Republicans regain momentum in this year’s midterms

The political wind is turning rapidly in the US midterm elections. The odds of a Democratic victory had increased markedly in the summer months thanks to a string of legislative victories and the unpopular Supreme Court decision on abortion. Polls gave Democrats a 1.9% advantage in September. However, rising interest rates and high inflation figures have helped Republicans regain momentum. Polls now give Republicans a 1.3% advantage. This election will have important economic consequences. A Republican win will doom Joe Biden’s legislative agenda and increase the risk of prolonged government shutdowns. A Democratic win on the other hand, might lead to increased spending on climate change and social care among other policy initiatives. The stakes could not be higher.

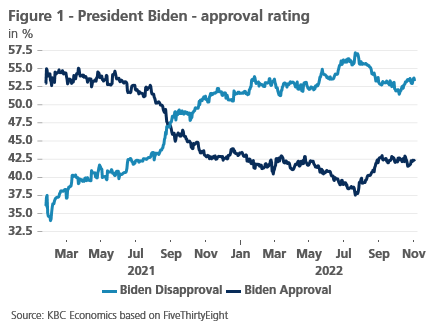

The US midterms, held on 8 November, are typically a referendum on the ruling president, often translating into a significant loss for the party in power. Historically, the party controlling the White House has lost an average of 28 House seats out of 435 in midterm elections. With gas prices reaching 5 USD per gallon in June and president Biden’s net disapproval rating reaching double digits, history seemed bent on repeating itself. Republicans held a solid 2.6% average polling lead in June.

Nonetheless, over the summer months the political momentum shifted. In June, the US Supreme Court decided to overturn the constitutional right to abortion, a decision around 60% of Americans disapprove of[1]. Gas prices also decreased by around 1 USD per gallon over the summer.

Furthermore, President Biden scored a string of legislative victories on issues such as gun control, subsidies for the semiconductor industry and veteran health care. The most important recent legislative success however was the Inflation Reduction Act. This law will put the US within striking distance of its commitment to reduce greenhouse gases to 50% below 2005 emissions by 2030. It will also reduce inflation by lowering prescription drug costs, while introducing a 15% minimum tax on corporations and reducing the deficit by around 300 billion USD in the coming decade.

These turnarounds temporarily gave Democrats the upper hand. In September, polls gave Democrats a 1.9% average lead in the generic ballot. Meanwhile, President Biden’s net disapproval rating briefly veered back into single digits (see figure 1).

Worrying economic data bolster Republicans

In recent weeks, however, the attention shifted back to the economy. Driven by a tight labour market and high energy prices, headline inflation remained at a still elevated 8.2% year-on-year in September. Core inflation reached 6.6%, far above the 2% target set by the Fed. As nominal wage growth failed to fully keep up with inflation, real wages declined by 3% on year over year basis.

Inflation aside, voters are also concerned about economic growth. Growth was negative in the first two quarters of 2022 before rebounding last quarter. Forward-looking indicators do not spell good news, however, as consumer confidence recently reached record lows and producer confidence indicators (e.g. PMIs) are in recessionary territory. Tighter monetary policy is also driving up mortgage rates, which are now around 7%, and is driving down residential investments.

The poor state of the economy and the cost-of-living crisis are likely to have a big impact at the ballot box. According to a recent NY Times poll[1], 45% of registered voters think the economy or inflation is the most important problem facing the country today. Furthermore, 47% of voters think the GOP would do a better job of handling the economy, while only 28% think the same of Democrats[2]. The latest economic developments have helped Republicans rebound in the polls. They now lead Democrats by 1.3%.

A divided Congress?

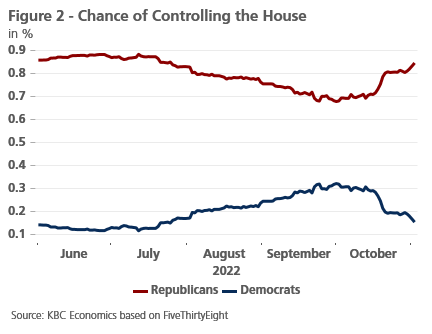

Despite their small polling lead, Republicans are still clear favourites to win the House. Polling models compiled by Fivethirtyeight now estimate that Republicans have an 85% chance of victory (see figure 2). This high probability is mainly due to a Republican redistricting advantage. Democrats need to win the popular vote by an estimated 2.5% to overcome this advantage[3].

The Senate map is relatively favourable to Democrats in this midterm election. In the House, all members are up for re-election, but in the Senate, only a third of senators are elected every election cycle. This cycle, Republicans are defending two seats in states Biden won, while Democrats are not defending any seats in states Trump won. Furthermore, Republicans have fielded relatively unpopular candidates in key swing states. FiveThirtyEight therefore gives Democrats a 45% chance of holding the Senate. Democratic chances to win 52 or more Senate seats are estimated at 18%.

Major consequences

The outcome of this election will have important economic consequences. If Republicans take one or both chambers, Biden’s legislative agenda will be doomed. Furthermore, in 2023, the debt ceiling will likely need to be raised again. Republicans could then use the threat of default or government shutdowns to extract political concessions, either of which would cause unnecessary economic pain (see Economic Opinion 31 January 2019).

If Democrats maintain control of the House, however, they will likely expand their majority in the Senate. This will allow them to advance on major policy priorities that are currently blocked by conservative Democratic senators. They might further expand funds to combat climate change, expand social care or increase taxation on the wealthy. They might also abolish the filibuster rule that requires 60 out of 100 Senate votes to advance most legislation. Democrats could then move forward with legislation on voting rights, immigration, and other legislation that could affect the economy.

Conclusion

On 8 November, the US is up for another nail-biting election. Though Republicans have the upper hand in the polls for the House, Democrats still have a decent chance to win. What is certain, is that the election will have major impact on what turn the country is taking. Climate change, social policy, immigration, the debt ceiling and much more are all on the ballot this November.

[1] Poll: Abortion, Trump boost midterm prospects for Democrats (nbcnews.com)

[2] Cross-Tabs for October 2022 Times/Siena Poll of Registered Voters - The New York Times (nytimes.com)

[3] Poll: Abortion, Trump boost midterm prospects for Democrats (nbcnews.com)

[4] America’s congressional maps are a bit fairer than a decade ago | The Economist