Electric driving, a privilege for rich countries?

Those following media coverage of the automotive sector could get the impression that a green wave dominates the sector. Sales figures, however, paint a more moderate picture. Diesel sales are declining, but mainly in favour of petrol cars. The higher price tag of electric cars still dissuades car buyers, especially in the economically weaker EU countries. However, government measures to encourage the purchase and use of electric cars, such as purchase subsidies, reduced road taxes and public charging infrastructure, can help bolster the transition to electric driving.

Electric cars on the rise but market share remains limited

The diesel car, long praised as the environmentally friendly alternative to petrol cars, has lost its shine. Diesel car sales figures are negatively affected by emission-testing scandals and the growing body of scientific research into the damage caused by particulate matter. In addition, a rising number of countries and cities are banning polluting vehicles. Although many environmental arguments for the declining diesel sales also apply to petrol cars, we see that petrol car sales in the EU countries are in fact reaping the benefits of the declining popularity of diesel cars (see figure 1). Declining diesel registration numbers in all EU countries were compensated by an increase in petrol registrations.

Figure 1 - Decreasing interest in diesel cars largely compensated by petrol cars (change in new passenger car registrations between Q1-Q3 2017 and Q1-Q3 2018, in % )

Source: KBC Economics based on European Automobile Manufacturers’ Association (ACEA)

Even more striking than the increase in petrol car registrations is the increase in electric rechargeable passenger cars (ERPC1). Between Q1-Q3 2017 and Q1-Q3 of 2018, new ERPC registrations in the EU increased by an impressive 40.2%. Despite the increasing popularity of alternative propulsion systems like ERPCs, however, their share in total car sales remains negligible. For example, the share of ERPCs in total registrations of new cars in the EU was only 1.8% in the first three quarters of 2018. The electric rechargeable car thus remains a marginal phenomenon in the overall automotive sector.

Richer countries in particular take the plunge

There are many factors that hamper the advancement of electric vehicles, such as charging infrastructure and limited driving ranges. For many car buyers, however, the most important threshold remains the purchase price. To this day, electric cars are still more expensive than comparable models that run on diesel or petrol, despite sharp price reductions in recent years.

To drive an electric car, you have to (be able to) dig deeper into your pockets. This is also evident in the shares of ERPCs across the EU countries (see figure 2). Overall, the share of ERPCs in countries with lower GDP per capita figures is smaller than in countries with higher GDP per capita figures. With the exception of Hungary and Portugal, ERPCs have a market share of less than 1% in all countries where GDP per capita is below EUR 30,000. Above the EUR 30,000 GDP per capita level, market shares are around twice as high. The absolute ERPC outperformer is Norway. There, the market share of ERPCs in registration figures of new cars is no less than 46.7%.

Figure 2 -In richer countries the market share of ERPCs is on average higher

Source: KBC Economics based on ACEA and Eurostat

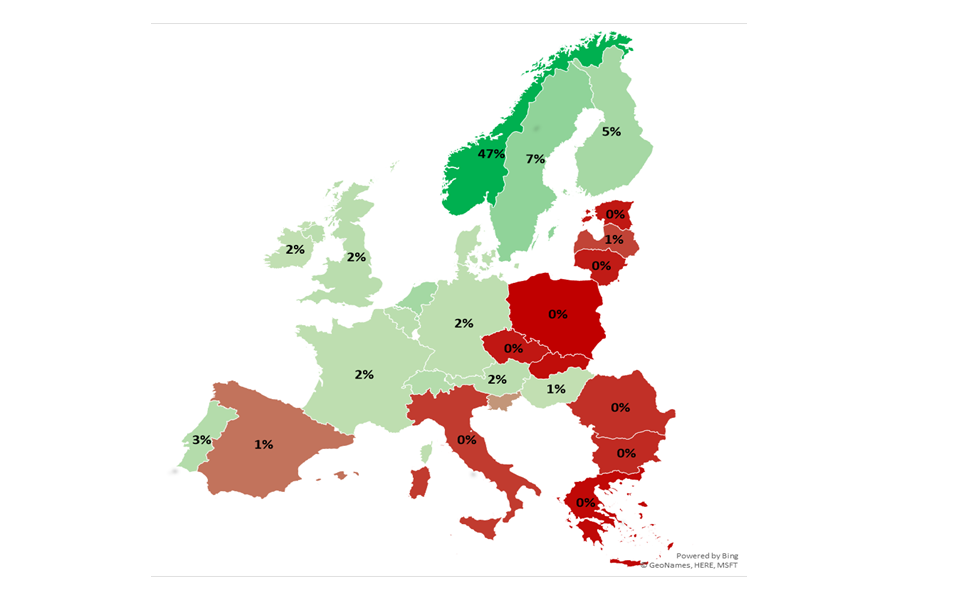

If we compare these data on a map of Europe, we see a clear difference in the market penetration of electrically rechargeable cars between Northern and Western Europe on the one hand and Southern, Eastern and Central Europe on the other (see figure 3).

Figure 3 - North-south and east-west distribution in popularity of electric driving (market share ERPCs in new passenger car registrations in the period Q1-Q3 2018, in %)

Source: KBC Economics based on ACEA

Government measures can make a difference

It is not only the wealth of a country that determines the popularity of ERPCs. According to studies by the International Council on Clean Transportation and the European Parliament, there is a clear link between the market share of electric cars and government support for the purchase and use of them. This public support also includes public investment in charging infrastructure. Here, too, there are major differences between EU countries. For example, in Estonia, Lithuania and Poland - all countries with an ERPC percentage in new sales close to 0% - there are no government measures to stimulate the sale of electric vehicles. Moreover, the number of public charging stations in these countries is very limited, at 384, 102 and 552 units respectively (figures for Bicycle and Automotive Industry for 2018).

On the other side of the spectrum we find Norway, the absolute world champion in the field of electric cars. For years, the Norwegian government has pursued an unparalleled active policy to promote electric cars. Electric cars are exempt from tolls, ferry costs and emission taxes in the cities. Moreover, electric cars can park for free and can use the bus lanes. The elevated ERPC sales figures in Norway, which are considerably higher than in EU countries with relatively comparable GDP levels, indicate that sound government support, financial and/or non-financial, can have an active influence on the energy market. Or at least in countries where GDP per capita is sufficiently high.

Footnotes

1/ This category includes both fully electric passenger cars and plug-in hybrids. Hybrid cars in which the electricity used is only produced by the combustion engine and by energy recovery through braking and deceleration do not count.