The US Twin Deficits: no cause for concern yet

The US trade deficit, or more specifically the goods balance deficit, is widening again. The deficit with China is particularly noteworthy. However, as a share of GDP, the deficit has not yet reached the levels seen just before the financial crisis, so there is no major cause for concern at the moment. In line with this, the US current account deficit is widening again. In macroeconomic terms, this reflects the reduction in net saving in the US economy, to a large extent due to the government’s dissaving by running up high budget deficits. This again leads to the phenomenon of Twin Deficits. Thanks to the international confidence in the US dollar as a reserve currency, these external and budget deficits are, for the time being, easily financed. However, if deficits were to become too large or persist for too long, a decline in confidence could quickly lead to higher US interest rates and a weaker dollar. The likelihood that the Twin Deficits will lead to a sharp appreciation of the dollar, as in the early 1980s, is therefore small in the current economic environment.

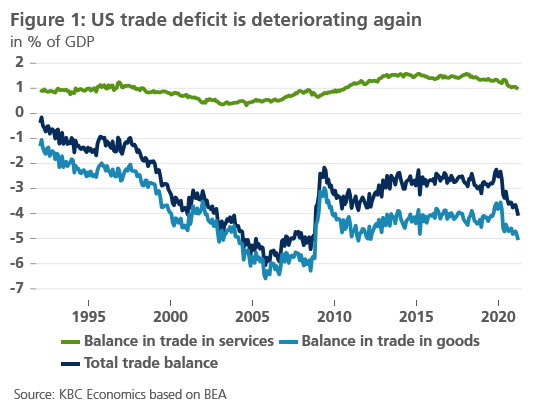

The US trade balance has deteriorated sharply again recently. Expressed in current dollars it even reached a new historic record. This deficit is caused by a deficit on the goods trade balance, which cannot be compensated by the surplus that the US records on the services balance. As a percentage of GDP, however, the trade deficit looks less worrisome (see Figure 1). It is not yet as large as in the period just before the financial crisis and the Great Recession.

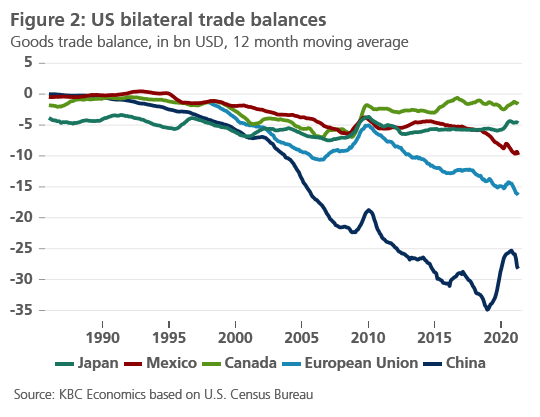

Figure 2 shows the regional breakdown of the US trade deficit. Three observations stand out. First, since 2010, the U.S. deficit with Japan, expressed in current dollars, has remained virtually stable and at a moderate level. The deficit with the EU, on the other hand, widened steadily over the same period. However, the deficit with China in particular increased sharply. This trend had already started in 2001, when China joined the World Trade Organisation. Partly as a result of the trade tensions during the Trump administration, the US trade deficit with China temporarily decreased somewhat, but since the beginning of 2021 it has resumed its structurally increasing trend.

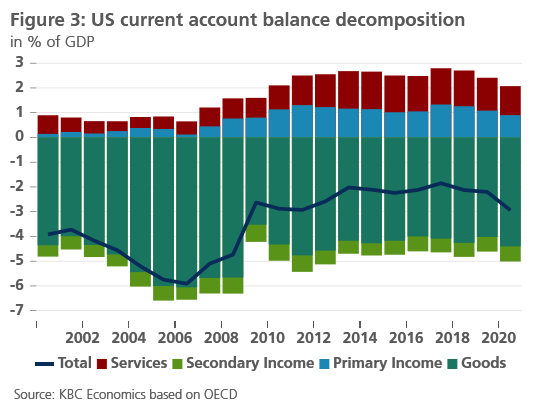

The US trade balance is also the main determinant of the US current account balance. This balance is also deteriorating again. The current account deficit is comprised of deficits in the balance of goods trade and international transfers, which cannot be offset by surpluses in the balance of services trade and primary income flows (Figure 3).

What is the main driver behind this rising external deficit? From a macroeconomic perspective, the current account balance primarily reflects the difference between total national savings (income minus consumption) and total national investment by government, households, and businesses. From this perspective, the increase in the external deficit in the US is determined by a rising investment rate, which is also accompanied by a declining savings rate (both in % of GDP). According to the latest IMF forecasts, the US national investment ratio will increase by 0.7 percentage points of GDP in 2021, while the national savings ratio is likely to fall by 0.3 percentage points of GDP over the same period. The result, still according to IMF figures, is an increase in the current account deficit of just under one percentage point of GDP (0.8%).

In turn, the declining savings ratio is to a large extent due to the government’s falling savings rate. The IMF estimates that the total government budget deficit will be as high as 15% of GDP in 2021. This lack of savings will not be fully compensated by the savings of households and businesses. On balance, the rising government deficit and the related current account deficit thus lead to the phenomenon of the so-called Twin Deficits for the US economy.

At this stage, these Twin Deficits are not a cause for concern. In particular, the current account deficit is not yet of the same magnitude as just before the financial crisis. At the time, these external imbalances could be seen as a warning sign of the forthcoming international crisis. Nevertheless, there is reason for caution. The US economy is currently relying on international confidence in the US dollar as a reserve currency, which allows it to finance its external and fiscal deficits smoothly for the time being. The danger lurks in the deficits becoming too large or if they are allowed to persist for too long. In that case, a decline in international confidence could quickly lead to higher rising US interest rates and a weaker dollar.

In this sense, there is an important difference with the development of the early 1980s. In the aftermath of the stagflationary 1970s, former Fed Chairman Volcker stepped on the emergency monetary brake. At the same time, former US President Reagan ran large government deficits, mainly through tax cuts as part of a supply-side fiscal policy. The resulting Twin Deficits, in an environment of high interest rates, led to a particularly sharp dollar appreciation, which could only be halted by the international Plaza Agreement of 1985. However, in the current inflation and interest rate environment, a repetition of such a scenario is extremely unlikely.