The ECB’s interest rate policy is counterproductive for growth

According to the Bank for International Settlements (BIS), the share of ‘zombie’ firms in the major industrialised countries has been steadily increasing since the 1980s. Under normal market conditions, these firms would disappear and make way for fundamentally more productive and profitable ones. In the literature, poor financial health of the banking sector and the low interest rate policy of central banks are cited as two important reasons for the survival of these ‘zombie’ firms. Said firms crowd out lending for investment by more productive firms, and thus weigh on productivity and employment growth. A first step by the ECB towards interest rate normalisation in the near future would therefore enhance the growth potential of the euro area economy.

More and more ‘zombie’ firms

Recent research by the Bank for International Settlements (BIS) shows that the share of so-called ‘zombie’ firms in 14 major industrialised countries has been steadily increasing since the end of the 1980s. Under normal market conditions, these firms would disappear and make way for structurally profitable and more sustainable firms.

The ECB, the OECD and the BIS, among others, have recently carried out research on this subject. It suggests that the poor financial health of the banking sector, e.g. measured by the Price-to-Book-ratio, is an important potential explanation of why such ‘zombie’ firms can survive (see Figure 1).

Figure 1 - Financial health of banking sector important determinant for share of ‘zombie’ firms (in percent)

Financially weak banks have an incentive not to acknowledge or write-off problematic loans if this would jeopardise the banks’ capital ratios. The problematic loans are often refinanced on a recurring basis, seemingly without any visible negative impact on the banks’ balance sheets. As part of the solution to this specific problem, a recent ECB report stresses the importance of efficient bankruptcy laws, which facilitate corporate restructuring. This would make it easier for structurally non-viable companies to leave the market in favour of more productive ones.

Monetary policy is part of the problem

In addition, the ECB’s current ultra-accommodative monetary policy encourages the continuation of loans to ‘zombie’ firms - loans which could not be financed at a more ‘normal’ rate of interest (see Figure 2).

Figure 2 - Low interest rate boosts ‘zombie’ share (in percent)

These ‘zombie’ loans partly replace the financing of investments by more productive companies, which disrupts the efficient allocation of capital. The BIS therefore warns that this weighs on macroeconomic investment and productivity growth and on employment. OECD research supports this conclusion. The BIS also states that, since the Great Financial Crisis, monetary policy has contributed to the structural decline of potential real GDP growth in most OECD countries.

‘Zombies’ in the public sector

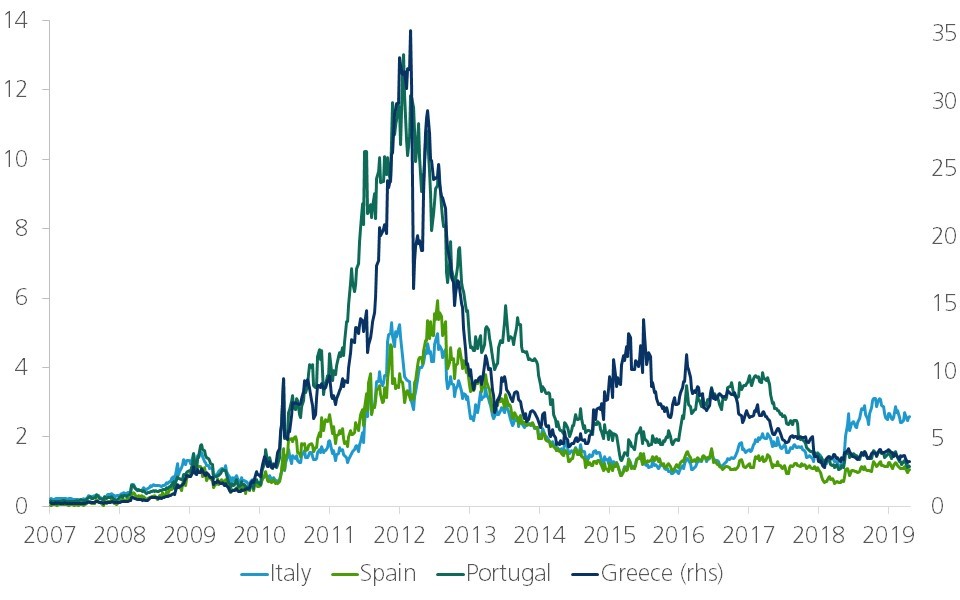

The market-distorting effects of extreme low interest rate policies are reflected not only in the private sector, but also in yield spreads between euro area government bonds (see Figure 3).

Figure 3 - Euro area public finances on life support by ECB (10 year government bond yield spreads, in percentage points)

Like the credit risk premium for ‘zombie’ firms, these government bond yield spreads no longer reflect the underlying economic reality, including the true credit risk. The most extreme example is the Greek 10-year government bond yield, which at present only offers a risk premium of 3.4 percentage points above the German Bund yield. The fact that this risk premium is highly artificial becomes clear when we consider that Greece had a gross public debt of 183% of GDP in 2018, which was only sustainable because a large part of that debt is held by other euro area governments. By keeping the cost of financing public debt artificially low, monetary policy reduces the pressure on governments to put their budgets on a sustainable path.

More normal interest rates would boost growth

Through its unconventional monetary policy, the ECB has undoubtedly saved the European economy from a deeper recession following the Great Financial Crisis. Since then, however, the undesirable side effects have gradually outweighed the benefits. In order to boost investment, employment and, ultimately, inflation, the ECB should therefore start normalising its policy interest rates as soon as possible. Not only does an unchanged policy stance hardly contribute to achieving the ECB’s inflation target (see KBC Economic Opinion of 30 April 2019), it also undermines the growth potential of the European economy.