Economic Perspectives November 2021

Read the full publication below or click here to open the PDF.

- In Q3 2021, the global economy painted a somewhat mixed picture. Growth in the euro area surprised positively, on the back of strong resilience, while US growth disappointed, mainly due to weak private consumption growth. Chinese economic growth was broadly in line with expectations.

- Going forward, the euro area economy remains vulnerable to the ongoing supply disruptions, weighing mainly on the industrial sector. We therefore expect a weak first half of 2022. Bottlenecks and supply disruptions are expected to only gradually resolve from the second half of 2022, with overall euro area economic activity accelerating again. In the US, labour market strength gives hope that private consumption growth will pick up again from Q4 2021 on, on the back of solid net job creation, a falling unemployment rate and robust wage growth. Meanwhile, the Chinese economy will continue to face financial stability concerns following the reigning in of real estate market excesses.

- The latest headline inflation figures in the US and the euro area have risen further. Inflation dynamics remain very much driven by energy inflation a supply-demand imbalances and re-opening effects. Provided these factors ease, we expect inflation to normalize towards central banks’ inflation targets, although this process may take longer than initially thought. Such circumstances mean the risk of second round effects feeding into the wage formation process clearly exist. While there is little sign of such pass-through in the euro area, some signs of wage pressure may be developing in the US.

- We expect that the Fed will respond to the relatively favourable economic environment by taking further steps towards policy normalisation. The tapering of its bond buying programme has started in November 2021 and is likely to end in mid-2022. By then, the US labour market will probably have reached reasonable definitions of ‘maximum employment’, allowing the Fed to raise its policy rate in the second half of next year by a cumulative 50 basis points. Meanwhile, the ECB will probably provide more guidance regarding the phasing out of its emergency bond purchase programmes at its December policy meeting. In our view, a first rate hike will not occur in 2022, although increasing market expectations of moderate rate hikes beyond that horizon will contribute to moderately rising bond yields in the euro area as well.

- As far as monetary policy is concerned, the highlight of the past month was the policy rate increase by the Czech National Bank (CNB) by no less than 125 basis points to 2.75%. Czech inflation is well above the CNB’s tolerance band. Consequently, the CNB forcefully prioritises on preventing a de-anchoring of inflation expectations from the 2% inflation target.

Economic reopening set to continue, but with temporary hiccups

In Q3, the global economy painted a somewhat mixed picture. In the euro area, quarter-on-quarter growth was much better than expected. This reflected the relatively strong resilience of the euro area economy during its reopening phase from the pandemic. In this respect, the sectoral structure of euro area member states is of particular importance. Economies such as for example France and Italy, with a relatively more important service sector, are currently in a better position to benefit from the post-pandemic reopening than economies that are more relying on industrial sectors (such as Germany) and therefore more vulnerable to supply bottlenecks and disruptions of global supply chains (Figure 1).

At the same time, we acknowledge that the ongoing fourth Covid-wave will indeed lead to significantly higher infection rates and also will put the capacity of the health systems under renewed pressure. We continue, however, to work under the assumption that this fourth wave is unlikely to lead again to widespread ‘hard’ lockdown measures in many countries that would weigh significantly on economic activity, as was the case in previous waves. Contrary to the hard lockdown in Austria, the recent tightening of Covid-related health measures in the Netherlands may have a significant social impact, but the impact on economic activity is limited. Moreover, the prospect of booster shots and the possibility of anti-viral drugs being available before long, as a supplement to the vaccines, makes it more likely that the pandemic remains manageable. However, downside economic risks related to pandemic disruptions have clearly increased compared to last month.

Supply side difficulties are likely to last well into 2022 and continue to adversely affect industrial sectors. Economies strongly dependent on these sectors, such as Germany, will be most affected. This obviously may have negative spill-over effects to the rest of the euro area economy. We expect these disruptions to be temporary, but we also acknowledge that they may not be fully resolved until the second half of 2022. Hence, we anticipate a weaker quarterly growth path in the euro area in the first half of 2022, followed by a notable acceleration from Q3 2022 on. All taken together, this scenario for the euro area implies an upgrade of our annual growth forecast for 2021 from 4.8% to 5.0%, reflecting the positive surprise to preliminary Q3 GDP data, but a more cautious view for 2022 (downgrade from 4.4% to 4.2%).

In contrast to the euro area economy, US economic growth in Q3 disappointed. This was mainly due to the much lower growth contribution of private consumption, which in turn was probably largely related to the impact of the new pandemic infection wave on sentiment and on the labour market as well as the adverse impact of higher inflation and the ending of some fiscal supports on spending power. The latest economic data for October, however, suggest that there will probably be a rebound in Q4. Strong net job creation in October (on balance 531,000 new jobs) and a fall of the unemployment rate to 4.6% point in the direction of a renewed strengthening of private consumption growth. In our view, the unemployment rate is likely to fall well below 4% in 2022.

However, as is the case in the euro area, near term disruptions in the industrial global supply chains will also affect the US economy, and the US car industry in particular. On the other hand, the latest data also suggest a positive inventory cycle in the US, with firms restoring their inventories after running them down at the heights of supply disruptions. This inventory cycle is likely to provide some temporary cushion to economic growth. On balance however, the much weaker than expected Q3 growth has caused us to downgrade our forecast for US real GDP growth in 2021 from 5.7% to 5.5%. We leave expected annual growth in 2022 unchanged at 3.6% for the time being.

Chinese economic growth in Q3 was broadly in line with our expectations. In that sense, the Chinese economy was somewhere between the disappointing US economy and the better-than-expected performance of the euro area. Uncertainties regarding energy supply are still a concern for the Chinese economy, although Chinese authorities intervened. Moreover, financial stability concerns caused by tensions in the property sector still remain largely unresolved. Acknowledging these risks, we confirm on balance our growth expectation of 8.2% for 2021 and 5.1% in 2022.

Higher inflation for longer (but not forever)

Both in the euro area and in the US, we have observed in recent months a slight deceleration of inflation of non-energy industrial goods prices, and an acceleration of inflation in the services sector. This is consist with the fact that the economies have been further re-opening, including contact-intensive sectors.

The major driving force of headline inflation, at present, continues to be energy prices. The price for a barrel Brent oil rose to well above 80 USD in Q4 2021. We further upgraded our oil price scenario this month. Oil prices are likely to reach their peak in Q1 2022 at about 85 USD per barrel Brent, before gradually declining towards 70 USD at the end of 2022.

The main motivation of this change in outlook compared to last month relates to increasing oil demand as a result of increasing oil-for-gas substitutions and the ongoing recovery. Although the European gas price TTF-benchmark has receded since its peak at 108 EUR per MWh in early October to currently about 75 EUR per MWh, it remains persistently high with significant uncertainty attached to it, as the ongoing stand-off between the EU and Belarus/Russia and the related threats to gas supply to Europe illustrates.

Global headline inflation remains high and even rose further in October in both the US and the euro area. In October, US headline CPI rose to 6.2% (core 4.6%), the highest figure since November 1990. Meanwhile in the euro area inflation increased from 3.4% to 4.1% (core 2.1%). The exception to the downside in this list is China, with an overall headline inflation rise in October from 0.7% to ‘only’ 1.5% (core 1.3%), largely driven by total food price inflation that was even negative at -2.4%.

In the US, the energy component (with a weight of 7.3% in the CPI basket) rose year-on-year by 30% (i.e. an inflation contribution of about 2.2%), while the contribution to inflation of other factors, including re-opening effects and housing, has strengthened of late. The owner equivalent rent of residences, with a weight of 23.6% in the CPI, rose solidly by 3.1% year-on-year (i.e. an inflation contribution of about 0.7 percentage points). This is largely related to buoyant house price inflation, which is beyond reach of the standard monetary toolkit of the Fed.

Meanwhile, in the euro area, the energy component of the HICP basket (with a weight of 9.5%) rose by 23.5% (i.e. a direct inflation contribution of about 2.2 percentage points). Upside risks to euro area inflation mainly stem from the upside risk from energy prices and supply-side bottlenecks of goods during the upcoming Christmas period.

Taking all these factors into account, we have revised our outlook for average inflation up for both the US and the euro area. In the US inflation for the whole of 2021 is now expected to be 4.6%, with the outlook for 2022 unchanged (at 2.7%). For the euro area, we expect annual average inflation to be higher in both 2021 (2.5%) and 2022 (2.0%). For China, on the other hand, we revised downward our forecasts for 2021 to 0.9%.

Sharp inflation uptick expected to be transitory as supply disruptions abate

There are two distinct elements in our inflation scenario. The first one is largely structural, with implications for the medium to longer term. The second one is essentially cyclical and therefore more relevant for the short term forecasting horizon.

From a structural point of view, increased taxation of carbon emission and, directly or indirectly, more expensive energy inputs will gradually but structurally lift the underlying inflation rate. Second, as we discussed for the US inflation rate, the imputed rent component is contributing in a non-negligeable way to overall US headline inflation and is likely to be a persistent driver in view of significant price pressures in US real estate markets. For now, imputed rents are not part of the HICP basket considered by the ECB. However, in its latest strategic review the ECB asked Eurostat to gradually include that component as well. Consequently, the same inflationary channel as in the US would also come to play in the euro area.

We take both of these structural factors into account in our inflation forecasts on a horizon beyond 2022. Once transitory factors (see below) have faded out, we expect inflation to return towards a level that is at consistent with the Fed’s and the ECB’s inflation objective. Particularly in the euro area, that would be an inflation rate above the average pre-pandemic inflation rate.

From a shorter term cyclical point of view, we confirm our view that the current inflation uptick is expected to be a transitory phenomenon, although it may be more pronounced and last somewhat longer than previously expected and the pace and degree of normalisation depends on how quickly and fully supply chain disruptions are resolved. Our reasoning is underpinned by the following arguments.

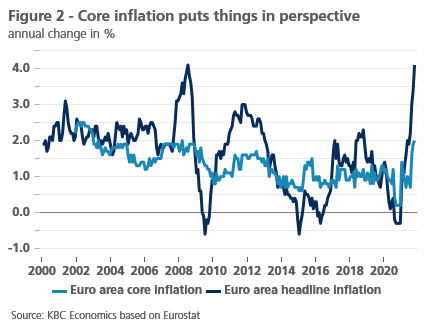

We expect current drivers of inflation related to energy inflation and re-opening effects to persist for some time. Imbalances between supply and demand will continue to put upward price pressure globally. As long as these disruptions persist, excess demand (for durable goods) will continue to underpin high inflation. As such, inflation volatility and upward pressures are likely to persist in the near term. However, in the medium term some of these upward pressures are likely to fade as – in line with our scenario - disruptions ease and the economy (and demand) normalize (see Figure 2). In addition oil price base effects may turn somewhat disinflationary by the end of 2022 and a number of technical factors (e.g. the elimination of the upward German VAT effect) may exert further downward inflationary pressure.

Financial markets’ inflation expectations - as implied by short term inflation swaps - remain broadly consistent with the transitory inflation narrative. At this moment, inflation swaps price in US and euro area inflation for the next 12 months of respectively 4.1% and 2.9%. However, in the following year (i.e. the one year period starting in one year), this already drops to 3.3% in the US and 1.9% in the euro area. Longer term inflation swaps paint the same picture. For the US and the euro area, inflation swaps price in an average inflation of respectively 2.9% and 2% on a 10 year horizon. (Figure 3).

However inflation risks remain clearly tilted to the upside as short-term inflation pressures are broadening and the risk of second round effects (through wage inflation) increase the longer the inflation surge persists.

Indeed, a major risk to our inflation scenario is the pass-through of higher inflation (expectations) into wage negotiations, leading to wage rises far in excess of labour productivity growth. According to the latest available ECB data of negotiated wages in the euro area (until Q2 2022), these wage increases are only 1.75% before even taking into account productivity gains. Data from the Bundesbank for Germany are slightly more recent and suggest the same conclusion.

In the US, wage dynamics are however much stronger than in the euro area, with the latest average hourly earnings accelerating in recent months to 4.9% year-on-year. This relatively high growth rate – together with record-high quit rates – reflect a tightening labour market and carries a potential risk of further wage inflation. It may be a first early warning indicator that cost-push inflation could become embedded in US macroeconomic dynamics and warrants close monitoring.

Monetary policy taking turn

At its latest policy meeting, the Fed decided to start tapering its asset purchase programme from November on. If its proposed reduction speed (reducing net purchases of Treasuries and Mortgage Backed Securities by 15 bn USD per month) is maintained in 2022, this means that the tapering process would be completed by mid-2022. In our scenario, we expect that by then, the conditions for the Fed to start raising its policy rate will be met as well in the course of 2022. When the current strong US labour market performance continues, the unemployment rate will drop below 4% in 2022 and reach about 3.6% by the end of 2022. In our view, this will give the Fed the scope to start its rate tightening cycle in Q3 2022 and continues in Q4 (by 25 basis points each).

In the meantime, the ECB is still taking a more cautious approach. At its policy meeting in December, the ECB is expected to provide additional forward guidance about the likely end of its Pandemic Emergency Purchase Programme (PEPP) in March 2022, with more details about which new programme format will replace the PEPP. In our view, a possible – but unconfirmed - scenario is that the ECB creates a new ‘envelope’ at its disposal to intervene flexibly in the euro area bond markets when necessary.

Consistent with our inflation outlook for 2021-2022, and in line with the ECB’s own forward guidance, we do not expect the ECB to raise its policy rate in 2022. It is indeed unlikely that the ECB’s asset purchases would be fully phased out in 2022, which means that the ECB would not raise rates if it sticks to its ‘sequencing principle‘ of first ending its asset purchases before tightening its policy rate.

Based on this outlook for monetary policy, we confirm our view on US and German bond yields. US bond yields are currently pricing in the start of the Fed tightening cycle in 2022 and will price in more as the Fed tightening cycle will proceed (Figure 4). This is consistent with a path of gradually further increasing US bond yields. German bond yields will follow that upward trend, albeit somewhat more moderately. The correlation between German and US yields plays an important role in this. Moreover, real 10 year bond yields are in our view currently at unsustainably low levels, particularly in the euro area and will correct upward.

The current weakness of the euro against the US dollar is mainly the result of real interest rate differentials and of expectations of differences in monetary policy between the Fed and the ECB. These differences currently work in favour of the USD. However, once the expected Fed tightening path is fully priced in by financial markets, underlying factors in support of the EUR will come to play, such as the gradually more hawkish ECB policy stance which is, contrary to the Fed, not yet priced into the markets. Moreover, in our view the EUR is currently undervaluation versus the USD. Based on this view, we expect the EUR to appreciate against the USD from 1.14 USD per EUR at the end of 2021 to 1.21 USD per EUR at the end of 2022.

All historical quotes/prices, statistics and charts are up to date, up to and including 15 November 2021, unless otherwise stated. The positions and forecasts provided are those of 15 November 2021.