The US debt ceiling – the sword of Damocles hanging over the global economy?

Here we go again. Without a political agreement, the US will likely hit its debt ceiling on June 1. Not raising the debt ceiling could trigger an economic calamity, given the key role played by US Treasuries in the global financial system. A recent Moody’s report estimates that even a brief default of a few weeks could shrink US GDP by 4%, while causing 6 million job losses. Though we expect US politicians to eventually find an agreement, the uncertainty around the debt ceiling negotiation outcome could likely cause important and unnecessary economic damage on its own.

Introduction

2023 is a year of sequels. Marvel fans eagerly await the releases of sequels of Spider Man and the Transformers in June, while fans of older classics will be excited to watch the Indiana Jones sequel this summer. Unfortunately another sequel will be less welcomed, namely that of the debt ceiling saga. In January, the US government again hit the debt ceiling. Luckily, Treasury Secretary Janet Yellen has a few tricks up her sleeves and managed to avoid a default using accounting tricks, such as deferring pension investments to conserve cash. However, these tricks don’t work forever and their magic is will be finished by June 1, according to Secretary Yellen. By then, the Republican House Speaker, Kevin McCarthy should find an agreement with Democratic President Joe Biden and Democratic Senate Majority Leader Chuck Schumer to raise the debt ceiling. Though it’s highly likely that an agreement will eventually be found, the possibility of a debt ceiling breach cannot fully be ruled out, which is worrying. It’s hence important to ponder the economic consequences of such a breach.

An unseen calamity

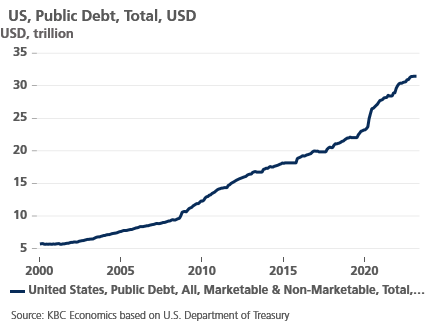

It’s clear that the consequences would be dire. US Treasuries are the back-bone of a USD-dominated global financial markets and economy and their importance has only grown as the US government debt has ballooned (see chart). US Treasury yields are crucial for the valuation of most US-denominated debts and stocks. US Treasuries are also key for short-term funding markets, which would likely dry up immediately in case of a US default. A US financial crisis would erupt as many banks would likely face severe liquidity and solvency constraints. Meanwhile, the US government would be forced to massively cut spending as it has no ability to issue debt anymore.

In a recent report Moody’s estimated that even a short default of a few weeks could cause irreparable damage to the US economy. According to this report, real GDP would decline almost 4% in total, job losses would total 6 million and the unemployment rate would skyrocket to over 7%. Stock prices would lose a third of their value, wiping out $12 trillion in household wealth. Treasury yields, mortgage rates, and other consumer and corporate borrowing rates would spike during the default and remain more elevated after an agreement is found, as US Treasuries would lose their safe-haven status.

Obviously, such an implosion of the US economy and its financial system would have reverberations around the world. A deep global financial crisis and global recession or even depression would be the final result.on or even depression would be the final result.

There is no alternative

In recent months, thinktanks have proposed several workarounds, hoping to avoid this calamity if no political agreement is found. Unfortunately, none of these workarounds would eliminate the uncertainty and each workaround would have severe economic side-effects.

A proposal to let the Treasury issue a trillion dollar USD platinum coin and deposit it at the Fed to pay down government bills would also likely be challenged in court, as the law authorizing envisaged commemorative coins. If the solvency of US Treasuries is dependent on a court decision, US bond holders would likely still rush for the exit.

Another proposal, invoking section 4 of the 14th Amendment which states that the “validity of the public debt of the United States…shall not be questioned”, would also face legal (even constitutional) questions, as the amendment was aimed at the war debt of Confederate states. A third proposal, i.e. prioritizing payments to bondholders over other government obligations (such as social security payments), would not only be politically complicated, but also legally face challenges.

A final proposal would be to issue bonds with much higher yields, being sold in markets at a high premium . This would allow the US Treasury to bring in much more money, while keeping the face value of its debt lower. This chicanery would take time to be rolled out and it would fragment and disrupt the proper functioning of the US debt markets.

Will politicians put country over party?

Given the economic calamity that would ensue a debt ceiling breach and the lack of unchallenged workarounds, one would expect politicians to raise the debt ceiling unconditionally. Unfortunately, Republican Congressmen are using the US economy as a bargaining chip to achieve political goals. The Republican House recently passed a bill that tied a debt ceiling hike to serious reductions in discretionary spending related to a.o. climate change, student debt relief and IRS funding. President Biden will probably be unwilling to make major concessions in these areas. Theoretically, Democrats and moderate Republicans could work together and find a majority to pass a clean debt ceiling hike. Unfortunately, Speaker McCarthy is unlikely to bring a proposal on a debt ceiling hike to the floor without the support of Freedom Caucus members, as this could cost him his Speaker job.

A prolonged negotiation, which will only be resolved close to the deadline is thus on the cards. Ultimately, we still think it is very unlikely that US politicians will push their whole economy over the cliff. A debt ceiling hike will hence eventually be passed, though it could be preceded by a leadership change. That said, even a prolonged negotiation and uncertainty could cause serious economic damage. In 2011, the closest Republicans and Democrats came to breaching the debt ceiling, S&P downgraded the US Treasury rating, while credit default swaps spiked to 80 basis points, 75 basis points higher than usual. Consumer and producer confidence also plunged. Unfortunately, a similar debt ceiling drama is likely to unfold this year. Prepare for US politicians to make their best acting performance to avoid political blame.