Hard Brexit will make Central European economies bleed

As the chaos surrounding Brexit continues, the likelihood of a hard Brexit or no-deal Brexit increases. Various impact studies have measured the repercussions of such a scenario for European economies. Most public attention has been focused on the very negative impact a hard Brexit would have on small, open Western European economies, like Ireland, the Netherlands and Belgium. However, the effect on Central European economies is also substantial due to their general trade openness, their strong integration in European value chains and their specialization in the automotive industry with close ties to the British economy. Based on our new simulation exercise, the short-term impact of a no-deal Brexit results in a substantial reduction in value added, and hence in GDP growth for these economies. Slovakia appears to be most sensitive to a no-deal Brexit, although the impact on the Czech Republic, Poland and Hungary is substantial as well.

From uncertainty to impact assessment

The consequence of an eventual no-deal Brexit or hard Brexit on European economies is very uncertain. No one can know for how long and how significantly the trade relations between the EU and the United Kingdom would be affected. Consequently, simulation tools indicate that the impact of a no-deal Brexit depends on the size, nature and duration of the initial shocks.

In our latest Brexit simulation, we focus on the short-term macro-economic impact of the initial trade shock. Various impact studies indicate that the disruption of trade relations with the UK – the decline in final demand for European goods in the UK – would have the biggest negative impact on traditional and nearby trading partners such as Ireland, the Netherlands or Belgium. In our simulation we use world input-output tables (WIOD) that give detailed information about interconnections of industries across countries. Using WIOD data, we assume UK final demand for all products and services imported from the EU falls by 25%. We compute the ultimate impact on value added under the assumption that the hard Brexit shock does not change significantly the way goods are produced. Hence, the outcome of this simulation exercise reflects the short-term effect of a hard Brexit.

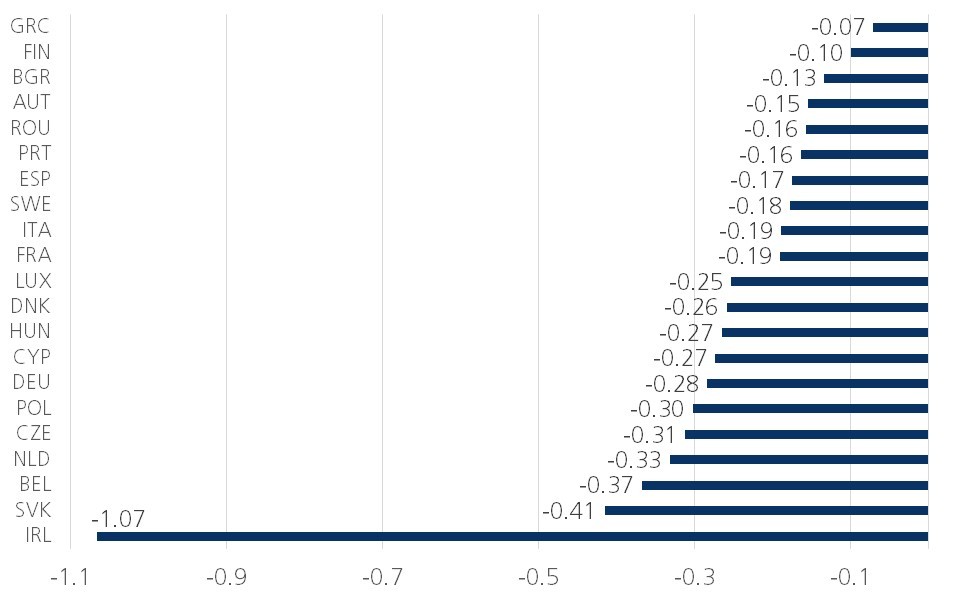

Our results confirm that several smaller Western European countries are very sensitive in a hard Brexit scenario. Nevertheless, according to our analysis, a number of Central European countries would be hit as well. Compared to previous studies, which neglected either the strong interconnections in European value chains or the short-term impact, it appears that Central Europe will be much more hit by a hard Brexit than previously presumed. However, the impact across the region won’t be homogeneous. Figure 1 indicates that Slovakia would be hit most by a hard Brexit. Total value added would drop by 0.41%, compared to a drop of 0.31% and 0.30% in Czech Republic and Poland respectively. Hungary would also be affected with value added declining by 0.27%. The relative numbers matter, however: the impact of a hard Brexit on the Slovak economy would be 50% larger than the impact on the Hungarian economy

Figure 1 - Hard Brexit Impact, % change in value added - Based on 25% decline in UK final demand for imports from EU

Heterogenous impact

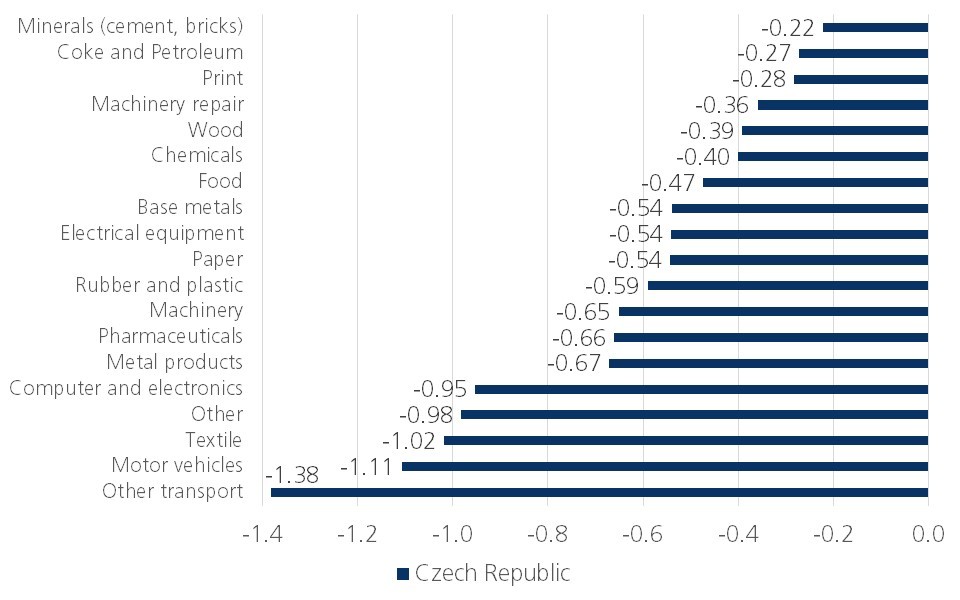

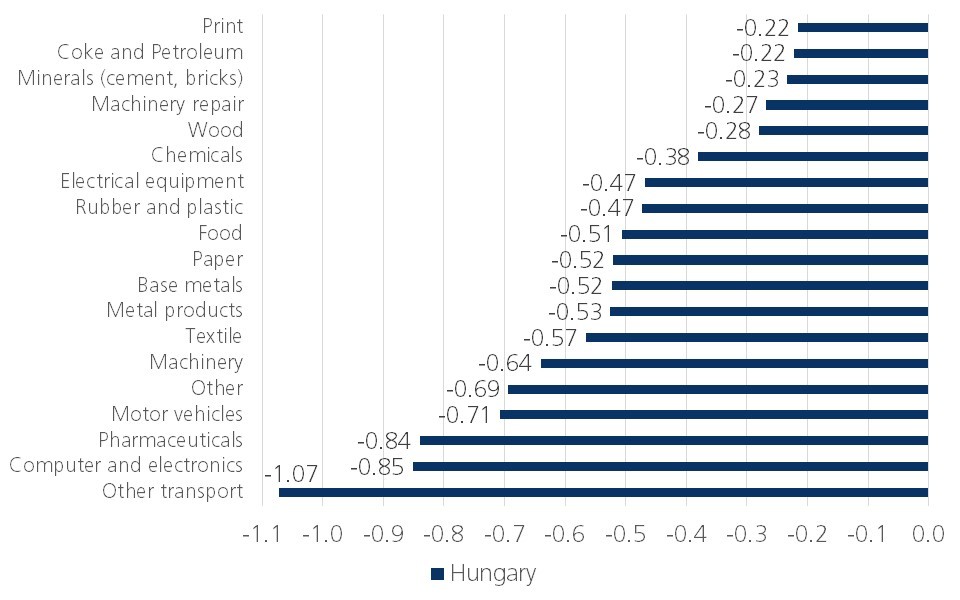

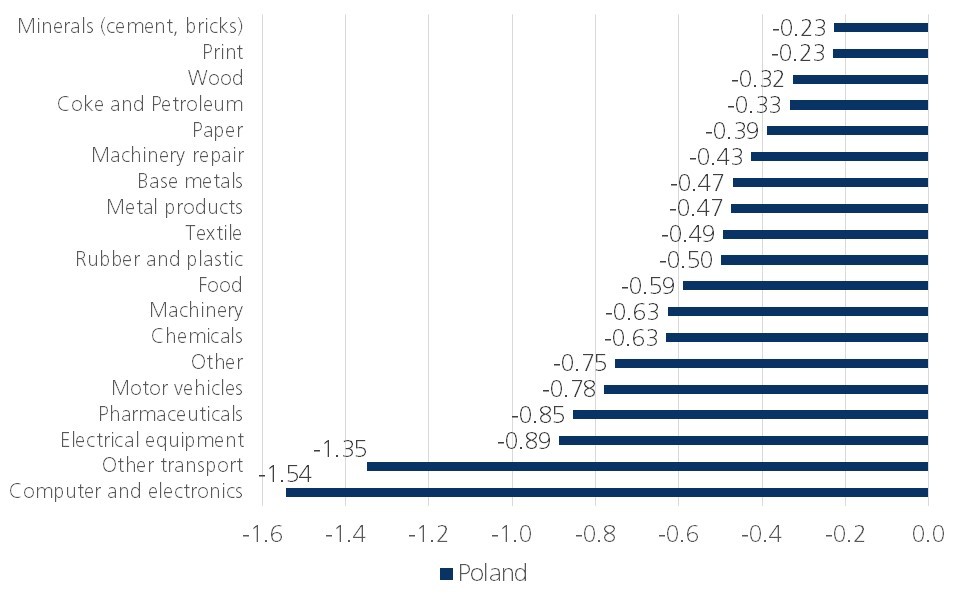

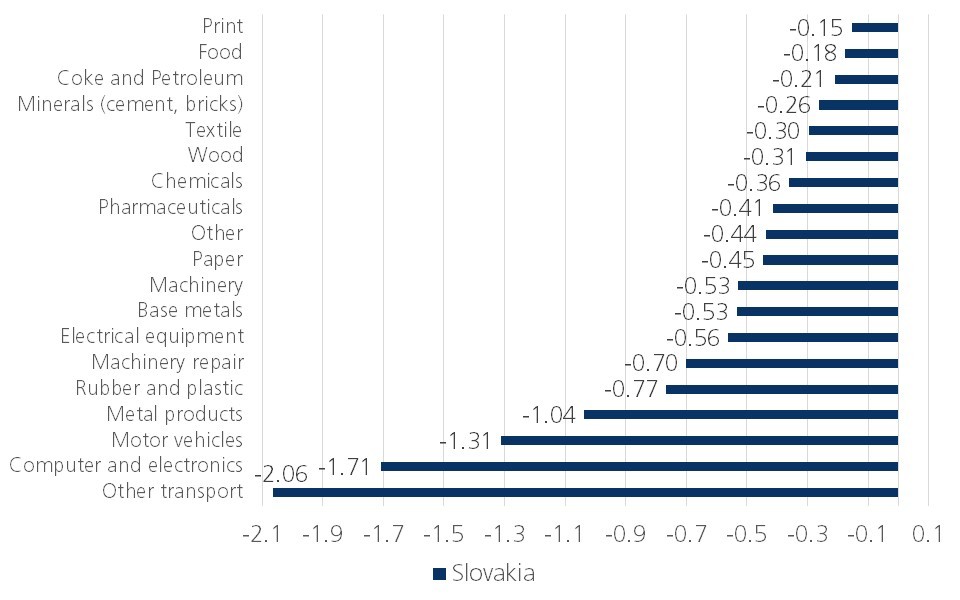

The short-term Brexit impact differs across countries as well as sectors in the Central European region. Our next step in the simulation exercise distinguishes between the impact on various industrial sectors in each Central European economy. The results are summarized in Figures 2-5.

Figures 2-5 - Hard Brexit impact on Central European economies’ industrial sectors (%) - Based on 25% decline in UK final demand for imports from EU

In all countries, the automotive industry (motor vehicles and other transport) would be hit hard. Given the importance of this industry throughout the region and its international interconnectedness, this is no surprise. Computers and electronics are also very sensitive to a hard Brexit scenario. Country specific factors include the sensitivity of electrical equipment in Poland and pharmaceuticals in Poland, Hungary and Czech Republic. Hence, all major industries in the region are likely to be affected in the short-run after Brexit occurs.

Just the beginning

These results show that a no-deal Brexit will have immediate and rather distorting consequences for many industrial activities in Central Europe. Moreover, trade disruptions between the EU and the UK are only a sort of “starter” for further shocks that may negatively affect demand and supply in Central Europe. Those who believe that Brexit will only affect their business in the long-run should be warned. Immediate preparations are required to mitigate the full blunt impact of a no-deal Brexit. Governments can intervene in the market to support domestic companies. Moreover, as the region attracts substantial foreign investments in all main industrial sectors, the multinational structure of companies may provide some shelter against the immediate impact. Nevertheless, it is clear that Brexit will have a distorting effect on Central European economies. It is better to be prepared.