Headwinds mount on Belgian housing market

Abstract

The Belgian housing market continued to perform well in recent years despite successive crises. Nevertheless, a weakening of buying and construction activity has been noticeable in recent quarters. This takes place against the backdrop of rising interest rates and is accompanied by lower annual house price growth dynamics. Together with strong nominal income growth among households (a consequence of high inflation, automatic indexation and robust job creation), the less exuberant house price dynamics put downward pressure on the overvaluation of the Belgian housing market. This was offset by upward pressure due to the rise in interest rates. On balance, the overvaluation, approached from an econometric model, remained between roughly 10-15%. The household debt ratio continued to rise in recent years, although that trend seems to have reversed recently. The headwinds in the housing market will likely result in a further deceleration in the nominal price growth rate in 2023-2024. Given still relatively high general inflation, that implies a house price decline in real terms.

1. Activity in the housing market

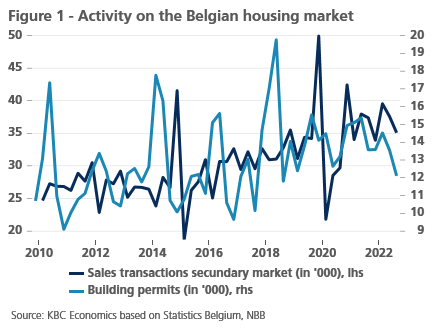

Despite a difficult period marked by the pandemic crisis and Ukraine and energy crisis, the Belgian housing market still performed very well over the past three years. Both the number of sales transactions on the secondary market of existing housing and the number of building permits on the primary market of new construction remained at a fairly high level (Figure 1). While both were volatile, this was apart from crisis related factors, such as the lockdown measures during the pandemic, also due to shifts in activity as a result of policy interventions, including the abolition of the housing bonus in early 2020 and the reduction of registration fees in early 2022 in Flanders. The sustained interest in real estate was also reflected in other indicators. For instance, the number of licensed real estate agents still increased steadily in recent years to currently around 11,000. The European Commission's confidence indicator, which gauges Belgians' intention to buy or build a home, also climbed to a new peak

The continued strong activity in the housing market was mainly due to favourable macroeconomic fundamentals. For instance, the until recently low interest-rate environment supported demand for housing substantially, including from investors buying properties to rent out or as second homes. The fact that the labour market held up well during the crisis years also played an important role. The unemployment rate rose only slightly, from an average of 5.4% in 2019 to 6.3% in 2021, before declining again to 5.6% in 2022. A net 182,000 jobs were added in Belgium between the end of 2019 and the end of 2022, a growth of 3.7%. Massive government intervention, both during the pandemic and the energy crisis, and the automatic indexation of wages and social benefits also propped up incomes. The real disposable income of Belgian households continued to grow in 2020 and 2021 and fell only marginally in 2022, against the backdrop of skyrocketing inflation.

The overall still favourable situation does not alter the fact that in 2022 there were increasing signs of a less dynamic Belgian housing market. For instance, the previously mentioned indicator measuring Belgians' intention to buy or build a home has been on a downward trend since mid-2021. The cooling was initially reflected in the primary new construction market, with a drop in building permits and effective construction investment on the one hand and a weakening of demand expected by construction companies on the other. According to National Accounts data, construction investment by households fell in the last three quarters of 2022. In the fourth quarter, they were 5% lower than in the first. According to the NBB business cycle barometer, the assessment of current orders in construction, although also declining since spring 2022, still held up reasonably well. But the expected future demand trend did plummet. The secondary market of existing homes is also cooling down. According to figures from the Federation of Notaries, 10.5% fewer homes were sold in the first two months of 2023 than in the same period in 2022.

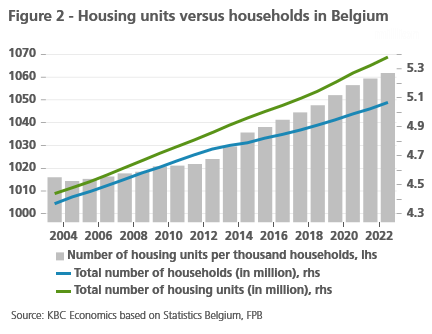

Although new construction activity slowed, the number of available housing units continued to increase more than the number of households in 2022 (Figure 2). This suggests that the supply of housing in Belgium has adapted well to demographic trends, and thus to the need for housing. The increase in the ratio of housing units to households, which occurred mainly since 2014, is partly explained by the increased number of non-principal residences, including second homes and student rooms. But it likely also reflects the fact that the housing shortage that prevailed locally has (partly) dissipated and may be turning into an oversupply of housing here and there.

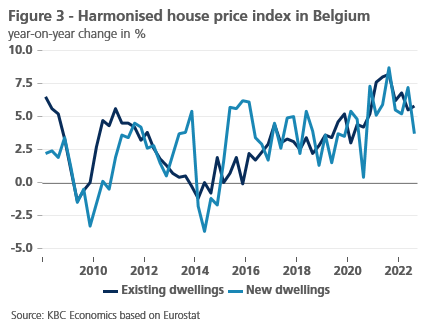

Recent signs of weaker activity in the Belgian housing market have been accompanied by weaker annual house price growth dynamics. The latter peaked in recent years at 8.2% in the third quarter of 2021, according to Statbel's residential house price index. These are the harmonised price figures of existing and new housing supplied to Eurostat by Statbel, adjusted for price changes due to changes in the characteristics of the property sold. Since the peak, annual price growth fell to as low as 5.4% in the third quarter of 2022 (the latest figure available at the time of writing). The weakening in price dynamics occurred for both existing and new homes (Figure 3). In 2021 as a whole, house price growth was still 7.1% against the previous year. In 2022, that is expected to have fallen to around 5.3%.

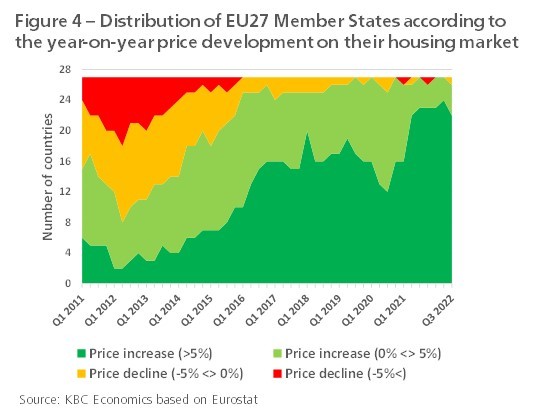

Compared to the European Union as a whole, house price growth in Belgium has been somewhat weaker in recent years, with the recent weakening of price dynamics setting in a little earlier. In the EU27, annual price growth peaked at 10.4% in the first quarter of 2022, two quarters later than in Belgium, and then slowed to 7.4% in the third quarter of 2022. The cooling-off was quite widespread: in the third quarter of 2022, annual growth dynamics declined in 22 out of 27 member states, compared to 13 countries in the second quarter. Nevertheless, price growth in the third quarter still was at more than 10% in 15 countries (Figure 4). In the list of the 27 states, Belgium ranked 21st in the third quarter of 2022 with a price rise of 'only' 5.4%.

The ongoing cooling of the Belgian housing market has mainly to do with rising interest rates and the energy crisis, which puts a brake on real purchasing power, albeit less than in most other European countries. For many Belgian households, it is becoming increasingly difficult to finance their own home. Real estate interest from investors, who until recently were looking for returns in the low interest-rate environment, is also waning. There is also the sharp rise in the price of building materials, which has exceeded that of all goods and services in the general consumer price index (CPI) over the past decade. Finally, apart from the mentioned 'hard' factors, the still considerable uncertainty surrounding the geopolitical situation (more specifically the further course of the Ukraine war) is causing some of the potential home buyers or builders to postpone their decision.

The headwinds in the Belgian housing market, combined with sky-high general inflation, have meant that nominal house price growth, which has slowed sharply but not stalled, has lagged behind developments in the general CPI since the end of 2021. Specifically, real house prices (i.e. nominal house prices adjusted for general CPI inflation) fell 6% in Belgium between the third quarter of 2021 and the third quarter of 2022. This is the strongest real price correction in a single year since the early 1980s.

An interesting question is to what extent the less exuberant house price dynamics of recent quarters have been able to dampen the overvaluation present in the Belgian housing market. The answer depends not only on recent price developments but also on the evolution of its main determinants (the so-called market fundamentals). An over- or undervaluation of real estate occurs when the development of house prices is no longer in line with what those fundamentals indicate. Often, demand factors, such as household income, mortgage interest rates and demographics, are mainly considered for the latter. However, measuring over- or undervaluation is a tricky task. The fact that different figures circulate is because there are different measures that are not all equally comprehensive.

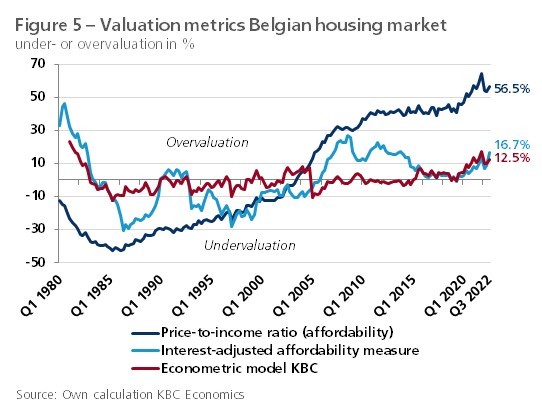

For instance, the price-to-income ratio is a simple measure that relates the evolution of house prices to that of households' disposable income. The reasoning is that this income is needed to build up a sum of money as equity when taking out a mortgage loan but more so to provide sufficient repayment capacity. The current value of the ratio is compared with its long-term average, which is assumed to correspond to an equilibrium level. When the ratio rises too sharply above its long-term average, there is indication that households' capacity to finance a home is compromised. Calculated this way, the housing market was still well-overvalued (56%) in the third quarter of 2022, but less so than at the end of 2021 (64%) (Figure 5). The decline in the measure since the end of 2021, besides the weaker price dynamics, has to do with the fact that nominal household incomes have risen strongly along with high general inflation via the automatic indexation of wages and social benefits.

Besides income, property affordability depends on the course of mortgage interest rates. This determines the repayment burden and thus the borrowing capacity of buyers. If we correct the price-to-income ratio to take interest into account, we obtain the interest-adjusted affordability. This compares the annual annuity a mortgagee has to pay (both capital repayment and interest) with disposable income. The more the annuity and income diverge, the more difficult it becomes to finance a home. As with the price-to-income ratio, this extended measure is expressed as percentage deviation from its long-term average. Because the trend of strong interest-rate declines has supported affordability, the overvaluation quantified this way is much lower, at 17% in the third quarter of 2022 (Figure 5). Recently, the measure has been subject to opposing forces, which explains its fluctuations. On the one hand, weaker house price dynamics and strong nominal income growth pushed the measure lower. On the other hand, the initiated rise in interest rates put upward pressure on the measure.

Housing market valuation is also often approached from an econometric model. One thereby seeks a long-term mathematical equilibrium relationship between house prices and their fundamentals. Besides household income and mortgage interest rates, these are usually demographics (number of households) and changes in the structural characteristics of the housing market (such as property taxes). The extent to which the effective price trend deviates from the equilibrium value calculated by the model (i.e., the error term in the regression equation) can then be seen as a measure of overvaluation. The ECB and the NBB, among others, use such models, with varying results. The ECB's model, which is quite rudimentary, even points to an 8% undervaluation in the third quarter of 2022. According to KBC Economics' model, which is similar to the NBB's and takes into account changes on property taxes, the overvaluation was at 12.5% in the third quarter of 2022 (Figure 5). Like interest-adjusted affordability, the model measure has also been subject to opposing forces in recent quarters.

4. Debt position and mortgage market

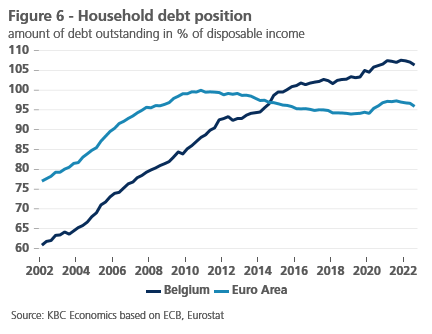

Besides the measurement of overvaluation, the risk in the housing market is usually also considered from the viewpoint of the evolution of the household debt position. Belgium is one of the European countries where mortgage debt increased the most in the past decade. Related to their disposable income, the total debt of Belgian households, predominantly composed of mortgage loans, has been above the euro area average since 2015. The debt ratio also continued to rise in recent years, although the trend seems to be reversing in recent quarters. In the third quarter of 2022, it reached a rounded 107% in Belgium, compared to 96% in the euro area (Figure 6). In line with weakening buying and building activity in the housing market, the number of new mortgage loans granted also declined since the summer of 2021 (Figure 7).

Not only has household debt structurally been increasing, a non-negligible part of it, moreover, still involves loans with a high risk profile. The situation in this area however has improved in recent years. Figures from the NBB (Financial Stability Report and Annual Report 2022) show, among other things, a decrease in the share of loans with a high loan-to-value (LTV above 90%) as well as a stable development of the share of loans with a high debt service-to-income ratio (DSTI above 50%).1 Nevertheless, recently the repayment burden of new mortgage loans has increased considerably, as well as the average own funds that buyers invest at purchase. Certain groups with mortgage loans remain vulnerable. This is especially true for low-income households, including singles with children, where a high DSTI is more common. Over the past year, more and more buyers and builders also opted for longer-term mortgages to reduce monthly repayments. On the positive side, the number of defaults in the mortgage market remains historically low, which in turn has a lot to do with the still well-functioning labour market.

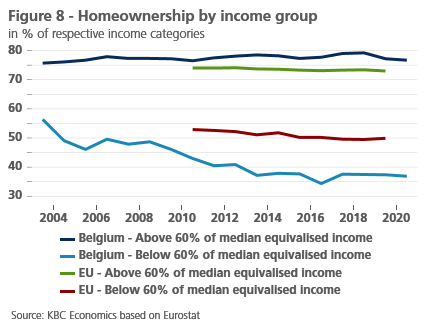

Rising interest rates are sharpening the duality that has been present in the Belgian housing market for some time. The combination of more expensive credit and high housing prices, following the sharp increases of the past decades, means that it has become more difficult, or even impossible, for a wider group of households to acquire their own affordable home. This is especially the case in expensive regions, more specifically in Brussels and the Flemish big cities. Households there increasingly rely on the rental market. On the other hand, there is another, still sufficiently large group of households that still can and want to buy property because they have the means to do so. Among the younger age categories, these are mostly families with financial support from (grand)parents. The duality in the housing market is reflected in the fact that homeownership among lower-income groups has fallen over the past two decades (although there has been some stabilisation in recent years) and is substantially lower than the European average (Figure 8)

5. Outlook and concluding remarks

The increasing duality is not a good thing for housing market stability. The latter is quite fragile and, for instance, if interest rates continue to rise sharply, the situation could potentially result in a (sharp) nominal price correction. Given the close link between the property market and economic activity, this could in turn impact the economy more generally. Whether the blowing headwinds will lead to a correction in the housing market remains very uncertain. Indeed, further price movements depend on several factors, for which making a precise prediction is difficult. Whether and especially the extent to which interest rates rise further is undoubtedly the most important one. Likely, long-term interest rates, which guide mortgage rates, will continue to rise for some time to come, in the wake of continued restrictive monetary policy to combat still-high inflation. This will further erode property affordability and also cause a decline in property investment demand. On the other hand, the Ukraine and energy crisis appears to be weighing less on economic activity than previously anticipated. A recession is avoided, nominal incomes are rising in line with inflation and job creation remains positive.

Therefore, KBC Economics assumes that nominal house prices will continue to rise in 2023 and 2024, albeit at an even slower pace. Specifically, we expect Belgian property prices to rise by an average of 2.5% in 2023 and 2.0% in 2024. Adjusted for expected general inflation in those two years, that still represents a real decline in house prices. This moderate scenario for Belgian property prices is not only an expected scenario, but also a desirable one. A 'soft landing' of the market, after the years of euphoria, is not a bad thing to prevent the overvaluation of the Belgian property market, which is currently still within limits, from rising too high.

That the market, against the backdrop of rising interest rates, has not cooled down more strongly than it did in recent quarters has several potential explanations. The rising trend in interest rates may have just been the trigger for interested buyers to act quickly to get ahead of even higher rates. It is also possible that buyers remained active, but bought a property in a somewhat less favourable location or of lower quality. In the coming years, the energy efficiency of houses will become an increasingly important determinant of house prices, in addition to their location. As a result, the price difference between energy-efficient and non-efficient houses will increase. In the process, it is even likely that energy-guzzling homes will nominally correct in price. After all, the government has decided that buyers of such houses will be required to renovate them. Buyers will already factor in a renovation budget when setting the price they want to offer, taking into account substantially more expensive materials to renovate.

1 Loan-to-value refers to the ratio between the amount borrowed and the price at which the property was bought. The debt service-to-income ratio refers to the debt burden in relation to households' disposable income.