Why is the UK in a recession?

Read the publication or click here to open PDF.

The UK formally entered a technical recession in 2023Q4 as it experienced two consecutive quarters of negative growth. The UK economy has been underperforming its peers in recent years. Several factors can explain this poor performance. The UK’s covid crisis was particularly severe and has caused a permanent decline in the employment rate. The UK suffers from low productivity growth due to a.o. tough zoning laws, high regional disparities and low infrastructure investments. Finally, Brexit has hurt consumers and exporters and has deterred investors.

Introduction

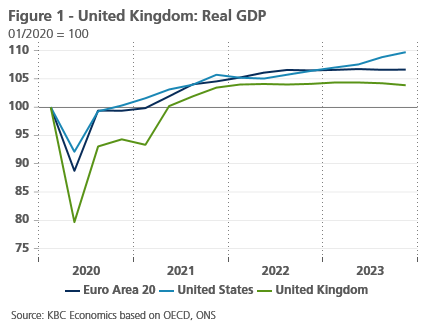

The UK has officially experienced a technical recession (i.e. two consecutive quarters of negative growth) in 2023. In Q4 2023, GDP growth declined by 0.3%, following a 0.1% decline in the third quarter. Britain’s economic underperformance is not confined to 2023, however. Since the Covid crisis started, the UK has strongly underperformed its peers (see figure 1).

UK has some important economic strengths

This underperformance is quite notable. The UK economy has some important strengths. The UK was less vulnerable to the 2022 energy crisis than its European peers as its gas production covers around half of its gas needs, and its oil production covers around two thirds of its oil consumption. Furthermore, the UK’s working age population continues to grow at a healthy pace. Thanks to the English language, the UK’s top universities and the role of London as a global financial center, the UK remains a magnet for immigrants. Notably, the decline in EU migration in the wake of Brexit has been fully compensated by a big surge in non-EU migration (see figure 2). This raises questions regarding the main drivers of the UK’s structural economic underperformance.

Covid hit the UK hard

A first cause of the UK’s relative underperformance relates to the covid crisis. Contact-intensive industries (such as accommodation, food services and entertainment) are very important to the UK economy. According to the Office for National Statistics, their gross value added declined by 37% from Q1 2019 to Q2 2020 and, more importantly, has not fully recovered since.

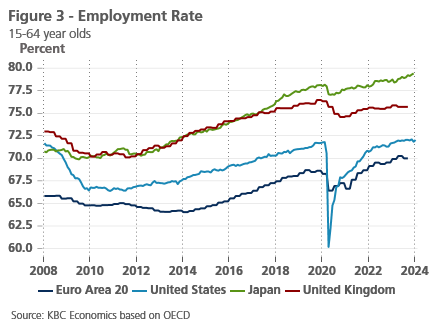

The UK government also mishandled the covid crisis. By delaying lockdown measures unnecessarily during the first wave, the UK suffered a high death toll per capita. The National Health Service was completely overwhelmed and has not recovered since. Patients continue to experience long delays. As a result, the economically inactive population now remains almost 500k higher than before the pandemic. Britain’s employment rate is now around 0.5 percentage points lower than before the pandemic. Most western peers, in contrast, saw an increase in employment rates in the same period (see figure 3)

Productivity growth remains low

Since the 2008 Financial Crisis, the UK has been suffering from a severe productivity growth problem (see figure 4). Its productivity only increased by 5.2% from Q2 2008 till Q4 2023 (i.e. on average around 0.3% per year). Among G7 members, only Italy performed worse.

The 2008 Financial Crisis hit the UK disproportionally hard. The size of the UK financial sector (as a % of gross value added) is almost twice as large as the eurozone’s and the UK thus suffered disproportionally. Yet, other factors have hampered productivity since. The UK has notoriously strict zoning regulations which slow productivity growth, as they hinder internal migration and greenfield investments.

The UK’s very large regional disparities also contribute to slow productivity growth, as the UK’s northern and eastern deindustrialized regions continue to have trouble catching up. GDP per capita in the North-East is 27% lower than the UK average.

The government has also underinvested in infrastructure. A recent study found that 11 % of the local road network across England and Wales are in poor condition and likely require maintenance in the next 12 months1. There is a similar need for more investment in rail infrastructure and 5G network infrastructure.

Finally, Brexit and the resulting loss of access to the EU single market has reduced the competitive pressure on UK and limited the potential economies of scale.

Brexit hurts consumers, exporters and investors

On 1 January 2021, the UK left the EU single market and customs union. Though the initial withdrawal agreement and the Windsor Framework (in place since February 2023) helped avoid serious disruptions, Brexit’s longer term effects are likely to be detrimental.

Consumers are hit hard by Brexit, due to higher tariffs and a sharp drop in the pound. A recent study by the London School of Economics found that Brexit was responsible for about a third of UK food price inflation since 2019, adding nearly £7 billion (8.1 billion EUR) to Britain’s grocery bill2. Though many developed countries have seen a surge in inflation in recent years, the UK unsurprisingly saw larger, and somewhat more persistent, price increases than many of its peers (see figure 5).

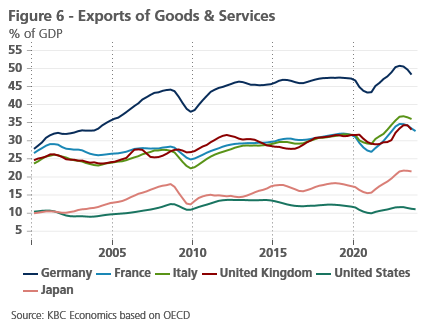

Exporters have also been hit by the loss of access to the single market. The EU still accounts for 41% of UK exports. Yet prior to December 2020, that figure was still 50%. The Office of Budget Responsibility (OBR) estimates that both imports and exports will be around 15 per cent lower in the long run than if the UK had remained in the EU. That said, the lower pound and the signature of three new trade agreements (New Zealand, Australia and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership) have partially compensated the negative effects of Brexit on export growth. The UK’s exports of goods and services grew roughly in line with its peers since the exit of the single market (see figure 6).

Brexit also had a depressing effect on foreign direct investments, as investors disliked the uncertainty surrounding Brexit and the loss of access to the EU single market. Foreign direct investment projects declined from 2265 in the year of the Brexit referendum to 1654 (in 2022).

Overall, given the negative impact on consumers, exporters and investors, the The OBR still estimates that Brexit will make Britain’s economy 4% smaller in total.

Conclusion

As the UK enters an election year, the economy is in a tough spot. GDP declined for two consecutive quarters, while inflation remains too elevated. To revive its economy, the new UK government will have to raise the employment rate, fix the UK’s productivity problems and improve its relationship with the EU.

[1] Asfalt Industry Alliance, 2023, "Annual Local Authority Road Maintenance Survey Report".

[2] Jan David Bakker, Nikhil Datta, Richard Davies en Josh De Lyon, 2023, "Brexit and consumer food prices: May 2023 update”