Presidential elections in Italy: a new ‘whatever it takes’?

The forthcoming presidential elections in Italy may be crucial for further economic reforms in the country, and especially for the implementation of the Recovery and Resilience Plan, for which Italy can count on some 200 billion euros of European support (grants and loans). That plan was only made possible after former ECB President Draghi entered the political forum as prime minister of a national unity government. Draghi is also seen as an important guarantee for the implementation of the plan. But that guarantee has an expiry date, as parliamentary elections are due in the first half of 2023 at the latest. After that, according to expectations, Draghi would no longer remain prime minister. At the same time, he now has a great likelihood to become president. As president, he would be less hands-on in policy implementation, but for another seven years could continue to use the reputation and influence he built as ECB President, not least with his legendary words ‘whatever it takes’. Perhaps Draghi, as prime minister, has also started a ‘whatever it takes’ momentum in Italy. Whether he could keep it going as president, however, remains an open question. Political economy teaches us that there are opportunities but also threats to success.

Political instability stifles growth potential

On 3 February 2022, the seven-year term of Italian President Sergio Mattarella will expire. On 24 January, an electoral college made up of all the members of parliament (629 MPs and 320 senators) and 58 representatives of the regions will hold the first round of voting for a successor. In the past, an average of nine rounds were needed.

Political elections have economic importance because they can determine future economic policy. This is certainly true of Italy. Italy not only has the third largest economy in the eurozone, but also the highest public debt. Financial markets are therefore watching closely. In recent weeks, the risk premium has already been under slight upward pressure.

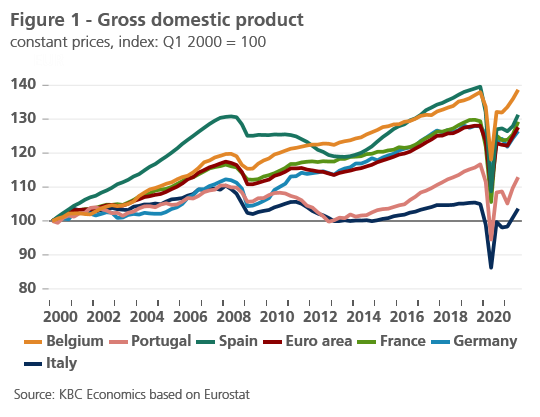

The problem of Italian public finances is mainly a problem of lack of economic growth (KBC Economic Opinion of 12 May 2020). On the eve of the Covid-19 pandemic, the economy was still smaller than before the outbreak of the financial crisis in 2008-2009, and in the years leading up to that crisis, the Italian economy was also growing below par (Figure 1). The glaring growth deficit stems from the political difficulty of structurally strengthening the economy, which in turn is a consequence of the country’s high political fragmentation and instability.

How long will Draghi provide stability?

After the euro crisis, reforms were implemented, but the then government subsequently lost the parliamentary elections in March 2018. Lega and the Five Star Movement won over half of the voters with populist programmes of tax cuts and public spending. They formed a previously considered impossible, euro-critical coalition, whose controversial policies undermined economic confidence and brought the already meagre economic growth to an almost complete standstill in 2018-2019 (KBC Economic Opinion of 16 November 2018). After a failed attempt by Lega leader Salvini to provoke early parliamentary elections, a more European-minded government came to power in September 2019. It was quickly confronted with the Covid-19 pandemic, which swept into Europe via Italy in early 2020. A year later, the fragile coalition failed to produce a Next Generation EU Recovery and Resilience Plan. Italy risked missing out on around €200 billion (12% of GDP) of European grants and loans. A unique opportunity for further reform was at risk (KBC Economic Opinion of 1 February 2021). Only when former ECB President Mario Draghi entered the political forum as prime minister of a national unity government, a recovery plan acceptable to European partners was put on track.

The forthcoming presidential election puts the further implementation of that plan at risk. Draghi’s premiership is usually seen as a guarantee for successful implementation. But that guarantee has an expiry date. New parliamentary elections will be held on 1 June 2023 at the latest. It seems unlikely that Draghi would participate in these elections, making it unlikely that he would be able to remain prime minister after 2023. At the same time, he seems one of the few candidates around whom a sufficiently broad consensus could be found for the next president.

As president, the now 74-year-old Draghi could remain politically active for seven more years but would have to resign as prime minister. The latter raises doubts about the chances of survival of the national unity government. It also raises the question of how Draghi - the man who, as ECB President, used to end almost every press conference with a call for structural economic reforms in Europe - himself could contribute most to economic reforms in his own country: with one more year as prime minister or with seven years as president.

Lessons from political economy

A recent paper (Aphecetche, T., et al., 2022) on the political economy of structural reforms in the EU recalls that the difficulty of reform lies not only in deciding, but also in implementing. Among other things, by bundling reforms into a coherent and targeted plan and by making the disbursement of European financial support to Member States conditional on milestones and targets, recovery and resilience plans have characteristics that should facilitate their implementation. This leads to optimism about the chances of success in Italy (and elsewhere).

But the paper shows that more is needed. Effective communication, based on objective analysis and facts, is another critical success factor. This is where Draghi gained a reputation with the legendary words “whatever it takes”. He virtually single-handedly sutured the euro crisis with these words. Draghi could make use of this reputation longer as president than as prime minister. But he risks losing that reputation because an Italian president has fewer levers to turn his words into action than an ECB president. A president has much less power in Italy than, say, in France or the US. He is much less of a hands-on guarantor of policy in Italy.

An Italian president appoints the prime minister and can dissolve parliament. This gives him an influential mediating role, especially during political crises. These are not uncommon in Italy. So, a strong mediator is not a luxury. Effective consultation with all stakeholders and constructive negotiations with opposition parties help, according to the paper, to build long-term support for reform. So, reform in Italy, while not an easy task, is not impossible in theory. Perhaps by getting into politics, Draghi has started a new ‘whatever it takes’ momentum in Italy. Whether he would be able to keep it going as president, however, remains an open question. Governments that have to navigate an unstable and fragmented political landscape certainly have less chance of success than governments with strong parliamentary support, according to the paper.