Long and bitter technology war on its way

The condemnation of Huawei by Donald Trump symbolises the escalation of the American-Chinese trade war into a technology war between the two superpowers. Trump justifies his drastic intervention by pointing to China’s unfair practices, in particular China’s market-distorting trade policy and violation of intellectual property rights. The Chinese transition to a technology-driven economy, however, also relies on investment in innovation and valorisation, at which China is rapidly outperforming Western countries. In contrast to the trade conflict, for which a short-term solution is possible, the technology battle will continue for a long time to come. A leading role for China in the world economy is written in the stars. Cooperation rather than confrontation is the best guarantee for our long-term prosperity. But a more assertive American and European attitude is needed to maintain a balance. So at least this time, we should listen to Donald Trump.

The new China has arrived

China’s steep rise on the world stage went through a number of phases. The development of an export-oriented industry made China grow into the ‘factory of the world’. China was eager to make use of Western knowledge, acquired both through joint ventures and through the direct import of Western technology and machinery. The Chinese expansion created great opportunities for Western companies that could, on the one hand, supply their products and services to the Chinese market and, on the other hand, reduce their production costs by relocating their production. Few companies were concerned about this state of affairs, probably blinded by major short-term profit opportunities. In the longer term, we now see that China has been able to upgrade itself to a leading player in high-tech sectors with a higher added value, in accordance with the official Chinese objectives. The Chinese technological advance is therefore not a one-day wonder, but a structural trend that is causing global disruption. This was made painfully clear recently when it became apparent that no other company in the world besides Huawei could roll out the 5G network in an equally quantitative (in terms of production volume and speed) and qualitative (in terms of technological standards) manner. This observation caused a shock, both in the business world and on the political stage.

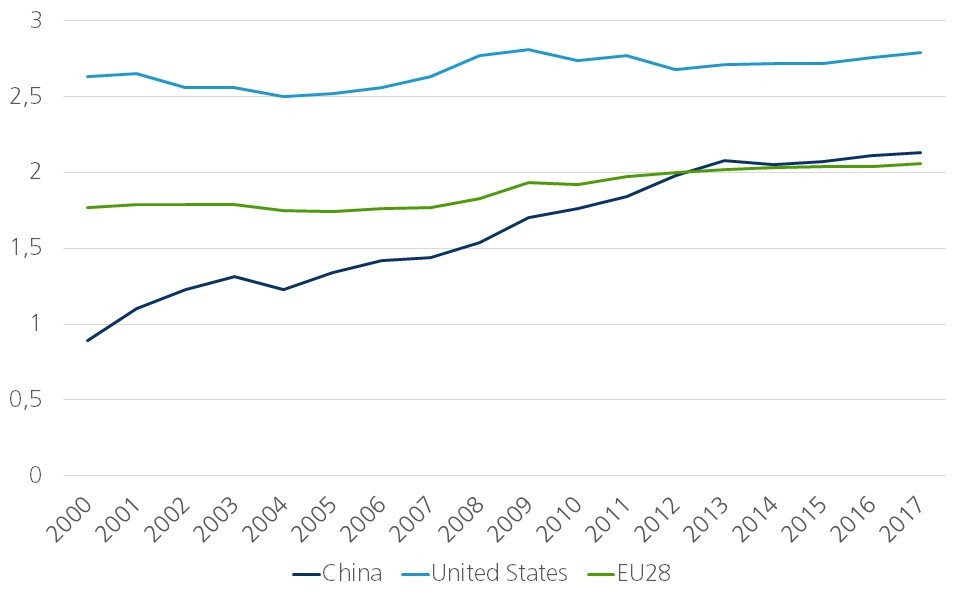

Huawei’s success is often quickly attributed to unfair Chinese practices. The lack of respect for international protection of intellectual property is seen as especially problematic. This interpretation is correct, but incomplete. China has long left behind the stage of achieving technological progress through imitation and reversed engineering. Structural and substantial investments in research and development have put China on the world’s technological map. Figure 1 shows that research and development spending in China (as a % of GDP) has increased significantly in recent years. China’s research and development spending even matches that of the EU, which, despite many policy intentions, has been barely increasing. The objective of the Lisbon Agenda (2000) and Europe 2020 (2010) to invest 3% of GDP in research and development has proved unattainable even after almost 20 years.

Figure 1 - Research and development expenditures, in % of GDP

China is not the only one to blame

It’s easy to point the finger at China. It would, however, be fairer to acknowledge that we are systematically lagging behind, certainly in Europe, but gradually also in the US. Especially the speed with which China is carrying out its technological upgrading is historically unprecedented. Research and development spending is certainly not the only measure of innovation, but it is an important one. Other indicators also show China’s strong technological expansion. When we look at the number of patents granted to foreign companies in the US, we see a huge percentage increase in China’s presence in the US technology market.

Not trade, but technology

The American stab at Huawei follows an escalation in the trade conflict. It is now clear that it is not trade, but technological and therefore economic leadership in the world that is dominating the American-Chinese tensions. During the recent negotiations on a trade agreement, it became clear that China was prepared to make concessions in the area of trade. But to deviate fundamentally from China’s strategy of becoming the leading economy and world power through technological leadership is a bridge too far for China.

Even if the US were to impose much tougher sanctions on Chinese technology players, it seems unlikely that the Chinese strategy could be undermined. Recently there has been talk of a new economic cold war. It is true that the American measures are hurting the Chinese economy. This is due to both the negative consequences of increasing protectionism and the drag from ongoing uncertainty. For the time being, the Chinese government can use fiscal and monetary stimulus to keep the Chinese economy on a soft economic landing path. Chinese economic growth in the first quarter of 2019 even surprised positively. Such stimulus is unsustainable in the longer term, not least because China’s total debt already stands at more than 250% of its GDP. However, it is wrong to think that the current aggressive US approach will convince China to change course. In addition to a large domestic market, China is now much more integrated with the global economy, thanks to international investment and intensive trade contacts. This makes China very resilient. In addition to increased resilience, China can also count on a very agile economy. Change can be implemented quickly and centrally, in contrast to the slowness of the Western, democratic market economies.

Yet an economic cold war is not a good thing for anyone. In the long term, one should not underestimate how a free market offers the ultimate stimulus for innovation and economic progress. Although China is currently the technological leader, it remains to be seen whether China can maintain that role within its current political and economic model. The great potential of international cooperation between the West and China lies in particular in bringing together two worlds: the intrinsic incentive for lasting innovation that a market economy brings with it, combined with the speed with which a centrally planned economy can achieve things. Hopefully, our political leaders will soon come to that conclusion. But it is more likely that this understanding will not be forthcoming for some time to come, leading to a prolonged and intense technology war.