iPhone, IKEA and Big Mac prices as a guide for exchange rate misalignments?

Economic Opinion

The recent sell-off of the Turkish lira and some other emerging market currencies once again brings us to the question: what is the fair level of an exchange rate? While there are a lot of sophisticated theories and econometric methods available to derive an equilibrium level of the exchange rate, it remains a tricky exercise. As such, simple and cheap methods derived from the theory of purchasing power parity (PPP) and the law of one price are still popular. Moreover, economists sometimes pick a single good as a proxy for aggregate prices. While such methods are cheap and convenient, analysis suggests that the results they produce should be viewed with a cautious eye...

PPP states that the exchange rate between two currencies should equal, in the long term, the price of a basket of goods and services in the relative economies ( [Basket_1/Basket_2] = Equilibrium exchange rate of currency 1 to 2 ). It is derived from the law of one price, which states that the price of something in one country should be the same as the price in another country once exchange rates are taken into account. Using a proxy item, we can then compare prices in two different countries and measure any deviation between the actual exchange rate and the PPP calculated exchange rate as a misalignment from the equilibrium level. The most famous ‘proxy’ item in this respect is the price of a Big Mac burger, used once or twice a year by the Economist magazine to measure deviations from PPP since 1986. However, there are alternative proxies for quick PPP testing as well. These must be homogeneous products or services, which are sold with same standards globally, and for which it is easy to get local prices.

With this in mind, we chose the Apple iPhone 8 (256GB memory without a network contract) as an example of a tradable luxury good, and an IKEA Lack side table as a normal tradable good. For several countries, we convert all available Big Mac, IKEA side table and iPhone 8 prices into euros, to calculate deviations from prices in the eurozone (the average of German and French prices). The first observation is that deviations from the law of one price are quite large (see Figure 1), which could indicate huge misalignments of some exchange rates from their equilibrium levels.

Figure 1 - EUR over/undervaluation based on PPP by using the Law-of-one-price (in %)

Curiously, however, the different products often suggest deviations from equilibrium exchange rates in opposite directions. For instance when we calculate a PPP value of the Swiss franc against the euro using Big Mac prices, we find that the CHF is strongly overvalued against the common currency. On the other hand, if we divide the IKEA (iPhone 8) prices in Switzerland and the euro area, we get the opposite result - the CHF is actually undervalued. In other words, the deviations from the PPP implied by various global products often tell a completely different story about the deviations from the law of one price. Of course, there are also positive examples, which point in the same direction – like the case of the Nordic currencies. One notable puzzle, however, is Turkey . Despite the huge recent depreciation of the Turkish lira, Turkey is the most expensive country to buy the iPhone 8 at the Apple store. What can be the reason behind this?

A significant body of academic research has theoretically stipulated and empirically confirmed that the PPP theory does not work because of a high share of non-tradable components in some services (like in a McDonald’s meal). Non-tradable products and services are usually cheaper in less developed countries with lower productivity and wages, as suggested by both the Balassa-Samuelson effect and the Bhagwati-Kravis-Lipsey theory. Hence, the equilibrium exchange rates of poorer countries could be undervalued compared to the FX rates implied by the PPP theory (or by a ratio of Big Mac prices).

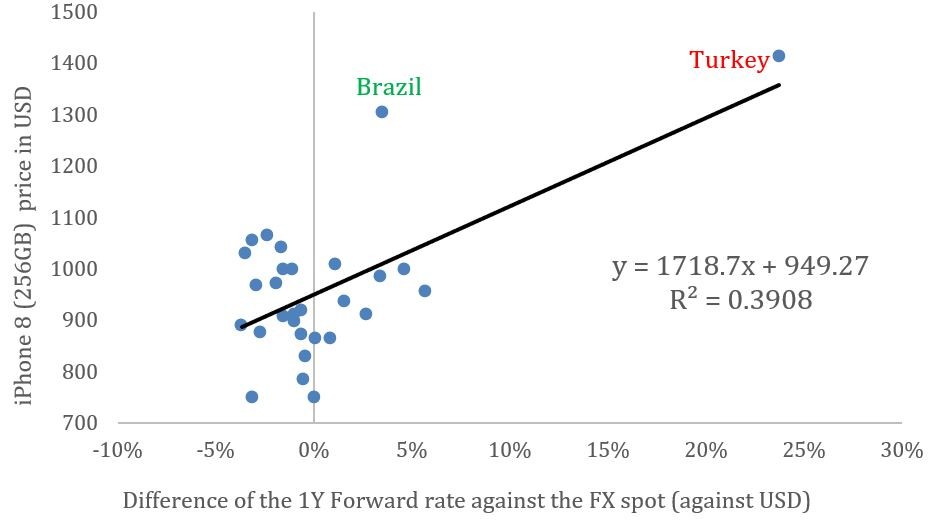

Differences in non-tradable components cannot explain why PPP does not hold for the iPhone 8 or IKEA side-tables. Explaining apparent violations of the law of one price for the latter will require further digging. However, an explanation with regard to the iPhone comes to mind. Apple may be using its monopolistic power to price-to-the-market to account for currency volatility (against the USD) or the forward rate. This finding is supported by simple but statistically significant regressions. Our analysis implies that the iPhone 8 is more expensive the higher the FX volatility or the weaker the FX forward rate (compared to the spot rate against the USD) (figures 2 and 3).

Figure 2 - Iphone 8 price and costs of FX hedging

Figure 3 - Iphone 8 price and costs of FX hedging

It seems that when a big multinational brand like Apple prices its products abroad, it also takes into account the related costs of FX hedging. Still, the relationship between the current deviation of global iPhone prices from the US level on one hand, and FX volatility or the interest rate differential (representing the forward FX rate) is not, extremely strong, especially if the role of regression outliers – Turkey and Brazil – is taken into account. This theory still leaves unanswered the question of why Brazilians would accept such high iPhone prices at home when they can theoretically buy the popular phones cheaper on-line in other countries. The explanation, which is another feature of the failure of the PPP theory, lies in high taxes applied on individual retail imports in Brazil.

Hence, it is not only the existence of non-tradable service components, monopolistic pricing power , or hedging costs, that cause violations of the law of one price, but also other factors like high tariffs or transport costs which limit the feasibility of international arbitrage. As a result, the law of one price might not hold even for global products. Thus, in this sense, it is wise to read the result of PPP-related exercises, which try to estimate equilibrium exchange rates, with the utmost caution.