Irish economic update January 2019

High frequency data continue to point to a slight easing in the economic expansion in Ireland. Retail sales data for November show that the volume of sales increased by 3.6% yoy, or 1.9% yoy when excluding car sales (previously 6.4% yoy and 4.2% yoy respectively). At face value this figure appears softer than what would have been expected given that Black Friday and Cyber Monday deals often give November retail sales a boost, but the reference period for November excluded these two major shopping events. Even still, nine of the 13 sectors posted annual growth.

The Irish unemployment rate held steady at 5.3% in December, bringing the average in 2018 to 5.7%. While the improvement in the unemployment rate has eased over the course of 2018 as the Irish economy moves closer to full employment, we expect the average unemployment rate in 2019 will drop further to 5.0% and edge up slightly in 2020 to 5.2% on the back of Brexit uncertainty.

Sentiment indicators highlight the uncertainty surrounding the Irish economy. Consumer sentiment remained unchanged in December as concerns for the Irish economic outlook, likely due to Brexit, outweighed optimism on consumers’ own personal financial situation. While PMI survey data continue to signal expansion, the manufacturing indicator hit a nine-month low and the services index posted the weakest reading since November 2017.

Irish house price inflation has eased further in November to 7.1%. This has been led by a slowing in Dublin property price inflation to 5% in spite of notably faster jobs growth in the capital than elsewhere of late. In recent months, property transactions have been more subdued in Dublin than elsewhere. This suggests that slowing demand likely linked to constraints associated with the Central Bank’s lending limits have become more influential.

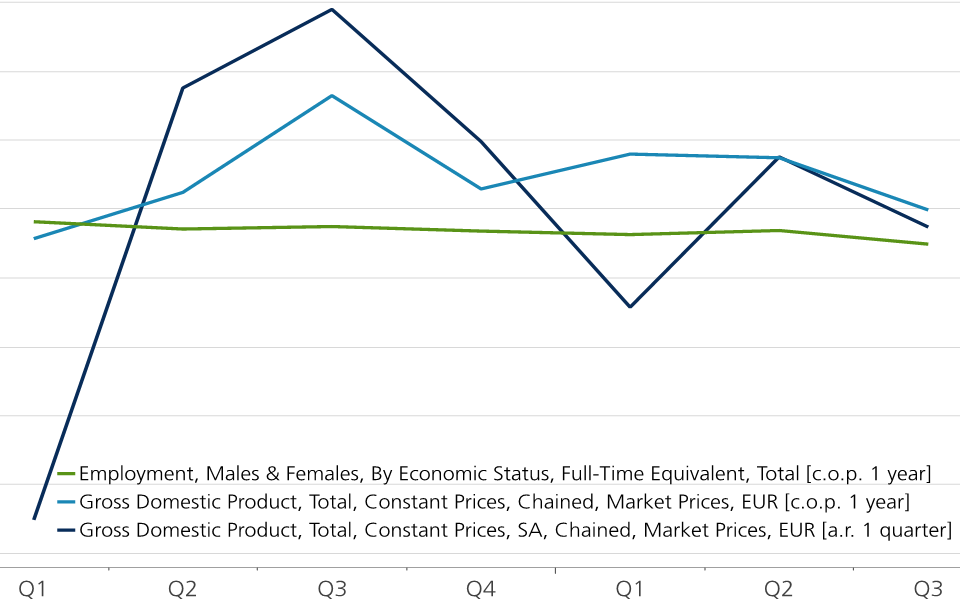

Figure IE1 - Irish growth slower but still solid (real GDP growth, in %)