‘New Capitalism’ in Japan: old wine in new bottles

Since 2013, ‘Abenomics’ policies have aimed to address Japan’s long-standing issues of longer-term consolidation of public finances, sustainably leaving the deflationary environment by pursuing highly expansionary monetary policy and structural reforms to address the longer-term growth implications of a rapidly ageing population. On all three accounts, these policies have not achieved their objectives. Current Prime Minister Kishida now adds different emphases in his doctrine of ‘New Capitalism’. The first pillar is related to correcting market externalities, which puts a greater emphasis on policies to address issues like climate change, energy transition and digitalisation. The second pillar relates to distributional issues and inequality, putting more emphasis on e.g. increasing disposable incomes and expanding consumption. However, it remains to be seen whether the ‘New Capitalism’ doctrine will in practice differ from ‘Abenomics’, and, if so, whether it will be more effective in solving the structural problems of the Japanese economy.

Since 2013, coordinated fiscal and monetary policy has focused on three structural policy objectives: structural reforms (in particular on the labour market), fiscal stimulus in the short term combined with consolidation in the medium term, and raising inflation by an even more expansionary monetary policy (in practice this amounts to monetary financing of public debt).

Boosting potential output

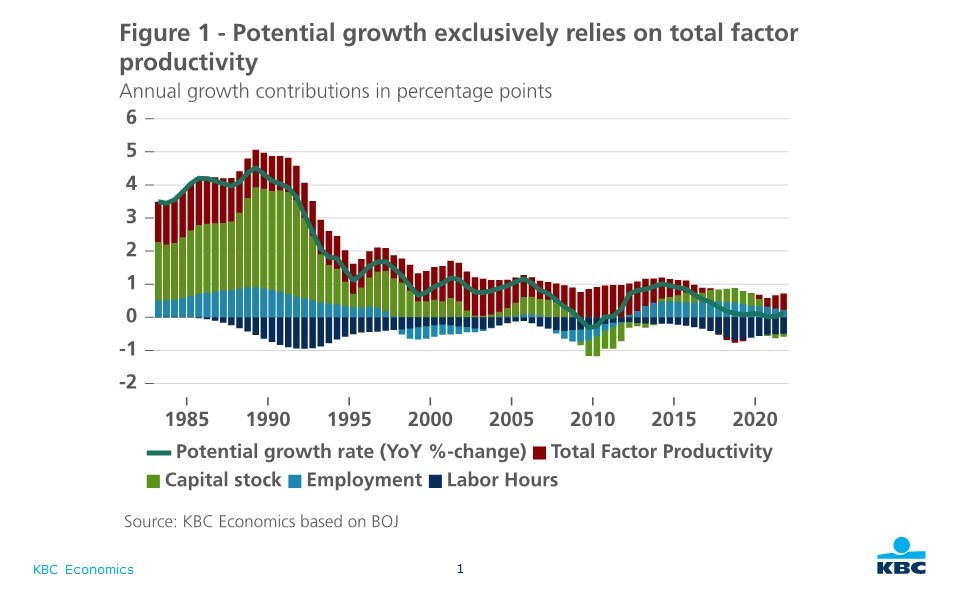

The first of these objectives relates to boosting potential real GDP growth against the background of an adverse evolution of the working age population. One policy focus is on labour market reforms. In particular, the aim is to raise the participation rate of Japanese women. Moreover, structural rigidity of the labour market institutions are being addressed, such as the strong dualism between regular and non-regular employment conditions. Despite the policy efforts made, the potential growth rate steadily declined since 2014 and is currently estimated by the Bank of Japan to be 0.1% (Figure 1). Potential growth is currently almost exclusively supported by total factor productivity (TFP) growth, which is just sufficient to compensate for the negative contribution to potential growth by labour supply (total hours worked in particular).

The declining contribution of the capital stock (and hence net investments) and employment catch the eye. There appears to be an investment shortfall, accelerated by the pandemic, which poses not only a direct medium-term challenge to the growth outlook, but also an indirect challenge via the impact on innovation and TFP. If the current trend persists, TFP growth is likely to be insufficient to prevent potential growth from turning negative in the near term.

Reanimating inflation

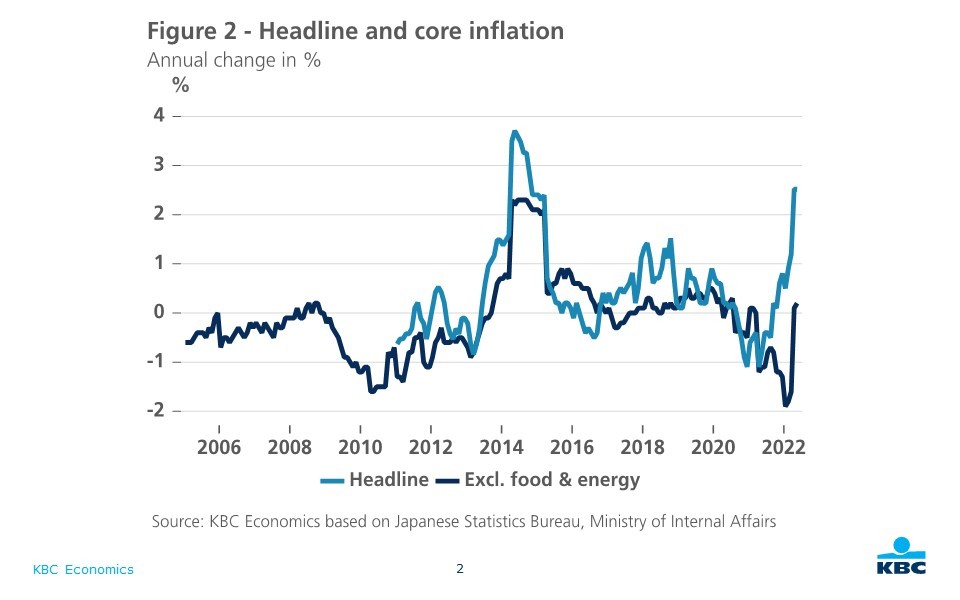

For the first time since March 2015, headline inflation reached the Bank of Japan’s 2% target in April 2022 (2.5%, stable in May 2022). This was however mainly due to energy and food price inflation. Core inflation (excluding energy and food) remained stubbornly absent (0.2% in May 2022) (Figure 2).

This persistent absence of inflation has been deeply rooted in low inflation expectations around 0% for a considerable time and appears to be very hard to change. As these low inflation expectations feed into nominal wage negotiations, this creates a self-reinforcing nominal price level rigidity, despite all the efforts of the Bank of Japan (BoJ) to raise inflation. The current President of the BoJ, Mr Kuroda, clearly intends to maintain the BoJ’s current policy stance at least until the end of its tenure in February 2023, despite the fact that the BoJ recognises the negative side-effects of this policy on financial stability and the weakening effect on the JPY exchange rate.

Consolidation of public finances

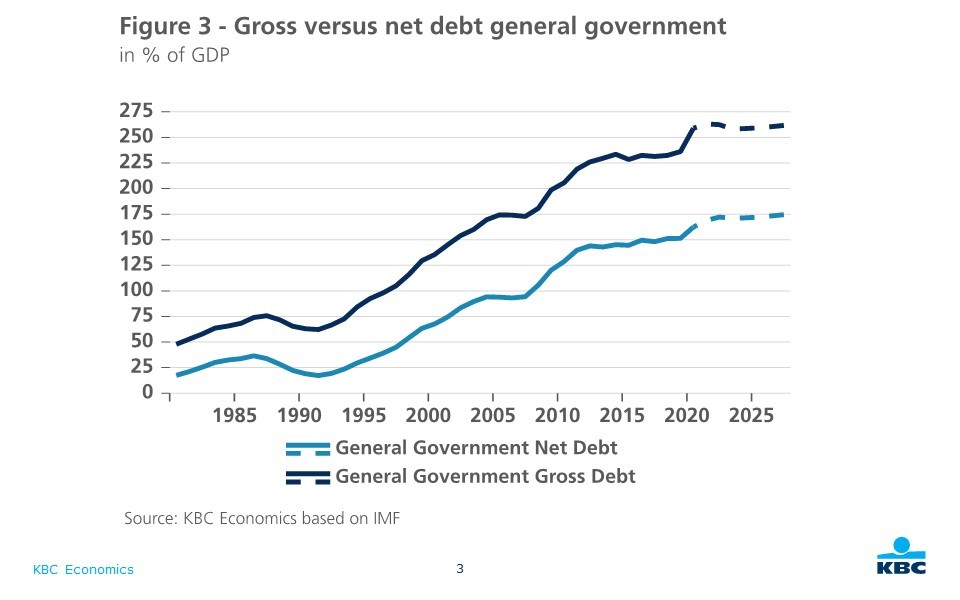

The fiscal medium term objective of the Japanese government remains a primary budget surplus by 2025, but this is probably overly optimistic. According to the latest IMF forecasts, this objective is likely to be missed, although significant fiscal consolidation is likely to be achieved compared to the current deficit. In general, the fiscal policy stance, as measured by the change of the structural (primary) budget balance, shows that Japanese public finances have indeed seen a tightening cycle between the start of Abenomics in 2013 until the outbreak of the pandemic in 2020. This path was resumed during the relatively short tenure of Prime Minister Suga, and is likely to be continued under the current Prime Minister Kishida.

Having said this, the fact that large (albeit decreasing) deficits continue to be accumulated, implies increasing public debt-to-GDP ratios as well (Figure 3). So the third original objective of Abenomics, the structural consolidation of public finances, is missed as well.

Will ‘New Capitalism’ be any different ?

Current Prime Minister Kishida appears to remain committed to structural reforms, but adds additional emphases via his doctrine of ‘New Capitalism’. Officially, this refers to the plan to ‘correct’ all kinds of negative externalities of a market economy. New policy priorities include addressing inequality and new challenges such as the green transition and digitalisation. It remains to be seen to what extent ‘New Capitalism’ will differ in practice from ‘Abenomics’. Based on the policy proposals so far, it is difficult to see why it would address the issues any better. Therefore, there is a risk that the ‘New Capitalism’ doctrine will turn out to be not more than old wine in new bottles.