Economic Perspectives July 2019

Content Table

Read the full publication below or click here to open the PDF.

- Fears of a widespread global economic slowdown have dominated economic sentiment in recent weeks. Financial markets anticipated additional and renewed monetary stimulus by the major central banks which led to a substantial decline in bond yields.

- Although the economic outlook has deteriorated, the overall global picture remains mixed. The weakness in the global manufacturing sector persists, though the services sector remains quite resilient. In particular in the euro area, there are signs of a business sentiment stabilisation in some countries, but overall there is no convincing rebound trend yet. This suggests that real GDP growth in the second quarter will be notably weaker than the unexpectedly-strong growth results in Q1 2019. Also the prospects for a sharp recovery in the coming months remain rather limited. This is in line with our growth and inflation scenario for the euro area.

- The US economy posted strong labour market results recently, but other indicators are pointing towards an underlying slowdown in growth. Headwinds from weaker global economic momentum together with the late-cyclical character of the US economy confirm our view of a gradual deceleration in the pace of US growth.

- The temporary ceasefire in the trade war between the US and China means that the risk of escalation in the short-term has diminished. However, chances of an outlook altering deal being reached in the near term remain modest. In the longer term, we expect the conflict to continue with occasional flare-ups and temporary relief rallies. Moreover, reduced tensions in the US-China trade conflict may open the door for new trade conflicts elsewhere in the world.

- Financial market expectations are shifting more and more towards additional monetary policy stimulus by the major central banks. This is mainly driven by the central banks’ dovish communication in recent weeks. In line with this, we expect both the Fed (two rate cuts) and the ECB (new QE programme) to ease their monetary policy again to prevent a major slowdown of the economy. This international context will also affect other central banks. In Europe, the Czech National Bank (CNB) is now expected to keep its policy rate constant, while the Hungarian central bank is clearly postponing its monetary policy normalisation.

No manufacturing recovery

The services sector remains resilient in the euro area despite the continued weakness in manufacturing that is part of a global pattern. The services PMI even went up from 52.9 to 53.6 in June. The European Commission’s Business Survey for services has also shown a rather stable trend since the start of the year. The relatively robust results from the services sector are in stark contrast with the persistent poor performance of the manufacturing sector. This has been reflected in corporate pessimism in most large euro area economies, with the exception of France, and weak activity data.

The German manufacturing sector’s results have remained particularly disappointing. Although industrial production growth ticked up in May (+0.3% mom), this is largely a reflection of month-to-month volatility as other data on new orders and sales plummeted. Moreover, there are some signs that indicate the first spillovers towards the more domestically-oriented sectors in Germany. Consumer sentiment indicators have been dropping recently, despite domestic consumption being the cornerstone of the global economy for some time. Consequently retail sales growth has been disappointing of late. All in all, Q2 GDP growth figures will likely be notably weaker than the unexpectedly strong results in Q1. The expected rebound in Q3 will likely be limited. Therefore, our growth and inflation scenario for the euro area remains unchanged.

Mixed signals in the US

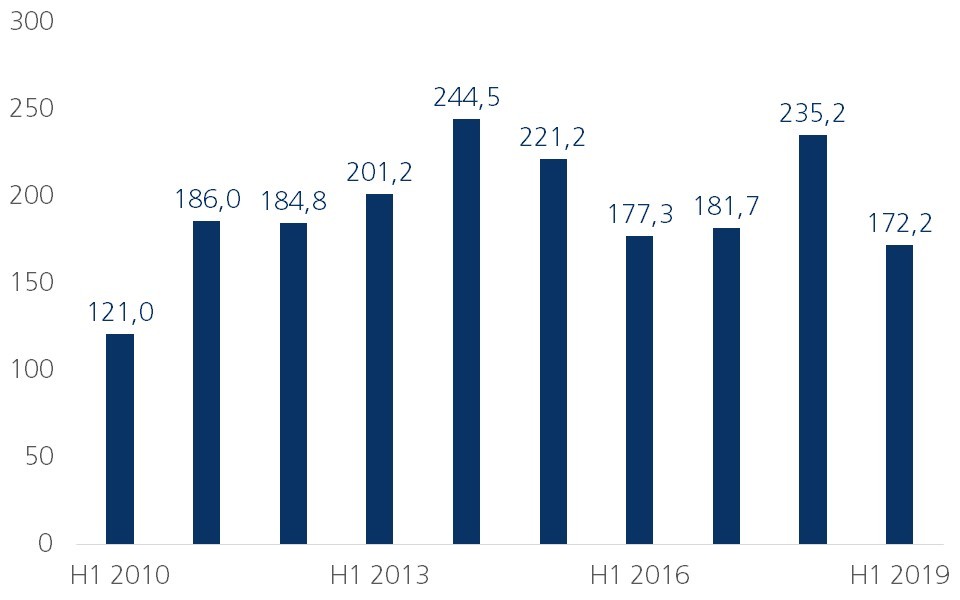

Recent economic indicators show mixed results for the US economy. On the one hand, corporate sentiment has deteriorated significantly across all main sectors since the start of the year. Though purchasing managers surveys still remain above the neutral level of 50 that separates economic expansion from contraction, their softening dynamics reflect the underlying weakening of the economy. On the other hand, job creation was again strong in June (+224K) after disappointing May figures. However, the average monthly jobs growth in the first half of this year was notably weaker than last year and also one of the weakest in the past decade (figure 1). Hence, though overall labour market results are still solid, some evolutions are indicating that the tide might be starting to turn for the US labour market. This confirms that the US economy is in a late-cyclical stage which is in line with our scenario of moderating growth. Therefore, our growth projections are unaltered compared to last month.

Figure 1 - Labour market data are starting to indicate some economic cooling down (US average monthly jobs growth in H1, in ‘000s)

Trade war truce… for now

The G20 summit in Osaka resulted in a short-term ceasefire in the trade war between the US and China. The countries agreed to re-start trade negotiations after the escalation of the conflict in recent months. The US said it would refrain from new import tariffs on Chinese products “for the time being”. The US also allows trading with Huawei again conditional on no national security threat. As a compensation, China agreed to increase food and agricultural imports from the US. The short-term truce provides some relief, but longer-term issues will remain on the table. Though the escalation risk in the short-term diminished, chances of a deal being reached in the near term are not necessarily higher. A lot will depend on US President Trump’s strategy going forward. After all, he will have to find a balance between being tough enough against China and not causing a serious US economic downturn before the 2020 presidential elections. Our outlook envisages a continuation of the conflict with irregular flare-ups and periods of ‘trade truce’ that in turn suggests episodes of concern and relief rallies in financial markets.

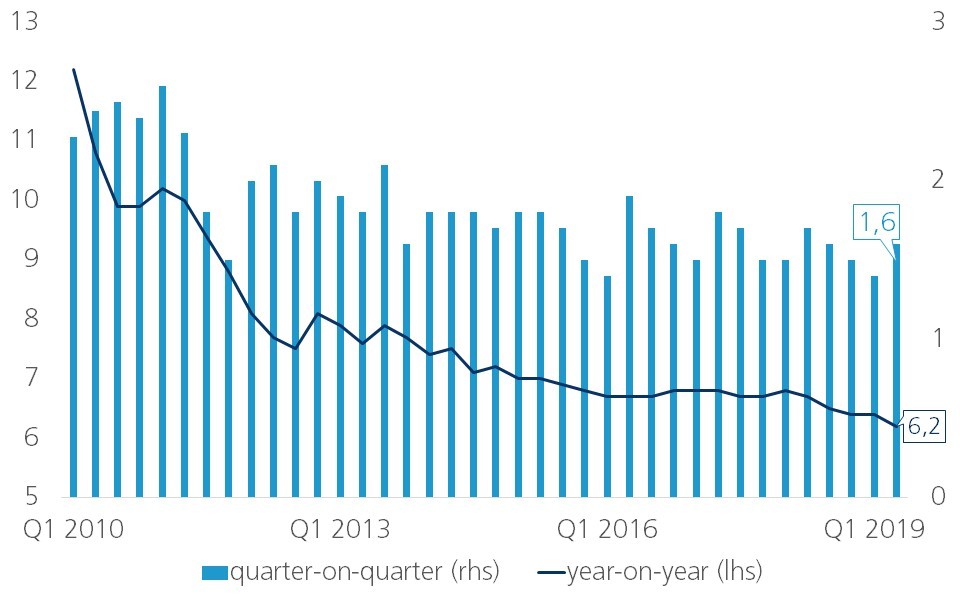

The current but possibly temporary trade ceasefire is good news for the global economy and China, in particular as that economy is clearly suffering from international headwinds to growth. Chinese real GDP growth figures for Q2 2019 showed a further growth deceleration to 6.2% yoy from 6.4% yoy in the two previous quarters (figure 2). These results are in line with the longer-term trend of an economic slowdown and are consistent with the government’s aim to go from high-quantity to high-quality growth. However, the recent growth decline is likely somewhat sharper than anticipated by Chinese authorities as the trade war with the US and the deterioration of global growth momentum have been forceful headwinds. Going forward, we expect the ‘soft landing’ scenario to hold with a gradual further slowdown of Chinese growth. However, we remain concerned about the long-term impact of the side-effects of the excessive Chinese stimulus as risks in terms of debt sustainability and financial stability are growing.

Figure 2 – Chinese growth deceleration continues (real GDP growth, in %)

Now that President Trump’s focus can temporarily shift away from China, there is an increased risk however, that he might target other trading partners such as the EU or Turkey (also see Box 1). US import tariffs on cars and car parts are still not off the table and would cause some serious damage to the euro area and related economies. To compensate for this risk and to counterbalance the general increase in global protectionism, the EU managed to close a trade deal with Mercosur - the Latin American trading bloc consisting of Argentina, Brazil, Paraguay and Uruguay. The trade agreement will liberalise a large majority of the trade in goods between the regions over a transition period of 10 years. Importantly, the ratification process in the EU could become difficult as the approval of all national parliaments is needed and as the deal touches upon sensitive sectors like agriculture, food and other labour intensive industries. However, the symbolic value of this trade agreement in the current international context is important.

Box 1 - Turkey: double dip crisis upcoming

Recent political developments in Turkey, in particular the appointment of a new central bank governor, have renewed concerns about the 19th largest economy of the world (IMF, 2018 data). After a severe financial shock in mid-2018, the Turkish economy fell into a recession in the second half of 2018, for the first time in a decade (figure B1.1). Although the economy rebounded in Q1 2019, this was largely driven by fiscal and quasi-fiscal stimulus before the March local elections. The effects of these policies are, however, already fading away, as suggested by high-frequency indicators. This puts the economy at risk of a double-dip recession in the second half of this year.

Figure B1.1 – Turkish rebound in Q1 2019 likely only temporary (contributions to real GDP growth, % year-on-year)

Source: KBC Economics based on OECD

As fiscal stimulus is likely to fade out, further economic expansion is likely to be held back as structural challenges will lead to a deteriorating Turkish economic outlook. First, there has been a rapid correction of the current account deficit (figure B1.2). While a sharp contraction in domestic demand has curbed imports, the improved price competitiveness after the real depreciation of the Turkish lira has boosted exports. Second, the labour market has been under severe pressure too, following the currency crisis. As a result, the unemployment rate has surged to 15%, owing not only to the adverse business cycle situation, but also to structural rigidities in the labour market.

Figure B1.2 – Turkish current account balance (as a % of GDP)

Source: KBC Economics based on TCMB

Meanwhile, although inflationary pressures eased somewhat in recent months due to the favourable base effect, headline inflation remains firmly entrenched in double-digit territory. Still, with the central bank’s key interest rate at 24%, ex post real interest rates stand now close to 10%, which seems prohibitively high. This, coupled with a significant easing in global financial conditions, opens the door for the start of the easing cycle. The crucial question is, however, the timing of the first rate cut and the subsequent path of monetary easing. The latest move by President Erdogan, who has been discontent with the tight monetary policy stance and replaced the central bank’s Governor with his deputy, suggests the first cut might already come in July, with a rather aggressive downward trajectory afterwards, bringing the key rate close to 20% by year-end. Such a politically motivated monetary policy path will, however, not only further erode the central bank‘s credibility, but also create a risk of too loose monetary policy conditions. These could undermine the ongoing process of rebalancing and again bring the existing vulnerabilities of the economy to the forefront.

Overall, the medium-term macroeconomic outlook for Turkey remains unfavourable. We expect a sluggish recovery ahead with growth restrained below potential by ongoing rebalancing and persistently weak fundamentals. Moreover, the Turkish economy continues to be exposed to several risks. Apart from those directly linked to monetary policy, political uncertainties and institutional weaknesses are also likely to undermine the ongoing adjustment. The government lacks a credible policy mix, which risks populist pro-expansionary measures and fiscal slippage. On the external front, the economy remains very sensitive to global sentiment shifts and possible headwinds. These are related mainly to increased geopolitical risks, including rising tensions between the US and Turkey due to the Turkish purchase of Russian S-400 defence missile systems.

All eyes on central banks

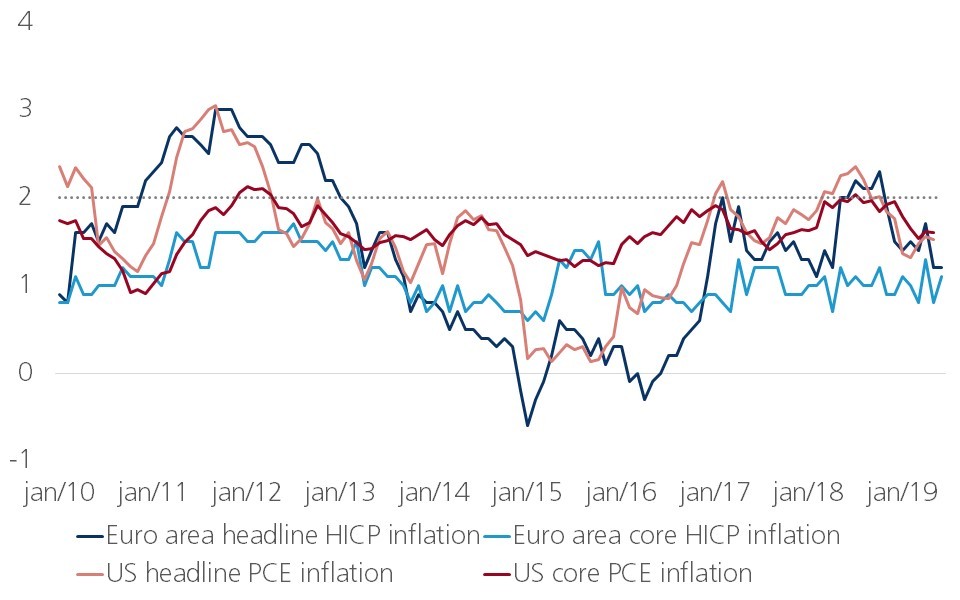

Financial markets are becoming more and more convinced that many of the world’s major central banks will ease their monetary policy. This reflects the gradual shift in the forward guidance of central banks in recent months. The Fed said it will closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion. By adding that “the case for somewhat more accommodative policy has strengthened”, Chairman Powell indicated that an official rate cut as soon as late July, the Fed’s next policy meeting, is now very likely. This combined with elevated economic risks and inflation persistently running below the Fed’s policy target of 2% (figure 3), supports our scenario change. We now project the Fed to cut the policy rate twice in the coming months to 1.875%, somewhat faster than earlier expected. As we don’t think the US economy is seeing a sharp decline and we also think the traditional reluctance of the Fed to intervene in an election year will be a factor, these will likely be the only two rate cuts in our view.

Figure 3 – Below-target inflation levels give central banks room to ease monetary policy

We are also expecting some new monetary stimulus from the ECB. Although we think this action will be material, we don’t see it being as aggressive in nature or scale as some others have suggested of late. Additional cuts of the policy rates are not projected (yet), but we do see a new QE round (Asset Purchasing Programme) as likely in coming months. Recent forward guidance by ECB president Draghi signalled this prospect. Unless the growth and inflation outlook improve quickly, the ECB will supply extra stimulus. Heightened economic risks (trade conflicts, Brexit, geopolitical risks) and persistently below-target inflation are also supportive factors for these new stimulus measures.

Market expectations about additional monetary stimulus have been the driving forces behind recent declines in long(er)-term interest rates. We interpret the recent fast decline in long-term yields as a market overshooting phenomenon, partly reacting to unrealistic market expectations about the pace of monetary easing as well as a possible overstatement of the nature and scale of downturn risks now facing the global economy. Nevertheless, as many risk facts will persist in the months ahead and as we do expect some monetary easing, the upward potential for longer-term interest rates is limited. Only by the end of the year, we expect a start of a gradual bond yield normalisation.

In the context of markets expecting stimulus interventions from major central banks amid a globally muted inflationary and growth environment, the market views on other central banks are shifting as well. In contrast to our view of a stable policy rate by the Czech National Bank (CNB), financial markets are expecting an easing cycle in the coming years (also see Box 2).

Box 2 - Central Europe on a looser monetary path too

In an integrated world economy and financial system, looser monetary policy by the major central banks seems to affect other central banks too. In particular central banks in the EU, but outside the euro area, seem to follow the direction of ECB monetary policy, or at least marked deviations from the ECB path have become less likely. A nice example is the situation in the Czech Republic, but also the Hungarian central bank has postponed a normalisation of its monetary policy.

In August, the Czech National Bank’s (CNB) Board will decide on the interest rates for the next period. The new decision will be based on new forecasts that are unlikely to deviate much from the current ones. Therefore, the CNB Board will be able to keep the key interest rate (the two-week repo rate) unaltered. At the same time, we expected the CNB to confirm that stable rates are envisaged over a longer time period too, as already indicated by the May forecasts. Hence, rates are expected to remain unchanged, regardless of current inflation being above the target or of the weaker-than-expected Czech Koruna.

Financial markets now even expect that the CNB will reduce rates rapidly in the coming years. The interest rate curve is strongly inverted and indicates that markets project one rate cut within one year, roughly two cuts within two years, and three cuts by 2022. However, we believe such a scenario is very unlikely. Only in case of a deep recession or a sharp strengthening of the Koruna would such an outcome become realistic. Such events are unlikely as the Czech economy still demonstrates relatively strong resilience to the deteriorating developments abroad. Also the muddling-through economic context in the euro area is not likely to cause a negative shock for the Czech economy. Moreover, the Koruna has no tendency of reaching new highs.

The exchange rate of the Koruna also remains under pressure due to the large amount of free liquidity, which is also partly channelled into Czech government securities. This has rapidly increased the price of government paper in recent weeks and has consequently lowered interest rates. The middle and long end of the Czech yield curve also reflects the decline in long-term interest rates in the euro area and Germany in particular.

Policy rate risks are to the downside. A faster-than-expected growth deceleration in the euro area could convince the CNB to loosen its monetary policy further. Nevertheless, the current economic performance doesn’t call for such action. Industrial orders (mainly automotive) and export performance remain strong. The vacancy rate remains the highest in the entire EU. Alternatively, additional ECB monetary stimulus might convince the CNB to follow the same path.

All historical quotes/prices, statistics and charts are up-to-date until 15 July 2019, unless stated otherwise. The views and forecasts provided are those of 15 July 2019.