Investment in sustainable government bonds: emerging markets

Sustainability of emerging markets: 2020 update

Abstract

In recent decades, emerging markets have become more integrated into the global financial system. High-yielding emerging market government debt (‘emerging debt’) gained growing interest from investors, especially against a backdrop of historically low interest rates in developed markets. Given the higher risk typically associated with emerging market assets and a general growing interest in socially responsible investing (SRI), it is important to be able to assess whether emerging debt meets certain criteria related to economic stability, good governance, and environmental and social impacts. In connection with the SRI funds offered by KBC Asset Management, in this research report we present an update of the sustainability screening of a wide group of emerging markets (the KBC Emerging Markets Sustainability Barometer) to arrive at a ‘best in class’ sustainable investment universe. As in the 2019 screening exercise, the Central and Eastern European countries score quite well in the ranking. Countries from the region secure the top 5 spots and 11 out of the 18 emerging countries that are eligible for investment in KBC's SRI bond funds originate from the region.

- Introduction

- Definition of emerging markets

- Screening methodology

- Screening results

- References

- Footnotes

- Appendix

You can open the PDF here .

Sustainability is an integral part of the KBC Group’s general business strategy. The socially responsible investment (SRI) funds offered by KBC form an important element of this. Since 2000, SRI has become increasingly focused on bonds alongside equity (see Box 1 on page 3 for an overview of KBC's SRI bond funds). 'Country screening’ becomes particularly important when considering the sustainability of government bonds. That is, the SRI profile of a country’s government debt is affected by the extent to which a national government attaches importance to sustainability and social responsibility when implementing policy.

Every year, the KBC Economics department on behalf of the KBC SRI funds carries out a sustainability analysis. While previously this was limited to developed markets – specifically OECD countries together with EU member states and accession candidates – in 2017 we introduced a parallel analysis for emerging market countries. In recent decades, private and institutional investors have increased their interest in investing in emerging or developing markets. This reflects the often-higher growth potential of those countries’ economies and the resulting higher return (but also risk) on investment. Such interest relates not only to investment in stocks, but also bonds, including government paper. As such, the country sustainability screening analysis for emerging markets has become increasingly important.

The process by which KBC undertakes this screening analysis is described in this report. The first section delineates the group of countries to be screened by outlining a broad definition for emerging markets. The second section then describes the criteria against which the countries are screened. These criteria can be summarized into five themes: (1) General economic performance and stability; (2) Socio-economic development of population; (3) Equality, freedom and rights of population; (4) Environmental performance and commitment; and (5) Security, peace and international relations. In the third section we explain how a sco

There is no strict definitionre is calculated for each country based on these criteria. Only those countries ranking in the top 25% of all screened emerging markets can be included in the investment universe of the KBC SRI funds. In conclusion, we discuss the results (the KBC Emerging Markets Sustainability Barometer) and how it has changed since the last screening round. We end up with 18 emerging markets in which KBC SRI funds can invest.

Definition of emerging markets

There is no strict definition for what constitutes an emerging market, which in turn means there is broad uncertainty and disagreement about which countries qualify as emerging. Often, however, ‘emerging,’ ‘developing,’ or ‘growth’ markets are countries that are developing rapidly and that have relatively strong economic growth. They are generally characterised by strong inflows of foreign direct investment, a high degree of industrialisation and substantial openness to external international markets. This means that growth in their gross domestic product (GDP) is primarily export-driven, although they often have strong and growing domestic markets as well. Emerging markets are also often characterized as countries focused on improving their infrastructure and institutions, including their financial, social and political systems. As a result, such countries are often in a major state of transition, with prosperity levels (per capita GDP) that, while rising rapidly, are usually lower – and significantly so in some cases – than those in developed countries. Such transitions are not always smooth or gradual, however, which means the country’s economic performance can be volatile and associated with higher levels of risk. Their performance in terms of sustainability principles may also be poorer at this stage compared to some developed markets.

Since there are no strict criteria for distinguishing emerging markets from developed markets, we opt for a very broad definition. Namely, we combine the differing criteria from two reputable international institutions as well as two financial institutions widely viewed as providing benchmark ‘emerging market’ products. The United Nations (UN), for example, notes that its use of the term ‘emerging economies’ is not meant as a strict definition but rather ‘refers to mainly middle-income developing and transition countries that are integrated into the global financial system.’ The term ‘middle-income’ refers to the UN’s classification of countries according to their per capita gross national income (GNI). The World Bank also classifies countries according to per capita income levels and into four different groups—low, lower-middle, upper-middle, and high income—though the resulting groups differ slightly from those of the UN. JP Morgan, a financial institution that provides a suite of emerging market bond indices seen as global benchmarks for investors, also considers per capita GNI among other factors. Specifically, to be included in the JP Morgan EMBI Global Index, a country’s GNI must be below an ‘Index Income Ceiling’ for three consecutive years in addition to having a sufficiently liquid bond market. Morgan Stanley, on the other hand, which provides the MSCI EM Index, a benchmark global emerging market equity index, considers several factors, such as size, liquidity, and market accessibility to determine which countries are represented in the benchmark.

KBC opts to do the sustainability screening with a sufficiently broad selection of possible emerging markets. We therefore include in the screening process any country which falls into at least one of the four following categories: (1) is defined as upper middle income by the UN, (2) is defined as upper middle income by the World Bank, (3) is included in the JP Morgan EMBI Global Index, or (4) is included in the MSCI Emerging Markets Index. Category one includes 50 countries, category two includes 55 countries, category three includes 73 countries, and category four includes 26 countries. There are, of course, significant overlaps between the four categories, and we end up with an initial set of 104 countries to be screened. However, insufficient data is available for meaningful screening in the case of 23 countries, so we exclude them from the exercise. Additionally, we add three countries that do not meet the above stated criteria. Estonia, Slovenia and Latvia are all included because it is inconsistent to exclude them when peers with similar per capita GNIs, such as the Czech Republic and Lithuania, are included. This brings the entire set of emerging market countries to be screened for sustainability to 84.

The methodology used means that several countries are included in the screening exercises for both developed countries and emerging markets. This applies specifically to the most recent EU member states (Poland, Czech Republic, Slovakia, Hungary, Slovenia, Bulgaria, Romania, Estonia, Latvia and Lithuania), and to South Korea, Mexico and Turkey (which were included in the exercise for developed countries as OECD members). Except for Slovenia and the Czech Republic, all these countries fall below the cut-off point in the developed markets screening and therefore would be excluded from the KBC SRI investment universe (the Czech Republic has entered a ‘waiting room’ this year in the developed markets screening, and will need to be confirmed by remaining above the cut-off point next year).

However, since these countries find themselves on the cusp between developed and emerging markets, and are thus duly classified in this analysis, they have a second chance at being included within the KBC SRI investment universe if they rank well enough relative to emerging market peers. Since the set of emerging markets to screen is quite large relative to that of the developed markets (84 versus 44) the criterion for being included in the sustainable investment universe is relatively more stringent. For emerging markets, a country must rank in the top 25% of the screening set to be included, while for developed markets the cut off is the top 50%.

Box 1 - KBC's SRI bond funds

KBC has long been active in the field of sustainable or socially responsible investment. In 1992, the KBC Eco Fund was launched as the first Belgian investment fund to invest in shares of companies active in the environmental sector. The first sustainable bond fund was launched on the Belgian market at the beginning of 2002, also by KBC: the KBC Institutional Fund Ethical Euro Bonds, a sub-fund of KBC Institutional Fund focused on investments in bonds denominated in euros. Since then, KBC's range of sustainable investment funds has expanded considerably, both for private and institutional clients. In 2018, Pricos SRI, the first sustainable pension savings fund on the Belgian market, was added to the range.Today, KBC's range of SRI products consists of more than 50 funds. The total assets under management in these funds amounted to more than 15 billion euros at the end of September 2020. The bond funds make up about a quarter of this. Part of these funds invest exclusively in corporate bonds. For the choice of companies, the fund managers of KBC Asset Management use the sustainability analysis of companies. For funds investing in government bonds, the fund managers use the results of the scoring model discussed in this report. This is the case, for example, in the total solutions approach for clients, such as the ExpertEase SRI funds.

The 84 countries delineated in step one are then assessed based on several sustainability indicators. The data used in this analysis, therefore, come from a variety of sources. However, the majority come from international institutions such as the International Monetary Fund (IMF), the World Bank, and the World Economic Forum (WEF). Standardized data are, therefore, available for most of the delineated countries, allowing said countries to be compared against each other. A complete list of indicators and sources can be found in the appendix to this research report.

There are five basic themes that are used to assess the sustainability of each emerging market: (1) General economic performance and stability; (2) Socio-economic development of population; (3) Equality, freedom and rights of population, (4) Environmental performance and commitment; and (5) Security, peace and international relations. Each theme is divided into 2-3 sub-indicators while each sub-indicator is in turn comprised of one or more data points. Box 2 provides a general description of the themes, indicators and data used. The themes, sub-indicators, and data used to assess emerging market sustainability are almost identical to those used for assessing developed markets, with two exceptions. First, the sub-indicator ‘commitment to development’, within the fifth theme on security, peace and international relations, is less appropriate for gauging emerging market sustainability. Unlike their developed market counterparts, emerging markets should not be expected to commit heavily to providing development aid, as they are generally still catching up themselves in terms of prosperity. We therefore omit the sub-indicator in question from the emerging market model. Second, within the first theme on general economic performance and stability, there is a sub-indicator on macro performance and the absence of disequilibria. In the developed markets screening, unemployment is one data point (alongside real GDP growth, inflation, the current account balance and the public deficit) used to create the sub-indicator. For emerging markets, unemployment is excluded due to the inconsistent availability of such data (in a reliable manner) for many emerging markets.

There are three stages to arrive at a score for each country based on these five themes. We begin at the sub-indicator level, specifically for sub-indicators comprised of various data series. Each series is standardized so that the best performing country gets a standardized score of one and the worst performing country gets a score of zero. The series are then averaged together, giving equal weight to each series, and thus providing us with a score for that sub-indicator. Sub-indicators based on a single data series are simply standardized from zero to one.

The second stage then moves to the theme level. The values for each sub-indicator, calculated in the previous step, are averaged together (again with equal weighting) and then standardized to a value between zero and one. The best performing country again gets a value of one and the worst performing a value of zero. If a value for one of the sub-indicators is missing, the raw theme score is calculated without that sub-indicator. If a country has data for less than 80% of sub-indicators - i.e. if three or more of the fourteen sub-indicators are missing - the country is excluded from the calculations. In the final stage, the standardized score for each of the five themes are then averaged together (with an equal weighting) and standardized once again to have a value between 0 and 1. The resulting scores comprise the KBC Emerging Markets Sustainability Barometer.

We then use the ranking of countries based on this barometer to determine a universe of sustainable emerging markets in which the KBC SRI funds can invest. As mentioned above, the cut-off for emerging markets is more stringent than that for developed markets. Specifically, only government bonds from the top 25% best-performing emerging markets may be considered for inclusion in the SRI funds. In addition, there is a band around the cut-off point consisting of the two countries below that point and the two countries above it. If a country moves below (or above) the cut-off in the current year but remains within the band, this does not immediately impact the investment universe. Instead, the country enters a one-year waiting period. If the country stays below (or above) the cut-off point in the next screening, it should then be removed from (or included in) the investment universe. Any other movement across the 25% cut-off point but outside the band will have an immediate impact on the investment universe.

Furthermore, KBC applies an additional exclusion criterion based on a list compiled each year of ‘controversial regimes’. This list considers data for 197 countries concerning political rights and civil liberties as provided by Freedom House and the World Bank’s Worldwide Governance Indicators. KBC excludes the 15 most controversial countries from all investment funds. KBC goes a step further for the sustainable government bonds funds: any country that appears in the top half of the controversial regimes list is excluded from KBC SRI government bonds funds, regardless of their ranking in the Sustainability Barometer.

This year, we have introduced a further ‘worst-in-theme’ screening. The purpose of this screening is to highlight whether any of the countries ranked above the top 25% cut-off point are among the worst performing countries in any individual theme (bottom 10%). Among the top performing emerging markets, none rank within the worst 10% for any particular theme. As such, this additional screening has not impacted the sustainable investment universe.

The sustainability screening of emerging markets is updated on a yearly basis, in parallel with the screening for the developed markets. Screening is viewed as a dynamic analysis and can be adjusted where necessary to account for new sustainability trends. KBC is aided in this by an independent panel of experts on the various sustainability themes (the SRI Advisory Board).

Box 2 - The five themes and their sub-indicators

Sustainability analyses for countries and their application for financial investing are even less common than those for businesses. This is because there is no universal description of what the ‘sustainability of countries’ precisely encompasses, which in turn reflects the fact that the objectives and tasks of governments are more multifaceted than those of businesses. Government policy is focused overall on the sustainable promotion of general well-being (i.e. the well-being of as many citizens as possible). This is determined by a whole range of factors: material prosperity, health, personal development, justice, equal opportunities, liberties, absence of social and political tensions, security and so on. It is equally important that this well-being is not achieved at the expense of future generations, citizens of other countries or animal welfare. Aspects such as environmental sustainability or international peace, therefore, need to be taken explicitly into account. We consider all these aspects in five main themes, each of which is sub-divided in turn into sub-indicators.

Theme 1: General economic performance and stability

Good and stable macroeconomic performance is the bedrock of a society’s prosperity. For this reason, sub-indicator 1.1 measures the strength and stability of economic growth and the absence of imbalances. The latter implies the retention of monetary value (low inflation) and balance-of-payments and public-sector-budget equilibrium. The model measures average real GDP growth over the most recent five years as well as its volatility over that period. Regarding imbalances, we calculate the sum of inflation, the deficit on the balance-of-payments current account (as a percentage of GDP) and the public-sector deficit (as a percentage of GDP). Once again, the five-year average is measured. All data points are taken from the IMF’s World Economic Outlook database.In addition to the current economic situation, we consider the future economic potential (sub-indicator 1.2) and the quality of public-sector institutions (sub-indicator 1.3). The first of these relates to the adoption of new technology and research and development efforts, while the second concerns institutions crucial to supporting market-oriented economic activity, such as the protection of ownership rights, the independence of the legal system and effectiveness of government spending. We use the World Economic Forum’s Global Competitiveness Index to this end, more specifically the pillars ‘ICT adoption’, ‘innovation capability’ and ‘institutions’.

Theme 2: Socio-economic development of population

In addition to economic performance and stability, governments focus on the socio-economic development of their citizens. In this regard, sub-indicator 2.1 measures traditional core development benchmarks as provided by the World Bank: per capita GDP, poverty levels and life expectancy. Sub-indicator 2.2 measures citizens’ education and labour-market performance. The former is based on the ‘skills’ pillar of the World Economic Forum’s Global Competitiveness Index and the latter on the employment to population ratio among citizens over fifteen (provided by the World Bank).The second theme also embraces the situation and policy efforts in public health (sub-indicator 2.3). These are measured using World Health Organisation figures on the number of people employed in the healthcare sector (doctors, dentists, pharmacists and nurses as a percentage of the population) and government spending on healthcare (as a percentage of GDP).

Theme 3: Equality, freedom and rights of all citizens

It is the task of government to limit inequality between citizens, but also to provide them with liberties and rights that enable their personal development and their ability to take initiatives. Sub-indicator 3.1, inequality between citizens, is measured using the traditional GINI coefficient calculated by the World Bank. Sub-indicator 3.2, voice, political rights and civil liberties, draws on the World Bank’s Governance Indicators, specifically that for ‘voice and accountability’. This brings together all traditional rights and liberties (freedom of speech, religion, press, travel, etc.). Specific attention is also paid to the freedom and ease of carrying out an economic activity (sub-indicator 3.3). This is measured by the World Bank’s Ease of Doing Business ranking.

Theme 4: Environmental performance and commitment

Progress on environmental quality (air, water, biodiversity, etc.) and reducing pressure on the environment (waste reduction, combating the depletion of raw material, etc.) are increasingly important factors for sustainability in the context of growing concern about climate challenges. The model focuses on three aspects within this fourth theme: environmental performance (sub-indicator 4.1), ecological footprint (sub-indicator 4.2) and climate change (sub-indicator 4.3).The first is measured by the Environmental Performance Index published by the universities of Yale and Colombia. It is comprised of benchmarks for environmental pollution, biodiversity, forest management, overfishing, etc. The second is measured using the Ecological Footprint score from the Global Footprint Network. This figure, measured in global hectares, indicates how large an area of biologically productive land and water a population group requires to maintain its level of consumption and process its waste production. The third is measured by the Climate Change Performance Index published by Germanwatch. This index compares the progress made in terms of climate protection by countries that are collectively responsible for 90% of CO2 emissions. It evaluates these countries based on emissions, renewable energy and energy use, as well as expert-based climate policy assessments.

Theme 5: Security, peace and international relations

The final theme focuses on the existence and achievement of peace and security and on international relations between countries. Peace and security are amongst citizens’ most important basic needs and are simultaneously essential preconditions for economic prosperity. Sub-indicator 5.1 is therefore Global Peace, which is measured using Vision of Humanity’s Global Peace Index. This index maps existing conflicts and measures insecurity based on, for example, the number of murders and assaults, and how easy it is to purchase weapons.Sub-indicator 5.2, International relations between countries, is measured based on the extent to which countries maintain open borders and sign international treaties. The concept of openness is measured via the KOF Institute’s Index of Globalisation, which considers economic, social and political globalisation. The extent to which a country has signed on to international treaties is measured as an average of the number of major treaties a country has signed and/or ratified with respect to human rights, labour rights, and the environment.

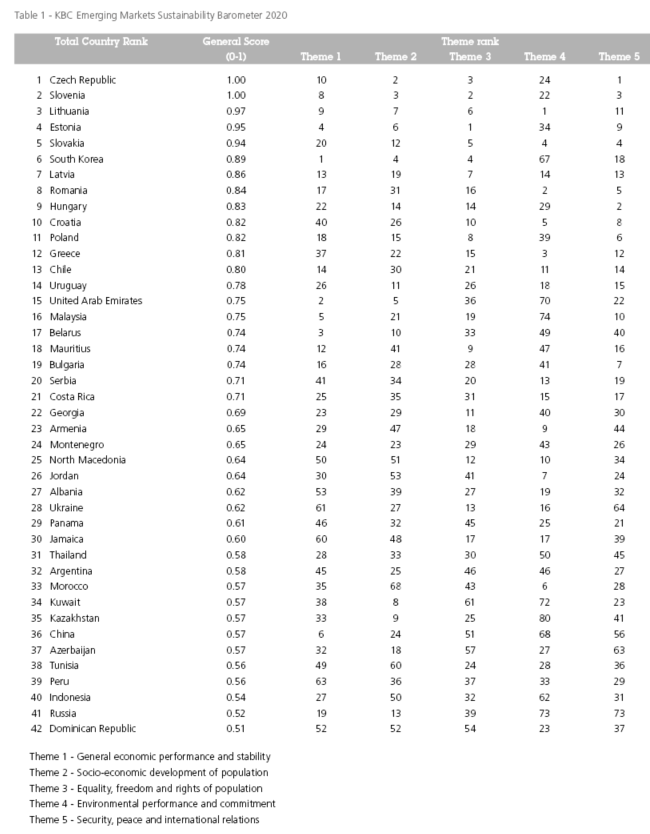

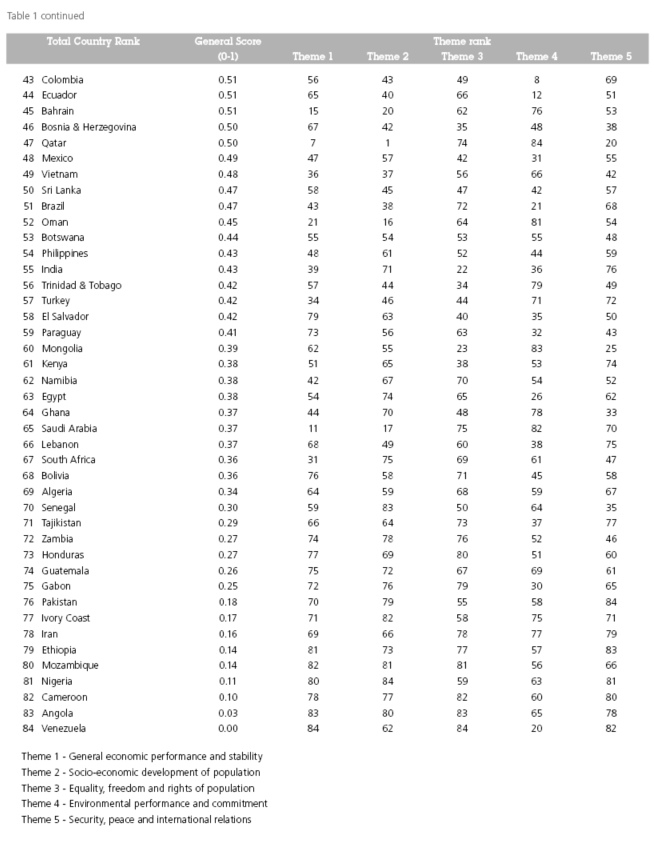

A top 25% cut-off line out of 84 countries yields 21 best performing emerging market countries. However, the United Arab Emirates and Belarus, which both rank relatively high within the Sustainability Barometer (15th and 17th place, respectively) thanks to strong performances in terms of macroeconomic stability and socio-economic development, are also within the top 50% of the above-mentioned list of controversial regimes. For this reason, these countries are excluded from the sustainable investment universe.

Furthermore, as mentioned above, there is a waiting period for countries that move above the cut-off point but remain within the two-country upper band. For this reason, Serbia, which occupies the 20th place in the Sustainability Barometer, enters a waiting room this year. If it again ranks among the top 25% of countries in the next screening, it can then be added to the sustainable investment universe. This leaves us with 18 emerging markets in which the KBC SRI funds can invest (see Table 1).

Of these countries, the Czech Republic, Slovenia, and Lithuania top the list with the first, second and third ranking respectively. The Czech Republic scores particularly well in Themes 5, 2 and 3 (1st, 2nd, and 3rd, respectively) while scoring slightly lower (10th and 24th) in Themes 1 and 4. Slovenia’s scores follow a similar pattern, while Lithuania has decent scores across the board, but stands out with 1st place in Theme 4 (Environmental performance and commitment).

Once again, the Central and Eastern European countries generally score well with 11 of the top 18 countries coming from that region. These are all countries that were also included in the developed markets screening. However, in that screening, only Slovenia ranked high enough to be included in the sustainable investment universe (the Czech Republic enters the waiting room in that screening). Since these countries can reasonably be classified as either emerging or developed markets, however, they received a ‘second chance,’ at being included in KBC’s sustainable investment universe.

The final list of countries can be compared to the list drawn up last year with no concrete changes. The only countries that moved up enough in the ranking to pass the 25% cut-off are Serbia, which enters the ‘waiting room’ to be confirmed next year, and the UAE, which is not included given its controversial regime status. No countries that were in the universe last year fell below the cut-off point.

In sum, we arrive at 18 emerging markets that can be considered for investment in KBC’s SRI funds: the Czech Republic, Slovenia, Lithuania, Estonia, Slovakia, South Korea, Latvia, Romania, Hungary, Croatia, Poland, Greece, Chile, Uruguay, Malaysia, Mauritius, Bulgaria, and Costa Rica.

Derwall, J. en K. Koedijk (2009), “Socially Responsible Fixed-Income Funds”, Journal of Business Finance and Accounting, 36 (1), p. 2010-229.

Drut, B. (2010), “Sovereign Bonds and Socially Responsible Investment”, Journal of Business Ethics, 92(1), p. 131-145.

Centre Emile Bernheim, Working Paper nr. 09/014.

Eurosif (2018), “European SRI Study 2018”, November.

KBC Economische Berichten (2014), “Duurzaam beleggen, de hype voorbij?”, nr. 20, 29 September 2014.

KBC Economische Berichten (2015), “Welzijn, meer dan ‘bruto binnenlands product”, nr. 26, 13 February 2015.

Leite, P. en M.C. Cortez (2016), “The Performance of European Responsible Fixed-Income Funds”.

Mellios, C. en E. Paget-Blanc (2006), “Which Factors Determine Sovereign Credit Ratings ?, European Journal of Finance, 12(4), p. 361-377.

North, D., Acemoglu, D., Fukuyama, F. en D. Rodrik (2008), “Governance, Growth, and Development Decision-making”, Wereld Bank.

WCED (1987), “Report of the World Commission on Environment and Development. Our common future”, New York, United Nations.

Footnotes

Appendix: KBC Sustainability Barometer, detailed themes and sub-indicators

Theme 1 - General economic performance and stability

Indicator 1.1: Macroeconomic Performance & Absence of Disequilibria (Source: own calculation based on IMF data)

- Real GDP growth (%, average of past 5 years) (25%)- Volatility of economic growth (standard deviation of real GDP growth over past 5 years) (25%)

- Sum of inflation (%), current account deficit (% of GDP) and government deficit (% of GDP) (average of past 5 years) (50%)

Indicator 1.2: Future Business Potential (Source: sub-index from Global Competitiveness Index, World Economic Forum)

Technological Readiness (agility with which an economy adopts existing technologies to enhance productivity) (50%):

- Availability of latest technologies, firm-level technology absorption, FDI and technology transfer

- Internet users, broadband Internet subscriptions, Internet bandwidth

- Mobile broadband subscriptions, mobile telephone subscriptions

R&D innovation (design and development of cutting-edge products and processes to maintain a competitive edge) (50%):

- Capacity for innovation, quality of scientific research institutions

- Company spending on R&D

- University/industry research collaboration in R&D

- Government procurement of advanced technology products

- Availability of scientists and engineers-

Patent applications, intellectual property protection

Indicator 1.3: Public and private institutions (Source: sub-index from Global Competitiveness Index, World Economic Forum)

- Property rights, intellectual property protection

- Ethics and corruption: diversion of public funds, public trust of politicians, irregular payments and bribes

- Undue influence: judicial independence, favouritism in decisions of government officials

- Public-sector performance: Wastefulness of government spending, burden of government regulation, efficiency of legal frame-work, transparency of government policymaking

- Business costs of terrorism/crime/violence, organized crime, reliability of police services

- Ethical behaviour of firms

- Accountability: strength of auditing and reporting standards, efficacy of corporate boards, protection of minority shareholders’ interests, strength of investor protection

Theme 2 - Socio-economic development of populationIndicator

2.1: Core Development Indicators (Source: World Bank)

- GDP per capita (33%)

- Poverty rate (population living below 50% of median income) (33%)

- Life expectancy at birth (number of years) (33%)

Indicator 2.2: Commitment to Education & Employment

Higher education and training index (50%) (Source: sub-index from Global Competitiveness Index, World Economic Forum)

- Secundary education enrolment rate

- Tertiary education enrolment rate

- Quality of the educational system

- Quality of math and science education & quality of management schools

- Internet access in schools

- Local availability of specialized research and training services

- Extent of staff training

Employment rate (50%) (Source: World Development Indicators, World Bank)

- People employed as a % of people aged 15+

Indicator 2.3: Commitment to Health

Healthcare Workforce (50%) (Source: World Health Organisation)

- Number of healthcare workers (physicians, dentist, pharmacists, nurses) (per 100 000 population)

Healthcare Expenditures (50%) (Source: World Health Organisation)

- Public expenditures on health (% of GDP)

Theme 3 - Equality, freedom and rights of the population

Indicator 3.1: Prevalence of Inequality (Source: World Development Indicators, World Bank)

- GINI coefficient

Indicator 3.2: Voice, Political Rights and Civil Liberties (Source: sub-index Voice and Accountability from Governance Indicators, World Bank)

Measuring (perceptions of) the extent to which a country’s citizens are able to participate in selecting their government, as well as freedom of expression, freedom of association, and a free media:

- Civil liberties: Freedom of speech, of assembly and demonstration, of religion, equal opportunity, of excessive governmental intervention

- Political Rights: free and fair elections, representative legislative, free vote, political parties, no dominant group, respect for minorities

- Freedom of the Press

- Travel: domestic and foreign travel restrictions

- Imprisonments: Are there any imprisoned people because of their ethnicity, race, or their political, religious beliefs?

- Democratic Accountability. Quantifies how responsive government is to its people, on the basis that the less response there is the more likely is that the government will fall, peacefully or violently. It includes not only if free and fair elections are in place, but also how likely is the government to remain in power

- Representativeness: How well the population and organized interests can make their voices heard in the political system

Indicator 3.3: Ease of Doing Business (Source: index Doing Business, World Bank)

- Starting a business

- Dealing with construction permits

- Getting electricity

- Registering property

- Getting credit

- Protecting minority investors

- Paying taxes

- Trading across borders

- Enforcing contracts

- Resolving insolvency

Theme 4 - Environmental performance and commitment

Indicator 4.1: Environmental Performance Index (Source: Yale University & Colombia University in collaboration with World Economic Forum)

- Environmental burden of disease

- Water (effects on humans): adequate sanitation & drinking water

- Air pollution (effects on humans): indoor air pollution, urban particulates, local ozone

- Water (ecosystem vitality): water quality index, water stress

- Air pollution (ecosystem vitality): regional ozone, sulphur dioxide emissions

- Biodiversity & habitat: conservation risk index, effective conservation, critical habitat protection, marine protected areas

- Forestry: growing stock

- Fisheries: marine trophic index, trawling intensity

- Agriculture: irrigation stress, agricultural subsidies, intensive cropland, burnt land area, pesticide regulation

- Climate change: emissions/capita, emissions/electricity generated, industrial carbon intensity

Indicator 4.2: Ecological Footprint (Source: Global Footprint Network)

- Extent of human demand on ecosystems (global hectares per person)

Indicator 4.3: Climate Change Performance Index (Source: Germanwatch, Climate Action Network International & the New Climate Institute)

- Per-capita emissions trend in four sectors (energy, transport, residential, industry) (50%)

- Absolute, energy-related CO2 emissions (30%)

- Evaluation of the countries’ domestic as well as international climate policy (20%)

Theme 5 - Security, peace and international relationships

Indicator 5.1: Global Peace Index (source: Vision of Humanity)

Measures of Ongoing Domestic and International Conflict:

- Number of external and internal conflicts fought: 2001-06

- Estimated number of deaths from organised conflict (external)

- Number of deaths from organised conflict (internal)

- Level of organised conflict (internal)

- Relations with neighbouring countries

Measures of Societal Safety and Security:

- Number of displaced people as a percentage of the population

- Political instability

- Level of disrespect for human rights (Political Terror Scale)

- Potential for terrorist acts

- Number of homicides per 100,000 people

- Level of violent crime

- Likelihood of violent demonstrations

- Number of jailed population per 100,000 people

- Number of internal security officers and police per 100,000 people

Measures of Militarization:

- Military expenditure as a percentage of GDP

- Number of armed services personnel per 100,000 people

- Volume of transfers (imports) of major conventional weapons per 100,000 people

- Volume of transfers (exports) of major conventional weapons per 100,000 people - UN Deployments 2007-08 (percentage of total armed forces)

- Non-UN Deployments 2007-08 (percentage of total armed forces)

- Aggregate number of heavy weapons per 100,000 people

- Ease of access to small arms and light weapons

- Military capability/sophistication

Indicator 5.2: Commitment to Development Index - Not applicable for emerging markets

Indicator 5.3: Index of Globalisation (Source: KOF Institute; United Nations for International Treaties, ILO)

Measures of Economic Globalisation (data on flows and on restrictions; Source: sub-index from KOF-Index of Globalisation) (20%):

- Trade (% of GDP)

- Foreign direct investments (flows & stocks, % of GDP)

- Portfolio investment (% of GDP)

-Income payments to foreign nationals (% of GDP)

- Hidden import barriers

- Taxes on international trade (% of current revenue)

- Capital account restrictions

Measures of Social Globalisation (data on personal contact, information flows and cultural proximity; Source: sub-index from KOF-Index of Globalisation) (20%):

- Outgoing telephone traffic

- International tourism (% of total population)

- Foreign population (% of total population)

- International letters (per capita)

- Internet users (per 1000 people)

- Cable television (per 1000 people)

- Trade in newspapers (% of GDP)

- Radios (per 1000 people)

- Number of McDonald’s restaurants and Ikea (per capita)

- Trade in books (% of GDP)

Measures of Political Globalisation (Source: sub-index from KOF-Index of Globalisation) (20%):

- Number of embassies

- Membership of international organisations

- Participation in UN Security Council Missions

Ratification of International Treaties (Source: United Nations, ILO) (20%):

Status of Major International Human Rights Instruments:

- International convention on the prevention and punishment of the crime of genocide

- International convention on the elimination of all forms of racial discrimination

- International convenant on civil and political rights

- International convenant on economic, social and cultural rights

- Convention on the elimination of all forms of discrimination against women

- Convention against torture and other cruel, inhuman or degrading treatment or punishment

- Convention of the rights of the child

- International convention for the protection of all persons from enforced disappearance

- Convention on the rights of persons with disabilities

- International Convention on the Protection of the Rights of All Migrant Workers and Members of their Families

Status of Fundamental Labour Rights Conventions:

- Freedom of association and collective bargaining

- Elimination of forced and compulsory labour

- Elimination of discrimination in respect of employment and occupation

- Abolishment of child labour

Status of Major Environmental Treaties:

- Cartagena protocol on biodiversity

- Framework convention on climate change

- Kyoto protocol to the framework convention on climate change

- Convention on biological diversity

- Vienna Convention for the Protection of the Ozone Layer

- Montreal Protocol on Substances that deplete the Ozone Layer

- Stockholm Convention on Persistent Organic Pollutants

- Convention to Combat Desertification