Limited impact of higher oil price on Belgian economy

Abstract

The price of Brent crude has peaked in recent weeks at just above 70 dollars a barrel. That is a sharp increase after trading at a low of around 20-25 dollars a year ago. The price rise in recent months represents a negative external shock for the Belgian economy. If the price remains at around its current elevated level until the end of 2021, as we expect, this will lead to a direct increase in the cost of imported oil amounting to 1.2% of Belgian GDP in 2021 compared with 2020. That is above the average for the euro area, reflecting the relatively oil-intensive nature of the Belgian economy. The majority of this higher oil bill (estimated at more than three-quarters) will fall to industry; a much smaller proportion (around a fifth) will have to be met by households and a small residual amount will be borne by the government. As well as this direct negative income effect, the rise in oil prices has an indirect negative impact on real economic activity, in so far as it prompts households, businesses and the government to moderate their spending. However, rough estimates suggest that the impact of a continuing higher oil price on real Belgian GDP growth in 2021 will be limited to no more than a few tenths of a percentage point. That is nowhere near enough to derail the anticipated economic recovery, which is set to gather pace from the summer onwards.

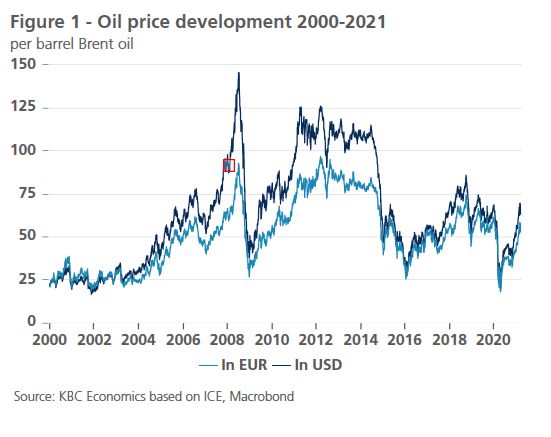

The price of a barrel of Brent crude has tripled over the last year, from a low of 23 dollars at the end of March 2020 to around 70 dollars today. This trend is in marked contrast to the situation at the start of 2020, when the price tumbled in a perfect storm as collapsing demand at the start of the pandemic coincided with a price war between Saudi Arabia and Russia. The sharp increase over recent months has pushed the oil price back to roughly where it was at the start of 2020 (Figure 1). There are several explanations for this impressive rally in the oil price. On the supply side, the production cap by OPEC+ (the cartel of oil-producing countries) has pushed up the price. Demand for oil has also recovered, initially driven mainly by China, a major consumer whose economy recovered relatively quickly from the Covid-19 shock, followed later by other economies as the economic impact of the second wave of the pandemic turned out to be less severe than feared. The oil price has drawn further support in recent months from the positive news about the vaccines and extremely cold weather in a number of countries. Recently, the price peaked after an oil production site in Saudi Arabia, the biggest oil producer in the world, was attacked by Yemeni rebels.

KBC is projecting that the oil price will remain at around its present elevated level of around 70 dollars per barrel of Brent crude throughout 2021. This implies that the average oil price over this year will be more than 50% higher than in 2020. Below we will explore the implications of this for the Belgian economy. We describe the theoretical implications of an increase in the oil price and quantify the impact. Specifically, the consequences manifest themselves in a negative terms of trade and income effect and in indirect supply and demand effects. We attempt to estimate the potential damage that the various factors could inflict on economic activity in Belgium in 2021, in the wake of the Covid-19 crisis.

2. Negative terms of trade and income effect

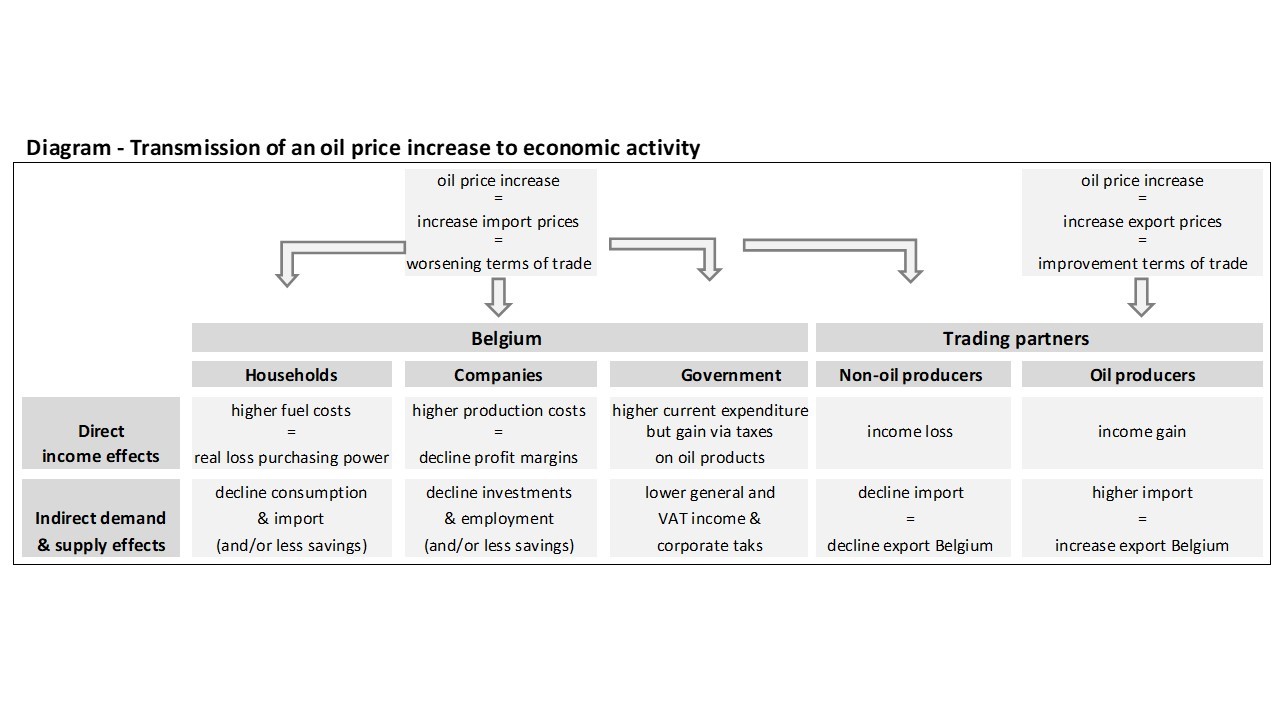

A first effect of the rise in the oil bill is that it confronts the Belgian economy with an immediate deterioration in the international terms of trade, i.e. the ratio between export and import prices (see diagram). This is because the elevated oil price means that import prices are higher than they would otherwise have been. This negative terms of trade effect can be mitigated to the extent that companies are able to pass on some of their higher oil costs in their export prices. As well as importing crude oil, Belgium also trades extensively in finished and semi-finished oil products, the price of which is also affected by the increase in the price of crude oil. However, their impact on the terms of trade is likely to be limited, because imports and exports of these oil products hold each other roughly in balance (Figure 2).

.JPG/_jcr_content/renditions/cq5dam.web.960.9999.jpeg.cdn.res/last-modified/1672930196004/cq5dam.web.960.9999.jpeg)

Belgium consumed around 665 000 barrels of oil per day in 2019. Consumption has been reasonably stable since 2012 in relation to the volume of total economic activity. Allowing for the contraction in real GDP of 6.3% in 2020 and our forecast economic growth of 4.0% in 2021, we can project oil consumption in 2020 and 2021 to be around 624 000 and 640 000 barrels per day, respectively. If the oil price remains around its current higher level, as we expect, this will mean a direct annualised increase in the cost of imported crude oil of 5.7 billion euros in 2021 compared with 2020, or roughly 1.2% of GDP. That is a bigger increase than the average in the euro area, reflecting the relatively oil-intensive nature of the Belgian economy. Related to GDP, Belgium’s oil consumption is almost two-thirds higher than in the whole euro area. On the other hand, oil consumption relative to real GDP has fallen by over a third since 1980 – though this reduction in oil dependency has been below the average in the euro area, where oil consumption has more than halved in relation to real GDP (Figure 3). The higher cost of imported oil contributes to a deterioration in the current account of the Belgian balance of payments. Figure 4 shows that between the end of the 1990s and 2012, the much sharper and longer-lasting rise in the oil price led to a marked deterioration in the terms of trade, contributing to the evaporation of the large current account surplus that Belgium enjoyed on its balance of payments up to the year 2000 (Figure 4).

The increase of more than 6 billion euros in the oil bill also depresses the income that is available for domestic spending. There is in other words a negative income effect, which is shared between households, businesses and the government. The precise distribution of the income effect depends on how much oil they each consume, the extent to which companies are able to pass on the higher oil costs to their customers and how far the government is able to compensate for a proportion of the reduced income by raising taxes. This income effect in turn has an indirect negative impact on economic activity in Belgium, the extent of which will depend on how far households, businesses and the government modify their spending as a result of the higher oil price (see diagram).

.JPG/_jcr_content/renditions/cq5dam.web.960.9999.jpeg.cdn.res/last-modified/1672930194922/cq5dam.web.960.9999.jpeg)

3. ndirect supply and demand effects

In practical terms, the income effect manifests itself in the final consumption of oil products. The main consumption by households is for car fuel and heating oil. In rounded figures, Belgian households consumed roughly 8 billion litres of petrol, diesel and heating oil in 2019 (not including fuel consumption by company cars1). That equates to 17% of total consumption of oil products in Belgium (Figure 5). Based on the average annualised price of the three products in 2019, that comes to just under 8 billion euros. Figures are not yet available for fuel consumption in 2020, but the widespread working from home as a result of Covid-19 may well have distorted the normal consumption pattern of households (less car fuel, more heating oil). In the hypothetical case that the amount of fuel consumed in 2020 were the same as in 2019, and taking into account the lower average prices of car fuel and domestic heating oil in 2020 (for which figures are available), households spent 1.2 billion euros less last year than in 2019 (0.4% of their disposable income).

The sharp increase in the price of oil in the past year meant that the maximum prices for the three fuels (petrol, diesel and heating oil) were much higher in February 2021 (up by 15%, 21% and 48%, respectively) than when they were falling in April 20202. If we assume (once again hypothetically) that fuel consumption in 2021 will be the same as in 2019 (helped by a post-Covid normalisation of road traffic), and that the prices of petrol, diesel and domestic heating oil remain constant at their present higher levels until the end of 2021, this translates into additional costs of around 0.6 billion euros for households on an annualised basis, or approximately 0.2% of estimated household disposable income in 2021. This is of course merely a simulation, which is heavily dependent on the assumptions made. It does however illustrate the order of magnitude of the income effect.

.JPG/_jcr_content/renditions/cq5dam.web.960.9999.jpeg.cdn.res/last-modified/1672930191303/cq5dam.web.960.9999.jpeg)

Unless households were to save less to compensate for the purchasing power they will lose due to the higher oil price, the oil price rise will lead to reduced consumption (= negative demand effect). This effect is somewhat greater in Belgium than in the euro area as a whole, because fuels take a relatively bigger share of the Belgian basket of consumer goods. The upward effect of the oil price increase on the general consumer prices index is also greater than the impact on the health index, because the latter leaves the price of car fuel out of consideration. Just as households see their purchasing power increase when oil prices fall (as happened in 2020) due to the use of the health index for wage-indexation, the reverse applies when the oil price rises: the wage-indexation based on the health index means household purchasing power is hit harder (see also the Box text for a description of the impact of the oil price rise on general inflation).

Businesses account for the majority (over three-quarters) of oil products consumed in Belgium (Figure 5). Most of this is non-energy-related consumption of oil (i.e. oil as a commodity rather than a fuel) and bunkering (the use of bunker oil to fuel aircraft and seagoing vessels in a port or airport). The direct negative impact of the oil price rise is accordingly significantly greater for businesses than for households. As with households, the negative impact in Belgium is greater than the average in the euro area due to the relatively high dependence on energy in the production process. Roughly 40% of Belgian companies operate in energy-intensive sectors, compared with an average of just 30% in the euro area. The oil price rise has a direct negative impact on company profitability. If their production costs rise faster than their selling prices, their profit margins fall proportionately. The lower profitability (and also the fall in consumer demand) could prompt companies to cut back on their investment and recruitment plans (= negative supply effect).

The Belgian government will also lose out in the short term due to higher current expenditure on energy. However, this direct impact is much more limited than for households and businesses given the government’s relatively low consumption of oil. On the other hand, the government will gain from additional VAT revenue on more expensive oil products. By contrast, the duty on fuel is fixed per litre and therefore does not fluctuate directly in line with the oil price3. Government receipts will however reduce indirectly due to lower general VAT revenue and corporation tax as a result of weaker consumer demand and lower corporate profitability.

Finally, the negative impact of the higher oil price on economic activity will also be felt in a reduction in net exports. Since its principal trading partners will also be affected by a deterioration in terms of trade, Belgium will suffer indirectly from reduced international demand. On the other hand, weaker domestic consumption in Belgium will reduce the leakage to other countries via imports. The ultimate trading volume effect will also depend on the extent to which oil-producing countries increase their imports from Belgium due to their higher oil revenues. This will have only a small impact, however, because the share taken by the major oil-producing countries (the OPEC countries plus Russia, Mexico and Norway) in total Belgian exports is limited, at just 5%.

All things being equal, the indirect supply and demand effects of an oil price rise will translate into lower economic growth. Just how big this impact on real GDP growth will be depends on uncertain factors, including the persistence of the higher oil price and the extent to which the supply and demand effects are tempered by reduced savings by households and/or businesses. Households and businesses will first have to be persuaded that the price rise will last, and in many cases will therefore only modify their spending behaviour after some time lag. In contrast to the direct effects on inflation (see also Box above), therefore, the impact of the higher oil price on economic growth will be more gradual.

The National Bank of Belgium (NBB) published a detailed estimate in 2010 of the impact on growth of a change in oil prices. The calculations formed part of a joint analysis by the national central banks of the Eurosystem for the Structural Issues Report which was published in that year by the European Central Bank (ECB4). According to the NBB calculation, an increase of 10% in the dollar-denominated crude oil price leads to a cumulative fall in real Belgian GDP of 0.09% after one year, 0.30% after two years and 0.46% after three years. That is much more than in the euro area, where the cumulative fall in GDP after three years is 0.24%. As well as Belgium, the impact in Germany and Italy is also projected to be fairly substantial (Figure 6). The greater impact in Belgium stems from a stronger effect on investments and net exports, while the fall in private consumption is more limited because partial indexation mitigates the reduction in real wages. The greater impact of an oil price shock is also principally an exponent of Belgium’s greater dependence on oil. The impact in the neighbouring countries of the Netherlands and France is significantly smaller: in the case of the Netherlands, this has to do with its extensive gas fields, and for France with the decision to maximise the use of nuclear energy.

Based on the March edition of KBC Economic Outlook, we expect the price of crude oil to remain in the region of 70 dollars per barrel until the end of 2021. This scenario would mean that the average oil price in 2021 would be 52% higher than the average in 2020. If a 10% price rise in dollars leads to a reduction in economic activity of 0.09 percentage points after one year, as the MBB calculation suggests, then all things being equal, the increase in the price of oil by about half would depress real Belgian GDP growth by around 0.45 percentage points. Assuming the oil price remains constant going forward, the cumulative effect after two years would be 1.5%, or a reduction in growth of more than one percentage point in 2022.

.JPG/_jcr_content/renditions/cq5dam.web.960.9999.jpeg.cdn.res/last-modified/1672930199948/cq5dam.web.960.9999.jpeg)

Naturally, these are very rough figures which are hedged in with lots of uncertainty. First, the dependence of the Belgian economy on oil has reduced further since 2010, when the NBB produced its calculations. This will also reduce the impact of changing the oil price today. In addition, the NBB simulations assumed an unchanged exchange rate. However, the reduction in growth calculated above for 2021-2022 could be partially offset by our projected depreciation of the dollar, which has the effect of weakening the average rise in the oil price. It also makes no allowance for the economic impact of earlier movements in the oil price, which is still working through the system. Prior to the price rise in the past year, the oil price had gone through a sudden sharp fall. As a result, even with the recent increase the current oil price is still on the low side (Figure 1). In nominal terms, the oil price has averaged 64 dollars a barrel since 2000, which is not much lower than the current price. The main uncertainty over the longer term relates to how persistent the higher oil price will prove to be. In our forecasts, we assume that the price will fall to slightly lower levels again from 2022. On the supply side, there is a possibility of additional supply coming on stream from Iran returning to the world oil market, if the new US government lifts the present sanctions. On the demand side, the ‘greening’ of the global economy is putting systematic downward pressure on the oil price.

Added together, all these factors mean that the negative impact of the recent oil price rise on Belgian economic growth is likely to be smaller than the above estimates suggest. That impact could moreover be cancelled out by other positive effects. The vaccination campaign against the coronavirus will be up to cruising speed by the summer, and this could lead to a concomitant increase in consumer and business confidence. This could open the way for a gradual normalisation of social and economic life and inject more pace into the recovery in Belgian economic growth. Normalisation following the historic downturn in activity in 2020 (-6.3%) suggests that the growth figure for 2021 will also be a relatively large number. So while the fact that the higher oil price will knock off a few tenths of a percentage point from that number may not be good news for the recovery, it will also not put it in jeopardy. Taking into account all relevant factors, including the projected oil price, we are currently forecasting real GDP growth for Belgium of 4.0% for 2021 and 4.1% for 2022.

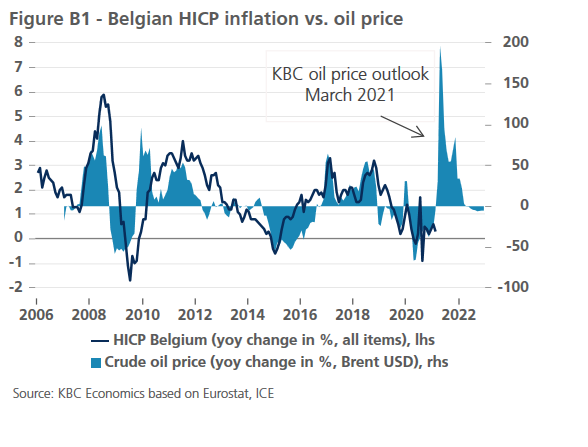

Box 1 – Higher and volatile inflation figures on the horizon

Belgian inflation has traditionally shown a strong positive correlation with the year-on-year movements in the price of crude oil (Figure B1). Over the period from January 2007 to February 2021, the correlation coefficient between the two stood at 0.60. The very low general inflation rate in 2020 (0.4% based on the Harmonised Index of Consumer Prices (HICP) was thus partly attributable to the much lower average oil price in that year (43 dollars per barrel). Until February 2021, the annual change in the oil price was – albeit to a limited extent – negative. General inflation in Belgium also fell in February 2021, sinking to 0.3% from 0.6% in January and an average of 0.4% over 2020. The combination of the steep fall in the price of oil in the spring of 2020 (reaching a low of just 20-25 dollars a barrel) and the recent sharp rally (to around 70 dollars) means the year-on-year change in the oil price will show a marked peak in the coming months. As a result, the very low inflation rate at the start of 2021 will be replaced by higher and probably more volatile monthly figures. Based on our oil price scenario for 2021, which assumes that the oil price will remain at around 70 dollars per barrel until the end of the year, we are forecasting that Belgian HICP inflation will come in at 1.8% for the full year 2021.

1No exact figures are available the consumption of car fuel by households and businesses. Our estimate divides the final consumption of fuel for road transport (for which figures are available) among households and companies based on the relative number of kilometres travelled by

2The impact of a change in the oil price is greater for domestic heating oil than for car fuel, because the price of the oil weighs much more heavily in the overall cost of heating oil than taxes and distribution costs. Specifically, more than half the final price paid for heating oil is determined by the price of oil coming out of the refinery; for petrol and diesel, the oil component represents less than a third of the final price.

3There is however a ratchet system which ensures that as diesel becomes cheaper, a proportion of the price fall goes to the government in the form of extra duty.

4See Baugnet & Dury (2010), ‘Energy markets and the macroeconomy’, NBB Economic Review September, and ECB (2010), ‘Energy markets and the euro area macroeconomy’, Structural Issues Report.