Residential real estate markets in Europe's capital cities

Which cities are at risk of a housing bubble?

Abstract

From anecdotal evidence, we know that property prices in many large European cities have risen sharply and at a faster pace than the respective country aggregates over the past years. This was driven by particular factors such as the role played by (foreign) investors. As a result, prices in some cities are now about twice or even three times as high as the average country price level. A close monitoring of housing markets at the city level is warranted, as there may be important spillover effects of price dynamics to the rest of the country. In this research report we offer an original but tentative perspective on the valuation of property prices in the 28 EU capital cities (we still include London). Based on various 'city indices' that reflect the relative attractiveness of the capitals as a place to live, to visit and to do business, we construct a measure of over- or undervaluation of the price of a typical inner-city apartment. From the analysis it follows that the biggest price misalignments emerge in Prague, Helsinki and Rome. Brussels and Copenhagen, on the other hand, seem most undervalued.

House prices in capital cities

House price levels still diverge substantially among European countries, often reflecting different standards of living of their inhabitants. Based on fragmented data available from different national and international sources, Luxembourg, France, Austria, the UK and Germany stand out as the countries in Europe with the highest average dwelling prices per square metre (sqm). A number of Eastern but also Southern European countries fall on the other side of the price spectrum, with countries like Romania, Bulgaria, Portugal and Greece having average house prices that are far below (often 10 times lower than) those of the top-ranking countries1.

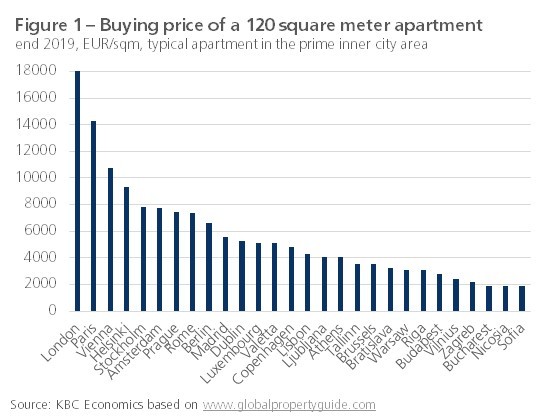

Similarly, house prices also differ widely among Europe's capital cities. Even more so than for countries, price level data are difficult to compare among large cities, given different data sources and definitions. Global Property Guide, a web-based information provider for residential real estate investors, regularly compiles comparable data regarding the buying price of a 120 sqm average apartment in prime inner-city areas (see figure 1). The latest data available, relating to end-2019, confirm that price differentials for the 28 EU capital cities are quite big (although the UK is no longer part of the European Union, we still include London in our analysis). London and Paris are by far Europe's most expensive capital cities in terms of transaction prices of an average apartment. Only one other city, Vienna, surpasses the 10,000 EUR/sqm threshold. Among Central European capital cities, Prague is the most expensive. Bucharest, Nicosia and Sofia are the only three capitals in Europe with price levels below 2,000 EUR/sqm.

The wide price differentials among the capital cities generally reflect the price levels in their respective countries, although there are remarkable exceptions. From Deloitte's Annual Property Index (see footnote 1), it follows that in some countries property price levels in the capital are about twice (the UK, Denmark, the Netherlands and Bulgaria) or even three times (France and Portugal) as high as the country average price level. Latvia and Croatia are the only two EU countries where the price level in the capital city is only slightly (less than 5%) above the national average.

Identifying overpricing at the city level

Heterogeneous intra-country house price developments, and excessively high city prices in particular, may be a cause for concern from a financial stability perspective. Although they could be justified by fundamentals, they could also signal excessive exuberance of house prices in certain places. In this case, the strong house price development may spill over to the entire country via ripple effects and thus possibly fuel general overvaluation pressures. Therefore, a close monitoring of housing markets at the local or city level is warranted, as it may provide an early indication of a potential build-up of vulnerabilities at the national level.

In this research report, we focus on the identification of potential signs of overpricing at the capital city level. This is a difficult excercise because we cannot simply rely on traditional metrics of overvaluation given data limitations and definition issues. For instance, we need long series to assess over- or undervaluation based on price-to-income ratios by comparing current values to long-term average levels. But we do not have such long series, neither for city property prices nor for inhabitants' disposable income. Moreover, a lot of residential property in large cities is bought by people living elsewhere in, or often outside, the country (e.g. as an investment, to rent out the property on Airbnb...)2. Therefore, compared to property valuation at the country level, the relative development of dwelling prices to inhabitants' income is less relevant when evaluating house prices at the city level.

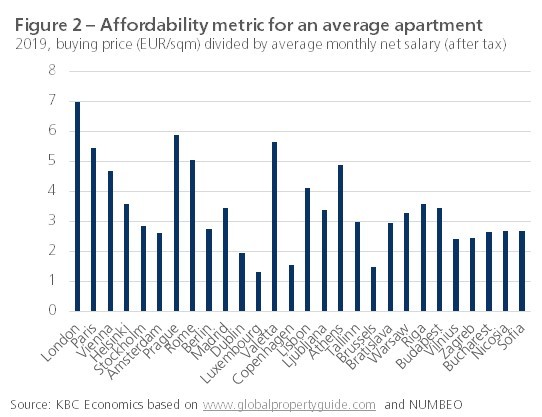

Just to give a rough idea on the affordability of housing, figure 2 presents the ratio between the buying price of an apartment (taken from figure 1) and the average monthly net salary earned in the various capital cities. The latter represents all employees working in the city, including those living outside it. It follows that people working in London, Prague and Valetta have to work the longest before being able to buy an apartment in the city centre. Taking another approach, the Swiss investment bank UBS publishes an annual survey where real estate experts are asked whether they see a high bubble risk in global cities' real estate markets (the so-called UBS Global Real Estate Bubble Index). Unfortunately, there are only six EU capital cities monitored by UBS. In its 2020 publication, the bubble risk is seen as elevated in Amsterdam and Paris. In London and Stockholm, markets are overvalued as well but not yet at risk of a bubble, whereas in Madrid and Warsaw markets were seen as fairly valued.

In what follows, we take a completely different approach in assessing the over- or undervaluation of property prices in Europe's capital cities. We use a set of 'city indices' which deliver valuable insights on the general attractiveness of the capitals. Their rankings for the various indices compared to the apartment price ranking help to shed light on the capitals' property market overvaluation risk.

Table 1 - City indices used in the calculation of the correlation coefficients (see figure 3)

| City index | Brief definition | Source | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Top 100 City Destinations | Ranking based on the number of international tourist arrivals | Euromonitor International | |||||||||||

| 2. Innovation Cities Index | Measures cities' potential as an innovation economy, based on 162 indicators relating to health, wealth, population and geographical factors | 2thinknow | |||||||||||

| 3. Cost of Living Ranking | Compares the cost of living for expatriates in cities (over 200 goods and services, including e.g. housing, transportation, food, clothing and entertainment) |

Mercer | |||||||||||

| 4. Sustainable Cities index | Ranks global cities on three dimensions: people, planet and profit (viability of cities as a place to live, their environmental impact and their economic/financial stability | Arcadis | |||||||||||

| 5. Dynamic Cities Index | Aims to capture the factors that make a city attractive to talent, resilient to disruptive technology and a leader in the knowledge economy | Savills Investment Mgt | |||||||||||

| 6. Top Cities Index | Survey based on question: "What is the best city to live in, to visit, to do business in?" | IPSOS | |||||||||||

| 7. Quality of Living Ranking | Living conditions according to political/social/economic environment, medical considerations, schools, public services & transportation, recreation, consumer goods availability, housing, natural environment | Mercer | |||||||||||

| 8. European Digital Cities Index | Index describing how well cities support digital entrepreneurship | Nesta | |||||||||||

| 9. Global 150 Cities Index | Cities that have the ideal combination of high salaries, low taxes and costs, and high quality of life | AIRINC | |||||||||||

| 10. Global Cities Outlook | A projection of a city's potential based on the rate of change in 13 indicators across four dimensions: personal well- being, economics, innovation, and governance | ATKearney | |||||||||||

| 11. European Green City Index | Measures the environmental performance of cities taking into account environmental governance, water consumption, waste management and greenhouse gas emissions |

Economist Intelligence Unit | |||||||||||

| 12. City Competitiveness Index | Factors determining a city's competitiveness, including business and regulatory environment, quality of institutions and human capital, cultural aspects, quality of environmental governance | Economist Intelligence Unit | |||||||||||

| 13. People Risk Rating | Measures the risks that organisations face with recruitment and employment by analysing factors such as demographics, access to education, talent development, employment practices and regulation |

AONHewitt | |||||||||||

| 14. Global Cities Index | Measures how globally engaged cities are in five dimensions (27 metrics): business activity, human capital, information exchange, cultural experience, political engagement | ATKearney | |||||||||||

| 15. Global Liveability Ranking | Considers 30 factors related to five dimensions: public safety/stability, healthcare, culture & environment, education, and infrastructure |

Economist Intelligence Unit | |||||||||||

| 16. City Prosperity Index | Measures city prosperity across five dimensions: productivity, infrastructure, quality of life, and environmental sustaina- bility | UN Habitat | |||||||||||

| 17. Global Power City Index | Ranks cities according to their magnetism or their comprehensive power to attract creative people, capital and enterpri- ses from around the world |

Institute for Urban Strategies | |||||||||||

Relating city price levels to city indices

Property prices in large cities are primarily determined by the cities’ general attractiveness as a place to live, to visit and to do business. To illustrate this, we relate the EU capital cities’ property prices (i.e. the price of a 120 sqm apartment in the prime inner-city area, as published by Global Property Guide) to a number of comparative ‘city indices’ that are available from different sources (for each, we take the latest data available). The various indices rank the capitals according to a diverse range of specific characteristics, such as the cost and quality of living, their business potential, cultural dynamism, environmental impact, etc. Taken together, they deliver valuable insights on the cities' general attractiveness.

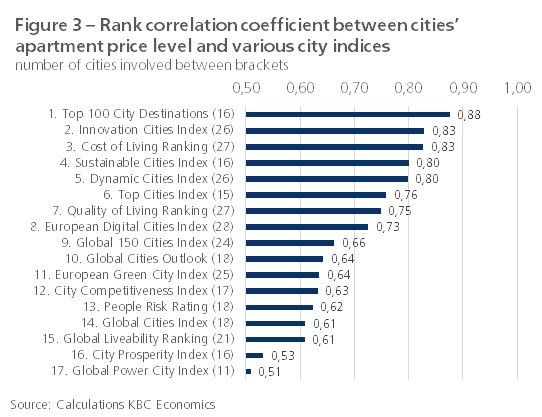

Figure 3 gives the rank order correlation coefficients between the capitals’ apartment price levels and each individual city index3. We have limited the list of city indices to the ones for which the rank correlation is above 0.50 (see table 1 for an overview of the 17 indices used). For several of the indices the rank correlation with the capitals' property prices is remarkably high. The highest correlation (0.88) is obtained in the case of the Top 100 City Destinations Index, which is calculated by Euromonitor International and based on the number of international tourist arrivals. The lowest correlation (0.51) is seen for the Global Power City Index from the Institute for urban Strategies, which ranks the cities according to their power to attract people, capital and enterprises from around the world.

The different city indices often reflect a specific theme. The rank correlation seems the highest (i.e. 0.80 or above) for the following themes: 'international tourism', 'innovation and knowledge', 'cost of living', 'sustainability' and 'infrastructure'. Remarkably, the rank correlation is very low or even negative for the theme 'safety', indicating that a city's safety in terms of the level of crime or illegal activity is not an important factor for real estate prices. E.g. for the Cities Safety Index (source: Numbeo) and the Safe Cities Index (source: Economist Intelligence Unit) the correlation was at -0.19 and -0.11, respectively (not shown in figure 3). Another striking fact is that the rank correlation with he capitals' apartment prices is higher for all city indices shown in figure 3 than for the capitals' GDP level (in PPP) (rank correlation only at 0.48).

Indicator of over- or undervaluation

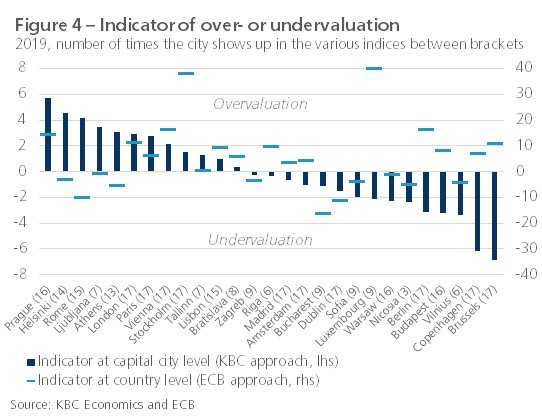

The above findings allow us to investigate whether and to what extent property prices in Europe's capital cities are over- or undervalued. To answer that question, we first quantify the deviation of an individual capital city’s rank by apartment price level from its rank in the various city indices. An implicit assumption here is that, being metrics of the cities’ general attractiveness, the city indices reflect fundamental drivers of the respective property markets. Next, an indicator of over- or undervaluation for a specific city's property price is obtained by summing up all deviations between its price rank and its rank in the different city indices shown in figure 34. As particular cities do not appear in all the city indices (due to data unavailability), the sum is divided by the number of times the city shows up in the various indices. A positive value for the indicator means that the city's rank for the apartment price level is higher than one would expect from the city's rank in the various city indices, and vice versa.

The indicator of over- or undervaluation is shown in figure 4. Prague, Helsinki and Rome seem to be the three EU capitals where the rank by apartment price is most out of line with fundamentals, as reflected by the various city indices. A surpring finding: property markets in London and Paris, although relatively overvalued, do not belong to the capitals where the overvaluation is the highest. At the other extreme, apartment prices in Vilnius, Copenhagen and Brussels seem most undervalued, as the three cities’ ranks in the various indices justify a relatively higher property price level. Whereas Amsterdam is seen as highly at risk of a housing bubble in the UBS Global Real Estate Bubble Index (see above), it is not in our analysis.

Figure 4 also includes the ECB's model-based valuation metric (end-2019 figure) for the residential property markets in the respective country of each capital. In general, there is no link between our city level indicator and the ECB's country level indicator5. E.g., according to our approach, the Brussels' market is clearly undervalued, whereas the Belgian housing market as a whole is found to be overvalued by the ECB. At the other extreme, property in both Prague and the Czech Republic as a whole seems to be clearly overvalued.

Obviously, the calculations and findings should be taken with great caution. Our city level approach only focuses on the relative attractiveness of the capitals, as reflected by the various city indices, and does not cover other driving factors that may be hugely important as well for the assessment of cities' property markets. These factors include specific demand and supply characteristics (changes in household numbers and structures, mobility of the labour force, land availability, the ongoing construction activity, the vacancy level, the availability of social housing...) as well as policy measures and mortgage market expansion (city-specific housing regulation, banks' mortgage exposure...). Unfortunately, data constraints for most of these factors limit hard evidence on house price misalignments, and housing vulnerabilities more generally, in Europe's large cities.

1See e.g. J. Briconge, A. Turrini and P. Pontuch (2019), 'Assessing house prices: Insights from "Houselev", a dataset of price level estimates', EC discussion paper 101; and Deloitte (2020), 'Property Index 2020: Overview of European residential markets'.

2 For the 'Airbnb-effect on Europe's house prices, see KBC Economische Opinie van 17 november 2020.

3The rank correlation coefficient measures the degree of similarity between the ranks of the values for two variables. The closer the coefficient is to 1, the stronger the similarity between the ranks. The closer to zero, the weaker the similarity.

4 Perhaps the lack of correlation is due to the fact that the inner-city area, to which the apartment prices relate, is a more safe neighbourhood than outer suburban areas.

5 Given the completely different approaches, we can not compare the levels of the two indicators.