Macro-prudential policy should bring Czech housing market out of higher gear

On 7 October, Eurostat published housing price statistics for the second quarter of this year. In this Economic Brief, we take a look at the Czech housing market, which has recently topped lists of Europe's most overvalued housing markets. To prevent further overheating of the housing market, sharp macroprudential measures have been back in force in the Czech Republic since April this year, after they were previously scaled back during the corona pandemic to support the housing market. Are the effects of these measures already being felt in the figures? What is the state of overvaluation, and what is the impact of the current turbulent economic times on the housing market?

Tighter macroprudential policy

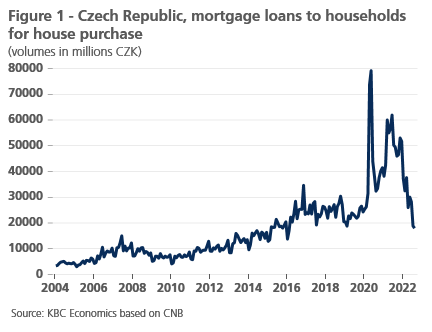

In November 2021, the Czech central bank announced it would tighten macroprudential measures for residential real estate again after suspending them during the corona pandemic. Limits on the debt-to-income ratio (total debt versus net annual income) and the debt-service-to-income ratio (monthly debt repayment versus net monthly salary) were reactivated. The ratios are currently 8.8 and 45% respectively. Less strict limits apply for those under 36 years of age (9.5 and 50%). The loan-to-value ratio (loan amount versus collateral value) was also reduced to 80% and to 90% for people under 36. The central bank sees this 80% limit as optimal to curb excessive loan growth without the housing supply plummeting. After all, if this limit is too tight (low), fewer people will be in a position to take out a loan to build a house, inhibiting supply and putting upward pressure on prices1. Figure 1 shows that excessive loan growth has already been curbed. Of residential loans taken out in 2021, some 25% would fail to meet current debt-service-to-income ratio limits.

An unfavourable economic environment

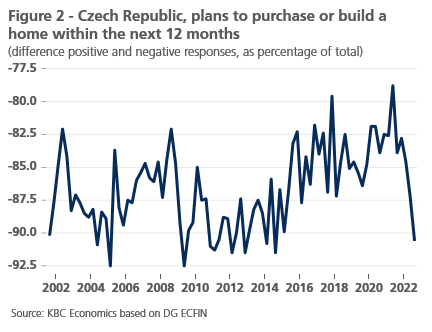

The fundamental economic factors of real house prices are not evolving recently in a way that could further support them. The KBC economic scenario foresees a cooling of the Czech economy in the second half of this year. Real wages, in the absence of automatic wage indexation, were already 10% lower in the second quarter of this year than a year earlier. Moreover, mortgage rates rose markedly. The so-called affordability of housing has thus worsened, which may negatively affect house prices in the long run. Households' intentions to buy or build a home already fell further in the third quarter of this year (see Figure 2). Moreover, the figures mask large differences among households. For people employed in some sectors, the real wage decline is much stronger. Add to this the fact that monthly mortgage loan repayments could rise in the coming years due to recent monetary policy and that energy bills have risen sharply, especially for less well-insulated homes. Then it is almost a certainty that the repayment burden could rise sharply and, in some cases, households will no longer be able to continue repaying their home loans.

What is the state of overvaluation?

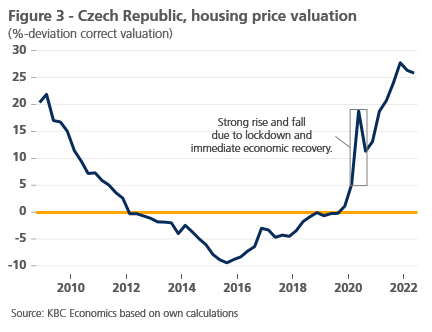

The sharp rise in overvaluation, which started in 2020, does not continue into 2022. Thus, real house prices are not rising faster than what can be expected based on economic fundamentals. In other words, the bubble is not getting any bigger. We estimate that the Czech housing market is currently about 25% to 30% overvalued (see Figure 3). Our scenario, which obviously depends on the further course of the war in Ukraine, foresees a gradual unwinding of this overvaluation, spread over the coming years. We estimate the average annual increase in house prices for 2023 at only 0.5%, while for 2022 we still record an expected annual increase of 17% in our scenario. Given the strong nominal rates of increase in recent quarters, that implies some quarters of zero to slightly negative growth. However, in real terms, given high headline inflation, we foresee a correction in the coming quarters. A collapse of the housing market is not an issue in our base case: the labour market is still very tight and due to strict building regulations, among other things, there is absolutely no oversupply of housing. Consequently, the reduced appetite and/or ability to take out housing loans is currently translating into increasing tightness in the rental market.

1Plašil, Miroslav, and Zlatuše Komárková. "Thematic Article on Financial Stability———1/2022."