Predictable midterm results. Still unpredictable Trump.

Economic Opinion

The results of the much-anticipated US midterm elections are largely in line with polling and market expectations ahead of the vote. Republicans expanded their margin of control in the Senate while the Democrats took back control of the House of Representatives. The result is a divided US Congress that will be unable, and mostly unwilling, to achieve anything on the legislative front. House Democrats will, however, now be able to launch investigations into President Trump and the many scandals plaguing his inner circle. As Democrats dig into these scandals, Trump is likely to focus on appealing to his base and distracting from any investigations. This means more extreme rhetoric and doubling down on his aggressive foreign policy agenda, including the trade war with China.

The market reaction to the US midterm elections has been generally subdued as the results were widely anticipated (Republican majority in the Senate; Democrat majority in the House). Given the vast differences between the Democrats’ and Republicans’ legislative agendas, and the precedent set in past years to reject bi-partisan compromise, little to nothing is expected to be accomplished over the next two years. Indeed, the more progressive wing of the Democratic party in particular, will likely urge party leadership to move further left rather than compromise with the current administration. Despite the stalemate in Congress, however, US political developments may still rock the global economy going forward.

The power of house committees

Control of the House of Representatives means Democrats have control of the House committees, which means they can launch subpoena-backed investigations into Trump’s financial dealings, Russian election interference in 2016, and security-clearance or other corruption/ethics scandals that seem to be common with the current administration (scandals which the Republican-controlled House were mostly uninterested in investigating). Though impeachment followed by removal from office is unlikely even if severe wrong-doing is uncovered, since conviction and removal would have to be approved by a two-thirds majority in the Senate, the expected onslaught of investigations will still weigh on the administration and its resources. As a result, Trump will be on the defense, and unable to push through his domestic agenda. With an eye towards the 2020 elections, his actions and rhetoric, particularly towards foreign policy and trade, could eventually become even more extreme and confrontational.

The trade war continues

One area where a divided Congress is less able to stymie Trump is on trade policy. Though the President doesn’t have specific power over international trade according to the Constitution, over time Congress enacted legislation that gave the President more authority to decide upon tariffs under certain circumstances without congressional approval. For example, if a specific domestic industry is injured or threatened by increased import competition, the US President can levy a temporary tariff of maximum 15% as a safeguard measure. For the tariffs on steel and aluminium imports into the US imposed earlier this year, Trump relied upon section 232 of the 1962 Trade Expansion Act. This states that the President is authorised to take actions that are deemed necessary if the Secretary of Commerce concludes that certain imports threaten national security. Under that same provision, the US Trade Representative is currently investigating whether the imports of automobiles and automotive parts threaten to impair national security. As long as President Trump keeps using these presidential trade authorities to impose new tariffs, the role of the US Congress is very limited, regardless of its composition.

Furthermore, though there may be a momentary lull in trade war escalation, that could change if Trump needs to distract the electorate from an onslaught of investigations. In particular with regard to China, the ongoing trade war is far from over yet. As the import tariffs are under control of the executive branch of the President, and because Democrats are unlikely to turn the trade war into a major partisan battle (there is some bipartisan support for pushing China to change its trade practices), prospects for a rapid truce are gloomy.

On the other hand, US Congress does have a say in the approval of new trade deals. This is important in light of the recently agreed trade agreement between the US, Mexico and Canada (USMCA), which replaces NAFTA. The ratification process by Congress could pose a hurdle. If Congress demands a lot of modifications, negotiations may drag out. However, since no deal at all between the three large trading partners would cause significant damage to the US economy, it is most likely Congress will eventually approve the USMCA.

Budget showdowns likely

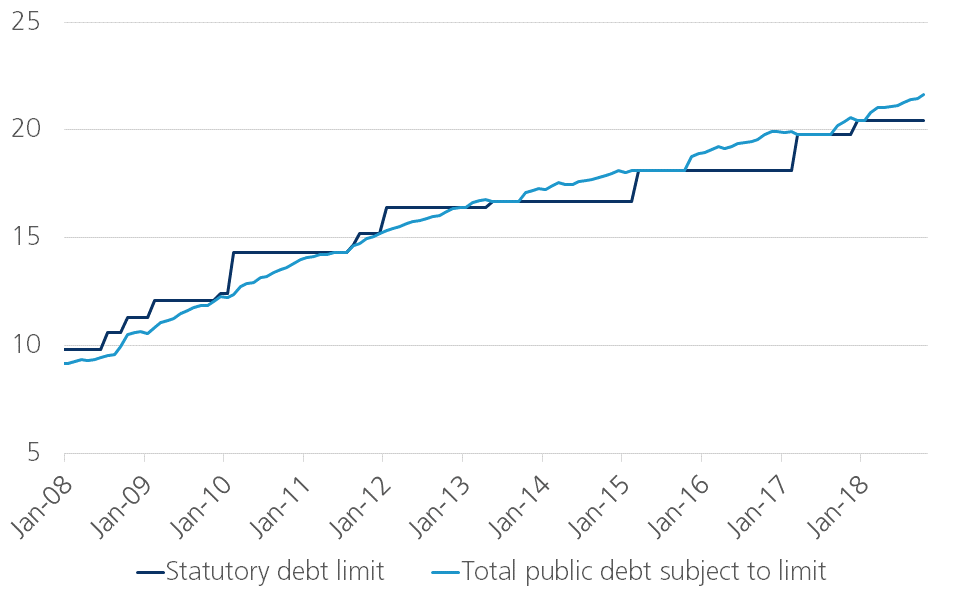

A divided and uncompromising Congress also increases the likelihood of major showdowns when it comes to raising the debt ceiling (suspended until March 2019, figure 1) and approving spending bills. With Democrats in control of the House, they may try to leverage the threat of a government shutdown in order to push forward some parts of their agenda. At the same time, if Trump remains adamant about securing funding for a border wall, something mostly opposed by Democratic leadership, the two sides may find it difficult to reach an agreement. The threat of a shutdown raises economic uncertainty, but overall both parties will likely want to avoid extended government shutdowns (so as to avoid blame for the consequences). However, rather than a major omnibus bill containing any fiscal stimulus (like the $1.3 trillion bill approved in March 2018), Congress is more likely to fund the government through much smaller stop-gap measures or continuing resolutions. A compromise on fiscal spending that both sides see as beneficial ahead of the 2020 elections (such as infrastructure spending) could still be reached, but considering current political polarization, the chances are slim.

Despite a divided Congress with little room on either side for legislative progress, US politics through 2020 are unlikely to be boring. Whether due to new Democrat-led investigations, Trump increasingly focused on his foreign policy and trade agenda, or major showdowns over the funding of the US government, the path over the next two years could be rather bumpy. As a result, increased economic and financial market uncertainty going forward would not be unexpected.

Figure 1 - US debt and the (currently suspended) debt limit (in trillions USD)