Will there be gifts under the Christmas tree this year?

2020 has been a unusual year in many ways. Because of the coronavirus, we have become acquainted with lockdowns, social distancing and face masks. It has also been a year full of challenges for the retail sector. For the second time this year, all non-essential physical shops are closed. This closure will be evaluated at the beginning of December and the outcome of this evaluation will depend on the extent to which the pressure on hospitals has been sufficiently reduced. Until then, e-commerce will have an important role to play in the retail sector. But open or not, the sector is likely to face a challenging end-of-year period. Normally, December is a peak period for the retail sector, but the prospect of a sober end-of-year period with limited social contacts throws a spanner in the works. However, there is one glimmer of hope: the disappearance of some major spending has led to a sharp increase in savings. So there could be room for more generous gifts in some families.

Not a normal year

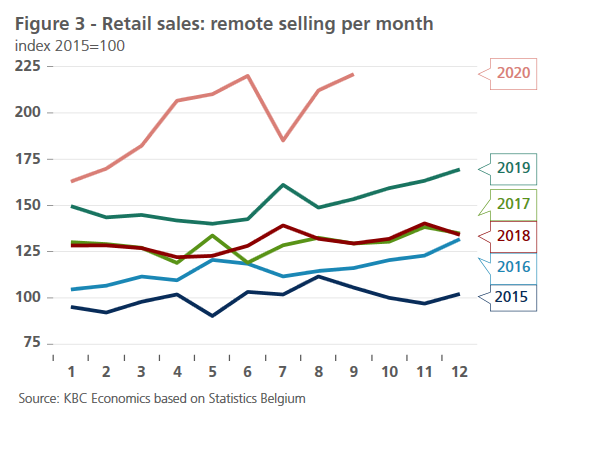

Unsurprisingly, 2020 has been an exceptional year for retail sales. The coronavirus has profoundly disrupted the normal purchasing pattern of many Belgians. The closure of non-essential shops during the first lockdown and the uncertainty caused by the spread of the virus have caused major changes in purchasing behaviour. Figure 1 shows an index of the volume of retail sales for 2020 compared to the figures for previous years (2010-2019). The latter are shown as a band marked by the highest and lowest monthly data points between 2010 and 2019. The figure shows that retail sales in 2020 were anything but normal. March and April, the months of the first strict lockdown, were remarkably weak months, while June and August showed stronger than normal figures.

What about the year-end peak?

As can be seen in the figure, December is traditionally the absolute top month for retail sales. Which direction the year-end sales will go is not entirely certain. It is an unusual year and there are various forces at play that work against each other. The most important hampering factor is undoubtedly the new lockdown. In November, all non-essential stores had to close their doors. At the beginning of December, this measure will be evaluated but an extension is certainly possible if the pressure on hospitals remains high and/or the hospital admissions do not fall to sufficiently low levels. Whatever is decided, Physical Christmas shopping will not be possible until December. And even if the measures are relaxed after 1 December, it is unlikely that end-of-year parties will take place in their traditional form this year. After all, bringing large groups and different generations together is a bad strategy if we want to curb the spread of the virus and safeguard hospitals. Fewer or less extended family parties will in some cases also mean fewer gifts under the Christmas tree and this is a drop in demand that will probably not be compensated once we are allowed to get together in larger groups again.

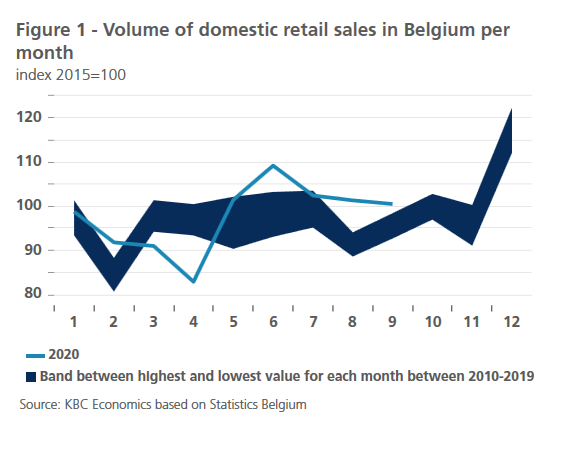

However, there are also reasons to believe that the gifts under the Christmas tree could be more expensive this year. After all, many important items of expenditure, such as travel and events, fell away this year. As a result, some Belgians were able to save extra. This is shown by the savings figures of the National Bank (figure 2). The balances on current accounts and savings accounts of Belgians increased sharply during the first lockdown. In uncertain times, it is often a reflex of the consumer to spend less in order to have some money for rainy days. But during the corona lockdown, the lack of opportunities to spend money also played an important role. This is demonstrated by the exceptionally strong recovery of demand after the first lockdown and the large crowds in shopping streets in the weekend before the second closure of non-essential shops.

E-commerce to the rescue

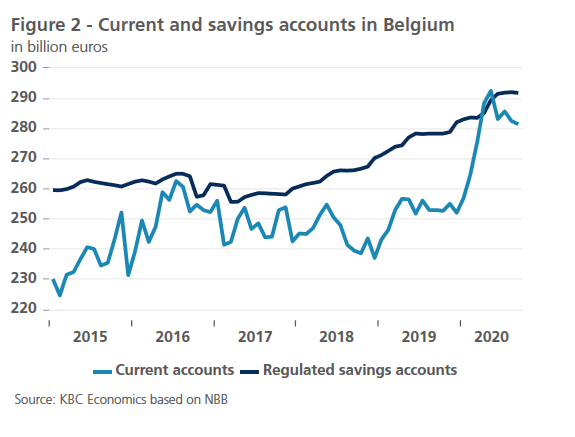

As during the first lockdown, e-commerce will have an important role to play in the coming weeks. Online sales have been on the rise in Belgium for a number of years, but the corona crisis has clearly reinforced this trend (figure 3). Now that non-essential shops are closed again and with some important sales and gift periods coming up, such as Black Friday, Sinterklaas and Christmas, it is likely that e-commerce will get another boost.

This expected trend also poses a challenge, both for the shops and for the consumer. After all, the e-commerce playing field is dominated by a few major players. The House of Marketing’s E-commerce Barometer 2019 for Belgium shows that 4% of all online sellers account for 87% of turnover. It will therefore be a challenge for the smaller online players (those with an online transaction value of up to €1 million) to reach consumers as long as the shop doors are closed.