It’s the car sector that’s to blame for the sputtering German growth engine, not the trade war

The German economy contracted by 0.2% in the third quarter of 2018. This weak performance is bad news for the entire European economy, particularly for countries that are highly integrated with the German economy, such as Belgium, which supplies many intermediate industrial products. The outcome was written in the stars. Eurostat previously announced that growth in the euro area had fallen to 0.2% in the third quarter. When combined with the growth figures for some other countries, a quick calculation already showed that Germany had suffered a poor quarter. Nevertheless, the markets were initially very surprised and reacted negatively. This had much to do with the message from the German statistical office Destatis, which blamed this slowdown on a plunge in German exports. The German export engine has of course been the success formula underpinning German economic performance of recent years, thanks to emerging economies that eagerly purchased German machines and cars. A minor panic attack therefore seems appropriate. But many apparently saw this as the first signs that the trade war has struck the mighty German bastion, with consequences for the entire European economy.

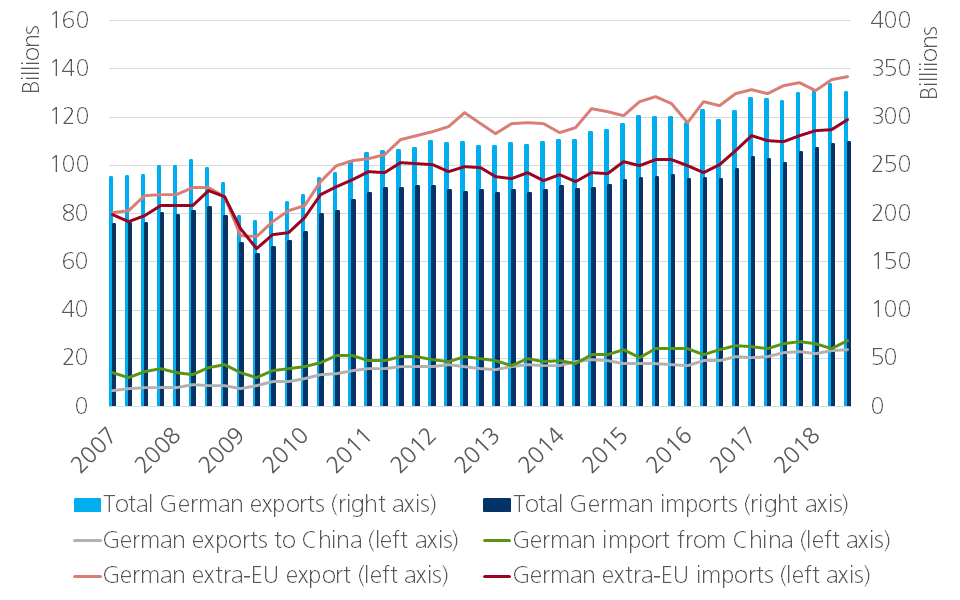

However, this interpretation of the facts is not correct. A more in-depth look at the German export figures shows that German exports to non-European markets grew by 1.04% in the third quarter. Exports to China also continued to grow. The decline in German growth can therefore hardly be explained by international trade disputes. Other factors are to blame for the relapse. For these, we should focus particularly on the German automobile industry. The introduction of new emission standards in recent months meant that many existing models have had to be modified and new adapted models be put on the market. This led to delays in the production process and therefore also impacted car sales. Consumers additionally hesitated to buy because of the uncertainty regarding the new standards. In Germany, new car registrations fell sharply in September and October 2018. Weak car sales were also reflected in the weak overall growth in consumption in the third quarter. The decline in consumption is surprising, given the third-quarter surge in employment and rising wages.

For the time being, therefore, the trade war has no impact on European export figures. The weak third quarter in Germany is not a structural slowdown in growth, but is likely a temporary blip due to practical supply-side problems in the economy. Nevertheless, the trade war will progressively weigh on economic growth due to the general deterioration in sentiment that we have been seeing for several months now. In other words, the growth slowdown that we are currently expecting in many European countries is indeed related to rising protectionism. The temporary problems in Germany unfortunately create the perception that the expected cooling off is already a fact. This is an unjustified conclusion, but as a self-fulfilling prophecy, it threatens to further weaken the European economy. The best protection against this is correct information and interpretation, a noble task for us economists.

The trade war is currently not the real culprit of the situation, but, in the longer term, increasing protectionism remains a threat to the European economy. Europe may currently escape direct confrontation in the US-China trade war, but will be indirectly affected by falling demand for European products in emerging economies, increasing import competition in the European market, and stronger competition in non-European markets. An escalation of the trade war that directly impacts Europe would be a disaster scenario. Indeed, the confidence indicators related to expected export orders are rapidly deteriorating across Europe. Being a passive observer of the world automatically makes Europe a victim of the trade war.

To be able to respond assertively in the current uncertainty, we need Germany despite its growth slowdown. German companies are the best among all European companies in being able to break through on international markets, thanks to their good reputation, innovation, international network and German political influence. It would be an illusion to believe that companies from smaller European countries could achieve this on their own en masse, with the exception of a few fine but isolated success stories. Indeed, the German economic locomotive is crucial to pull the rest of Europe with it.

Figure - German trade: total, extra-EU and with China