past have resulted in the survival of so-called zombie-firms (see also KBC Economic Opinions of 8 May 2019 and 30 April 2019). Creative destruction stimulates innovation and productivity growth (total factor productivity in jargon), which also increases the growth potential of the economy. Against the backdrop of an ageing population and an increasingly scarce labour market, this is of crucial importance, especially for the European economies.

Softening the blow

Although recessions are not abnormal in an economic cycle and may even be useful, this does not mean that we simply have to endure them. There are instruments to soften the blow. First, there is a system of automatic stabilisers in our current economy, which weakens the economic cycle. The existence of income taxes and social security benefits, even with unchanged policies, mitigates a recession by increasing the public deficit. Indeed, tax revenues are falling while benefits are increasing, thus supporting macroeconomic demand. In addition, the fiscal authorities have the possibility to take discretionary counter-cyclical measures, such as the launch of investment programmes as the economy cools down.

In addition to budgetary efforts, the monetary authorities can also try to mitigate the impact of a recession. Central banks have gone a long way in this respect over the past few decades. Not only have they tried to alleviate recessions, they have also tried to prevent them or at least nip them in the bud. In the 1990s, this ambition was named ‘the Great Moderation’. In particular, former Fed chairman Greenspan fed the illusion that central banks, by subtly adjusting their policy interest rates, are almost completely in control of the business cycle. However, in order to achieve this, the Fed had to reduce its policy rates more and more with each recession until interest rates had become unusable as a policy instrument. Because of this, the central bank had to resort to quantitative easing during the last recession.

So, while some measures can be taken to soften the impact of a recession, avoiding them altogether proves to be difficult, if not impossible, without negative long-term consequences. This should not be viewed as a problem if we consider recessions, whatever way they are defined, to be healthy phases of the economic cycle in market economies. As long as individuals that suffer the consequences of recession are compensated and society as a whole prospers because of the benefits of creative destruction, the R-word should not automatically be seen as a threat.