Is Austria a model for Belgium?

Recently, Austria made headlines with its remarkable government formation. Could it be an example for Belgium? We won't go into that question. We rather look at economic similarities and differences. The similarities point to similar policy needs. Austria and Belgium are rich countries, but they both have growth problems, especially in terms of productivity. Productivity is higher in Belgium, but recent developments are somewhat more encouraging in Austria. Austria owes its average higher per capita wealth to the fact that significantly more Austrians are at work. Inspiring for Belgium, since increasing the employment rate is major challenge for Belgium! Both countries have small, open economies. Competitiveness is crucial then. Austria’s cost competitiveness recently did less well than Belgium in terms of wage cost developments, but still achieved more success in export markets. Contrary to Belgium, it has maintained its external surplus in recent years. At the same time, it took public finances out of the red. In short, the Austrian economy does not systematically outperform the Belgian economy, but here and there policy may find best practices.

Rich industrial country

In terms of surface area, Austria is almost three times larger than Belgium but has over 20% fewer inhabitants. On average, they are a little richer than the Belgians. Their economy generates 8.5% more added value per inhabitant. In the ranking of euro area countries by size of the economy, Belgium and Austria are in sixth and seventh place, between the Netherlands and Ireland.

Those who only associate Austria with idyllic mountain landscapes, tourism, Mozartkugeln or Wiener Walze, have an incomplete picture. It is true that the share of hotels, restaurants and related activities in Austria’s total added value is almost three times higher than in Belgium. It is the highest in the EU, after five southern European (holiday) countries. More surprising, however, is probably the relatively high importance of the manufacturing industry: almost 17% of GDP. Aside from that of Ireland, Germany and Slovakia, it is the largest among all euro area countries and more than four percentage points higher than the manufacturing sector in Belgium. Especially in the first decade of this century, the share of manufacturing in value added fell more sharply in Belgium than in Austria. In Austria, the importance of manufacturing has again increased very slightly over the last decade. Sectors such as metal processing, mechanical engineering, wood processing, but also electronics and the automotive industry make the difference.

Austria’s higher GDP per capita is a legacy of the past. In the first ten years after the introduction of the euro in 1999, Belgium and Austria experienced almost identical economic growth (figure 1). Due to the greater importance of industry, Austria was hit harder by the Great Recession of 2008-2009. And it experienced a longer period of extremely weak growth in the wake of the euro crisis in 2011. In the second half of the last decade, however, the economy rebounded more strongly. In both countries, however, growth remained lower than in the pre-crisis period. Fortunately, it also became more labour-intensive. This was necessary in the context of higher population growth, mainly due to migration, in both countries. Unfortunately, it was also accompanied by a sharp drop in productivity growth, the engine of real wealth creation. Contrary to Belgium, productivity has recently picked up again in Austria, albeit after a sharper downturn. In any case, both countries share the challenge of further boosting productivity growth.

Figure 1 –

Economic performance Austria vs Belgium

Belgium is also lagging behind in terms of employment. Austria owes its higher prosperity per inhabitant to a higher employment rate. Nearly 78% of 15-64-year-olds are in work, compared to just under 70% in Belgium, albeit with regional differences. On average, working Belgians produce 3% more added value. This partly compensates for the loss of prosperity due to the lower level of employment. However, as noted above, Belgium is lagging behind in terms of productivity growth.

Small, open economy

The greater importance of industry means that the recent slowdown in world economic growth is again hitting Austria a little harder. In principle, however, Belgium is more export sensitive. Exports of goods and services account for more than 80% of GDP, compared to 'only' around 55% in Austria. The important Belgian seaports contribute to this.

In both countries, more than 70% of goods exports go to other EU countries, with Germany as the most important trading partner. However, the German market is even more important for Austria than for Belgium (in 2018 29.5% of total goods exports versus 17.7% for Belgium; source: IMF). In addition, Austria maintains important trade relations with its Central and Eastern European neighbours, of which only Slovakia belongs to the euro zone. Less than 20% of Austria's goods exports go to euro-area countries other than Germany and Slovakia. For Belgium, the figure is 40%. Membership of the euro area thus yields slightly less exchange rate stability for Austria. However, this does not make a big difference in terms of cost competitiveness.

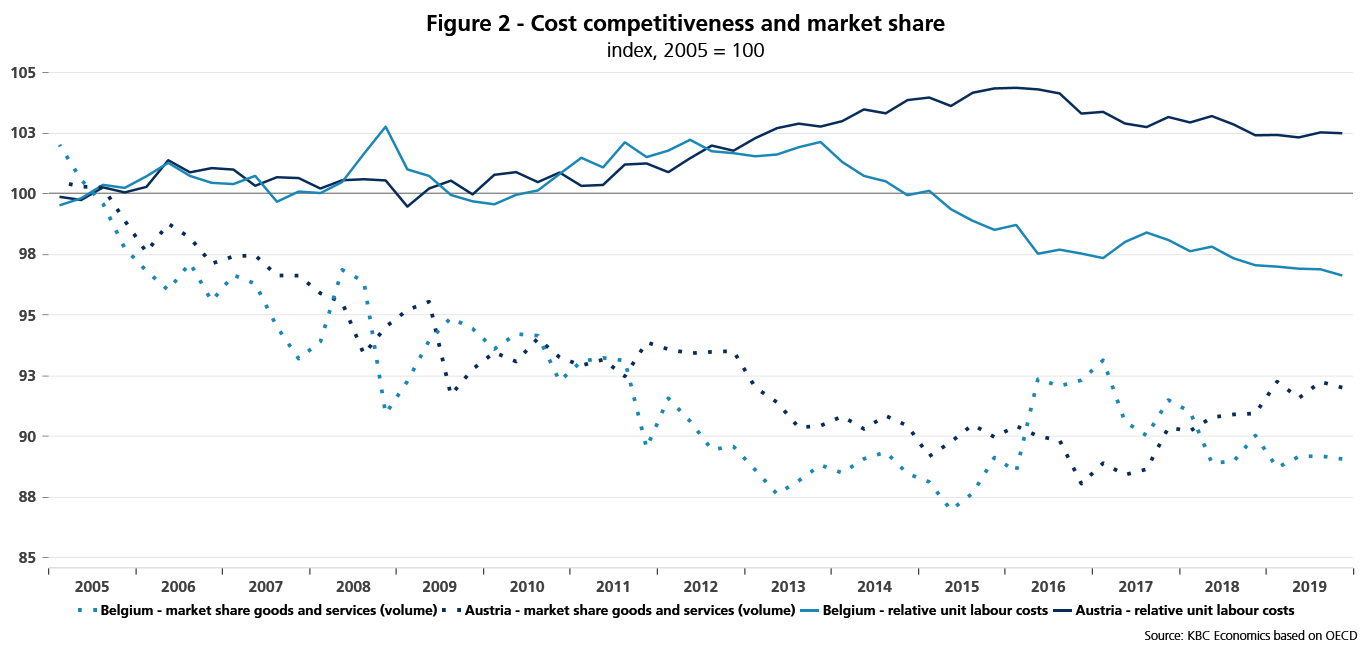

More important is the evolution of relative labour costs per product unit. This important measure of cost competitiveness came under pressure in both countries after the euro crisis. Belgium intervened faster than Austria, with the result that relative labour costs per product unit at the end of 2019 were more than 3% lower than in 2005, while they were 2.5% higher in Austria (Figure 2). However, Belgium regained market share only to a limited and temporary extent. Despite less labour cost moderation, Austrian exporters regained more market share. This allowed Austria to maintain a current account surplus, contrary to Belgium.

Figure 2 - Cost competitiveness and market share

Last but not least, Austria's public finances have improved in recent years. The structural deficit was eliminated in 2019 and, according to the estimate of the European Commission (EC), will turn into a small surplus in 2021. In Belgium, according to the EC, the deficit will rise to 2.2% of GDP. Reducing the tax burden on labour is on the OECD's list of priority reforms for both countries. Austria has created more budgetary room for manoeuvre in recent years. In short, the Austrian economy does not systematically outperform the Belgian economy, but here and there policy may find best practices.