The thriving market of second residences on the Belgian coast

The ten coastal municipalities in Belgium traditionally count a lot of second residences. Some 2% of all Belgian households are owners of a second home on the coast. The great interest in coastal real estate can be explained by economic factors, such as the low interest rate environment, but perhaps even more by ‘emotions’. The Covid-19 crisis may affect people’s ability to buy a second home, but it may also spark interest of others to do so. Being a special segment on the market, coastal real estate is likely to hold up relatively well. In the longer term, the thriving market for second residences poses challenges for the coast. These include growing pressure on available space and on the affordability and availability of housing for the local population.

Exact figures on the number of second residences in Belgium are not available. The research department of the Flemish Government did make an estimate for Flanders a few years ago. It made a distinction between second homes in ordinary buildings (houses or apartments) and those in vacation homes (located in residential parks, on campsites or in recreational areas). Residences that are mainly rented out as vacation homes, and are therefore not used as second residences, were not taken into account. Seen this way, there were 215,000 second homes in Flanders in 2016, of which 162,000 were situated in normal buildings and 53,000 in vacation homes. Together, these represent 6.9% of all available residences in Flanders.

Almost half of all second residences in Flanders (some 104,000 in 2016) are located in the ten coastal municipalities. On the coast, almost half of the total housing stock is used as second residences. The vast majority of these are apartments and studios. Middelkerke and De Haan are characterized by the highest density of second residences (almost 60% of all housing), while Blankenberge is characterized by the lowest (less than 40%).

Who are the second residents?

According to a survey conducted by Westtoer in 2015, 45% of the owners of a second residence on the coast are 65 years of age or older. The 50- to 64-year-olds (35%) are also an important group. Only a quarter have resident children. Contrary to the purchase of other additional real estate, a second residence on the coast is less often regarded as an investment. Only one in three indicated in the survey that this is why they bought it. Contrary to popular belief, only a limited proportion of second residences are rented out on a regular and commercial basis. Most claim to have bought on the coast to escape their daily routine and to spend time with family and friends.

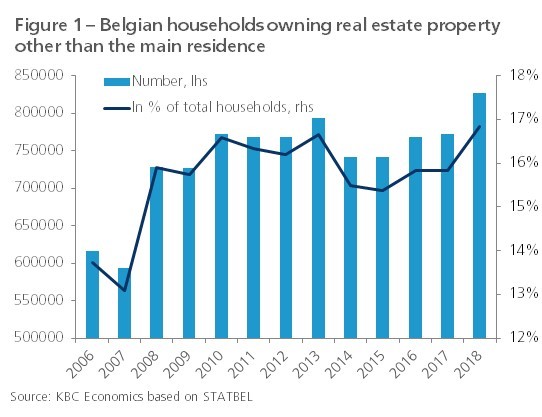

If we correct the number of second residences on the Belgian coast for ownership by foreigners (8% according to Westtoer) and then divide the result by the total number of Belgian households in 2016, it is found that some 2% of all households own a second residence in one of the ten coastal municipalities. This figure is higher for Flanders (2.7%) than for the rest of Belgium (1.0%), because the majority (71%) of second residences on the coast are owned by Flemish households. By way of comparison, according to STATBEL figures, 16% of all households in Belgium owned additional real estate in 2016 aside from the house in which they live. Together with second residences, such as those on the coast, this figure includes homes that are rented out, building plots, meadows, store premises, garage boxes, etc. Often, they are co-owned.

Over the past decade and a half, Belgians have become significantly more interested in buying additional real estate. The main reason is undoubtedly the low interest rate environment. Likely, the successive crises also play a role. Between 2007 and 2013, the period of the financial and European sovereign debt crises, the proportion of households owning additional real estate rose from 13.1% to 16.6% (Figure 1). Thereafter, that percentage fell slightly, but in 2018 it again peaked at 16.8%.

More recently, there have been signs that coastal real estate sales continue to perform well during the current Covid-19 crisis. During the lockdown period in the spring, the number of transactions fell sharply, but since then interest has once again been strong. The Covid-19 crisis makes people think about the speed and fragility of life. It makes them crave a second place to stay. It is also possible that reduced competition from the foreign second-residence market, because flying becomes less pleasant and less feasible, also plays a role.

Uncertainty and challenges

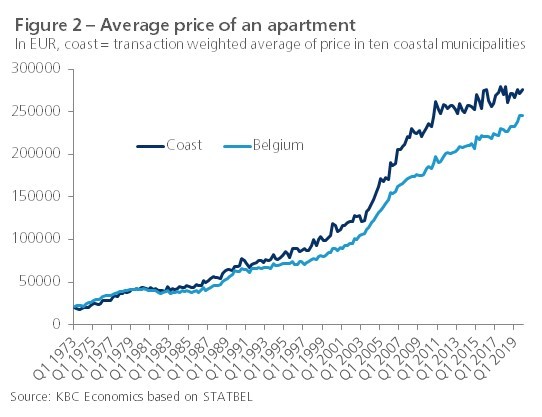

Strong Belgian interest in coastal real estate is also reflected in relative price developments. The price of an apartment on the coast has risen significantly faster than the average for Belgium as a whole in recent decades, although the price gap has narrowed somewhat in recent years (Figure 2). The average increase in the price of a coastal apartment (including studios) has been 4.3% per year since 2000. Adjusted for inflation, this was 2.3% per year.

Whether investments in second residences on the coast, and hence price increases, will continue remains uncertain. The severe recession caused by the Covid-19 crisis will increase the number of bankruptcies and unemployed in the coming quarters. Moreover, the deterioration in public finances creates uncertainty about future real estate taxation. All this could affect the ability and appetite of Belgians to buy coastal real estate. However, we must not become too pessimistic, since second residences, as indicated, are not just (and often not at all) bought for investment reasons. The uncertainty surrounding the Covid-19 epidemic may therefore just as well fuel interest in a second residence. Being a special segment on the market, coastal real estate is likely to hold up well on balance in our opinion. This is in contrast to Belgian real estate in general, for which we do expect some price decreases.

In the longer term, the demand and supply of coastal real estate will be limited by the heavy pressure on available space. In order to preserve the liveability and tourist attractiveness of the coast, which are also essential for second residents, it is necessary to preserve the characteristic elements (the open space of beaches, dunes and polders, the typical polder villages...) to a sufficient extent. Furthermore, the phenomenon of second residents also has a major impact on the affordability and availability of housing for the local population. Moreover, the departure of young families reinforces the already aged profile of the coastal population. This ageing population also poses major challenges to the coast.