Ireland - Economic update June 2019

Higher frequency indicators suggest that the Irish economy will continue to grow but at a somewhat moderated pace over the course of 2019. Provisional retail sales data for April show that the volume of sales increased by 4.0% yoy, following a weather-boosted March increase of 5.1% yoy. Excluding car sales, the volume of sales increased by 5.6% yoy. Nine of the 13 retail sectors saw increases, with sales growing strongly in both big and infrequent purchase areas (electrical goods +25.9% yoy) as well as more frequent and less expensive areas (pharmaceuticals, medical and cosmetic articles +11.3% yoy).

The latest Irish jobs figures show that employment increased by 3.7% yoy in Q1 2019, which is the fastest pace in two years. This rate of increases amounts to an increase of 81k jobs in last year, which is the largest gain since the third quarter of 2007. The job gains were broadly based across sectors and regions. Importantly, the unemployment figures were revised down strongly, with the May unemployment rate now sitting at 4.4% (April now at 4.6% compared to 5.4% before revisions). We think the pace of job gains reflects a healthy Irish economy but may somewhat overstate the underlying growth rate.

Preliminary estimates for Irish earnings show that in Q1, average weekly earnings increased by 3.4% yoy. Eleven out of the 13 sectors saw an annual increase in pay. Private sector pay continues to drive the overall trend, with average weekly income in the private sector growing by 4.2% yoy in Q1. Public sector salary growth eased further in Q1 to 1.2% yoy. The increase in weekly earnings partly reflects a rise in the number of hours worked. In terms of wage inflation, average hourly earnings increased by 2.3% yoy in Q1. Wage growth has not necessarily led to price inflation, as the May inflation figure still remains at a relatively low 1.0% yoy. Increases in restaurants and hotels and housing costs, such as rent and utilities, contributing the most to consumer price inflation.

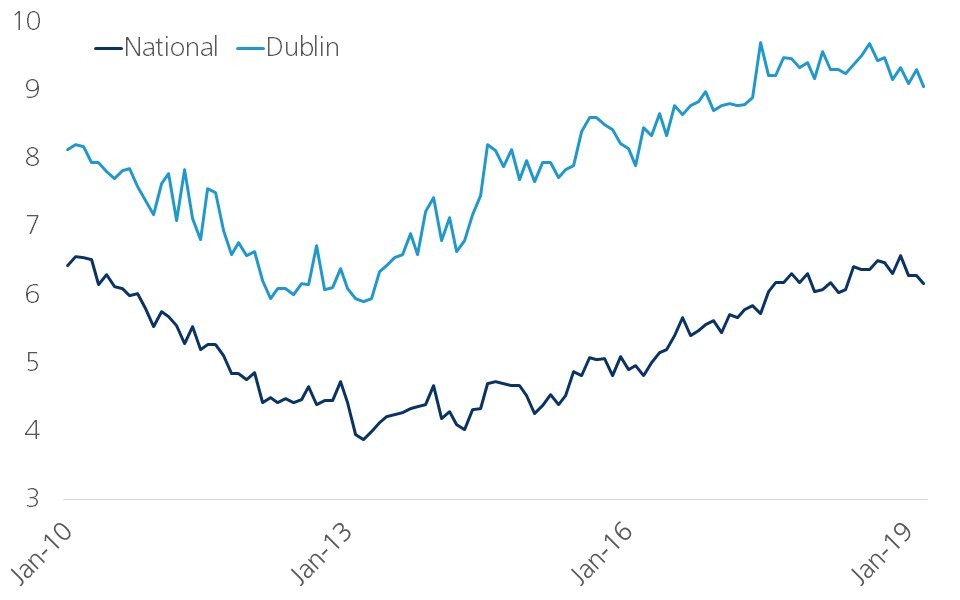

Meanwhile, house price inflation has continued to ease, with a modest monthly rise in April translating to annual growth rate of 3.1%, the slowest residential property price inflation rate in 6 years. This marks the first time since 2013 that property price inflation has been below earnings growth. Affordability and supply continue to push inflation towards a more sustainable path, particularly as house price to earnings ratios now stand at around 6 nationally and 9 in Dublin (figure IE).

Figure IE – Housing affordability and supply continue to push inflation towards a more sustainable path (house buyer market median price ratio to national average earnings)