Turkey: testing the limits of unorthodoxy

The Turkish lira lost more than 40% of its value against the US dollar in 2021, plunging the economy into yet another currency crisis. Unlike in 2018 when the FX shock reflected unsustainable external imbalances, the current lira sell-off was triggered by the ultra-loose monetary policy which is firmly in the grip of President Erdogan. As a result, already elevated inflation is set to accelerate further in the coming months to around 50% yoy with pronounced negative implications for the overall economy. Although we see an urgent need for a significant monetary policy tightening, the local authorities have instead implemented highly unorthodox regulatory measures to avoid an economic downturn ahead of the 2023 elections. In the absence of sound monetary policy, these measures are, however, unlikely to break the vicious circle of a weaker currency feeding into higher inflation. The longer the unorthodox experiment in Turkey lasts, the greater the risk of a sharp emergency rate hike and a painful hard-landing scenario for the economy.

The Turkish lira lost a staggering 44% of its value against the US dollar in 2021, plunging the economy into yet another currency crisis (figure 1). In contrast to the 2018 balance of payment crisis, the current FX shock was not triggered by unsustainable trends in external balances; in fact, the current account balance, traditionally a major source of vulnerability, has flipped into a moderate surplus recently. This time, the sharp lira sell-off was caused by a pronounced easing cycle delivered by the central bank against the backdrop of elevated inflationary pressures and mounting credibility concerns.

A flawed macroeconomic policy mix

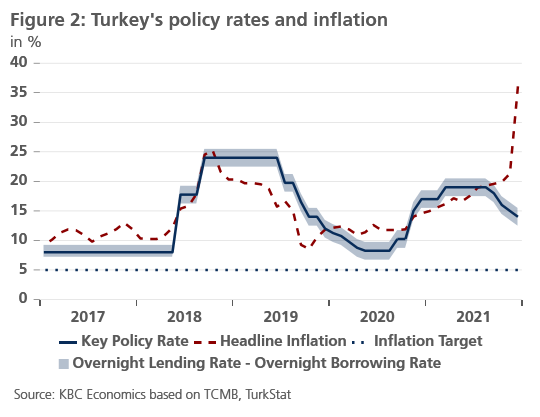

At its December policy meeting, the Turkish central bank (TCMB) cut the key rate by 100 bps to 14%, in total delivering an aggressive 500 bps easing in less than three months. As headline inflation surged to 36% yoy in December, the TCMB has fallen significantly behind the curve with real interest rates now deeply in negative territory (figure 2). The growing disconnect between economic fundamentals and monetary policy actions reflects strong political pressure from President Erdogan who is well known for his preference of low interest rates. That said, we view the lack of independence and an erosion of TCMB’s credibility to keep inflation under control at the heart of Turkey’s economic problems.

Against this background, the lira exchange rate has been poorly anchored and the risks to price stability have increased sharply. With a rapid FX pass-through from the depreciating lira (estimated at around 30%) and a planned 50% hike in the minimum wage in 2022 (more than 40% of all workers in Turkey earn the minimum wage), we expect annual inflation to reach 45-50% in the first half of 2022 (assuming no policy reversal from the TCMB). Admittedly, the uncertainty around the inflation profile remains enormous and risks are clearly tilted to the upside. Furthermore, we see a notable risk stemming from a faster dollarisation from locals that could jeopardise financial stability, and in the worst case lead to a loss of confidence in the Turkish banking sector (figure 3).

What next for Turkey?

We see a number of possible scenarios for the Turkish economy going ahead. A significant tightening of monetary policy (suggested by a standard Taylor rule) to re-anchor the lira and contain price pressures would represent a U-turn towards economic orthodoxy. Although we believe this would be the most appropriate policy in the long run, a sharp interest rate hike would likely lead to an economic downturn similar to 2018. And since presidential and parliamentary elections are only 18 months away, the government has come under increasing pressure – especially as President Erdogan is losing support in polls – to avoid any slowdown in economic activity.

To this end, the Turkish government has implemented a mix of regulatory and administrative measures, largely aimed at stabilising the currency. In December, the government announced the new FX-linked deposit scheme under which depositors will be compensated (by the Treasury) to any depreciation that goes beyond the interest rate on lira deposits. Following the announcement, and helped by central bank’s FX interventions, the lira has recovered some of its losses. However, the trading remains extremely volatile as the currency market continues to assess the impact of the new FX-linked deposit scheme.

The risk of a hard-landing increases

In our view, the FX-linked deposit scheme could buy local authorities some time by stabilising the domestic currency (leaving aside significant pressure on the fiscal balance). Against this backdrop, Turkish authorities may be tempted to implement even lower interest rates to boost growth heading into 2023 elections, possibly along with additional unorthodox regulatory measures. However, all these measures provide only short-term, if any, stability, as they do not address the real problems of the economy, i.e. the vicious circle of a weaker currency feeding into higher inflation. In other words, Turkey is in a desperate need for more comprehensive macroeconomic policy anchors, most importantly sound monetary policy. The longer the unorthodox experiment in Turkey lasts, the greater risk of a sharp emergency rate hike and a painful hard-landing scenario for the economy.