Only the agile survive in a Chaordic Economy

In today’s world, both ‘chaos’ and ‘order’ are increasingly impacting businesses. Although chaos is a constant, it is now taking on a more global and multidimential scale with plenty of economic and non-economic rapid changes involved (e.g. successive crises, technological advances, climate change...). This results in a turbulent and risky environment and in turn gives way to governments taking more control and order by introducing new regulation and supervision. The rise of the so-called ‘Chaordic Economy’ will require businesses to become increasingly agile and adaptive.

When economists are asked about the next severe crisis, they will most likely refer to (1) a recurrence of events that already happened in the past (e.g. an asset bubble bursting in a major economy, an unsustainable development of public/private debt, a major bank going bankrupt, an oil price shock due to geopolitical tensions...), or (2) an escalation/worsening of events that happened very recently or are happening at this moment (e.g. spread of new variants of the coronavirus, a resurgence of the global trade war, renewed worries about the stability/sustainability of the EMU, another country following the UK out of the EU, extreme weather following climate change...). Because facts and events are still fresh in their minds, most people are confident that the next crisis will look quite similar.

What might trigger the next crisis?

Of course, the examples mentioned may effectively be crisis triggering factors. The problem is that quantifying the likelihood of any such trigger is very difficult. Only using past and current events to predict a future crisis is a problem as well. This way of thinking underestimates the chances of something happening that has never happened before or one doesn’t think of at the moment. So-called ‘Black Swan events’ (cf. book written by Nassim Taleb in 2007) are extreme events that come as a surprise and have a damaging and even permanent impact on the economy and markets (e.g. the 9/11 terrorist attacks, the 2004 tsunami in Southeast Asia, the 2008 financial crisis, the 2011 Fukushima nuclear disaster, the 2020-2021 pandemic). What one doesn’t know or think about can prove to be far more important than what one does know.

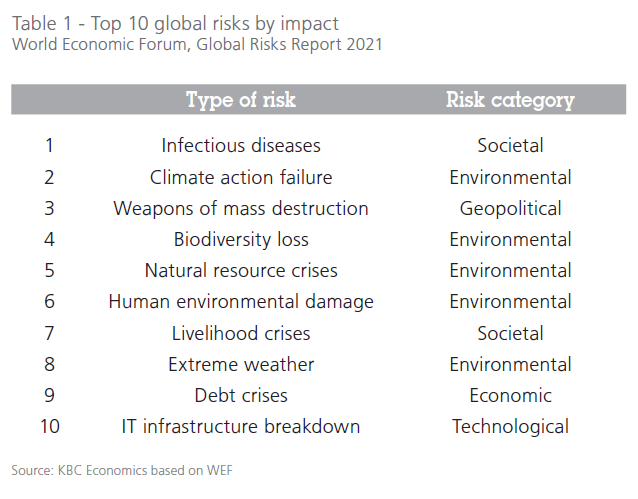

None of the above often-mentioned (mostly economic/political) factors is likely to be the first candidate for the next real major crisis. Each year the Global Risks Report of the World Economic Forum (WEF) works with experts and decision-makers across the world to identify the most pressing risks that we face. In the 2021 edition published in January of this year only one of the top 10 risks in terms of impact are in the category ‘economic’ (i.e. debt crises, see table 1). All other major risks are in the field of ‘societal’ (like livelihood crises), ‘environmental’ (like failure of climate-change mitigation and adaptation), ‘geopolitical’ (like a terrorist attack using weapons of mass destruction) and ‘technological’ (like an IT infrastructure breakdown). Although these risks themselves are non-economic in nature, the economic and financial impact potentially is very high. Moreover, in contrast with conventional economic risks, humanity is much less competent/experienced when it comes to dealing with this kind of non-economic high-impact risks. Remark that the fact that infectious diseases are the top worry in the WEF report supports our point that people like to look backwards when thinking about future risks.

It’s a VUCA world

Admittedly, these kinds of non-economic risk events are plentiful as well (e.g. data fraud/theft, water crises, intensified large scale migration...). To a large extent, they result from the societal and economic environment becoming more VUCA, which stands for Volatility, Uncertainty, Complexity and Ambiguity. The acronym came into common usage in the late 1990s to describe the world’s new reality. Today, the world looks more VUCA than ever, largely due to the increasing speed at which things are changing. Several forces are driving this, from continuous geopolitical tensions to more structural trends like climate change, ageing and the accelerating pace of technological advances.

VUCA increases the likelihood and potential disruptive impact of major crises occuring, like the ones mentioned in the WEF’s Global Risks Report. It implies increasing chances of something happening that has never happened before and that is completely outside one’s scope of awareness (so-called unknown unknows). As a result of VUCA and its increasingly international and non-economic nature, individual businesses are moving into a highly turbulent and chaotic environment. This has a significant impact on their daily operations and longer-term strategic decisions. VUCA chaos may even threaten businesses’ continuity, as witnessed by the current pandemic.

Agile in a Chaordic Economy

Post the financial crisis of 2008 and answering challenges like climate change and advancing technology, massive new legislation, regulation and supervision has been implemented and will further be introduced (e.g. related to data and privacy protection, accounting standards, fraud prevention, environmental quality, non-discrimination in employment, etc.). These increasing government interventions often are critically important to societal well-being. They protect people and businesses from harmful things that they cannot prevent on their own (the restrictions following the pandemic are a good illustration of that). But these interventions usually also come down to increased workloads and costs for businesses. In practice, businesses are subject to an evergrowing set of legislative and regulatory requirements and governance and administrative procedures, putting immense pressure on staff to comply with them. This move towards control and order is in itself adding to complexity and hence is feeding the VUCA world.

More and more, businesses are therefore operating in what we can call a Chaordic Economy. The term ‘chaordic’ (cha from chaos and ord from order) - that we apply here in a macroeconomic context - was coined in 1999 by former VISA CEO Dee Hock. It became a popular buzz word in the management literature, whereby a chaordic enterprise is defined as “an enterprise in which chaos and order are maintained in dynamic balance by virtue of an intentional process of management”.

The businesses that will survive and ultimately stand out in a chaordic economy are those that are agile and continuously shift their strategy. This requires responding to and taking control of the changing environment. By anticipating and thinking about what might come and preparing strategic responses, businesses can create some certainty for themselves and hence have an important advantage vis-à-vis non-agile competitors. Of course, as said, it is often impossible to predict when disruptive events will materialise and, hence, it’s even more difficult to plan for them. But at least one should be aware of their potential devastating impact. One should take them into account, not as predictions but as food for thought. In some case, new tools like big data and artificial intelligence can provide a helping hand in managing chaos and order. The chaordic economy should therefore not be seen as a threat. Instead, it widens the spectrum of possible action and, by stimulating creativity and innovation, may even open the way to a successful future... at least for agile businesses.