Economic Perspectives May 2019

Read the full publication below or click here to open the PDF.

- Preliminary figures indicate that real GDP growth in the euro area recovered to 0.4% qoq in Q1 2019. Available details suggest that domestic demand remained the main driver of economic growth. The Q1 GDP growth figures confirm that weakness in H2 2018 was exaggerated by several temporary elements and signal that the euro area is not heading towards a recession in the near term. Nevertheless, the recent growth acceleration is likely to be only temporary and therefore unlikely to be the forerunner of any longer-term acceleration of the underlying growth dynamics. Our scenario of a general trend of growth deceleration remains in place.

- US GDP growth for Q1 2019 surprised on the upside. However, a look at the growth composition highlights some signs of underlying weakness in final domestic demand. In particular private consumption growth reported a marked deceleration, which is at odds with the strong performance of the US labour market. The acceleration in the headline growth figure was mainly supported by a stronger growth contribution from net exports and an inventory build-up. We still expect GDP growth to slow in the coming quarters.

- Since there are currently no major macroeconomic or price-related factors that warrant a change in monetary policy, we stick to our scenario for the ECB and Fed. Our scenario for the ECB deposit rate hence remains the same as last month, with the first rate hike only in the second half of 2020. Regarding the Fed, we don’t expect any further rate hikes over the forecast horizon. In fact, given the expected moderation in the pace of growth going forward, a rate cut in the course of 2020 is likely.

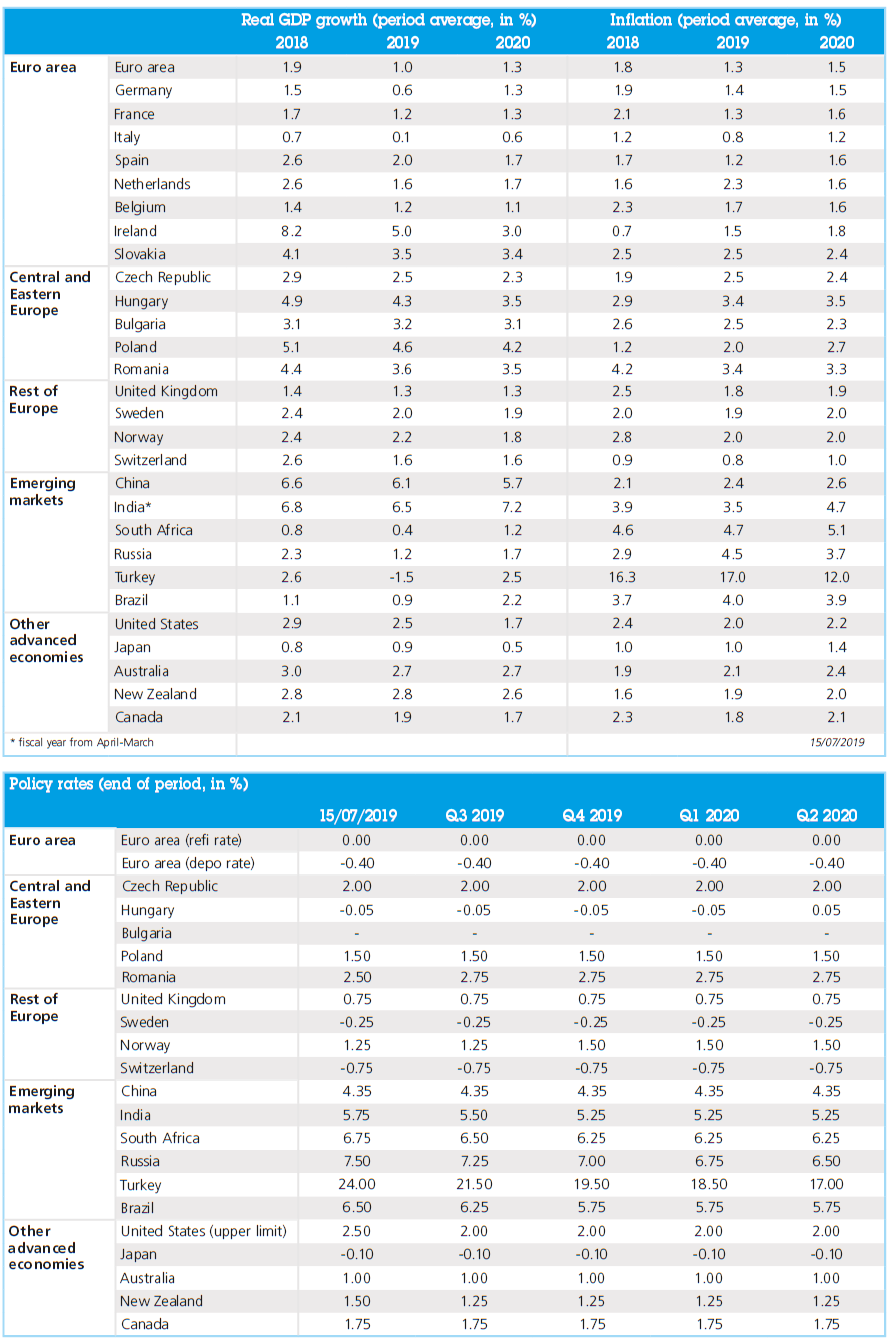

Positive EMU surprise in Q1

Preliminary figures indicate that real GDP growth in the euro area recovered to 0.4% qoq in Q1 2019 (figure 1). The latest growth figures confirm that weakness in the euro area in H2 2018 was amplified by several temporary elements and signal that the euro area is not heading towards a recession in the short run. Nevertheless, the growth figures don’t suggest an acceleration of the underlying growth dynamics. Available details suggest that domestic demand remained the main driver of economic growth. Private investment also continues to support European growth. The trend of continuous strong domestic demand, combined with external headwinds, is consistent with recent survey results, in which persistently weakening sentiment in manufacturing industries is being compensated by some strengthening of sentiment in services and continuous strong sentiment in the construction sector.

Figure 1 – Quarterly real GDP dynamics (% change quarter-on-quarter)

Private consumption and, to an extent, investments will continue to support growth going forward. Strong international headwinds are, however, expected due to the slowdown in other major international economies, notably the US and China, even amplified by rising trade tensions and geopolitical conflicts (Iran, North Korea, Venezuela…).

Looking at individual euro area countries reveals clear growth differences among the member states. Spain (again) strongly outperformed, mainly thanks to a continuous positive growth contribution of net exports. Meanwhile France, Italy and Belgium published figures below the euro area average. The Italian economy remains the major laggard despite some recovery in Q1, while the French economy is still vulnerable with substantial social challenges and concerns about public finances.

Most importantly, the rebound in German GDP growth (figure 1) contributed substantially to the euro area recovery at the beginning of 2019. German real GDP growth bounced back to +0.4% qoq in Q1 2019, from -0.2% and 0.0% respectively in Q3 and Q4 of 2018. The Q1 figure was in line with average growth for the euro area as a whole. Though growth composition details haven’t been published yet, the German national statistical institute reported strong growth in investments and household consumption expenditures. The German growth revival came earlier than we expected, since we previously projected the recovery only in the second half of this year.

Nonetheless, we still see continued weaknesses in the largest European economy. While some industrial sectors are recovering, total manufacturing output is still showing a slightly negative trend, with persistent negative growth figures for total manufacturing production in Q1 2019 (also see Box 1). This observation, combined with the continued downward trend in manufacturing sentiment, raises concerns about persistent weaknesses in the sector. By contrast, there has been a remarkably strong growth in the output of the construction sector in Q1 2019. Rather than reflecting an acceleration of the underlying growth dynamics, this could possibly be related to good weather conditions. Retail sales also recovered from weaknesses in the second half of 2018, which was reflected in the first quarter GDP growth figures. The recovery was likely a correction of weak Q4 2018 retail sales growth figures rather than the start of a new upward trend though.

Box 1 - German industry faces new challenges

The sharp slowdown in the growth of the German economy in 2018 was partly due to exceptional factors. The failure of car manufacturers to be prepared in time for the application of the new global test procedures led to a major disruption in the production and sale of passenger cars. Between May and October 2018, production in the German automotive industry fell by almost 10% (in volume) (figure B1.1). At the same time, an exceptionally low water level on the Rhine caused transport problems. The Rhine is an important link between German industry and the North Sea, Belgium, the Netherlands and Switzerland. Approximately 80% of the German freight transport by ship sails through it. The chemical industry is particularly dependent on the supply and transport of goods by sea. This explains why the low water level contributed to a drop in chemical production of almost 8% between the end of 2017 and November 2018.

Figure B1.1 - Industrial production in Germany (volume index, 2015=100, 3-month moving average)

Source: KBC Economics based on German Federal Statistical Office

By definition, temporary factors fade. As expected, production is recovering in both sectors. In the first quarter of 2019, the automotive industry produced 1.3% more (on an annual basis) than in the fourth quarter of 2018. In the chemicals sector, this growth was approximately 6%. This normalisation contributed to the growth recovery of the German economy in the first months of 2019. Unfortunately, however, this can be said much less for the whole of German industry. Indeed, in the first quarter, production in the total manufacturing industry was still slightly below the average level of the previous quarter. At best, one can argue that the downward trend, which started in the course of 2018, has stabilised.

However, downside risks remain. Confidence indicators continue to deteriorate (see main text). While two major domestic logistic problems have been solved, German industry is still experiencing the headwind of the slowdown in international trade. The latter has slackened considerably since the turn of the year, and it has immediately been accompanied by a fall in orders in German manufacturing, particularly from outside the euro area (figure B1.2). At the same time, stocks are rising sharply. This suggests that the production of the German manufacturing industry will resume its downward trend of 2018 in the coming months.

Figure B1.2 - German manufacturing industry and world trade (volume index, 3-month moving average, annual change in %)

Source: KBC Economics based on German Federal Statistical Office and Dutch Bureau for Economic Policy Analysis

Based on the actual Q1 growth figures, we upwardly adjusted our 2019 annual average growth forecast for the euro area from 1.1% to 1.2%. Hence this upward revision is merely the result of stronger-than-expected Q1 growth results. It does not reflect a fundamental growth upheaval. As such, our scenario with a general trend of growth deceleration remains in place. Since 2020 quarterly growth dynamics remained unchanged, our 2020 annual average growth forecast was downgraded from 1.4% to 1.2%. Due to this mechanical adjustment, we are now more pessimistic about the growth prospects for 2020 than most other forecasters and international institutions. We think the assumption of another rebound later on in 2019 has become unlikely given the latest escalation in the US-China trade war (see further) and the continued and even strengthened uncertainty created by increasing protectionism and Brexit.

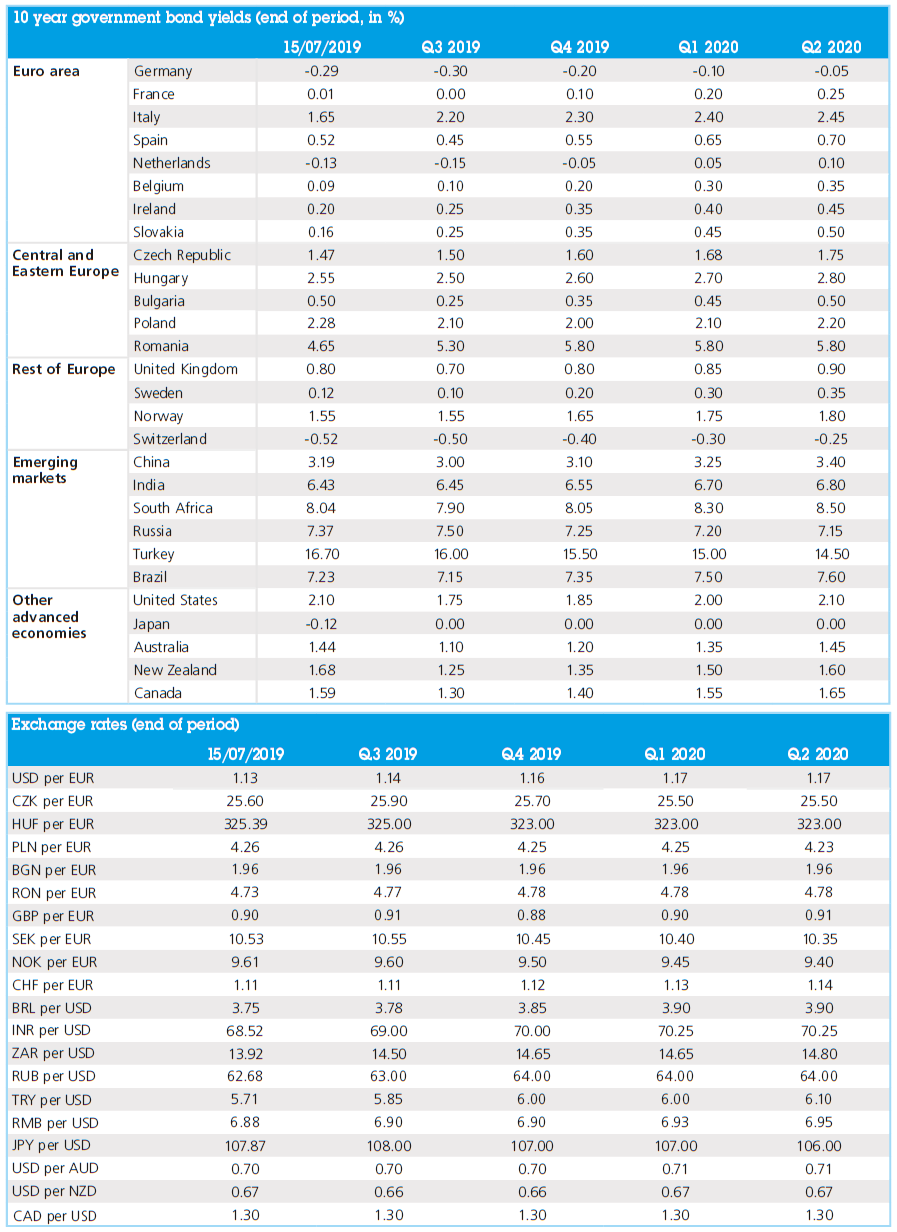

Underlying weakness in US

US economic growth for Q1 surprised on the upside, as real GDP growth accelerated from 0.5% qoq in Q4 2018 to 0.8% qoq in Q1 2019 (from 2.2% to 3.2% in annualised rates) per the advance estimate (figure 2). Although this headline figure is exceptional, a closer look at the details highlights some areas of weakness. The growth contribution from domestic demand fell to 1.5 percentage point in Q1 (annualised) from 2.2 percentage points in Q4. In particular private consumption growth reported a marked deceleration, which is at odds with the strong performance of the US labour market. Investment growth also slowed compared to the previous quarter. The acceleration in the headline growth figure was mainly supported by a stronger growth contribution from net exports, with an improvement in exports while imports fell. The latter is another sign that domestic demand weakened in Q1.

Figure 2 - Higher US Q1 growth, but underlying weaknesses (contributions to real GDP growth, in percentage points)

Another factor that contributed to the unexpected US GDP growth acceleration in Q1 compared to the previous quarter is the build-up in inventories. Survey data from the ISM manufacturing inventories component in recent months have been consistent with this upward trend of inventory build-up above its long-term average, towards the upper bound of the ‘normal’ range. The key question here is whether this inventory build-up was voluntary or involuntary. The latter would mean that firms are increasing their inventories as a result of lower-than-expected demand. Comparing the new orders - a proxy for incoming demand - and inventories components of the ISM manufacturing suggests that the inventory build-up has been mainly involuntary. This ratio tends to return to its long-term average, hence a decline in Q2 is likely. It implies that the growth contribution from inventories in Q2 will most likely be negative.

Going forward, we expect private consumption to recover somewhat towards from the weak Q1 growth contribution. Continued strong labour market results will remain supportive. Given the stronger-than-expected growth results in Q1, we upgraded our 2019 annual average GDP growth projection to 2.5% from 2.3% previously. The main risk that could derail the US economy is the impact of the US-China trade war, that escalated further with the unexpected implementation of higher tariffs on US imports from China and the announced retaliation measures by China earlier this month.

Trade war fears popping up again

Alongside the publication of surprisingly strong GDP growth figures for the first quarter of the year, risks to the global economy have again increased substantially. Somewhat unexpectedly, the US-China trade war escalated further. Because US President Trump and his negotiation team didn’t think the trade talks with China were going as smoothly as hoped for, Trump decided to increase pressure on China and implement higher import tariffs on Chinese goods worth USD 200 billion. In response, China announced retaliatory measures by increasing import tariff rates as well, albeit on a much smaller amount of imports from the US. To add some more fuel to the fire, the US also started the process for implementing import tariffs on essentially all Chinese products that are not affected yet.

These actions might be a part of a negotiation tactic to reach a deal in the near future. New trade negotiations are planned at the G20 meetings in June, so reaching a deal has become more difficult but is still possible. After all, in the build-up to the US presidential elections in 2020, Trump would like to claim a trade deal with China as a personal victory. Nevertheless, the US-China conflict is not exclusively about free trade, but also about technology (also see KBC Economic Opinion of 11 April 2018). The recent executive order that effectively prohibits US companies from using any telecoms equipment manufactured by the Chinese firm Huawei illustrates this once again. Technological leadership will determine economic leadership in the future. As a consequence, the confrontation between China and the US, and by extension the economic power struggle between the West and the emerging economies, is not an overnight event but an endeavour that will stretch for years while a new and workable model for future globalisation is found.

In a sense, the new escalation in the US-China trade war is a relief for the European Union and Japan. Now that the US focus remains on the Chinese trade battle front, the decision on implementing higher US import tariffs on cars and car parts was postponed by six months until November 2019. Although delayed, the tariff threat remains on the table until the end of the year. Hence, it continues to be a substantial risk to the EU economy.

Brexit uncertainty supporting UK GDP… for now

Despite the continued Brexit uncertainty, UK real growth accelerated from 0.2% qoq in Q4 2018 to 0.5% qoq for Q1 2019. In fact, Brexit uncertainty may have even supported growth. Many companies increased their production and inventories during Q1 to create a buffer against supply and trade flow disruptions in case of a no-deal Brexit. This inventory build-up is a one-off and will, at least partly, be reduced in the second quarter now that the Brexit deadline is postponed until October 31. Apart from the large contribution of the inventory component, real GDP growth was also significantly supported by domestic demand as private consumption remains solid. Financial markets reactions to the GDP figures were limited though. Uncertainty about the future remains high and volatility will continue to be a key element going forward (also see Box 2).

Box 2 – Brexit uncertainty and sterling volatility

As May’s Brexit deal has been rejected by Parliament three times, she decided to engage with the Labour opposition in an attempt to win over their support. The pound showed remarkable strength at the beginning of May, despite the lack of progress in the talks between Prime Minister Theresa May and Labour party leader Jeremy Corbyn (figure B2). Markets were frontrunning a potential cross-party Brexit agreement. May hinted at a “kind of” customs union post-Brexit earlier this month, a key demand by Labour. Meanwhile, the local elections showed major losses for May’s Conservative Party, to a large extent the result of the Brexit stalemate. Markets were hoping this would create a sense of urgency at the minds of policy makers. News flows, however, suggested no such thing. Jeremy Corbyn even pulled the plug on the cross-party negotiations. Markets are reassessing the case for a short-term breakthrough, sending sterling back lower. The pair edges back up in and even above the 0.85-0.87 trading range. We expect this kind of Brexit related volatility in EUR/GBP as long as uncertainty around Brexit persists.

Figure B2 - Exchange rate GBP per EUR

Source: KBC Economics based on Macrobond

No reasons for monetary policy changes

As inflation remains rather muted and mainly driven by volatile components and some seasonal effects in major economies, central banks are not in a hurry to change policy paths. Apart from some seasonal effects – related to the timing of Easter – oil price developments, which were by rising geopolitical tensions in the Middle East, positively contributed to recent headline inflation. The oil price effect will last throughout H1 2019. However, since slowing global economic growth will weigh on oil demand, we expect the oil price to move back towards USD 65 per barrel by the end of 2019. Hence, oil price effects will still be a drag on annual average headline inflation in 2019 as a whole.

Since there are currently no major macroeconomic or price-related factors that warrant a change in monetary policy, we stick to our scenario for the ECB and Fed. Our scenario for the ECB deposit rate hence remains the same as last month, with the first rate hike only in the second half of 2020. The main motivation for it will be a move towards deposit rate normalisation out of negative territory. Financial stability considerations and the adverse impact on the European banking sector play an important role. However, in order to limit the policy tightening signal coming from this depo rate hike, the ECB is likely to decrease the upwards corridor between the refi and the depo rate to 10 basis points from 40 basis points at present.

Flight to quality and safe haven effects, sustained excess liquidity, scarcity factors due to regulation, the sustained German budget surplus, relatively subdued European (core) inflation and a dovish ECB will cause German 10y bond yields and intra-EMU sovereign spreads to remain low in 2019. The main exception to the latter could be Italy. National political jitters and a potential new confrontation with the European Commission in the context of the 2020 budget discussions after the summer months, might lead to increased financial market volatility and spikes in the spread to the German 10y bond yield.

Regarding the Fed, we don’t expect any further rate hikes over the forecast horizon. In fact, given the expected moderation in the pace of growth going forward, a rate cut in the course of 2020 is likely. The run-down of the balance sheet will likely be completed by September 2019. By the end of September, we estimate it to be around USD 3.75 trillion, significantly higher than the original estimates of a decline towards levels in the area of USD 2.5 trillion. As a consequence, we expect long-term bond yields to remain roughly flat throughout the forecast horizon.

Alle historische koersen/prijzen, statistieken en grafieken zijn up-to-date, tot en met 13 mei 2019, tenzij anders vermeld. De verstrekte standpunten en prognoses zijn die van 13 meil 2019.