The US housing market is slowing but not slumping

The US residential real estate market has been showing signs of weakness over recent months. Therefore, worries are developing as to whether the market has peaked and is ready for a slide. We believe that construction activity is unlikely to become a noticeable driver of US economic growth again soon. But a slump in construction, and the housing market in general, is unlikely as well. In particular, a 2008-style systemic collapse with a new real estate crisis seriously hitting the broader economy is highly improbable, as today’s conditions in the US housing market are fundamentally different compared to a decade ago.

Housing market shifting into a lower gear

Whether the US housing market has entered the danger zone again is an important question, as housing is a classic cyclical sector that usually slides into a crisis ahead of other sectors in the economy. Ten years ago, in September 2008, housing market developments pushed Lehman Brothers into bankruptcy, fueling a financial crisis that sent the US, and much of the world, into a deep recession. So, the current weakness in the housing market could be seen as a flashing warning sign pointing at an imminent slowdown, or even recession, of the US economy as a whole. In recent weeks, financial markets also seem to suggest that investors have become worried that US real estate may have peaked.

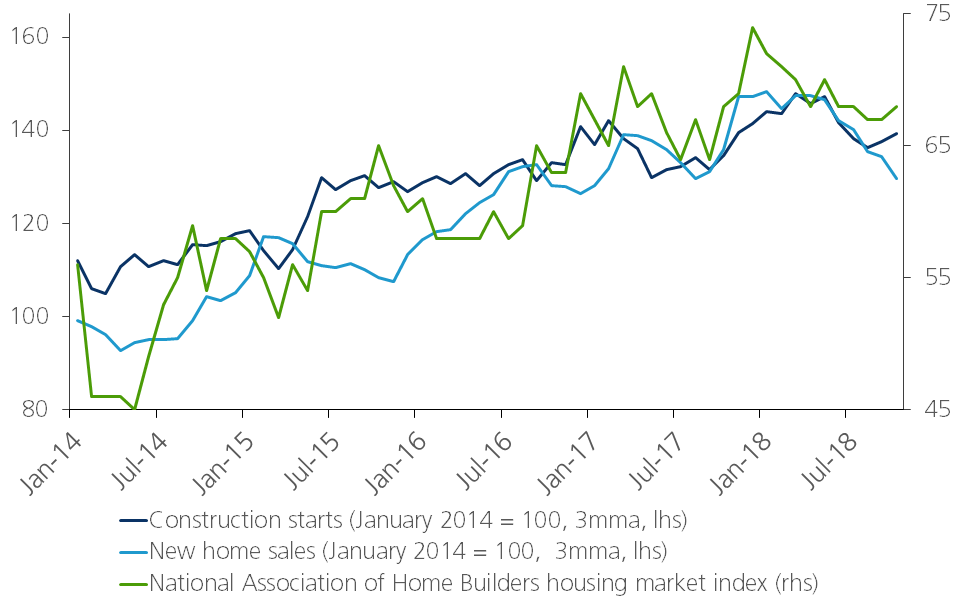

Should we worry? Let us look first at what statistics tell us. The weakness in housing data has been ongoing for a while. Investment in US residential construction, for instance, has been stagnating since the beginning of 2017. In the first three quarters of 2018, growth in real residential construction investment was only 0.8% compared to a year earlier. In contrast, yearly growth from 2011 till 2016 was no less than 9% on average. More recently, weakness in the housing market is also seen in high-frequency leading indicators, with faltering construction permits and starts, declining home sales and weakening builders’ confidence (Figure 1).

Figure 1 - Relatively weak US housing data in recent months

What is behind the slowdown?

This weakness seen in the US housing market is not really in line with the general optimism in the US economy. For example, the strong labour market performance actually speaks in favour of rising construction spending. The US unemployment rate indeed has fallen sharply and, at 3.7%, is now at a 50-year low. So, what then is behind the slowdown in the housing market?

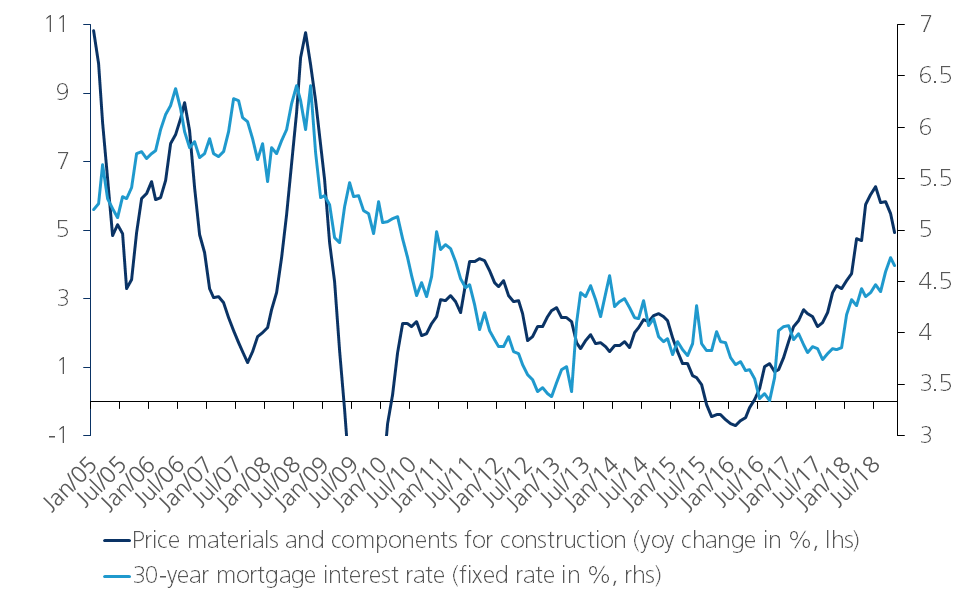

One reason is that construction has been negatively affected by the steep rise in prices for building materials and components. In recent months, building costs have become around 6% more expensive compared to a year earlier (Figure 2).

Figure 2 - Rise in construction costs and mortgage rates

The additional tariffs on wood from Canada and on steel imports play a role here. On top of that, the tight construction labour market is also weighing on building costs by boosting the sector’s wage growth.

In addition, real estate financing has become noticeably more expensive. Since September 2016, the average interest rate for the typical 30-year mortgage has risen by nearly 1.5 percentage point (Figure 2). A more structural influence dampening growth in the construction sector is the worsening demographic outlook. The latest projections indicate that the US population will grow by just under 2.4 million per year over the next few years. The 2014 projection, in contrast, saw US population growth at around 2.6 million people per year till the early 2020s. The difference is likely due to lower immigration and partly to a lower projected birth rate.

Slowdown won’t be a collapse

Rising costs and higher interest rates will problably limit construction activity for some time to come. Hence, construction investment is unlikely to become a noticeable driver of US economic growth again soon. But a slump in housing activity, and the housing market in general, is unlikely as well. At least, a 2008-style systemic collapse, with a new real estate crisis seriously impacting the total US economy, is highly improbable.

First, today’s conditions are fundamentally different compared to a decade ago. Back then, lending standards were non-existent, with subprime loans everywhere. By contrast, lending standards today are still stringent, as evidenced by the higher than normal credit scores of those who are able to obtain a mortgage. That is why mortgage default and foreclosure rates remain at historic lows. Moreover, most mortgages (around 85%) are now lent at fixed rates, which suggests that the majority of existing mortgages will not be affected by rising interest rates.

Second, although housing affordability declined as mortgage rates rose in tandem with the 10-year Treasury yield, it remains elevated, in part thanks to the drastic improvement in the labour market. Also, the debt ratio of US households has fallen sharply to 66% of household disposable income, well below its long-term trend. Households were even able to slightly reduce their mortgage debt in absolute figures, which is unusual in American history. As a result of higher interest rates, debt payments as a percentage of disposable income stopped declining in recent years, but remain at their lowest level in four decades.

Finally, the recent weakness in US housing data should not be overstated as indicators have more often been quite volatile in the past and are still at relatively high levels. So, summing up, we can conclude that there is no need to become overly pessimistic yet. In the most likely scenario, the US housing market is heading for a soft landing in the near term, driven mainly by the normalisation of interest rates, but fortunately still finding support in a strong labour market.