Paradox in the car industry

The 100th Brussels Motor Show is seemingly taking place under a bad star. Last year saw the smallest number of new cars registered since 1995. The loss of purchasing power due to the energy price shock and uncertainty caused by the war make weak demand for cars quite plausible. But demand is probably stronger than the extremely low number of registrations suggests. Supply problems have also been a factor since 2018, first due to tighter environmental regulations, and then due to lockdowns and disruption of supply chains. Today, the latter are getting resolved and car production is recovering. It is, however, still running more than 20% below 2017 levels. It leads to the paradoxical observation that a sector in full transformation crisis is today supporting economic growth from a cyclical point of view!

Registrations plummeted

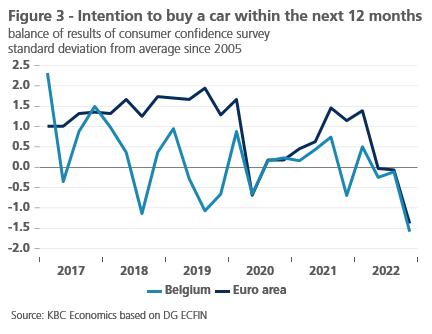

The 100th Brussels Motor Show is taking place under what appears to be an unfavourable star. The number of new passenger car registrations in Belgium in 2022 has fallen to its lowest level since 1995, more than a third less than in the peak year of 2017 (Figure 1). KBC Economics has previously pointed out that the car market in Belgium has become a saturated market, on which sales are mainly driven by replacement demand. Its dynamics would depend heavily on what happens with respect to company cars.

The recent drop in registrations may give the impression that the demand slump is much more severe than just an expected stagnation of demand. This is probably currently the case (see below), but presumably to a lesser extent than suggested by the sharp fall in registrations. Indeed, production problems with new cars caused improbably long waiting times for delivery. Many cars ordered in 2022 will not be delivered until 2023. So there was a demand, which supply could not meet. This is not only the case in Belgium, by the way. New passenger car registrations have also fallen in other European countries, although the drop in the recent period in Belgium was slightly larger than the euro area average (Figure 1).

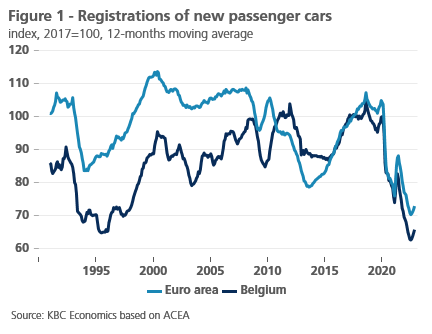

Nor is the decline a recent phenomenon. It has started since autumn 2018. That is also when production in the European car industry started to slacken (Figure 2). That is when stricter tests on car emissions came into force. This gave car sales an initial boost, as manufacturers were eager to get rid of outdated models in anticipation of the new rules. An EU agreement on limiting CO2 emissions (late 2018) subsequently reinforced the demand shift towards greener cars. An ECB analysis shows that this was accompanied by a weakening of demand at the time, as electric or hybrid cars tend to be more expensive. Simultaneously, production stalled as production lines had to be adjusted.

Supply issues

On the eve of the pandemic, car production in the eurozone was therefore running at just 90% of the 2017 average (Figure 2). Lockdowns during the first Covid-19 wave caused a further, sharp downturn. Initially, this was quickly overcome, but from 2021 onwards, the automotive industry entered a new malaise due to the disruption of global supply chains and, in particular, a shortage of chips, later followed by energy shocks. Between mid-2021 and mid-2022, production levels were between respectively 30% and 40% lower than the 2017 average.

The ECB's mentioned analysis finds that the post-pandemic malaise is mainly explained by the disruption of supply chains and, from mid-2021, increasingly also by the energy shock. From the end of 2020 until August 2022 (the end of the period analysed by the ECB), there is a positive impact of demand. However, this could only be partially met due to the disrupted supply. Strong (pent-up) demand on top of supply problems caused sharp price increases from 2021 onwards. The annual increase in the price of new cars had reached 7.5% in the euro area by November 2022, well above core inflation (5%). The price rise of used cars was as high as 12.4% at the time.

The paradox of recovery

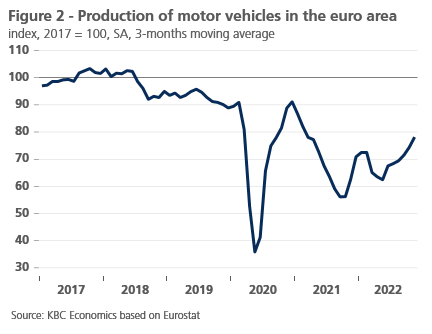

Nevertheless, according to European Commission consumer confidence surveys, demand for cars would have cooled sharply during 2022 (Figure 3). This is quite plausible against the background of the loss of purchasing power due to the energy price shock and the uncertainty of the war in Ukraine. Nevertheless, a positive turnaround in registrations has been noticeable since mid-2022 (Figure 1). This may indicate that car supply is returning to normal as bottlenecks in supply chains get resolved. Car production has also been picking up since mid-2022 (Figure 2). So while other energy-intensive sectors, such as chemicals, are going through a severe recession, the car industry is recovering. However, production levels are still more than 20% lower than in 2017. It leads to the paradoxical observation that a sector in full transformation crisis, is today supporting economic growth from a cyclical point of view!