EU cohesion policy remains essential for Eastern Europe’s economic development

The EU is working on its new multi-annual budget framework. A major discussion issue will be the new EU cohesion policy budget. Central and Eastern Europe benefited substantially from recent EU fiscal transfers, but more EU support will be required for the region’s economic development. Reorienting the EU budget to the greening of the European economy and other policy priorities may cause a major disruption to the region. At the same time, the proposed European Green Deal may create new opportunities for the region. It is important that future EU cohesion policy continues to support income convergence through income and productivity growth as it has been doing in recent years.

Many perceive that Central and Eastern Europe is mainly a beneficiary of EU agricultural funds. For instance, Poland receives substantial transfers from the EU common agricultural policy. However, for the region as a whole, the inflow from the EU structural funds is much more important. The main purpose of these intra-European transfers is to support the real income convergence between the emerging economies in Central and Eastern Europe and their economically more advanced EU-partners. In order to achieve such convergence – or ‘cohesion’ in the EU terminology – funds should go beyond supporting consumption growth. The financial support should also be used for investment in poorer member states and regions within those member states. In particular, such investments should support productivity growth. But is this EU cohesion funding effective? As a substantial part of the entire EU budget is spent on this policy domain, it is a very relevant question. And at this moment, the discussion on the new EU multi-annual budget is starting. In order to shed some light on this debate, below are a number of insights based on a simple analysis.

Income transfer without distortions

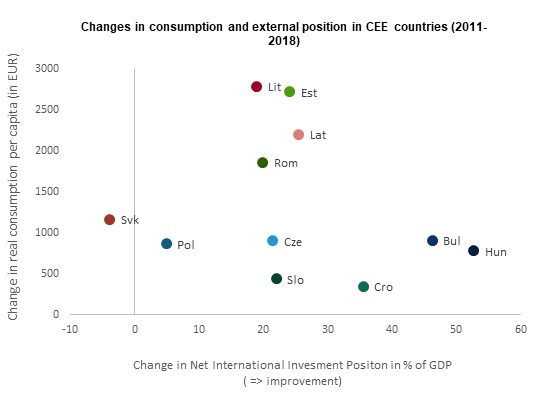

Transfers from EU funds flowing to newer EU member states in Central and Eastern Europe can be considered as additional income for these receiving countries. From a theoretical perspective, such fiscal transfers support domestic consumption and hence overall domestic demand. Moreover, economic theory argues that these incoming transfers represent a positive shock that permits the receiving economies to live with a higher consumption and relatively strong (real) exchange rate without violating the long-term sustainability of their external position. A closer look at the development of the net international investment positions and real consumption (expressed in euros) over the last seven years (a period equivalent to the current EU multi-annual budget) in Central and Eastern European countries confirms these theoretical expectations. All Central and Eastern European countries have managed to significantly increase their real consumption in the past seven years and to improve their net international investment positions. This development took place against the backdrop of virtually stagnating real exchange rates. In other words, consumers in Central and Eastern Europe are currently able to spend much higher amounts without jeopardising the external balance of their economies (with the only exception being Slovakia – see Figure 1). This observation signals that EU funds have contributed substantially to economic development in the region as well as to the average welfare level of people living in the region.

Changes in consumption and external position in Central and Eastern Europe (2011-2018)

From higher transfers to higher productivity?

If the impact of EU fiscal transfers were restricted to boosting consumption – even without jeopardizing the external balance, they would only have a short-term and non-lasting effect. The ultimate goal is to boost income levels in the Central and Eastern European region, and hence welfare, in a permanent way. In order to check whether this is the case, we aim to evaluate the impact of EU transfers on receiving countries’ productivity. This is the central issue in the debate on the long-term impact of EU cohesion policy. To this end, we run an empirical test1 to check whether there is a positive relationship between the volume of funds Central and Eastern European countries have drawn from the EU cohesion funding and their productivity, proxied by GDP growth per capita. Our results indicate that an additional transfer of 1% of GDP increased GDP growth per capita by slightly less than 1% during the period 2012-2018. Figure 2 indicates that this average effect holds for all countries but that the extent of the convergence differs.2 Countries with a higher initial GDP per capita benefited less from the fiscal transfer, in line with the predictions from convergence theory. Hence these results confirm that EU structural funds did have a positive impact on economic development in Central and Eastern Europe in recent years by enhancing productivity growth, with the largest effects in the most lagging economies.

Average annual real GDP growth in Central and Eastern Europe relative to inflows from structural funds (2012-2018)

New EU budget: transition, not disruption

Based on these insights one can conclude that EU cohesion policy is important for supporting long-term income convergence through consumption growth as well as productivity growth. As continued support from EU cohesion policy is likely to benefit economic development in Central and Eastern Europe further, it seems wise to maintain the main principles of the current EU budget framework in the future.

However, the actual impact of future cohesion policy will be more limited as income levels have increased substantially throughout the region. Moreover, the impact may be more uneven across countries. In particular countries with still relatively low GDP per capita and a high ability to draw EU subsidies, like Poland and Hungary, might benefit from extending the current fiscal transfers in the new EU multi-annual budget. By contrast, richer countries in the region may benefit less, although also for them the support will be essential to continue their ongoing positive development.

However, it is unlikely that current EU fiscal support for the region will be continued as it is. It is clear that the EU institutions have new spending priorities, including an emphasis on green policies rather than traditional investment projects, often focused on infrastructure. This would imply a major disruption to Central and Eastern Europe. Despite the many opportunities a greening of the regional economy may bring along, it will be a structural break with many traditions, in particular in some industrial sectors. It is important that the next EU budget framework will acknowledge the likely disruptive nature of a too drastic shift of attention. Moreover, as our analysis shows, the focus should remain on long-term economic development in the region, which is likely to be helped more by a gradual transition than a sudden and disruptive change of approach.

1. For this test we run a simple panel regression analysis based on data for all Central and Eastern European economies for the period 2012-2018. It tests the relationship between real GDP growth per capita (expressed in real euros) and the annual transfer received from EU cohesion funds. We include the initial level of GDP per capita as an additional explanatory variable in the regression specification in order to account for the fact that less developed countries have a longer path of real convergence ahead and, therefore, as growth theory suggests, should grow faster. Results are statistically significant.

2. The contour lines in figure 2 represent average annual growth rates of real GDP per capita for a given initial convergence level (GDP per capita as % of euro area GDP) and a given average inflow of transfers from the EU Structural funds over the seven-year period.