Economic Perspectives April 2019

Read the full publication below or click here to open the PDF.

- Recent activity and sentiment data signal a continued globally synchronised downward growth trend. The weakness remains concentrated in the manufacturing sector. Meanwhile, more domestically-oriented services sectors are holding up well.

- For the euro area we expect a growth rebound in the second half of 2019. A key element in this scenario is a gradual recovery in German economic activity after the disappointing results during recent months. Such a recovery is likely for several reasons. First, distorting events like the introduction of new CO2 emission regulations in the automotive industry and the impact of exceptional drought will fade out. Second, some temporary growth support will come from a further reversal of the inventory cycle. Third, global financial conditions improved compared to the end of 2018 as central banks became more dovish and long-term interest rates decreased. Chinese policy stimulation will likely start having a positive impact on German growth as well.

- Uncertainties in the global economy remain high and numerous. The latest Brexit extension means a continuation of high uncertainty for British firms, British trading partners and for the global economy as a whole. We keep our view that some kind of agreement will be found in the end without a collapse of the UK or EU economy. However, the longer the uncertainty lasts, the more sentiment will be harmed and investment decisions may be postponed. The risk of an escalation of the trade dispute between the US and the EU also remains on the agenda, despite the expected (re)start of bilateral trade negotiations.

- Recent economic data did little to warrant a change in the cautious stance of major central banks. On the contrary, both the Fed and the ECB have adjusted their reaction functions towards greater dovishness based on the latest inflation and growth evolutions. For the ECB, this implies that interest rate normalization will start in 2020 at the earliest. For the Fed, we now pencil in a rate cut in 2020 as reaction to the deceleration in the US economy. In response, long-term bond yields will remain low throughout 2019.

Synchronised slowdown

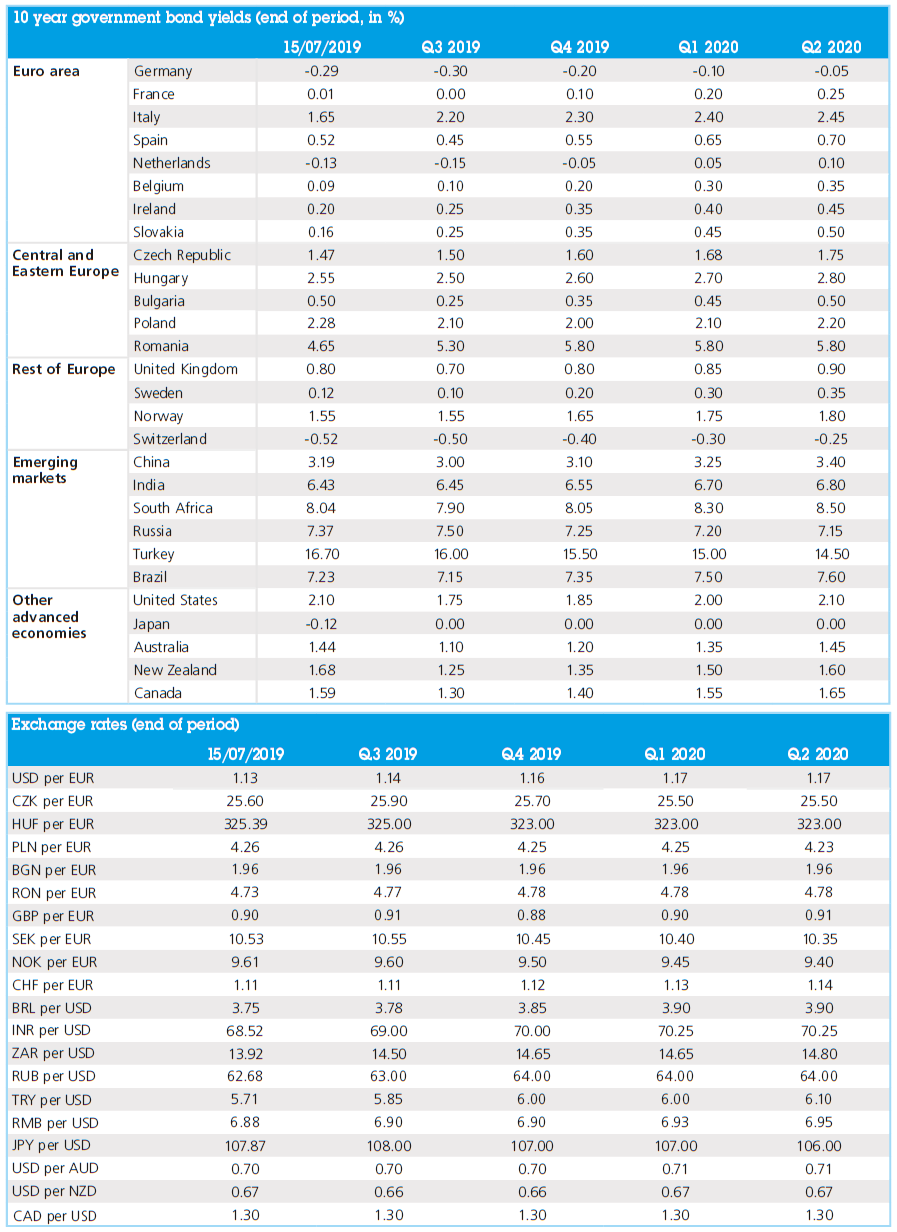

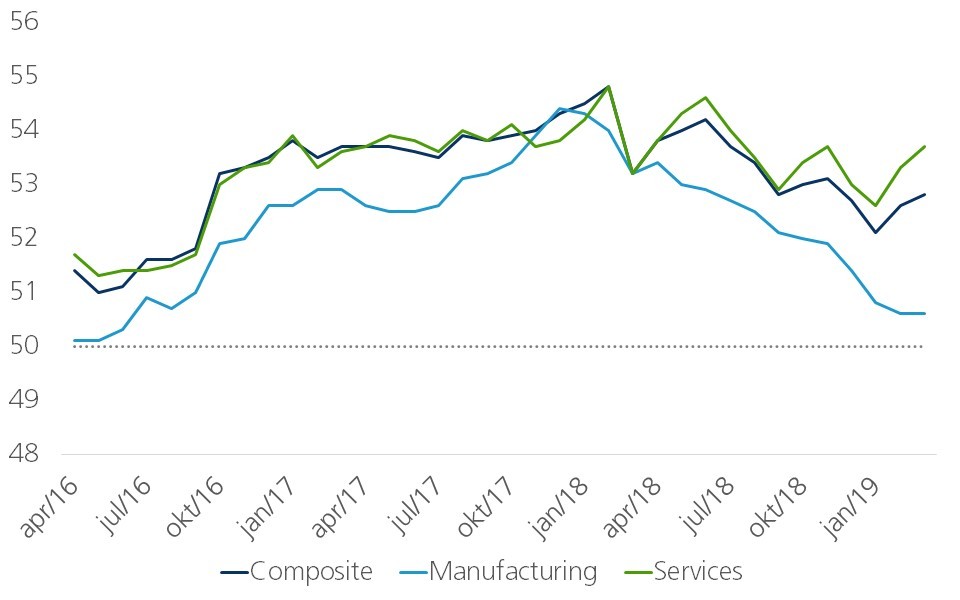

The IMF recently joined a long line of international institutions by cutting its growth forecasts for the global economy. The IMF expects advanced, emerging and developing countries to face a substantial growth slowdown in 2019 and envisages global GDP growth will be at the slowest pace since 2009. Recent activity and sentiment data signal that the global synchronised downtrend of economic growth continues. The weakness remains concentrated in the manufacturing sector (figure 1) while the more domestically-oriented services sector remains stable. The global PMI for services even rose for the second month in a row in March. Although its current level of 53.7 is below the multi-year highs reached at the beginning of 2018, it still points towards healthy corporate confidence among services providers. This is despite economic activity slowing across regions and continued uncertainty globally. Strong domestic demand, in particular in developed economies, is likely the main factor behind the resilience in the services sector.

Figure 1 - Global weakness concentrated in manufacturing sector (global PMIs, 50 = neutral level)

Contrary to the geographically synchronized trend in 2019, the latest IMF figures confirm our view that some regions are likely to benefit from a growth rebound in 2020. In particular for the euro area, our scenario contains a number of temporary factors that weigh on growth this year, but that make a recovery later on this year very likely. One factor that may support growth in the second half of this year and throughout 2020 is additional Chinese fiscal and monetary policy measures. Some positive effects are already becoming visible, such as the rebound in Chinese business confidence indicators in recent months and could also be consistent with better-than-expected retail sales and industrial production data for March. The government’s and the central bank’s measures to stabilise economic growth and avoid a hard landing likely played a role in this. Additionally, the positive messages coming from the trade negotiations between the US and China may have also contributed to the uptick in corporate sentiment. Finally, Chinese consumers appear to be reaping the benefits of the stimulus measures, leading to a pick-up in retail sales growth. Hence, our scenario of a gradual but orderly slowing of the Chinese economy remains in place. As the Chinese market is an important export destination for many countries and products, healthy Chinese economic activity should result in positive international spill-over effects. These will underpin the recovery of global growth in this year and next year.

Overall, emerging markets are doing relatively well in the context of heightened international uncertainties and the deterioration in the international trade climate. Corporate confidence is at solid levels across regions (e.g. Brazil, Russia, India). And although emerging markets are suffering from the Chinese growth slowdown and the trade war between China and the US, particularly those in Asia, their economies remain quite resilient. Hence, we don’t see signals pointing towards a general systemic emerging market crisis in the near future. That being said, idiosyncratic vulnerabilities remain. Recent events in Turkey highlighted that country-specific risks will continue to contribute to financial market volatility (see Box 1).

Box 1 - Painful Turkish economic downturn impacting local election results

At the end of March, Turkish voters went to the polling booth for the local elections - the first election round since the major constitutional changes and the shift towards a presidential system last year. Although the AKP - President Erdogan’s party - received the most votes nationwide (44%), the party suffered a heavy blow as his party lost control of the capital, Ankara, and the major economic centres of Istanbul and Izmir, to the main opposition party (CHP). Hence, the opposition secured its grip over the only centre of power outside the otherwise centralised presidential system.

One of the key reasons behind the worse-than-expected election results for the ruling party is the weakening of the Turkish economy. The trigger was the currency crisis of late summer 2018 when the Turkish Lira depreciated by more than 30% against the USD. Underlying macroeconomic imbalances - a weak external position and increased reliance on volatile short-term capital inflows - were fully exposed. As a result, for the first time in a decade, the Turkish economy fell into recession with real GDP declining by 1.6% qoq in Q3 and by 2.4% qoq in Q4 2018 (figure B1).

This year, we expect the economy will shrink by 1.5% (with the risks tilted to the downside) given the ongoing events, including a rapid drop in domestic demand on the back of a sudden stop in capital flows and subsequent credit crunch. Moreover, there are no suggestions of a rapid recovery of economic activity in the near future. The economy’s fundamentals remain weak and extremely vulnerable as corporate balance sheets are fragile, foreign reserves are limited and the Lira remains volatile. In addition, the external environment will be challenging due to the expected slowdown of the EU economy, Turkey’s main trading partner. Given the lack of scheduled elections, the upcoming years seem to be a suitable period for reforms to strengthen Turkey’s economic fundamentals. However, for these to be effective, some notable changes to economic policy will be needed (also see KBC Economic Opinion of 4 April 2019).

Figure B1 - Turkish economy in a recession (real GDP, % change quarter-on-quarter)

Source: KBC Economics based on TurkStat

German rebound

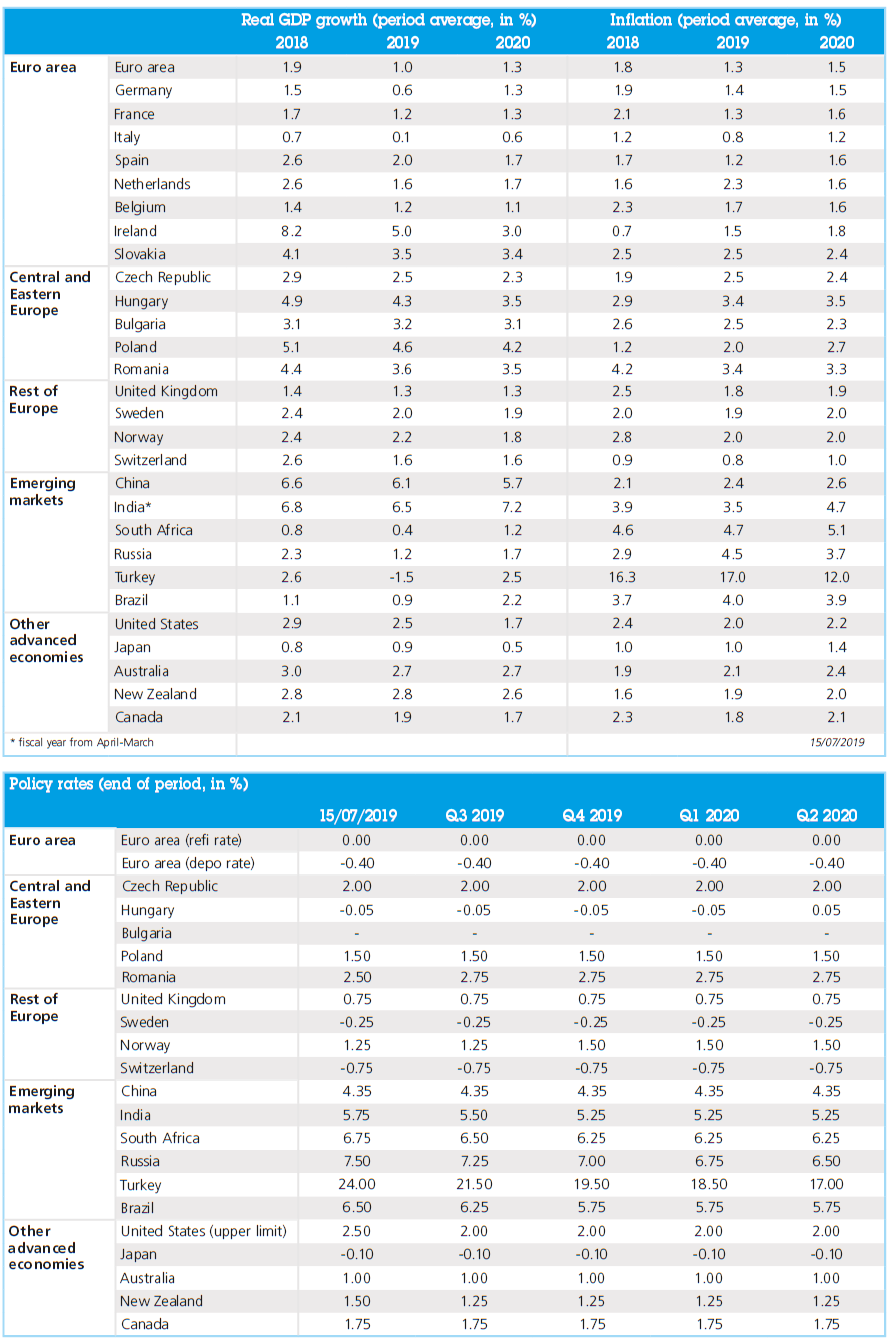

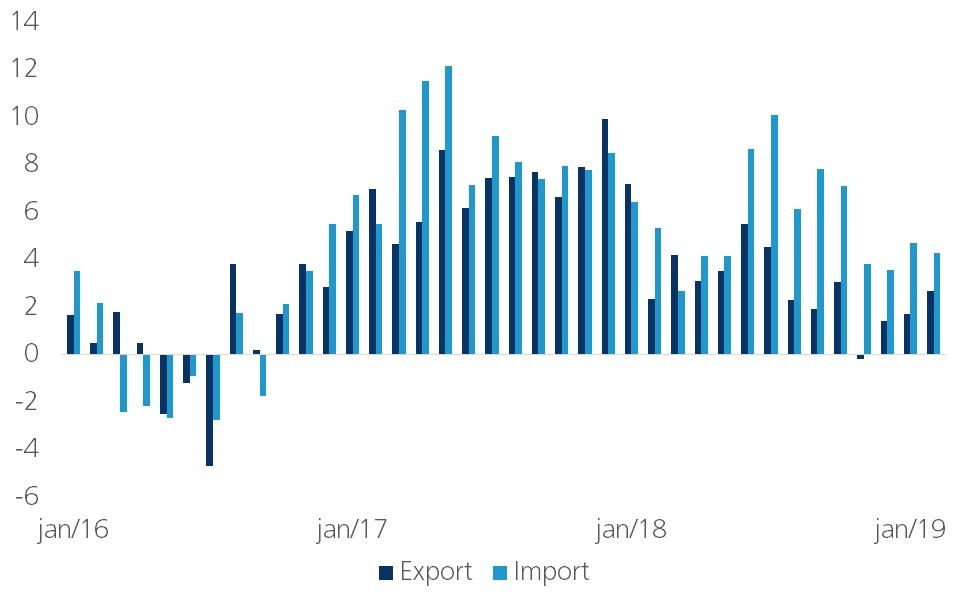

A key part of our growth scenario for the euro area economy is the assumed rebound of German economic activity after the disappointing results of the past months. The current weakness of the German economy is the result of a combination of factors. While the weaker global economic environment is negatively affecting German export growth, German import growth remains strong due to domestic job creation and favourable wage evolutions boosting consumption (figure 2). Consequently, German GDP growth in recent quarters has been driven mainly by domestic demand components such as private consumption, investment and government expenditures. Although German exports have remained resilient despite the global uncertainties and economic slowdown, net exports are not contributing much to overall German growth as import growth exceeds export growth.

Figure 2 - German import growth exceeds export growth (goods trade, seasonally and calendar adjusted, % change year-on-year)

Furthermore, industrial weakness has broadened, starting from the automobile industry (due to new CO2 emission regulations) and the chemical industry (suffering from transportation issues due to low water levels in the Rhine), and spreading towards other manufacturing subsectors. German automotive production dropped by 7.2% in H2 2018 compared to H1 2018. New orders in manufacturing dropped by 8.4% yoy in February. The unexpected temporary headwinds led to a strong inventory build-up in Q2 and Q3 2018 and the subsequent run-down thereafter. Supply side constraints stemming from the increasingly tight labour market are also holding back the manufacturing sector. Whether this is temporary or structural depends on the willingness to invest in additional capacity. The continued strong investment growth seems to suggest that the capacity constraints can be overcome. The temporary decline in manufacturing output also mitigated the actual capacity constraints.

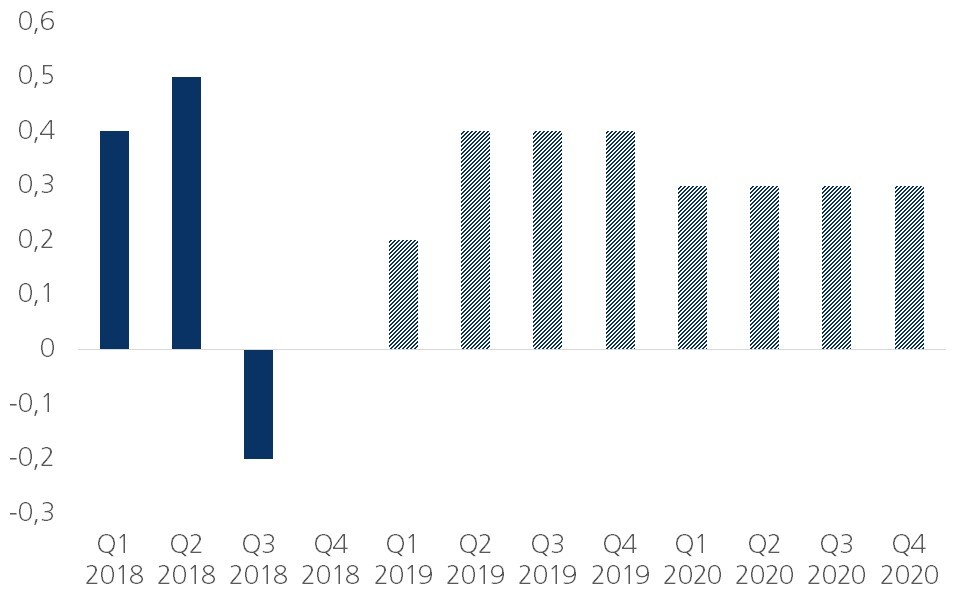

In the short term a recovery is likely for several reasons. First, there will be some temporary growth support from a further reversal of the inventory cycle. Second, global financial conditions improved compared to the end of 2018 as central banks became more cautious and long-term interest rates decreased. Chinese policy stimulation will likely begin having a positive impact on German growth in H2 2019 as well. It is also important to note that our weak annual average growth forecast for 2019 masks relatively favourable quarterly growth dynamics that area broadly in line with estimated potential growth (figure 3). In terms of the longer-term economic outlook, growth is likely to gradually weaken further. To a large extent this will be the result of supply side factors such as the labour market tightening and increasing labour shortages, which will be aggravated by demographic factors and will weigh on potential growth. The main risks to this scenario are of a political nature (Brexit and global trade policies).

Figure 3 - Weak annual averages mask still decent German quarterly growth dynamics (real GDP, % change quarter-on-quarter, forecasts from Q1 2019)

Uncertainty remains high

Uncertainties in the global economy remain high and numerous. One of them is the Brexit saga. Despite the extended period for ratification until 12 April 2019, Members of the British Parliament were not able to find a majority support for the Withdrawal Agreement (WA) Prime Minister May and the European Council endorsed in November 2018. In response to the UK’s request for a further extension of the Article 50 period, the European Council granted a further extension to allow for the ratification of the Withdrawal Agreement with an end date of 31 October 2019. This period can be seen as a ‘flextension’ in the sense that the UK can also leave the EU earlier once the WA is ratified by the UK Parliament. The extension comes with a few conditions though. The UK is obliged to participate in the European Parliament elections if the WA has not been ratified by 22 May 2019. Moreover, the UK committed to “act in a constructive and responsible manner throughout the extension period” implying it will not hamper the decision-making processes of the EU.

The new extension means a continuation of high uncertainty for British firms, British trading partners and for the global economy as a whole even if it seems to reflect an overwhelming desire to avoid a hard Brexit. We keep our view that some kind of agreement will be found in the end without a collapse of the UK or European economies. However, the longer the uncertainty lasts, the more sentiment will be harmed and investment decisions may be postponed. Hence, although the extension implies a larger probability of a softer Brexit outcome, it also means that uncertainty will continue to weigh on economic activity.

Another factor of uncertainty, in particular for the European economy, is a potential escalation of the trade dispute with the US. The risk of US import tariffs on cars and car parts would be harmful for the euro area economy. Moreover, the threatened measures in response to the conflict between Airbus and Boeing could be an additional cause of economic damage (see Box 2). Furthermore, geopolitical risks have risen of late. The conflict in Libya escalated in recent weeks, which was mirrored in a rise of the oil price. Other tenuous political situations in countries like Iran, Nigeria and Venezuela remain vulnerable and susceptible to oil supply disruptions.

Box 2 - Global trade in a dip

Whereas 2017 brought a lot of positive surprises on the economic front, with stronger-than-expected GDP and trade growth, 2018 was defined by a slowdown in trade and activity. This weakness has been seeping through into the start of 2019 as well. The World Trade Monitor of the Dutch Bureau for Economic Policy Analysis (CPB) illustrates this very well (figure B2.1). The index measures international trade volumes of goods flows on a monthly basis. The figure clearly indicates the strong results in 2017, the struggles in 2018 and the collapse of trade growth at the end of the year. The first figures for January 2019 only show a partial recovery in goods trade.

Based on preliminary estimates by the World Trade Organisation (WTO), the global annual average growth rate of international trade volumes was 3.0% in 2018, well below the WTO’s initial estimates and significantly less than the 4.6% growth pace recorded in 2017. The very disappointing fourth quarter figures were the main cause of this notable underperformance in 2018. Weakness in trade growth was mostly concentrated in Europe and Asia, two regions with a very important share in total global trade flows. However, on the bright side, commercial services trade reported strong growth in 2018 (+7.7%), for the second year in a row, supported largely by robust services import growth in Asia.

Several factors were at the origin of the disappointing results for goods trade. The escalation of the trade war between the US and China was undoubtedly one of them. Multiple rounds of import tariff increases on both sides caused trade flows between the two countries to be distorted. Moreover, trade flows of other economies with close trade ties with the US or China were affected. The increased uncertainty led to a global negative impact. The persistent opacity surrounding the UK’s exit out of the EU also weighed on global trade flows. Weaker global demand and a decline in global GDP growth contributed as well to the deceleration in trade growth. In addition, temporary factors played a role. The problems in the German car manufacturing industry due to new emission test regulations and the US government shutdown likely led to transitory postponements in consumers’ and businesses’ purchase decisions.

Forward-looking indicators don’t suggest any marked improvement for international trade in the near term. Corporate sentiment, as measured by PMIs, is still on a downward trajectory in the manufacturing or tradeable goods sector. In particular the subcomponent of export orders remains weak overall. The World Trade Outlook Indicator of the WTO does not appear to be pointing towards a recovery of trade growth in the first half of 2019 (figure B2.2). Based on these findings, the WTO revised its forecasts for merchandise trade volume growth down to 2.6% in 2019 and 3% in 2020. A rebound of trade growth in 2020 is not unlikely, and this is consistent with our scenario of a partial recovery in global activity.

An important determinant for trade going forward will be the evolution of the trade tensions and surrounding uncertainty they cause. Trade negotiations between China and the US are still ongoing. A final deal has not been reached. Communications from people involved speak of progress, but a possible deal has been postponed until May at the earliest. One of the main stumbling blocks is whether or not the tariffs that were already implemented will be rolled back. Moreover, the US demand for enforcement mechanisms is a difficult topic for the Chinese authorities. Nonetheless, the US and China recently agreed on setting up enforcement offices that will monitor the compliance to the deal. Our base scenario doesn’t contain a further escalation of the US-China conflict as we think reaching some kind of an accord in the near future seems more likely. However, underlying issues will not be fully resolved. It is likely that the dispute will move away from trade issues to focus more on technology matters as China is focusing more on the production and export of products with high added value (also see KBC Economic Opinion of 11 April 2018)

Apart from the conflict with China, the US is building trade tensions with the EU. In the context of the long-standing conflict between aircraft manufacturers Airbus and Boeing, the US announced additional tariffs on imports of European products. The tariffs are a reaction by the US against the presumed illegal subsidies of the European governments to Airbus. The preliminary list includes products worth some USD 11 billion. This threat comes on top of the risk of additional US import tariffs on cars and car parts. For the already weakening European economy, these are notable factors of uncertainty that could potentially harm economic activity. Nevertheless, the EU decided to give a green light to new trade negotiations with the US. Although this is a hopeful signal, as long as trade tensions hold steady and uncertainty remains high, trade flows and investment decisions will be distorted globally.

Figure B2.1 – CPB World Trade Monitor (merchandise trade volumes)

Source: KBC Economics based on Dutch Bureau for Economic Policy Analysis (CPB)

Figure B2.2 - WTO World Trade Outlook Indicator

Source: KBC Economics based on World Trade Organisation

Monetary policy doves ruling

Recent economic data have not persuaded any of the major central banks to change their cautious stance. At its most recent policy meeting, the dovishness of the ECB was again emphasized. ECB President Draghi signalled that the ECB is able and willing to use its full ‘toolbox’ of policy instruments to ensure inflation converges towards its target. By doing this, the ECB is adding a more dovish tilt to its forward guidance and is undertaking additional ‘verbal easing’. This more dovish position on the outlook for policy is clearly a reflection of a more negative economic outlook.

Our scenario for the deposit rate hence remains the same as last month, with the first rate hike only in the second half of 2020. The main motivation for it will be a move towards deposit rate normalisation out of negative territory. Financial stability considerations and the adverse impact on the European banking sector play an important role. However, in order to limit the policy tightening signal coming from this depo rate hike, the ECB is likely to decrease the upwards corridor between the refi and the depo rate to 10 basis points from 40 basis points at present.

In line with this and given the recent movements in the German long-term bond yields, we moderated the upward path of German 10 year yields expected for the forecasting horizon. In particular we now see them rising to 30 basis points by the end of 2019 and 60 basis points by the end of next year. Several arguments are underpinning this. The latest ECB forward guidance, including its reference to ‘mitigating’ policy measures if appropriate, could point to lower for longer short term rates in the case of a tiered rate system. Moreover, there is continued strong liquidity supply. Global risk aversion in the light of heightened economic and geopolitical uncertainty will also continue to weigh on German long-term yields. In circumstances where demand for German bonds is particularly strong, the prospect of shrinking supply because of an expected fall in Germany’s debt to GDP ratio could also be an important factor. In particular in the short run, the upward potential for the German 10 year bond rate seems non-existent. The extended Brexit-deadline, the global trade tensions and the expected new discussions on the Italian budget later on this year are likely to weigh on German rates.

In the US, monetary policy dovishness is also dominating (see Box 3). We therefore don’t expect any further rate hikes over the forecast horizon. In fact, given the expected moderation in the pace of growth, a rate cut around Q2 2020 has become likely. The run-down of the balance sheet will likely be completed by September 2019.

Box 3 - The Fed’s U-turn

The Federal Reserve has gone a good deal further in the monetary policy U-turn it started at the start of the year. The US central bank shelved all rate hike bets for the remainder of the year and is now pursuing an end to its balance sheet run-off by September. Moreover, the new Fed projections pencil in only one more rate hike this cycle (2020). Patience appears to be the central bank’s key word. Fed chair Powell seemed discouraged by the fact that the central bank didn’t achieve its 2% mandate “in a more symmetrical way”. One of the main drivers behind the Fed’s rigid pace of rate hikes last year was an expected inflation overshoot which didn’t materialize. Fed governors now want firm evidence of higher inflation before taking more action. Dark international clouds are piling up above the economy. Therefore, the Fed made clear that there’s no rush to act in “one direction or the other”, stating that “It may be some time before the outlook for jobs and inflation calls clearly for a change in policy”.

The updated Fed dot plot mirrors the Fed’s wide-shared willingness to stay side-lined, at least for now. The median policy rate forecast for this year declined from 2.875% in December (2 hikes) to 2.375% in March (no hikes). Importantly, 11 out of 17 governors backed this unchanged policy view, compared to only 2 out of 17 in December. The 2020 median federal funds rate estimate dropped from 3.125% to 2.625%. That should be the final rate hike this cycle, with the 2021 median at 2.625%. FOMC Minutes of the March policy meeting reflected Fed Chair Powell’s doubt though that it shouldn’t be taken for granted that the next move will be a rate hike rather than a rate cut. Short term interest rate markets currently discount a 40% probability of a rate cut at the Fed’s final meeting this year (December 11).

Apart from the dovish shift in the new dot plot, the Fed altered its balance sheet normalization principles and plans. The Fed intends to slow the pace of the decline of its balance sheet over coming quarters. The Fed currently lets USD 30bn in Treasuries and USD 20bn in mortgage-backed securities (MBS) mature on a monthly basis without replacing them. The cap on monthly redemptions of US Treasuries will drop from the current level of USD 30bn to USD 15bn beginning in May 2019, before ending them altogether at the end of September. The Fed’s balance sheet shrunk from over USD 4.5tn at the start of the run-off in Q4 2017 to below USD 4tn currently. By the end of September, we estimate it to be around USD 3.75tn. That’s far higher than original estimates of a decline towards levels in the area of USD 2.5tn.

All historical quotes/prices, statistics and charts are up-to-date, up to and including 15 April 2019, unless stated otherwise. The views and forecasts provided are those of 15 April 2019.